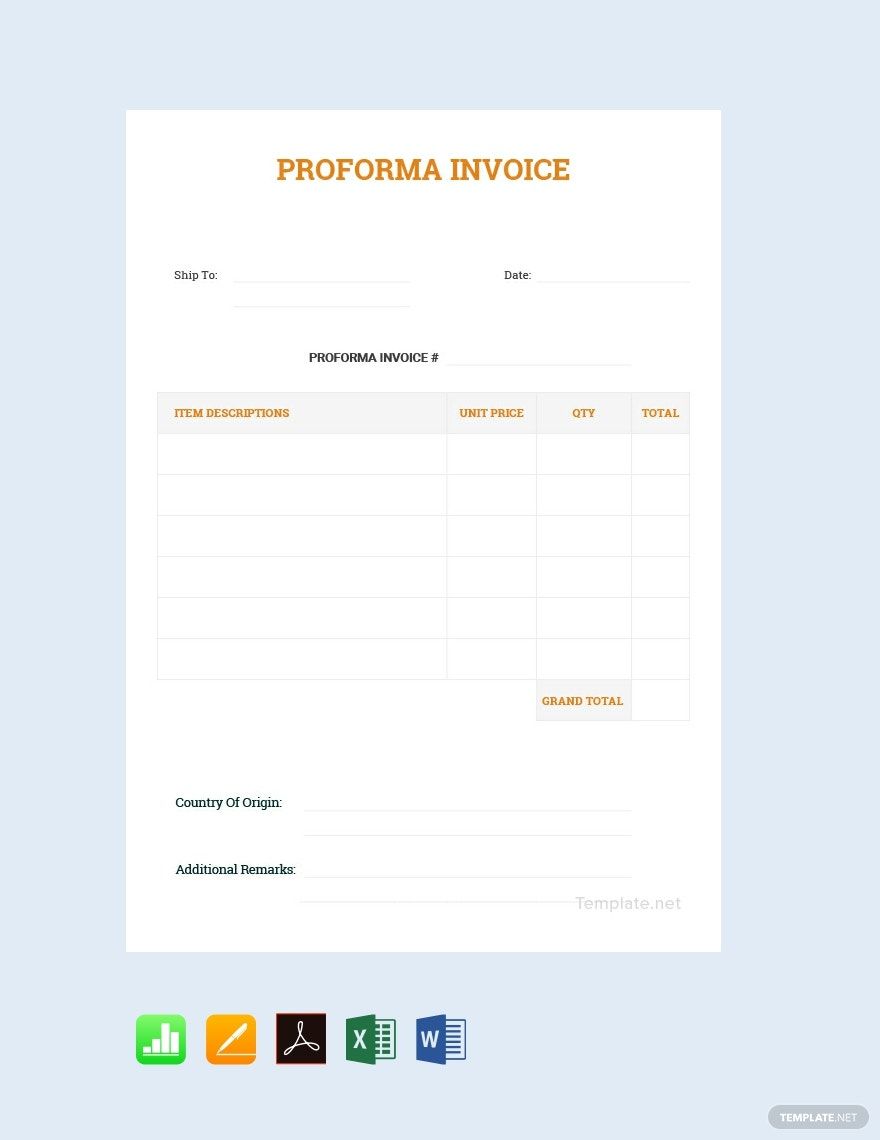

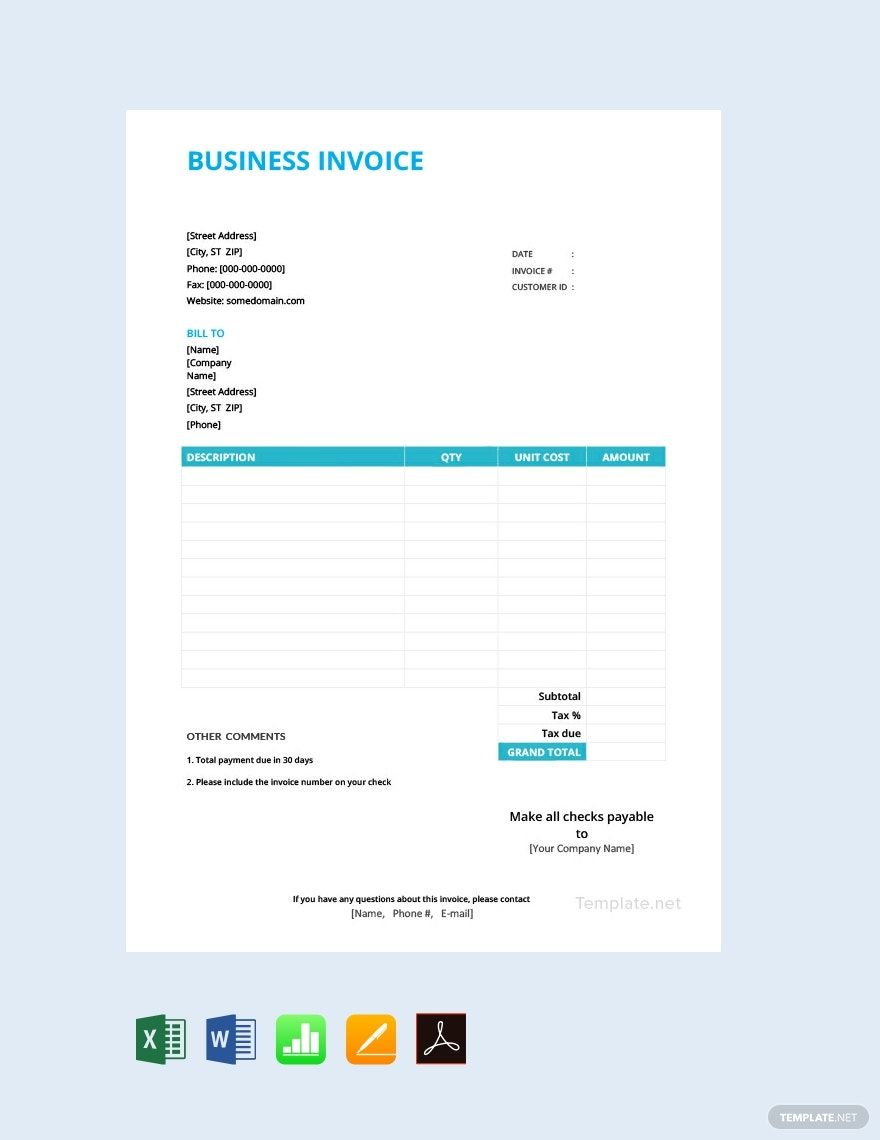

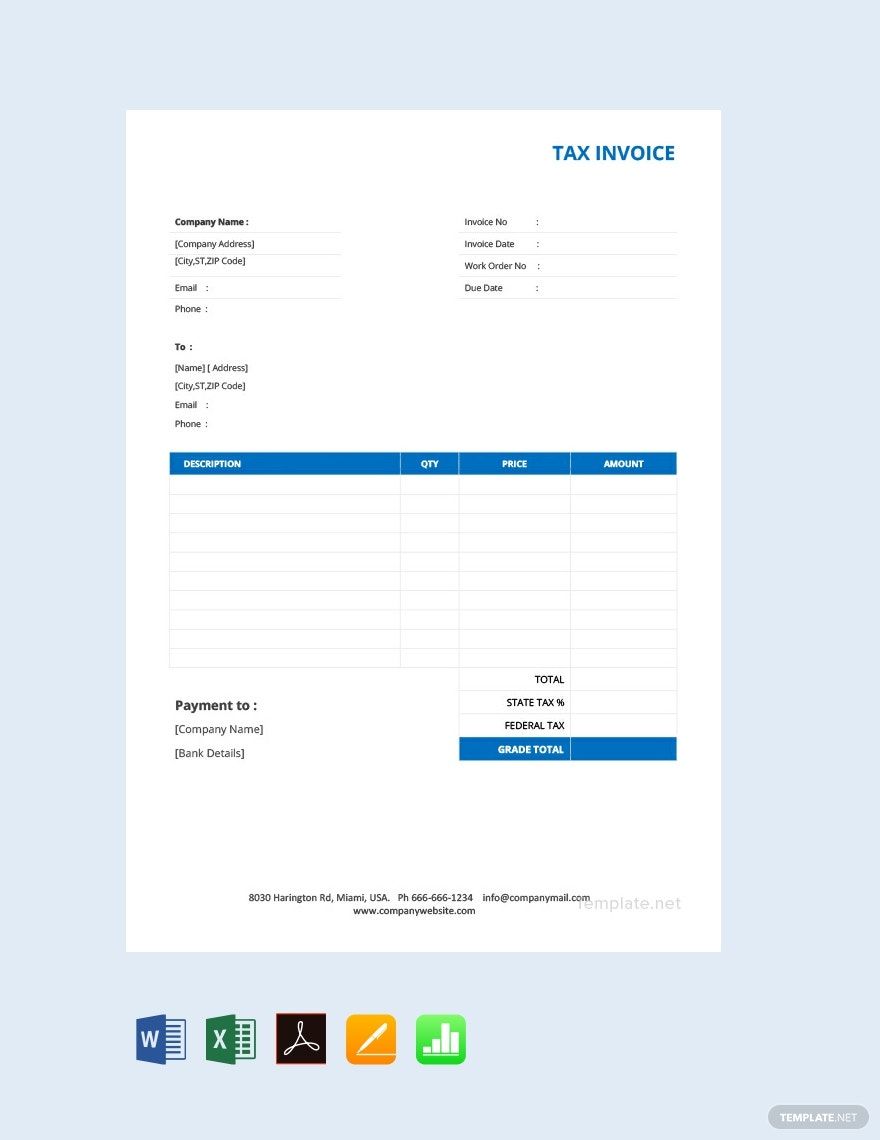

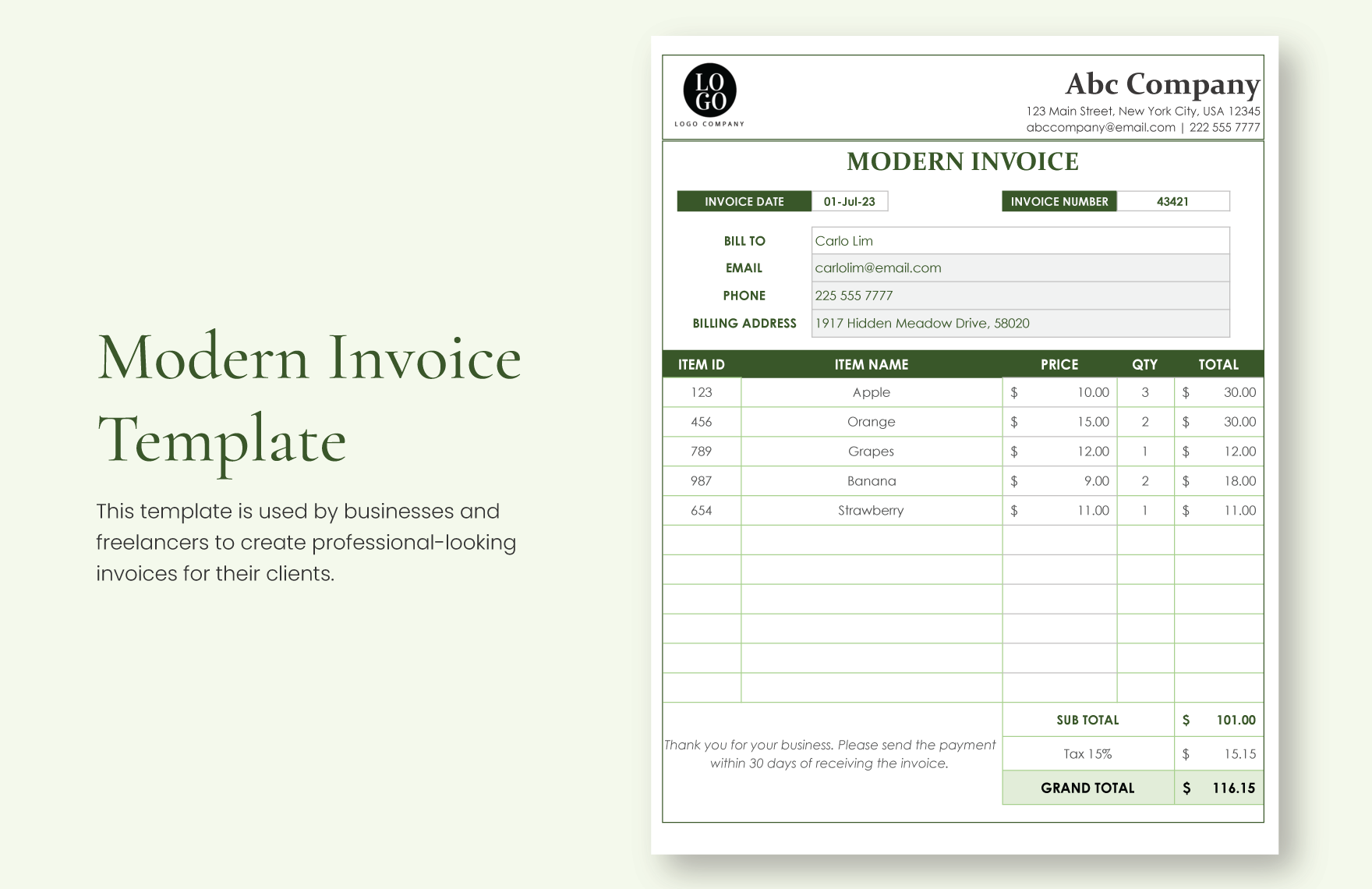

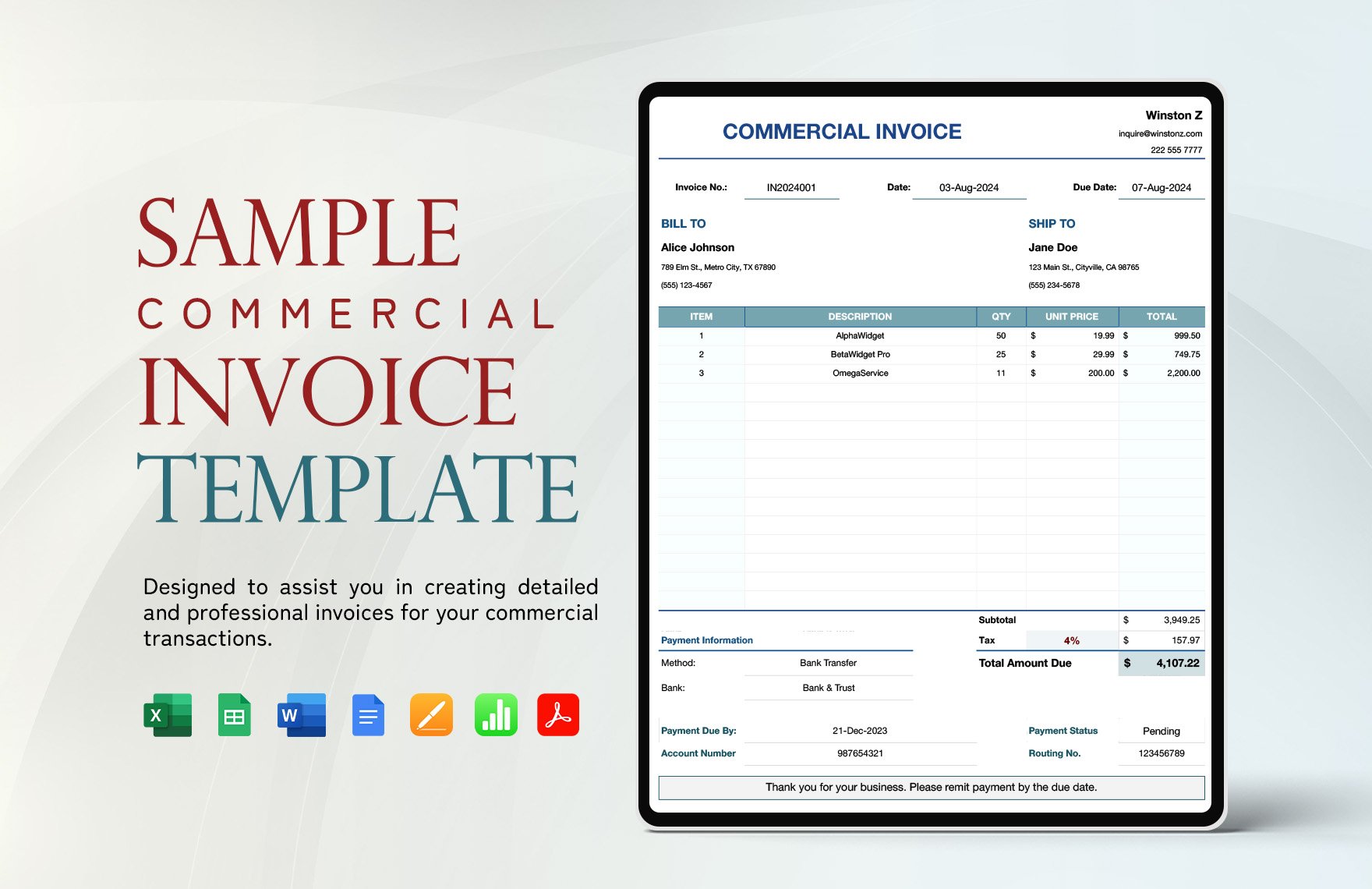

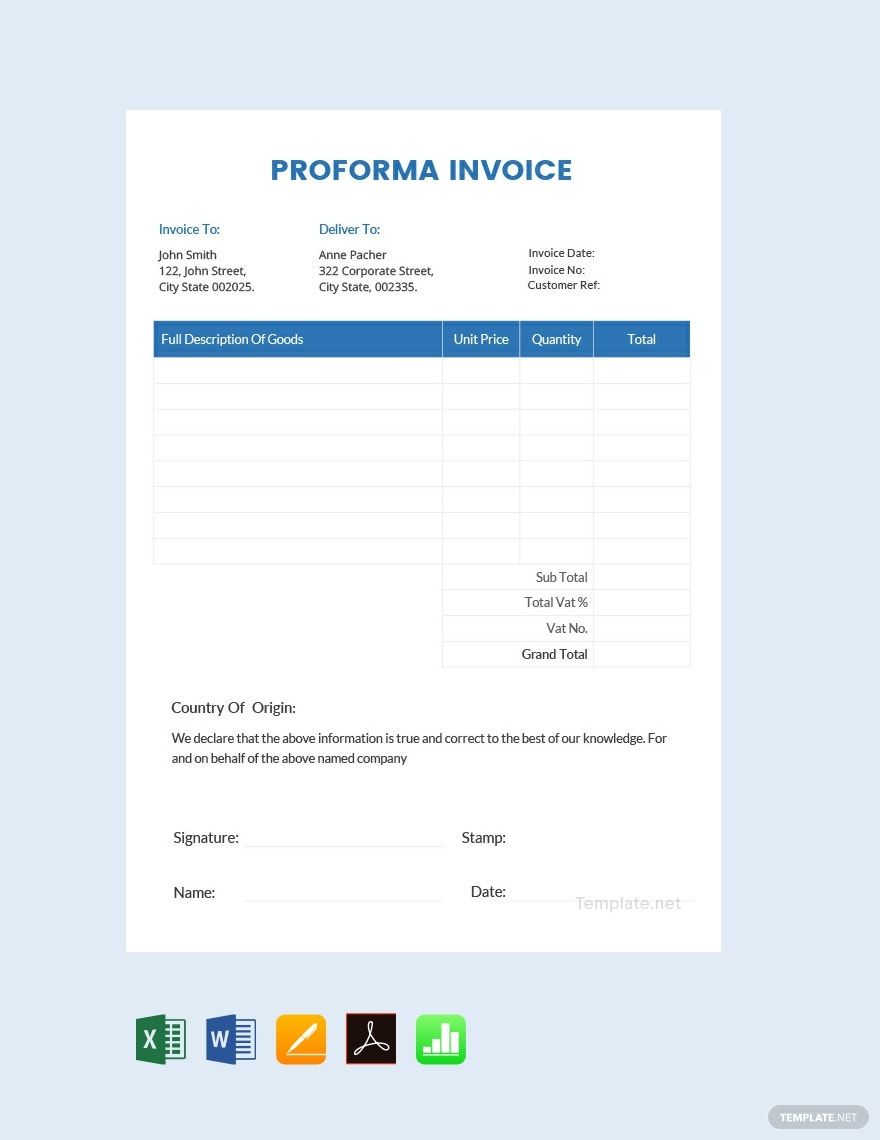

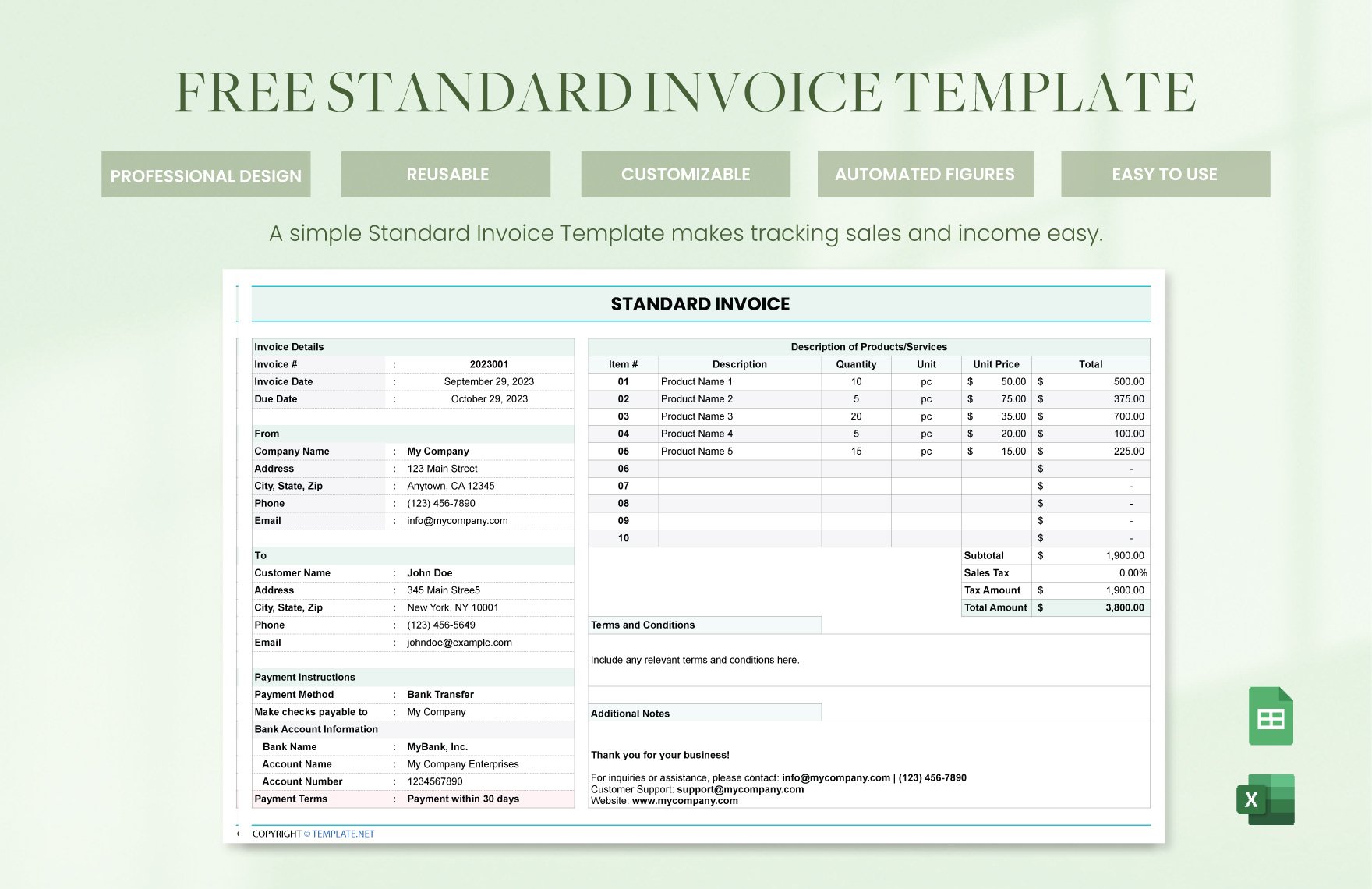

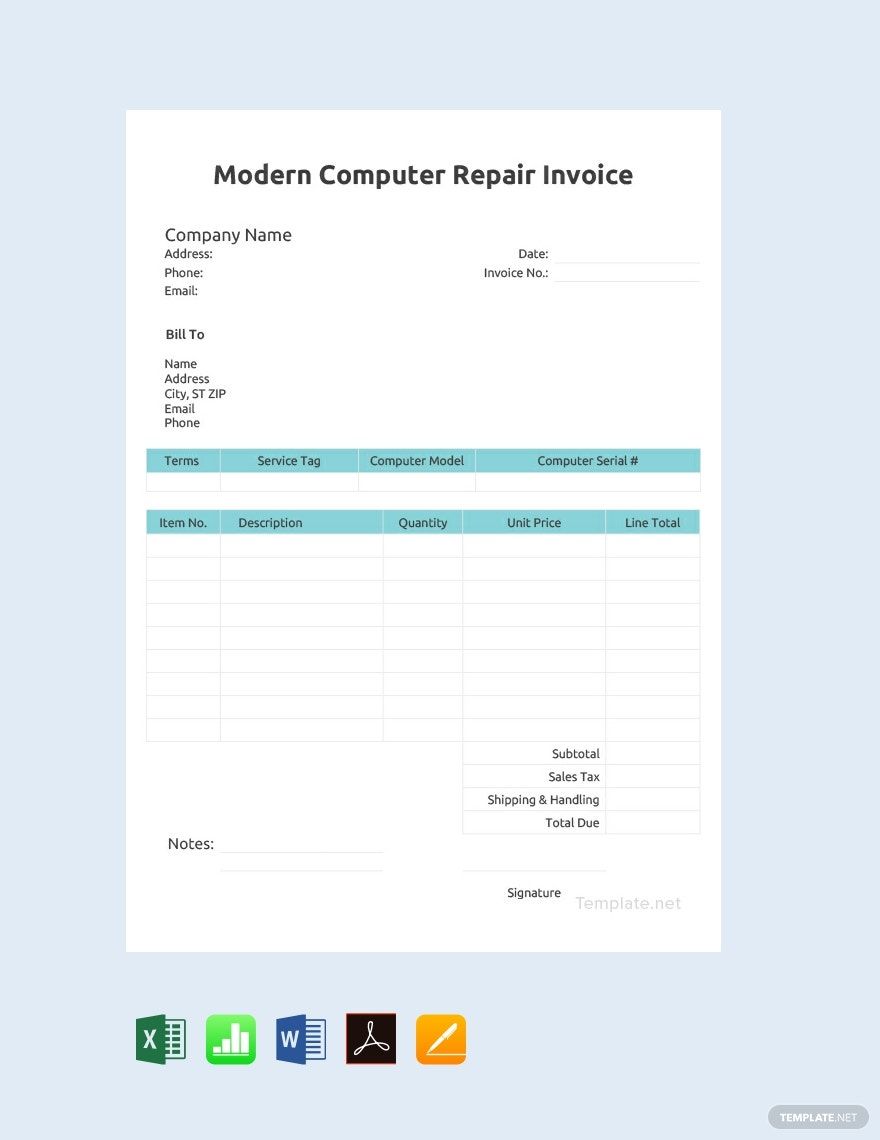

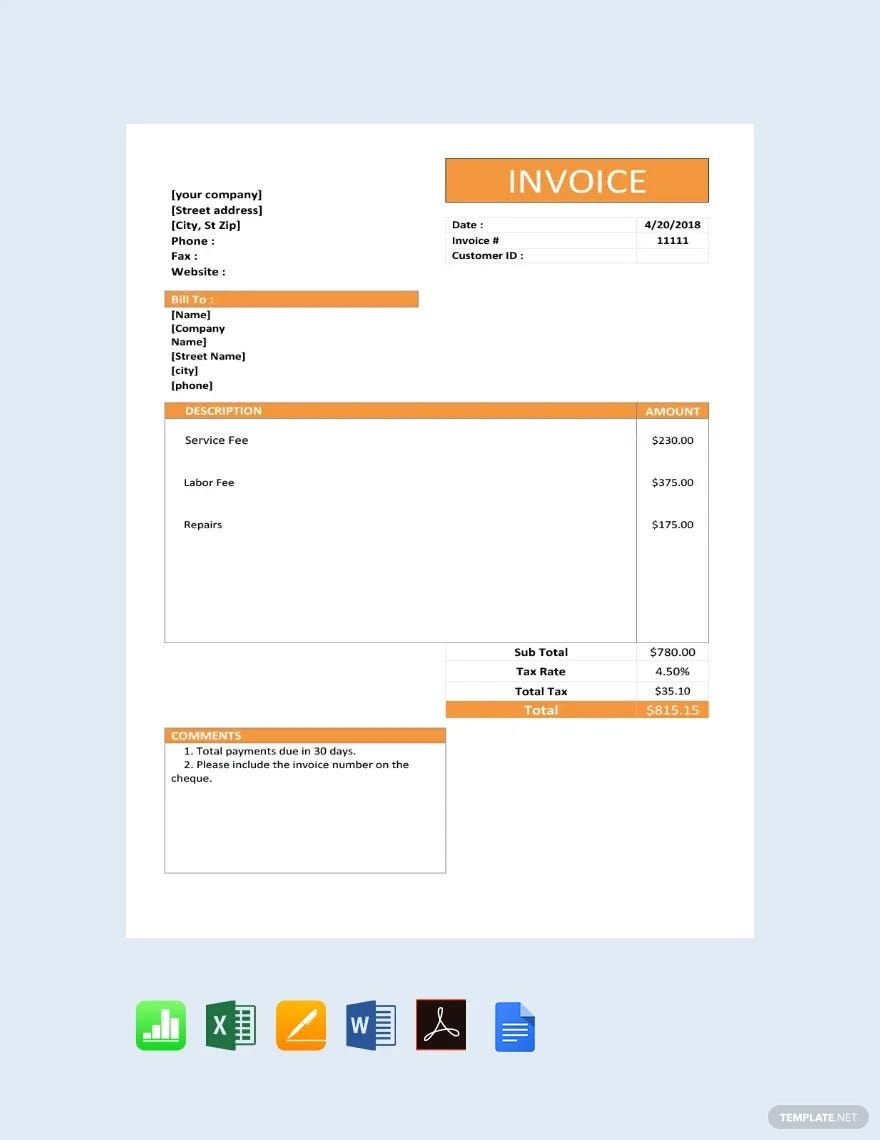

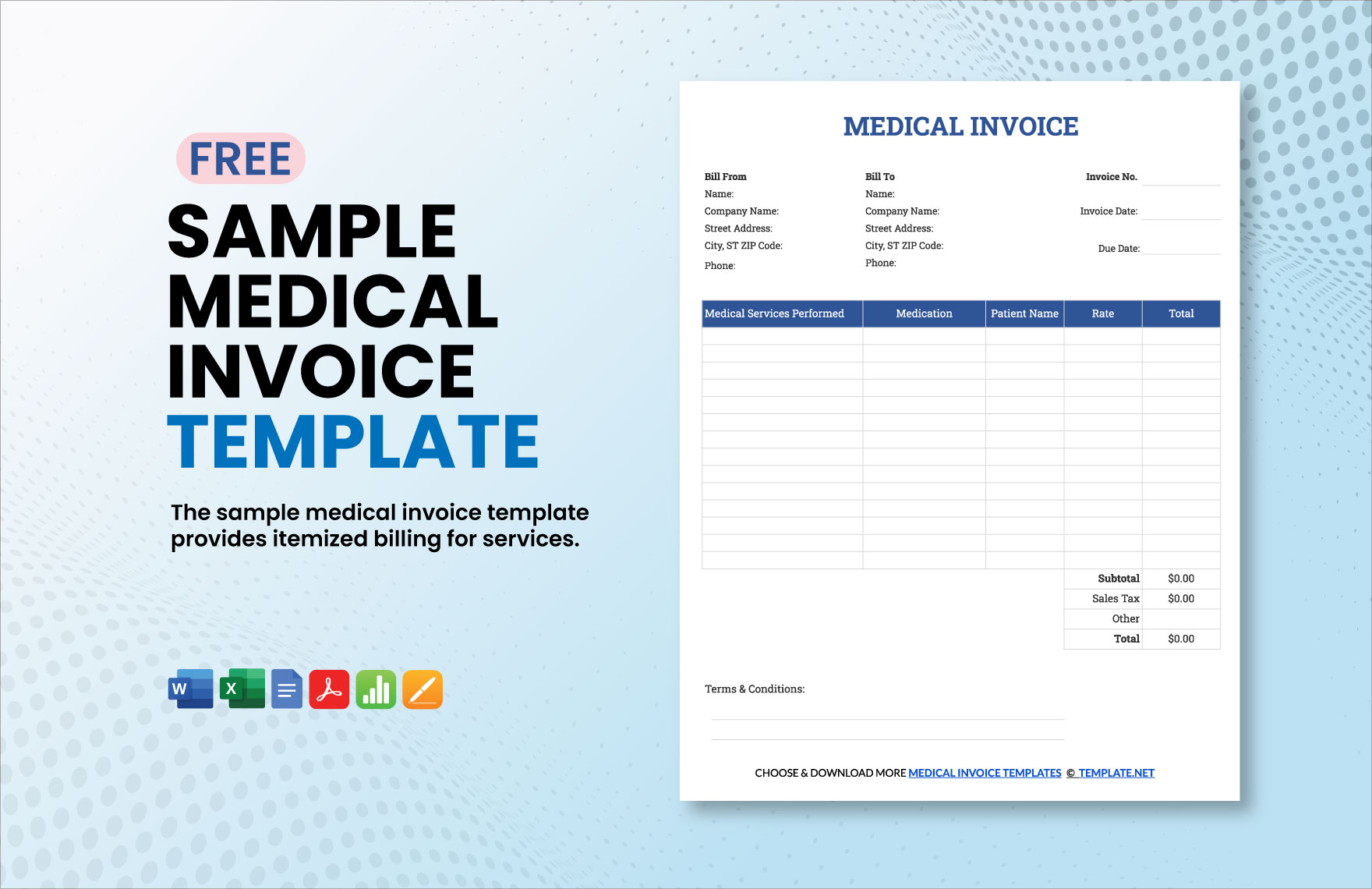

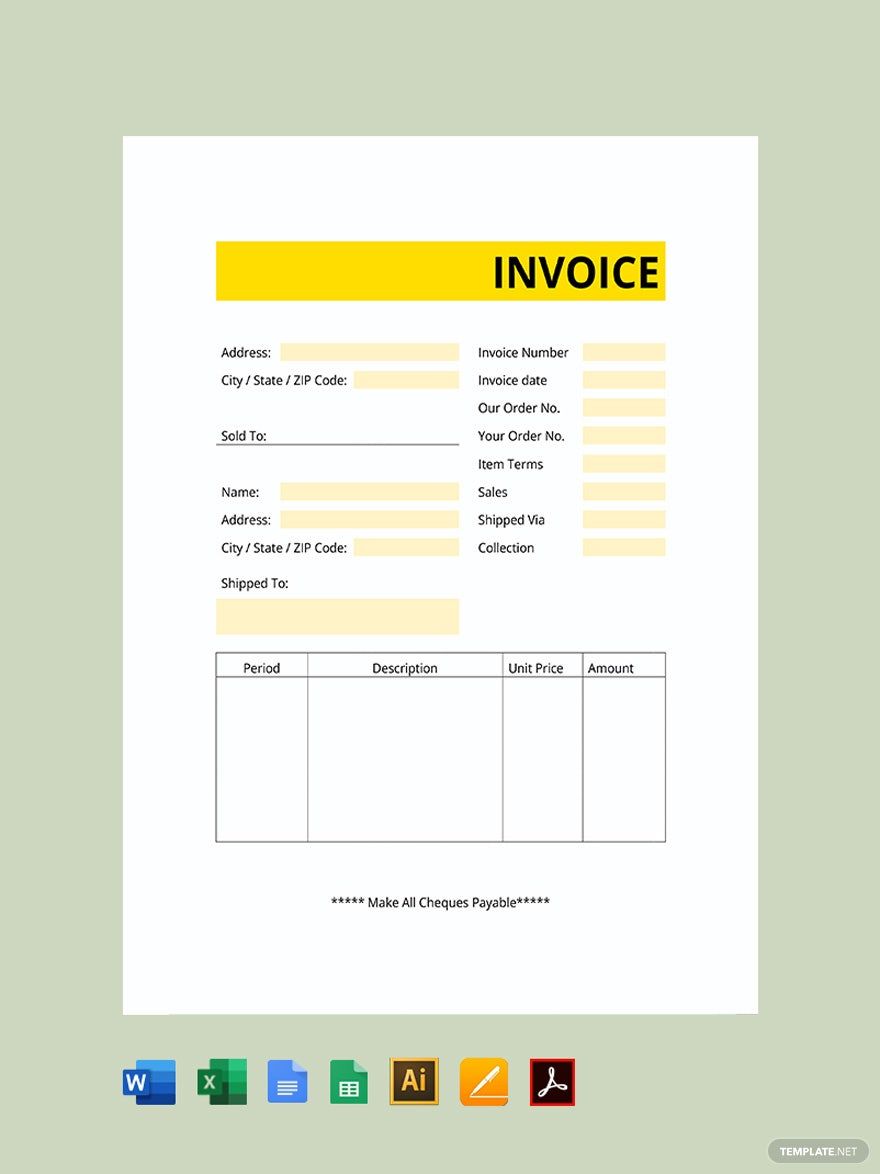

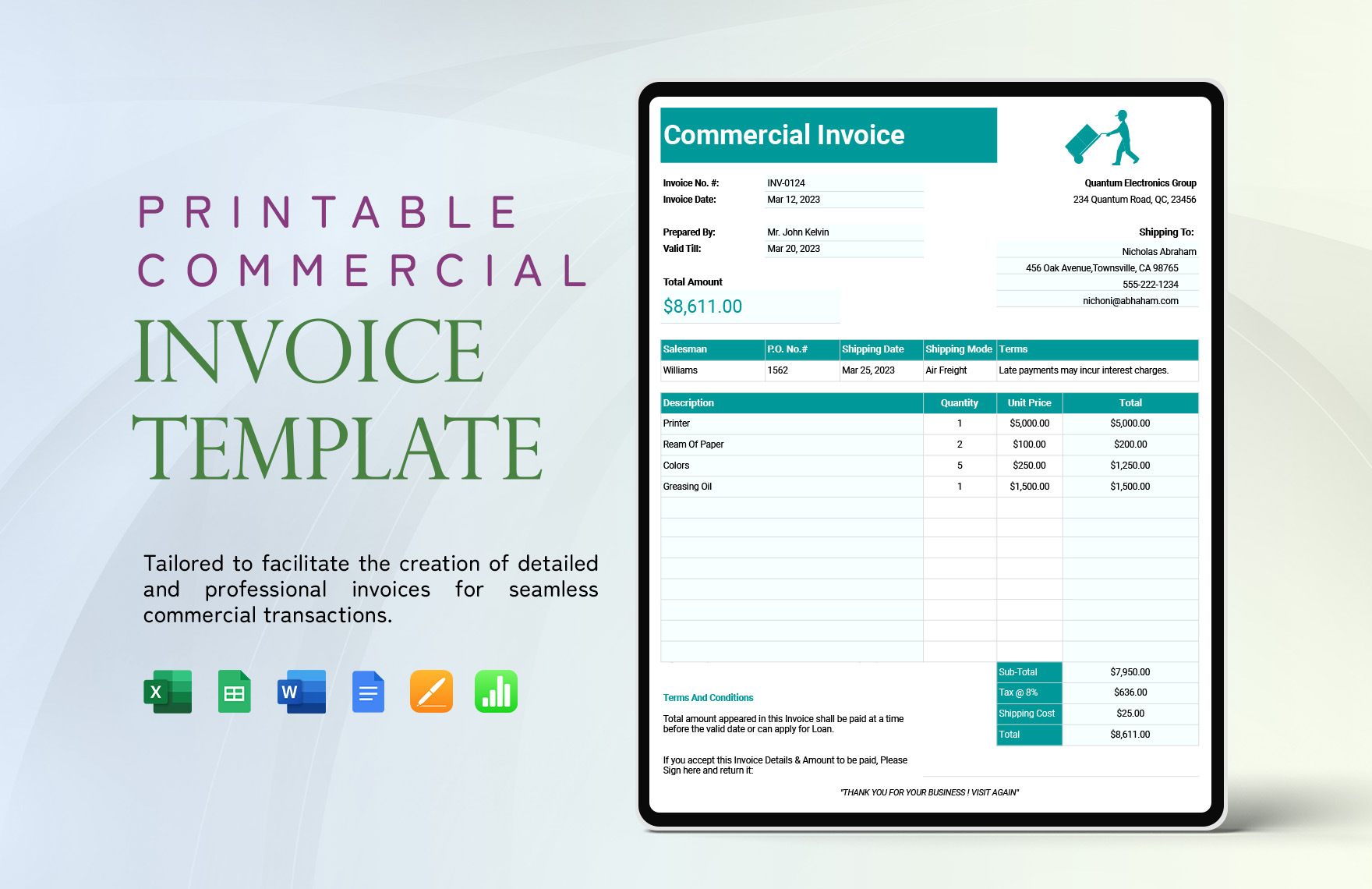

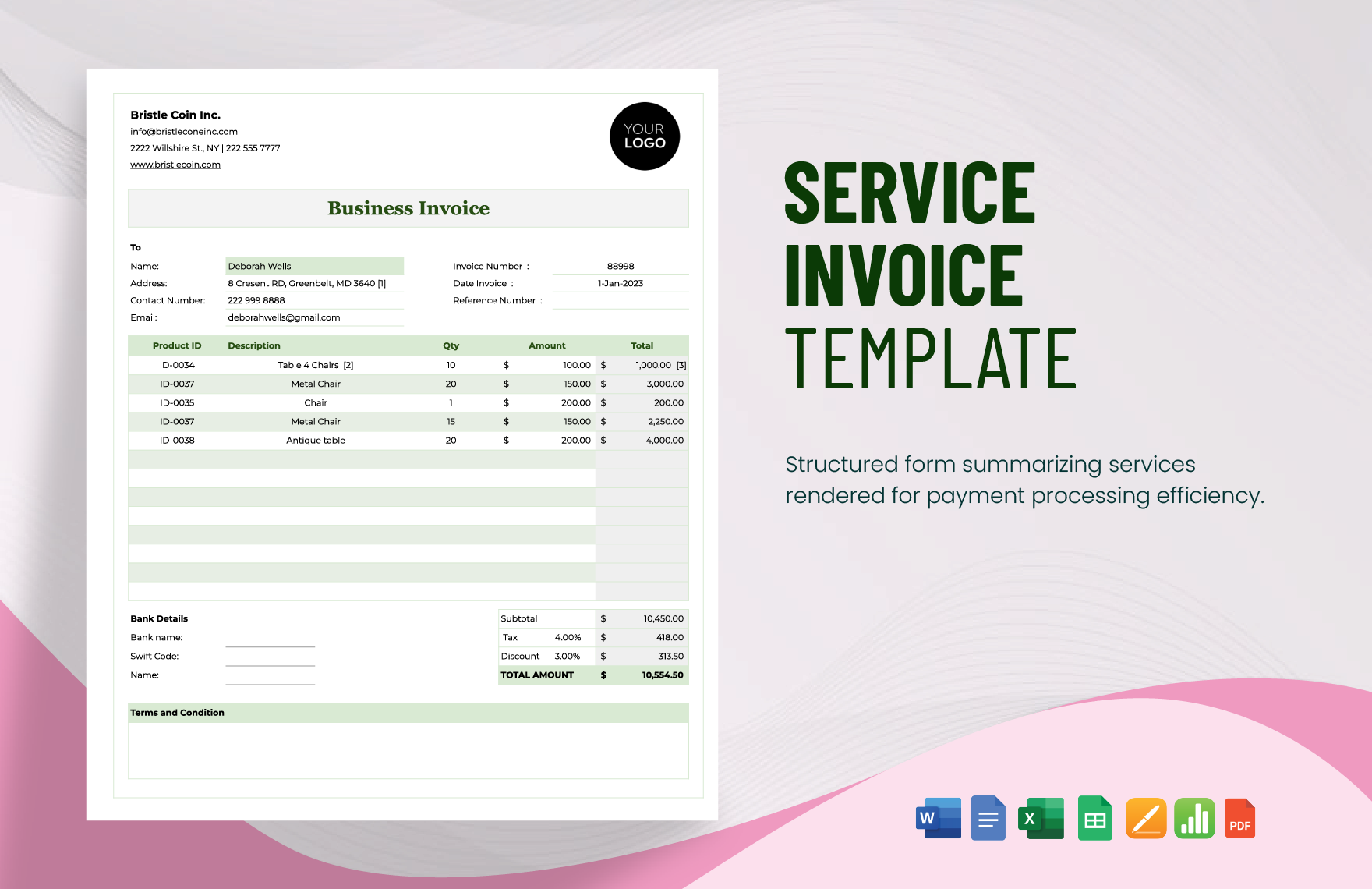

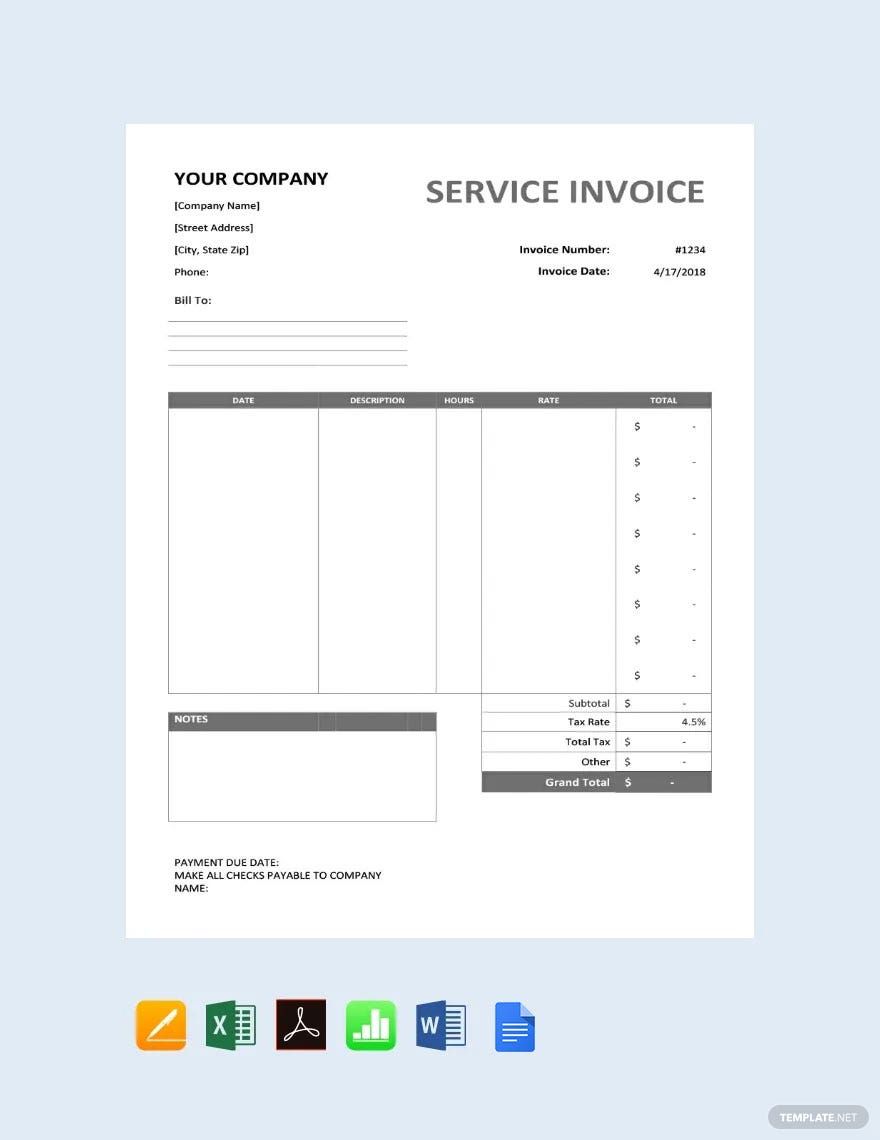

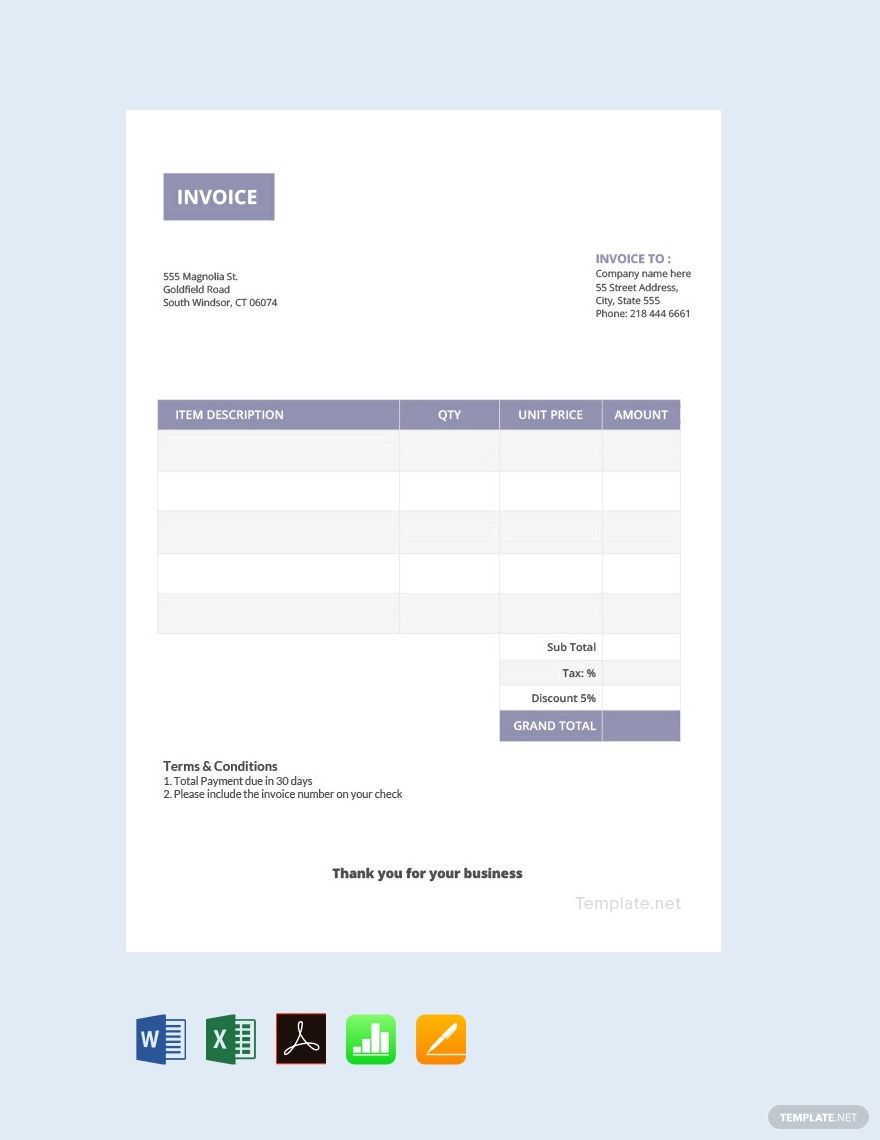

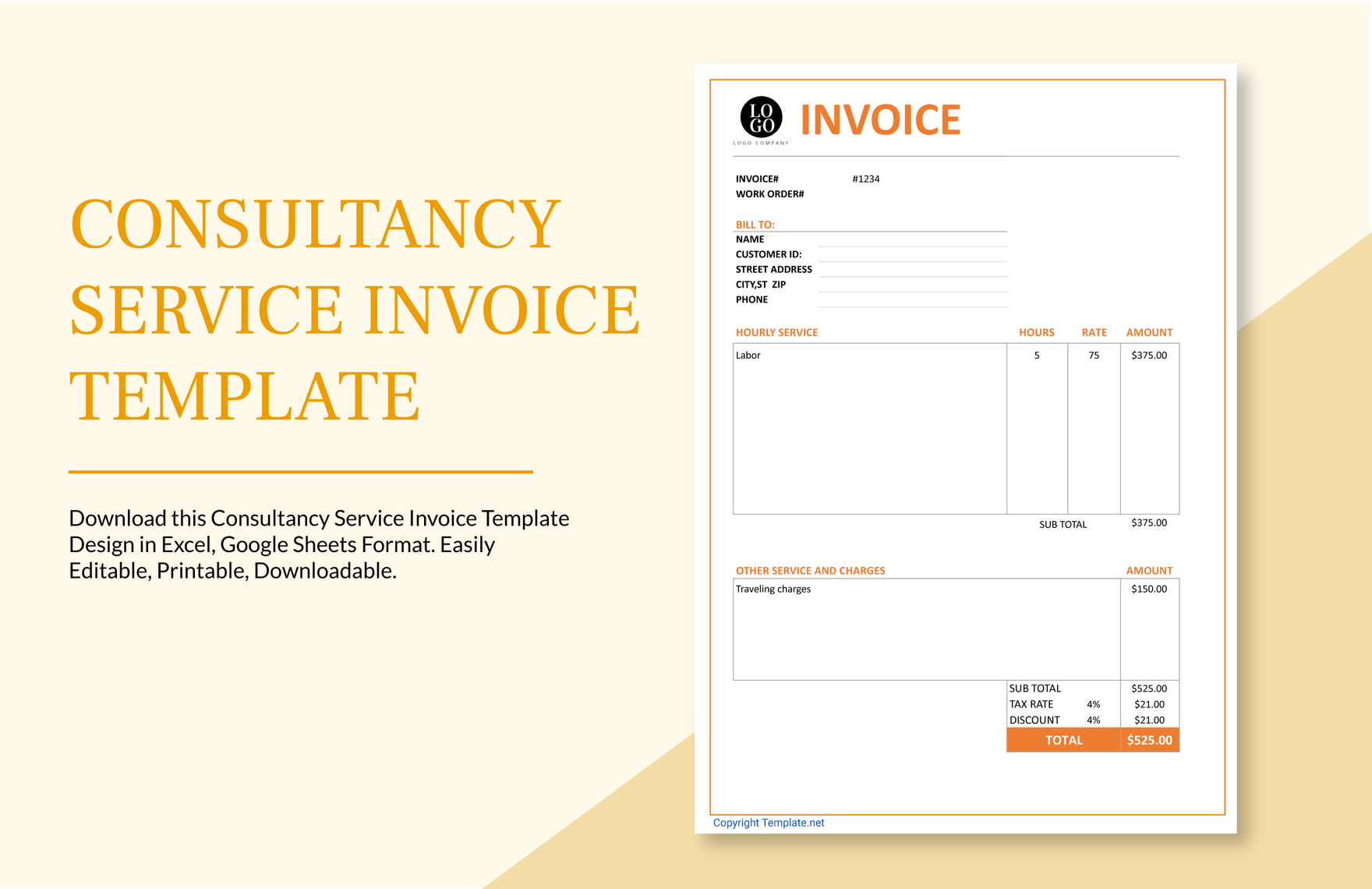

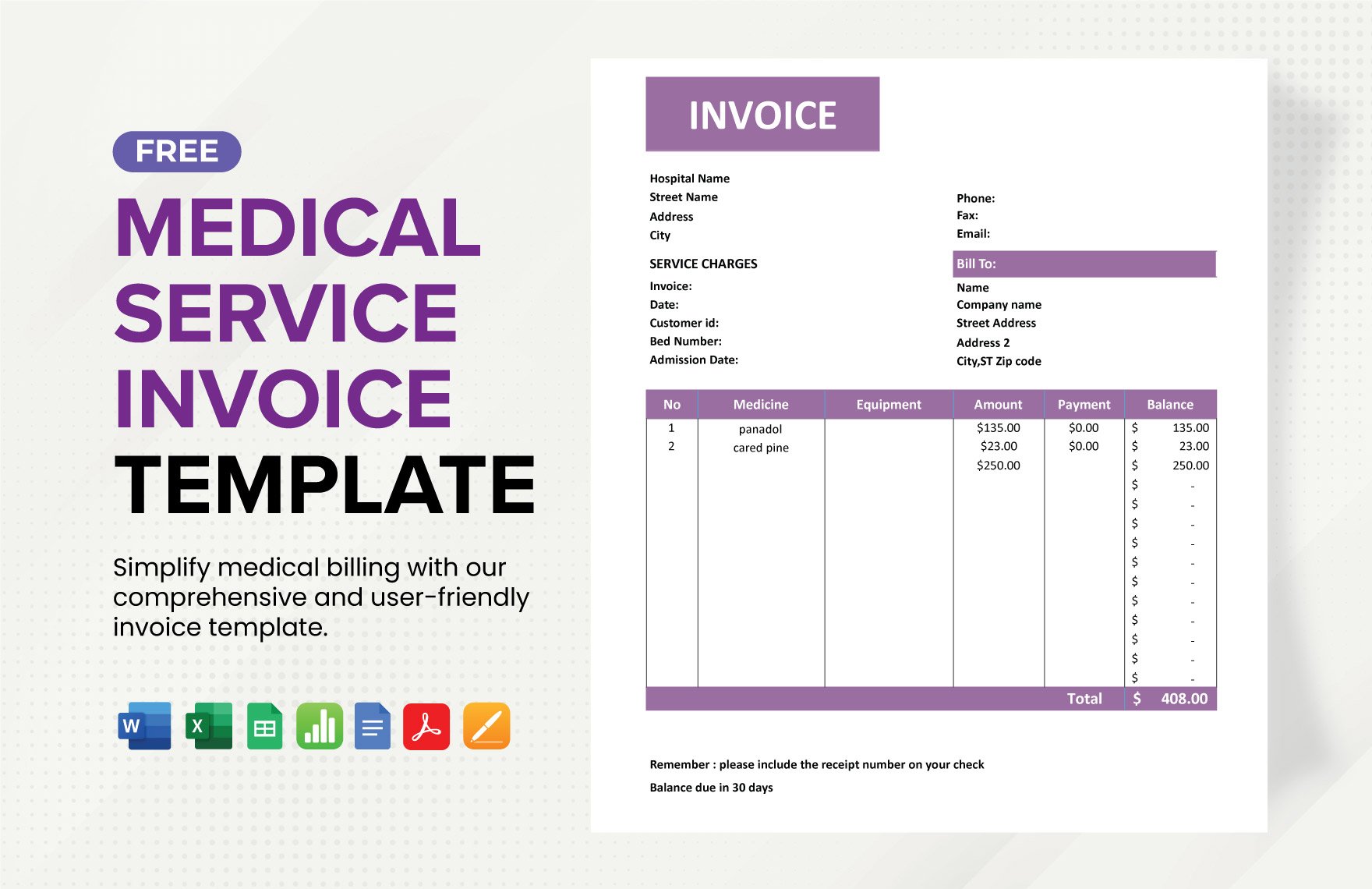

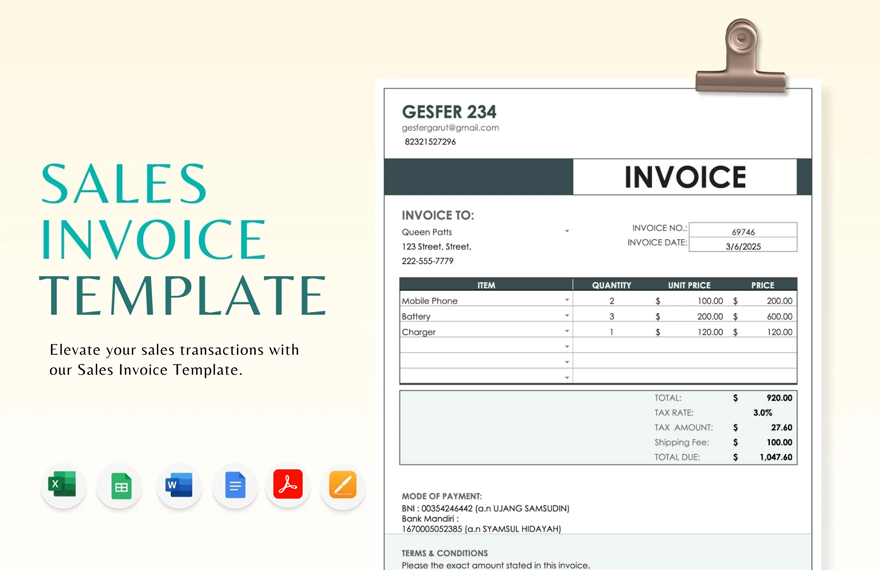

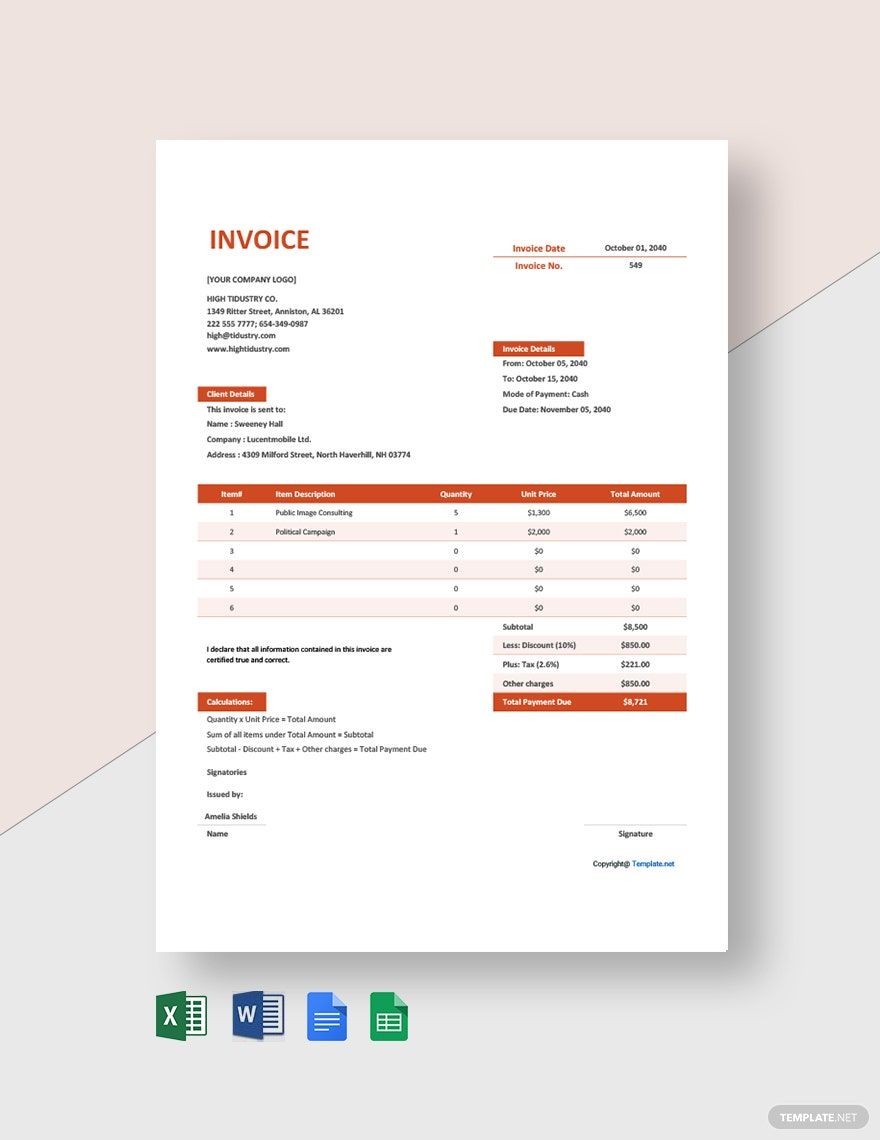

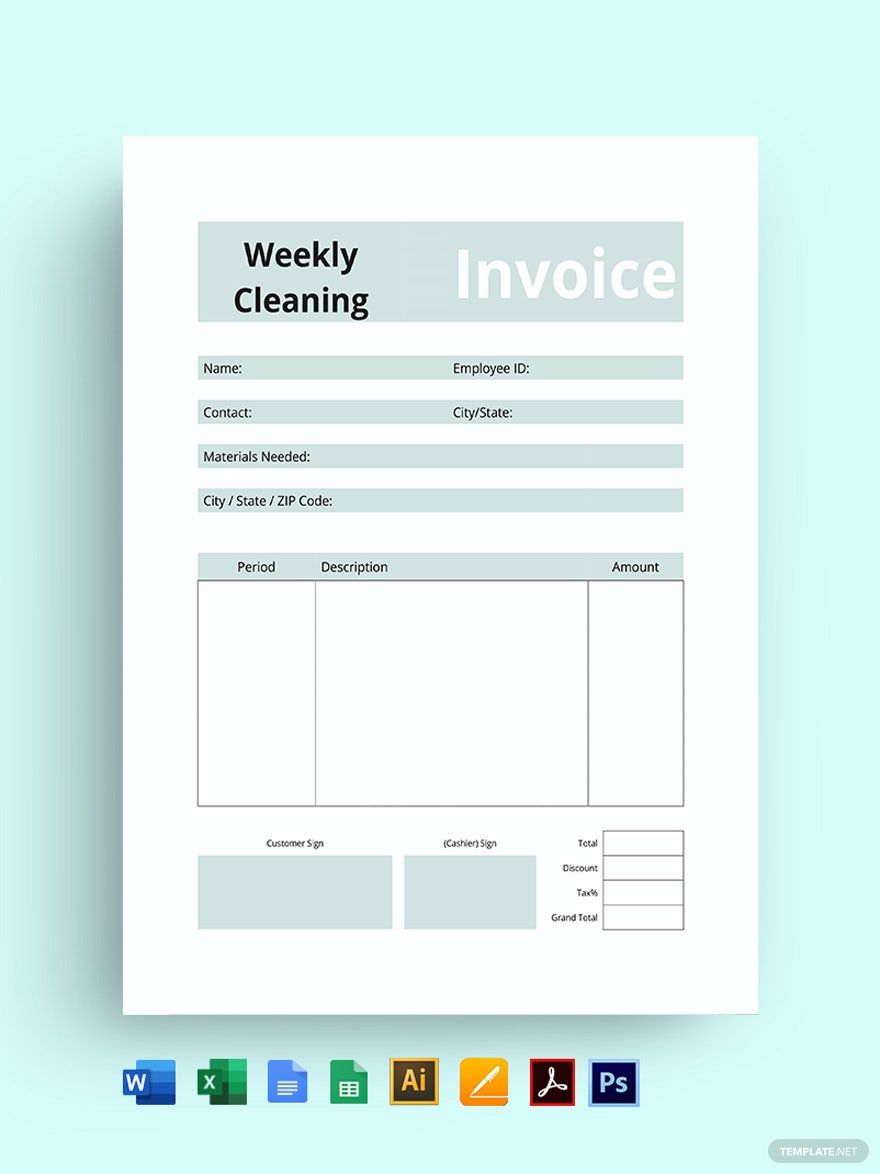

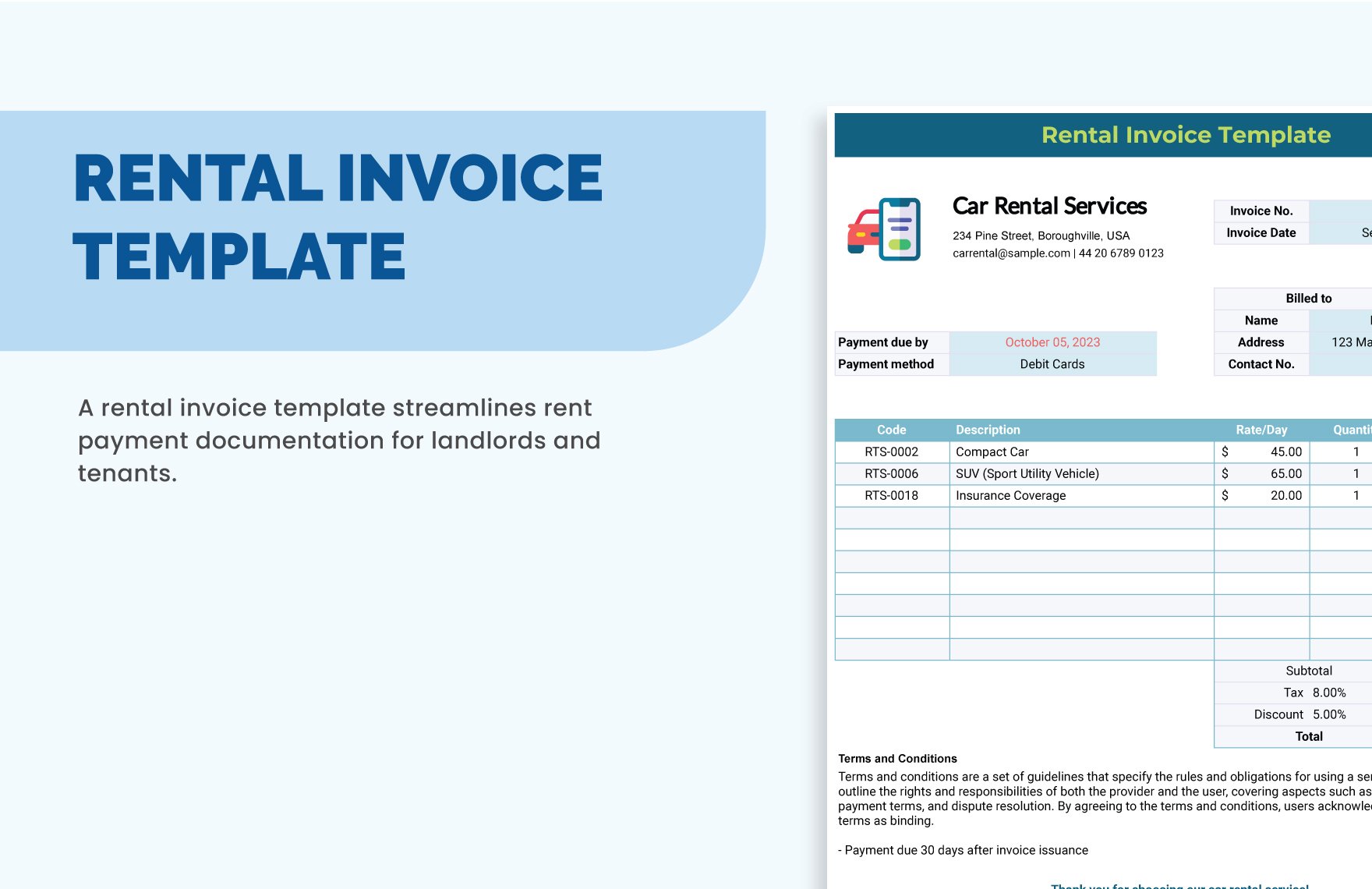

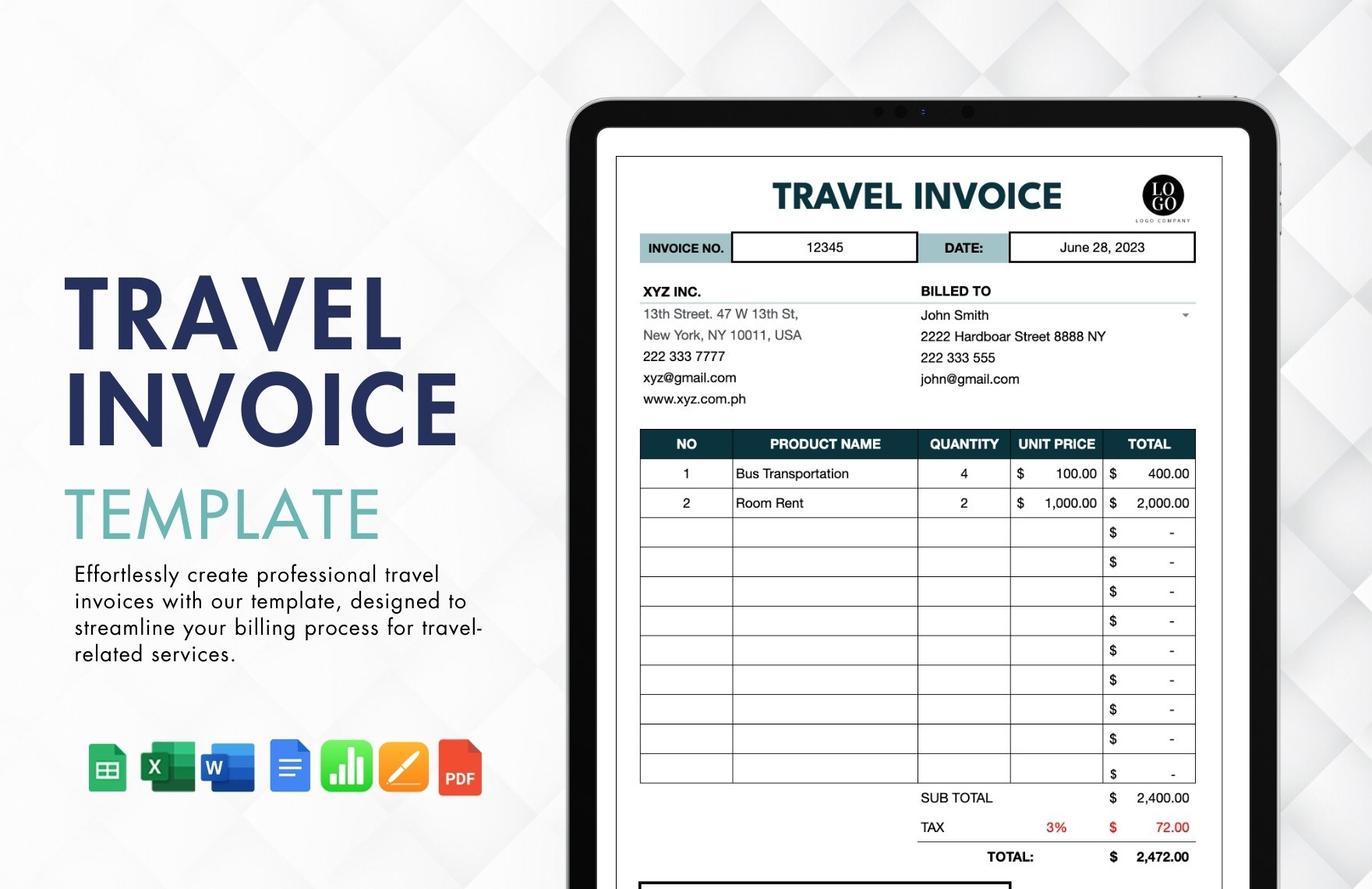

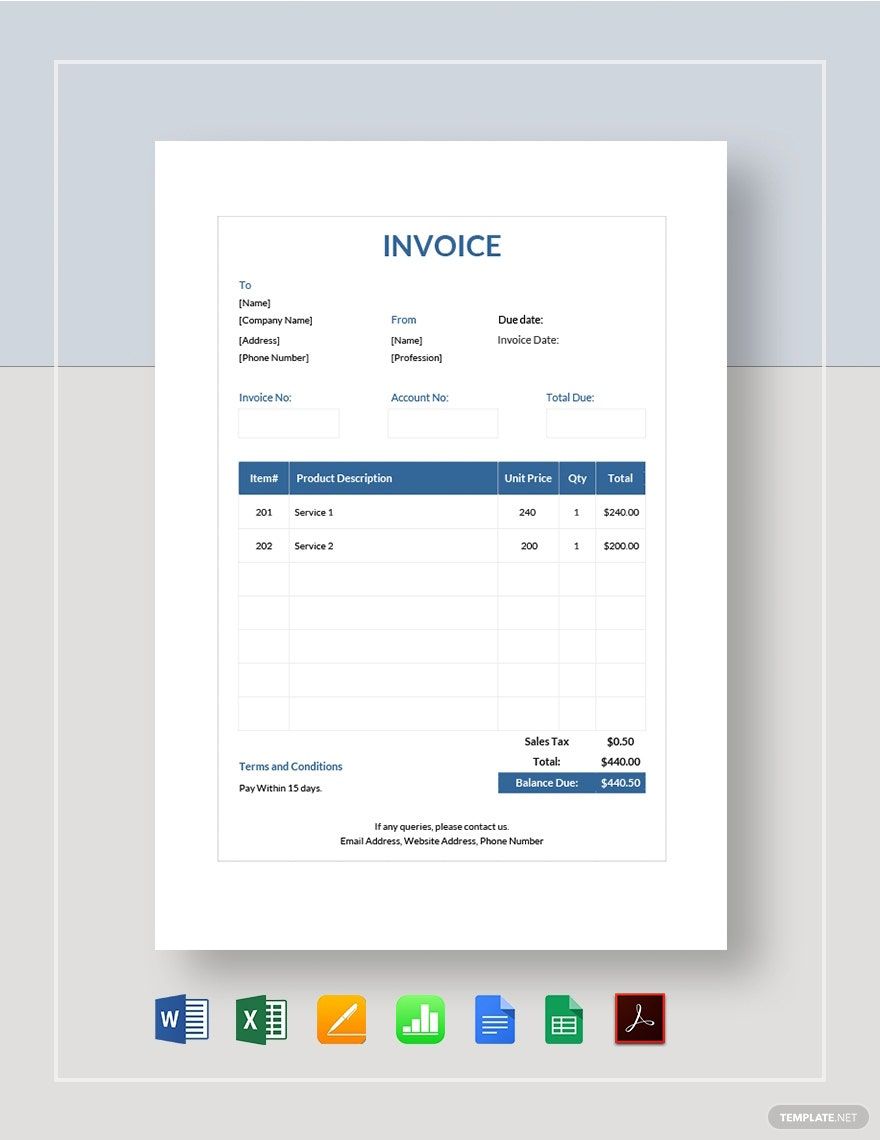

Providers issues invoices to their customers as proofs for the said purchase. Apart from that, companies keep invoices for legal security. So, start securing your company now and issue invoices in every transaction by downloading our high-quality, professionally written, and industry-compliant Simple Invoice Template. This template guarantees you 100% customizable and easily editable features for business or personal use. Comes with Microsoft Excel format, this template is downloadable in any device and printable in A4 & US sizes. So, make a move for your business by clicking the download button now!

How to Make a Simple Invoice in Microsoft Excel

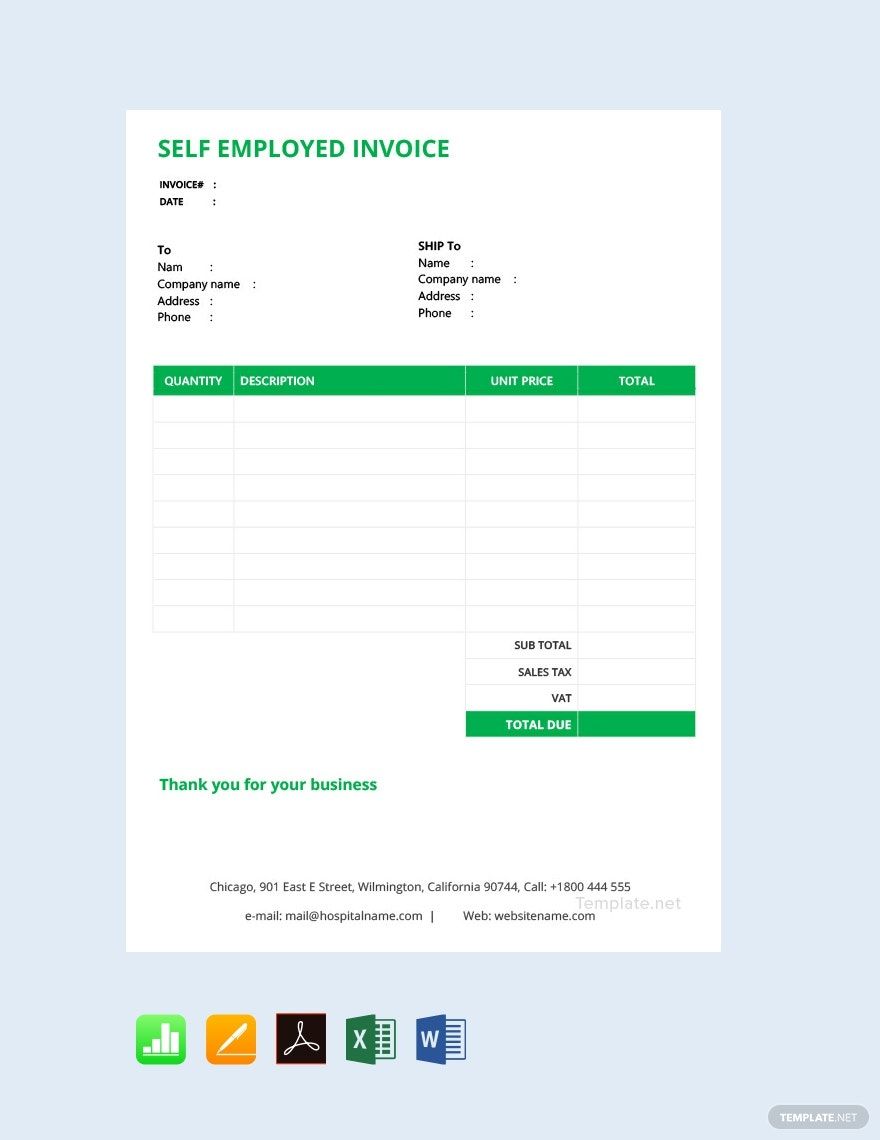

According to AP Statistics, the average cost of producing invoices is between $4.47 - $11.00. This number is nothing compared to the convenience and security that invoices give to entrepreneurs— whether freelance, self-employed, or small-scale. So, if you wanted to secure your business immediately and wanted to start making your basic invoice, here are some few tips:

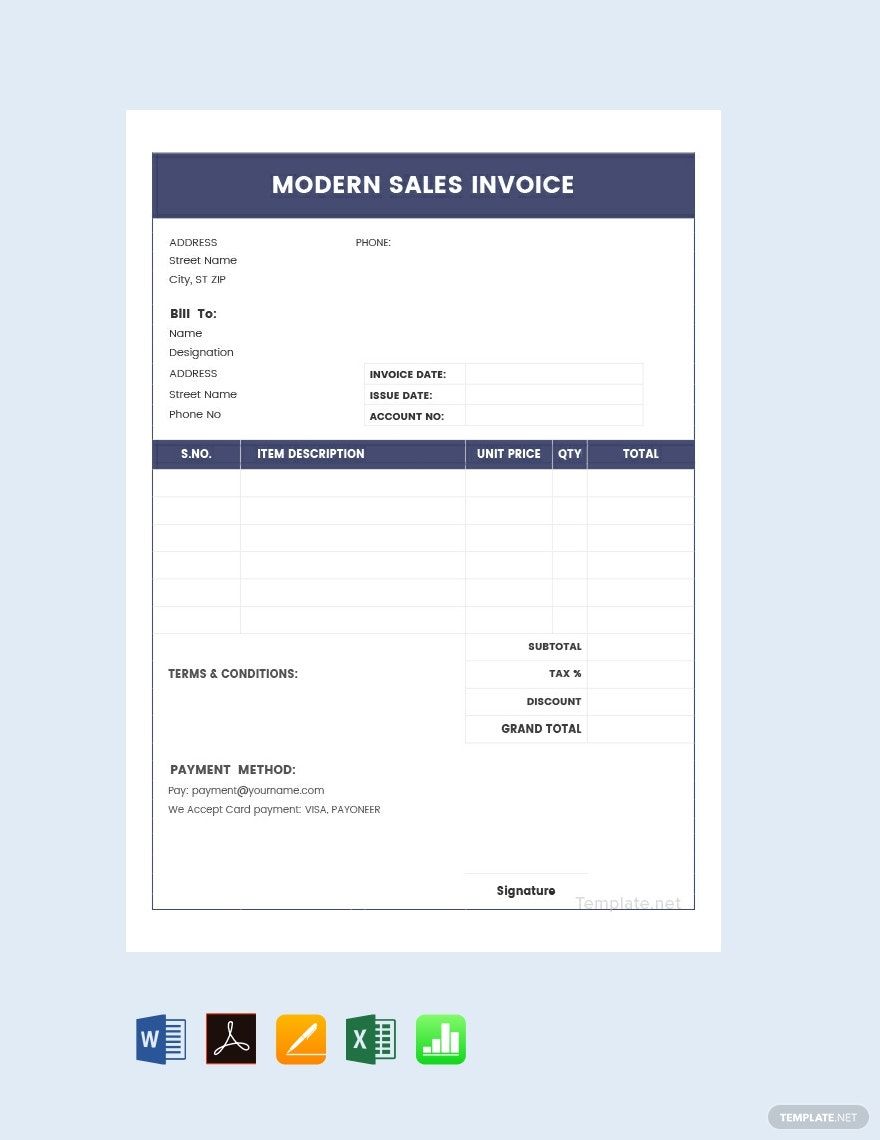

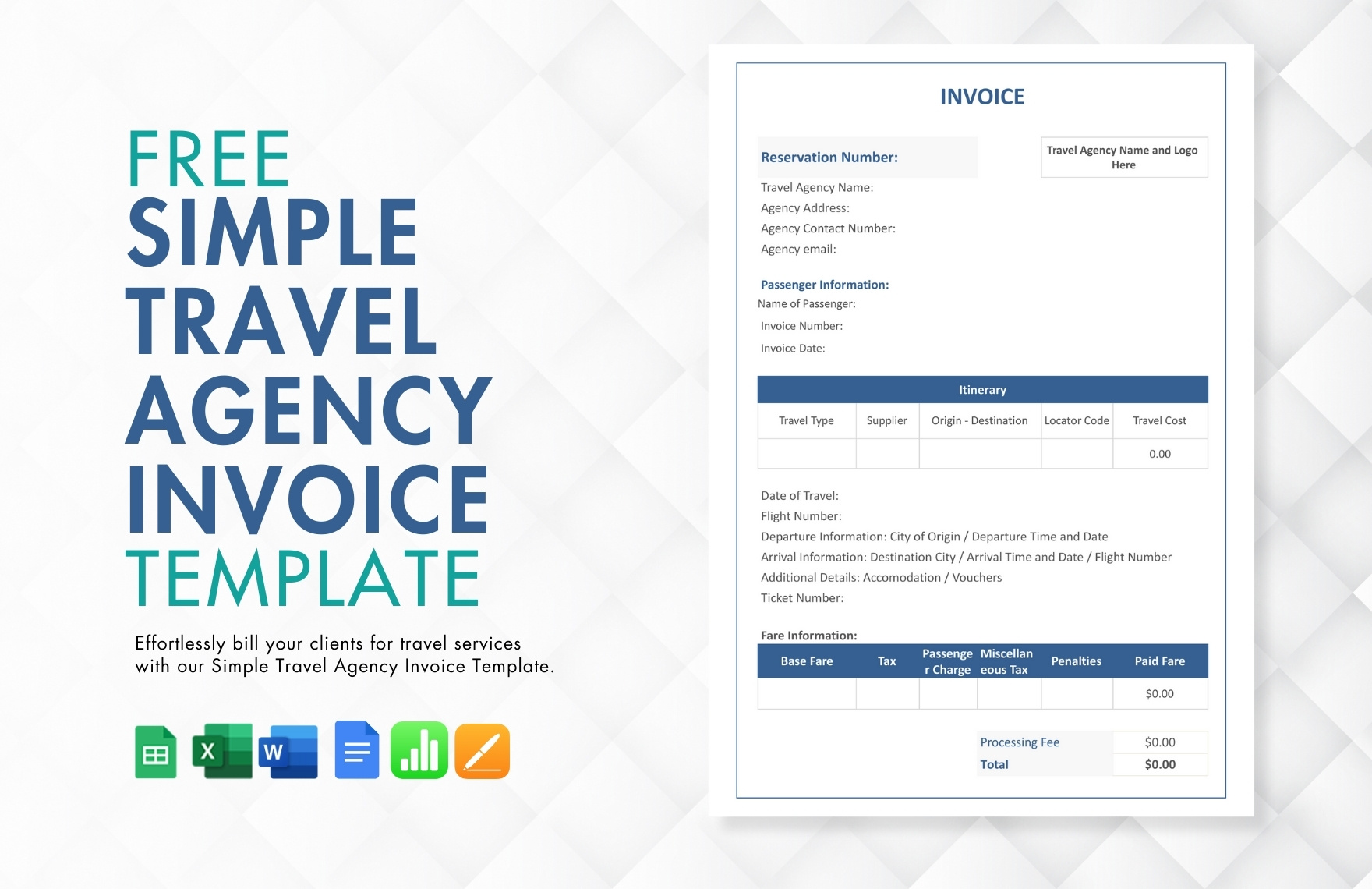

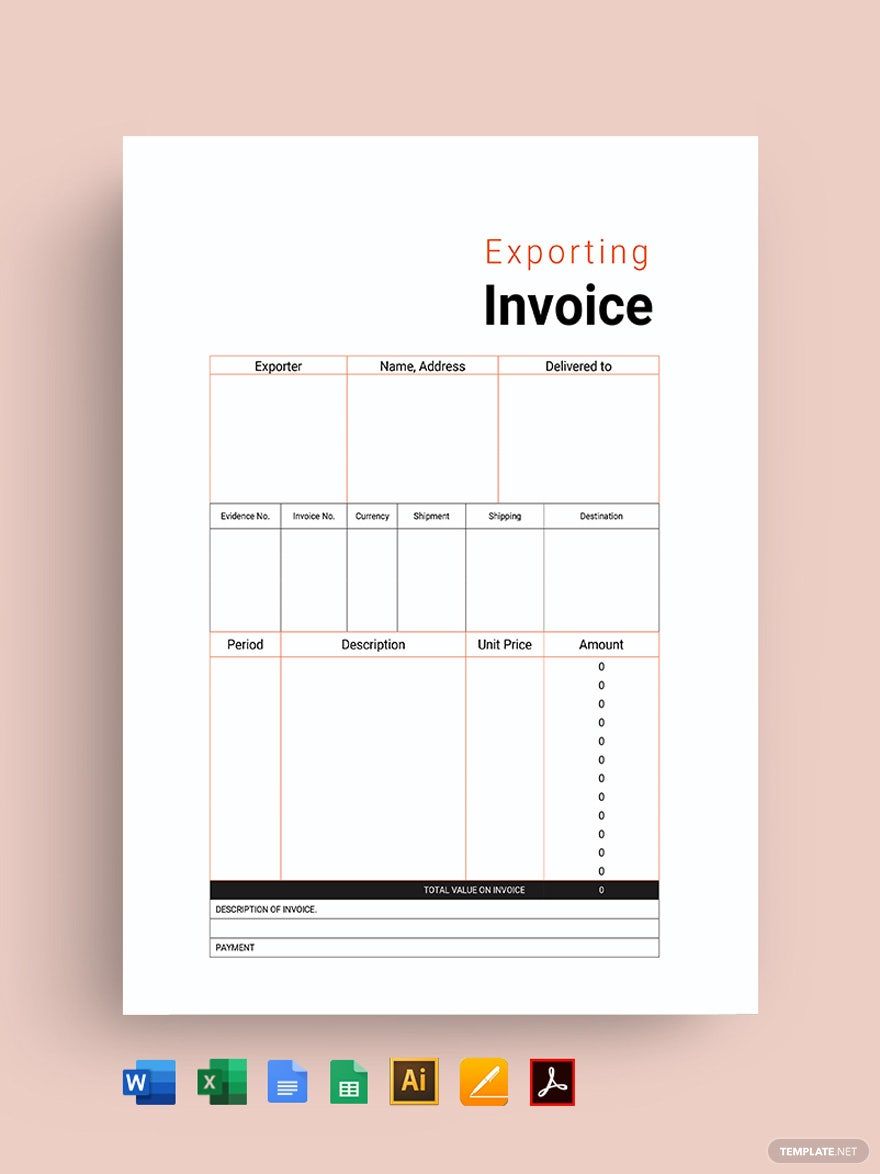

1. Be Straightforward

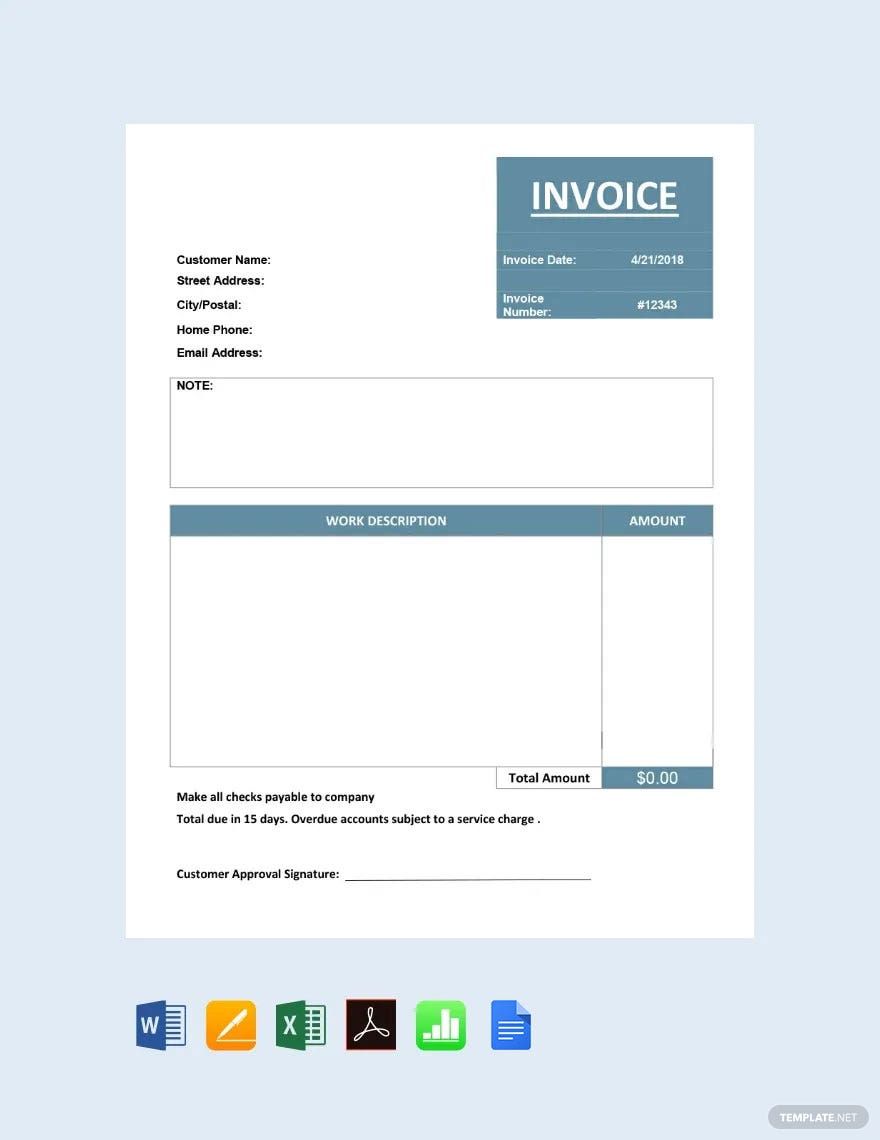

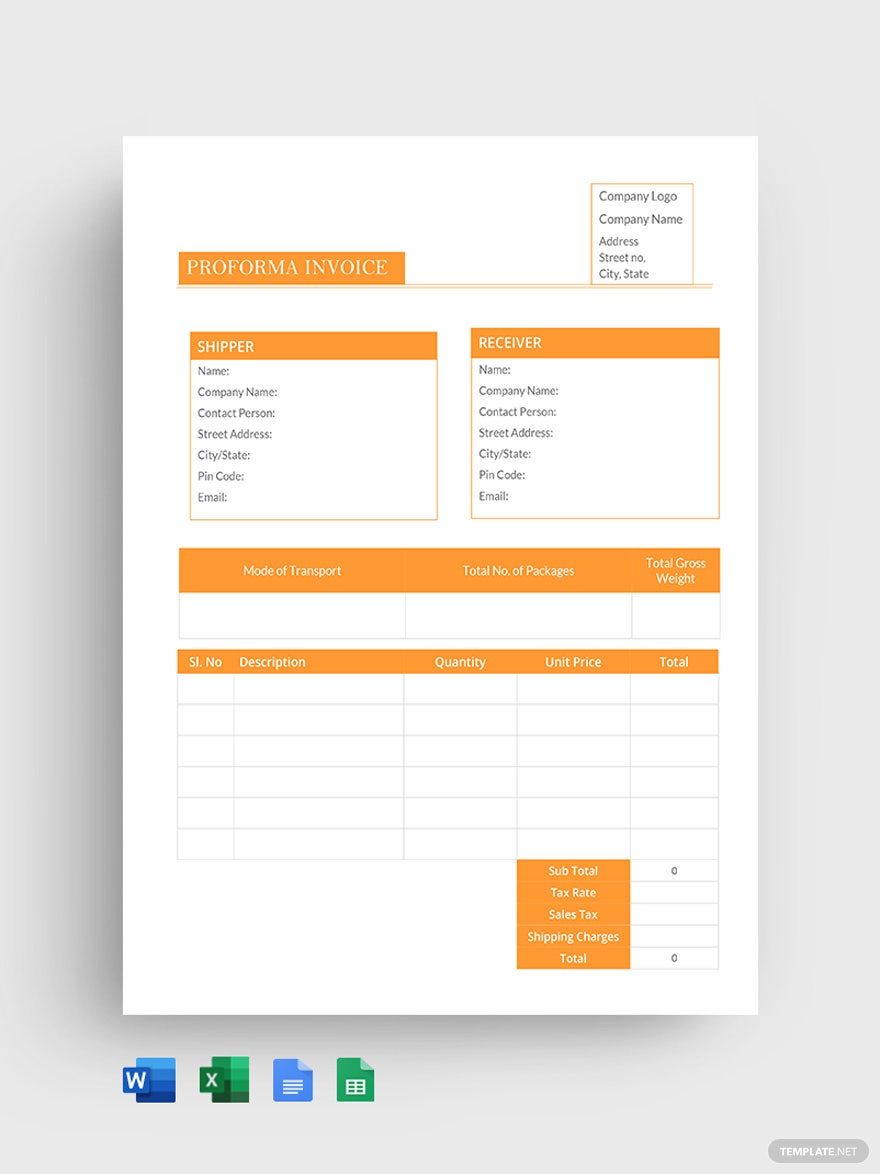

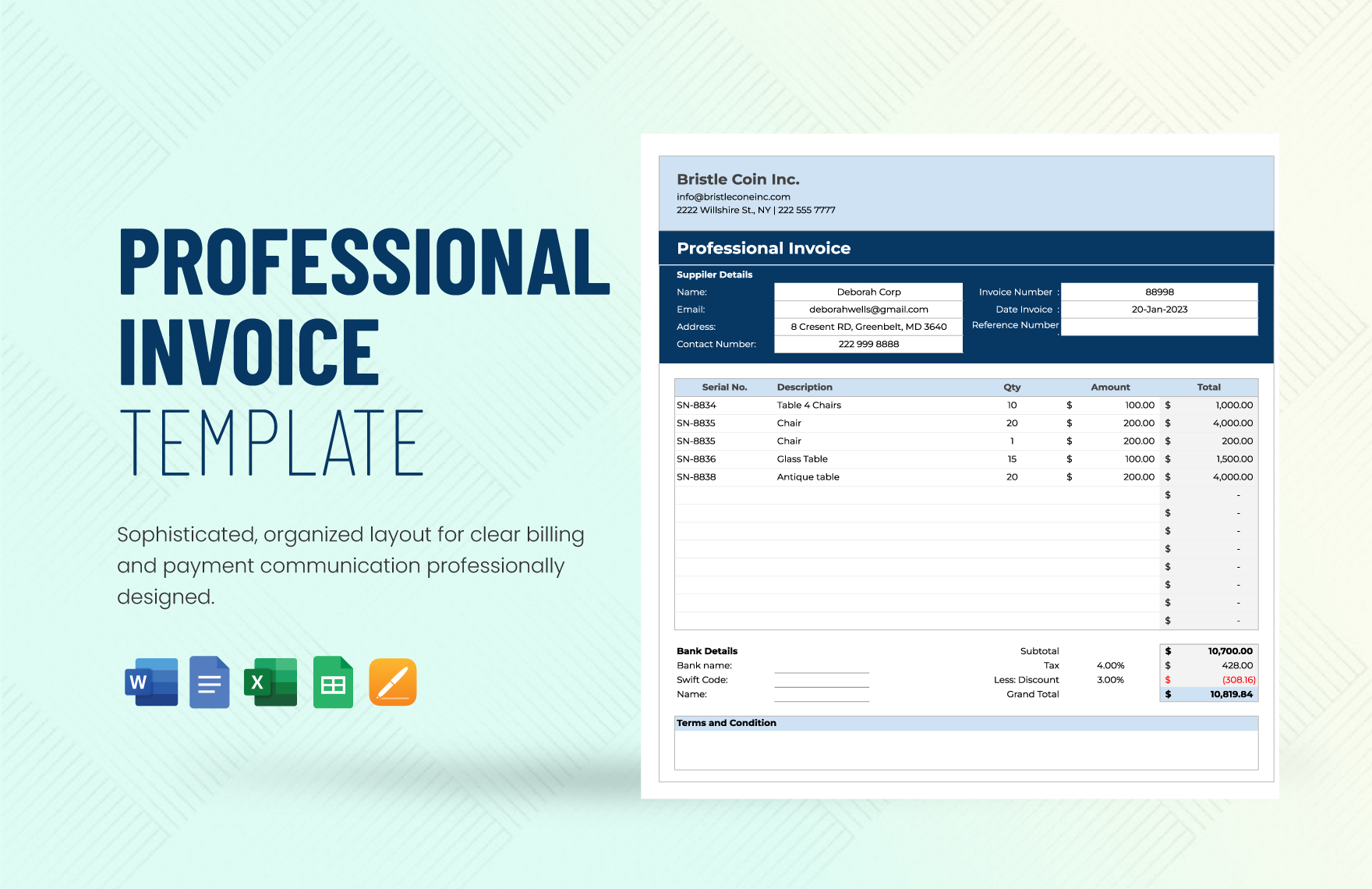

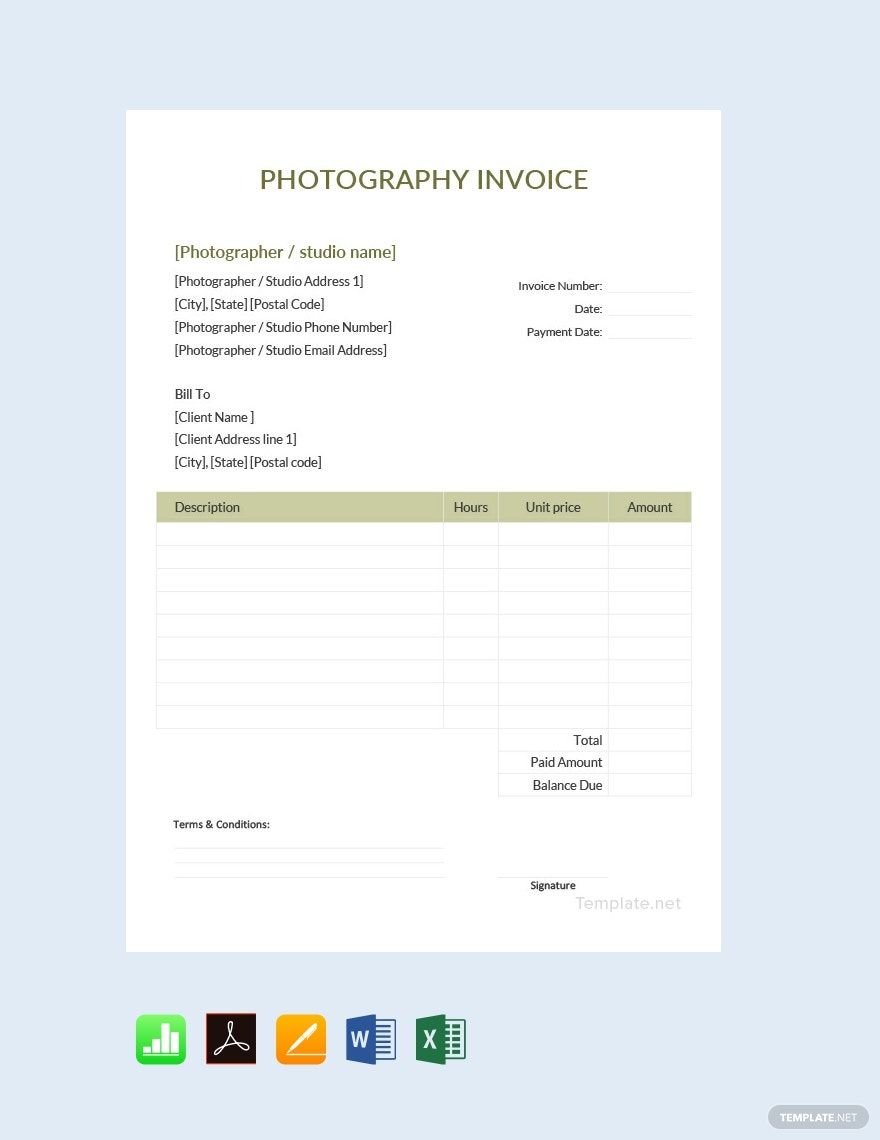

To jumpstart your invoice journey, you need to take note that invoices are made for the purchasers to pay in time, so make it understandable and straightforward. Make a list of every order and sort them accordingly. For instance, if your customer ordered kitchen furniture, you need to present the orders in a way that customers would immediately know what they are.

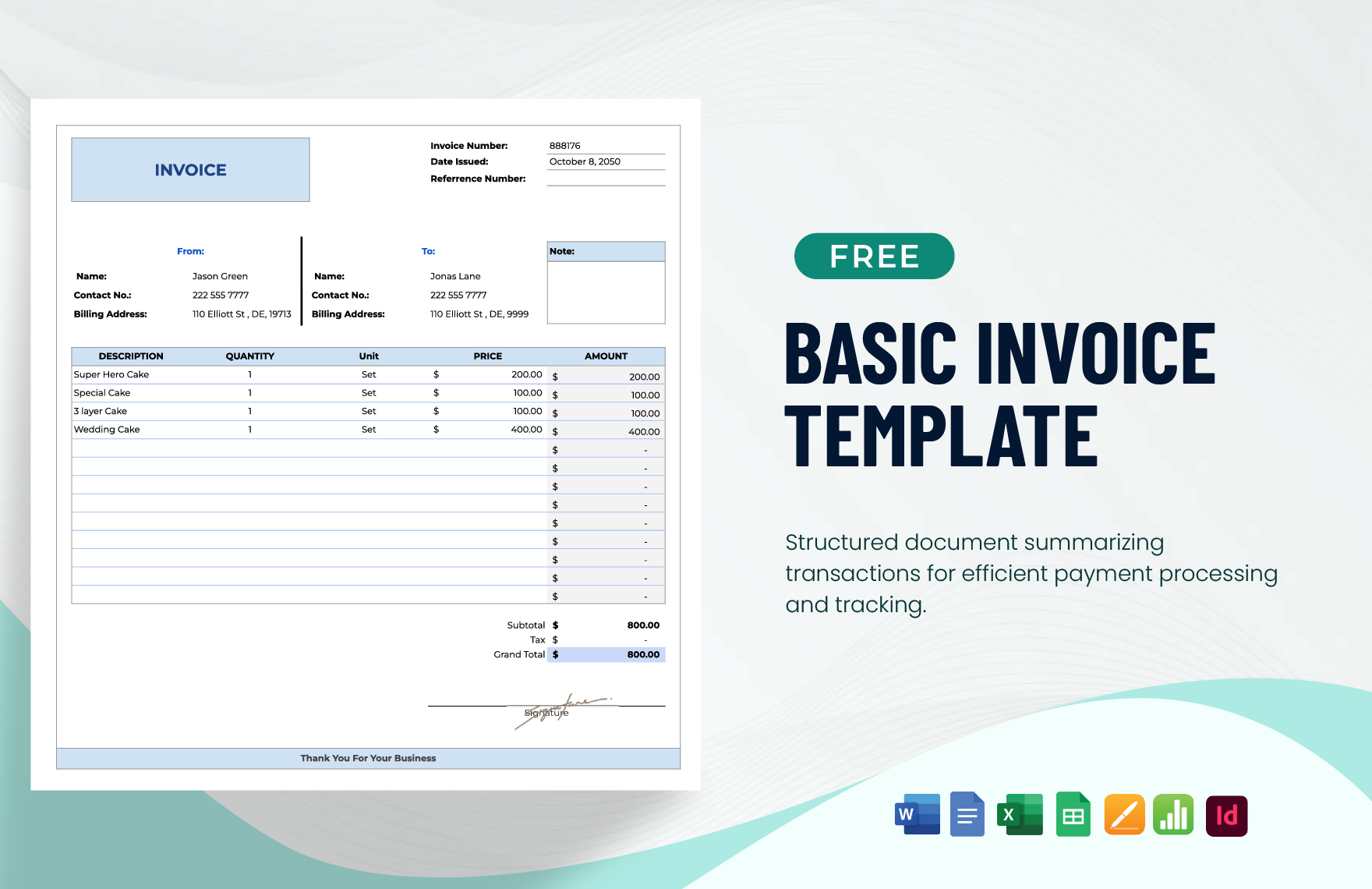

2. Present Terms of Payment

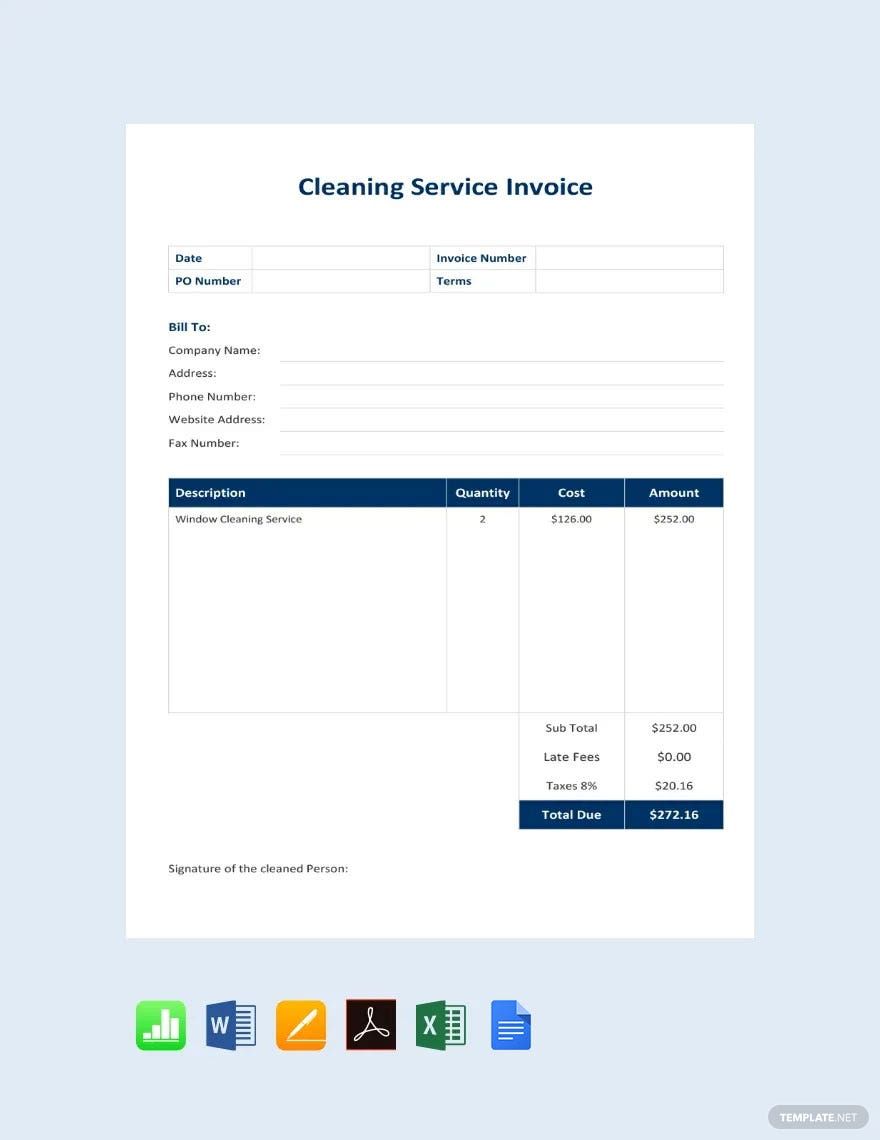

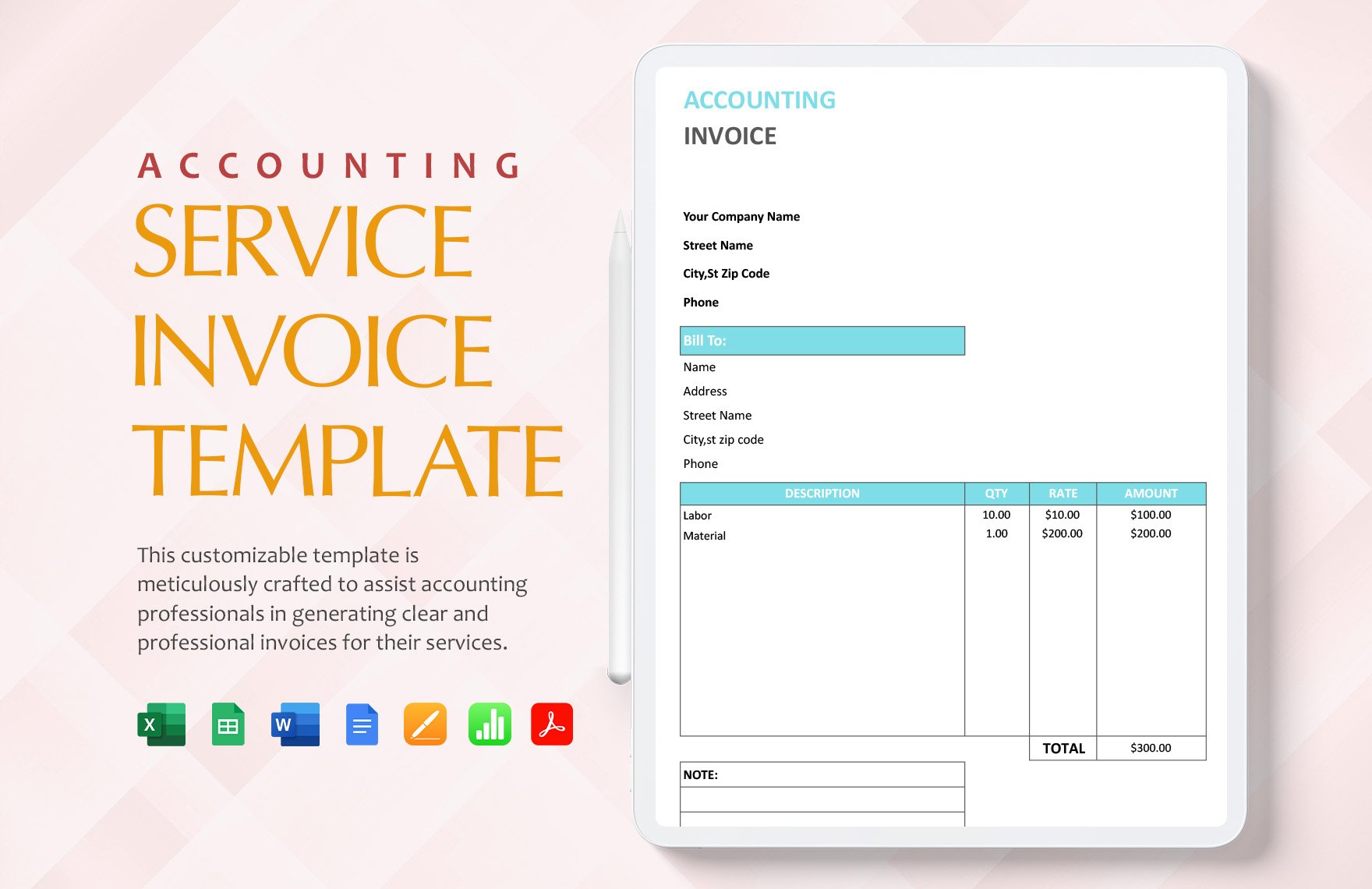

As invoices serve as a reminder for customers to pay for their order, you need to present some payment terms. But, you need to consider that not every customer pays on the said date. According to statistics, 32% of invoices are paid late. So, expect to shorten the payment terms if you urgently need the payment.

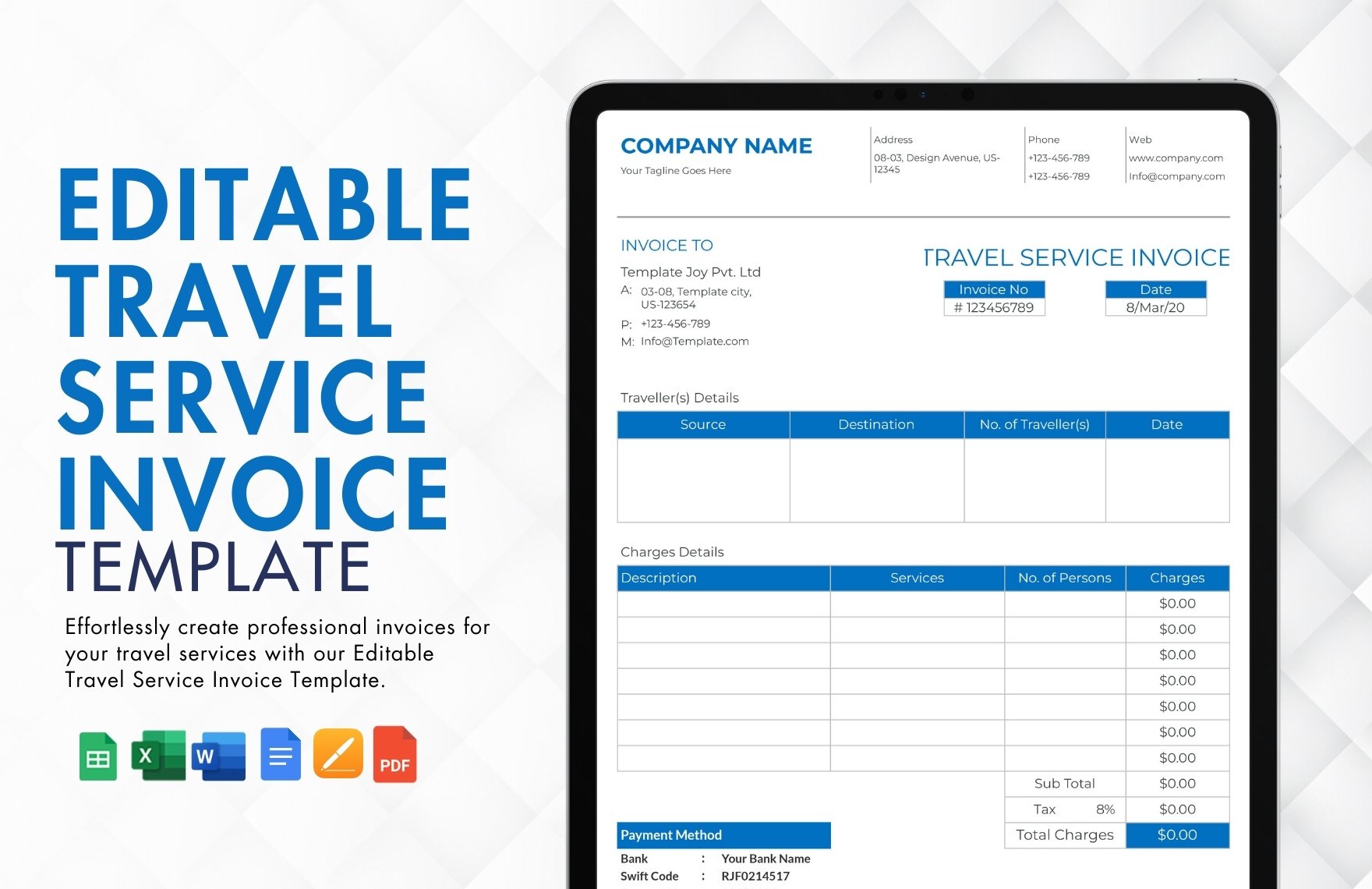

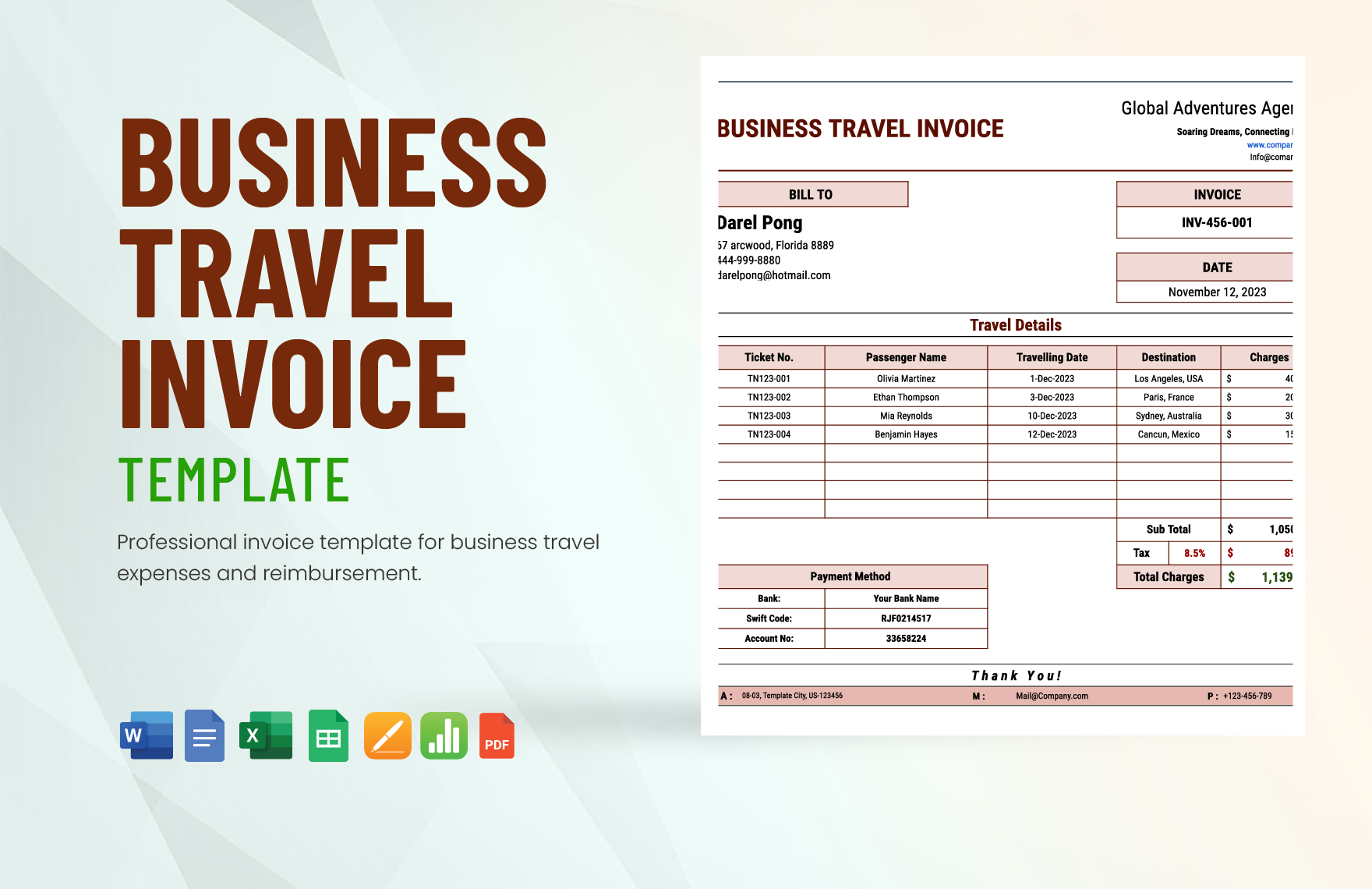

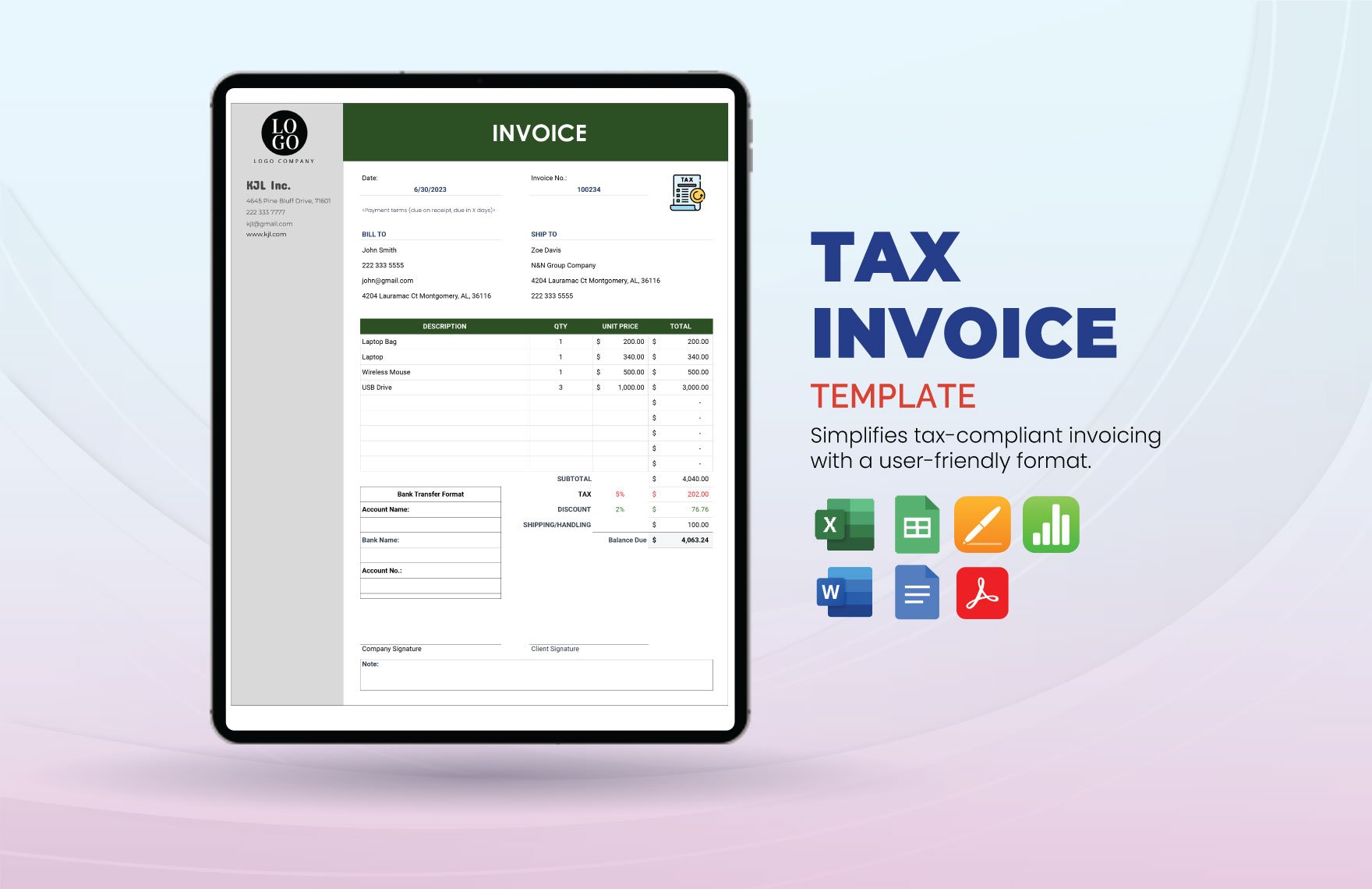

3. Include Payment Methods

With the terms presented, you would also need to include payment methods. Make it easier for your customers and give them options by including 2-3 payment methods in your simple invoice. In this way, your customers can pay in a convenient and familiar way.

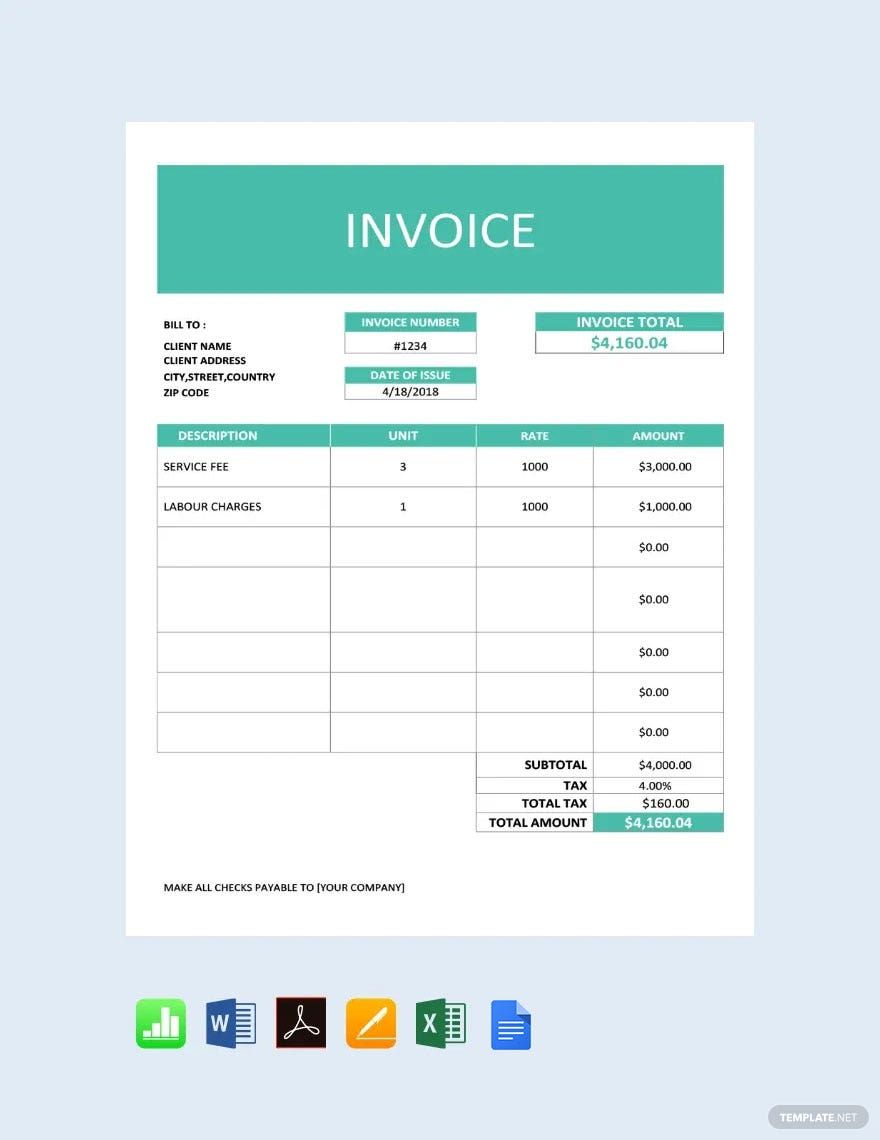

4. Insert Incentives and Discounts

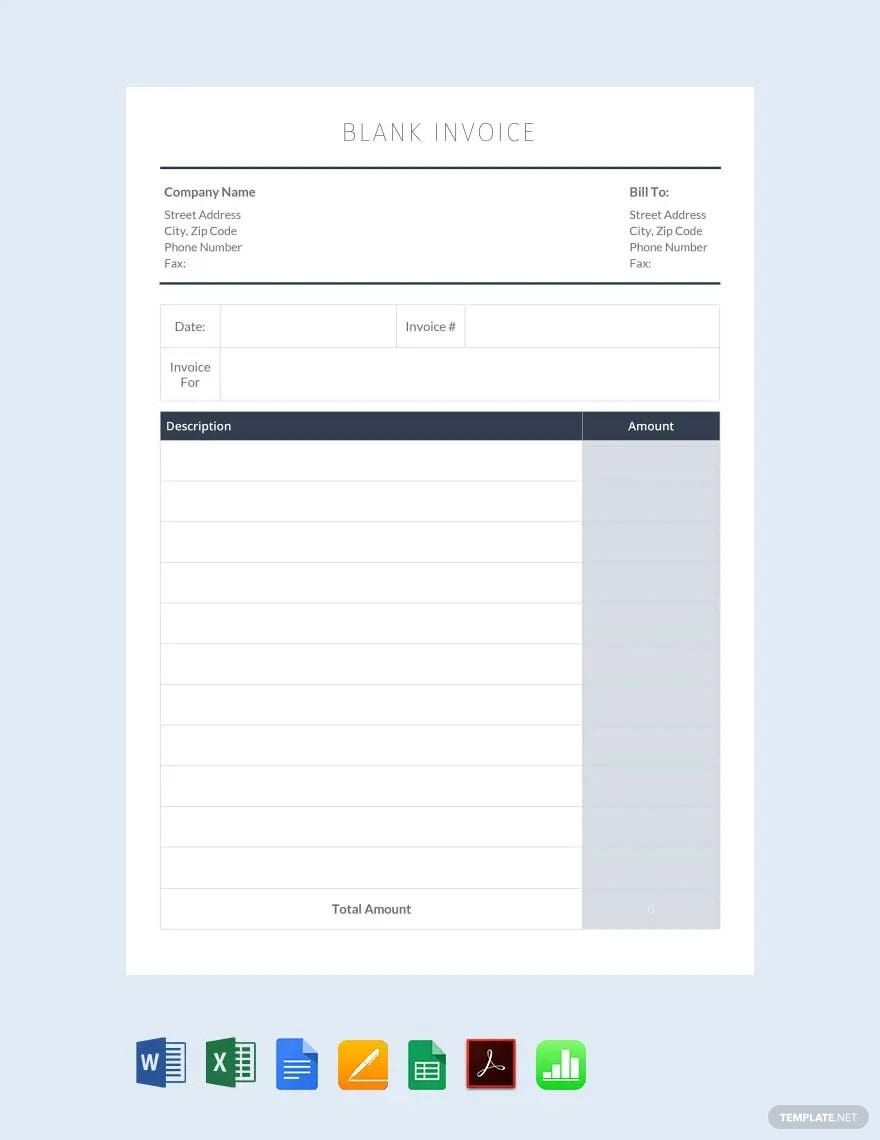

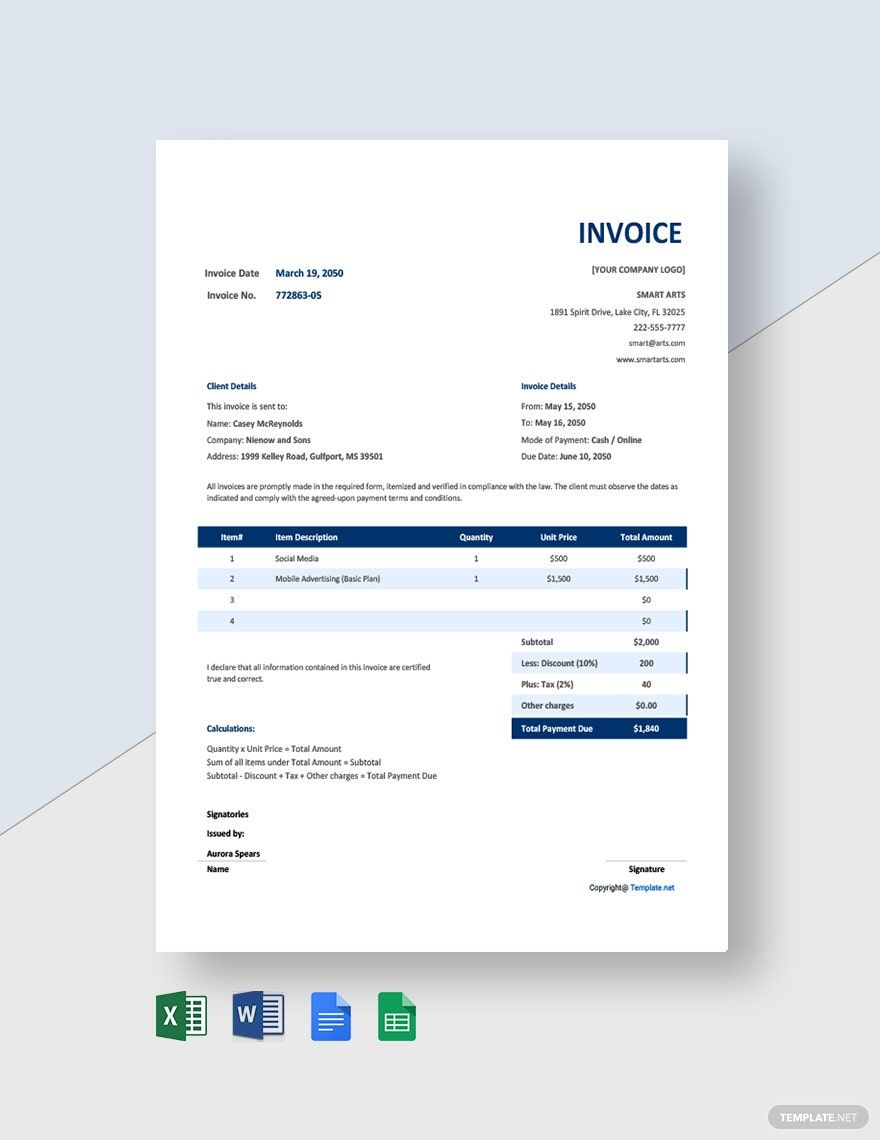

Unlike a blank invoice, it would be preferable to lay out incentives for those who pay early. Your purchasers might be encouraged if you would reward them a token of gratitude for settling their payments early. To do this, you need to decide the time frame for the incentives and decide the percent of discount.

5. Indicate Late Payment Charges

Of course, it would be convenient for you if you would include charges for late payments. Either way, you are issuing an invoice to give notice to the customers to pay you on time, so late payment charges are reasonable. But, take note that you might receive tons of vocal feedback, especially to those people who pay late habitually.