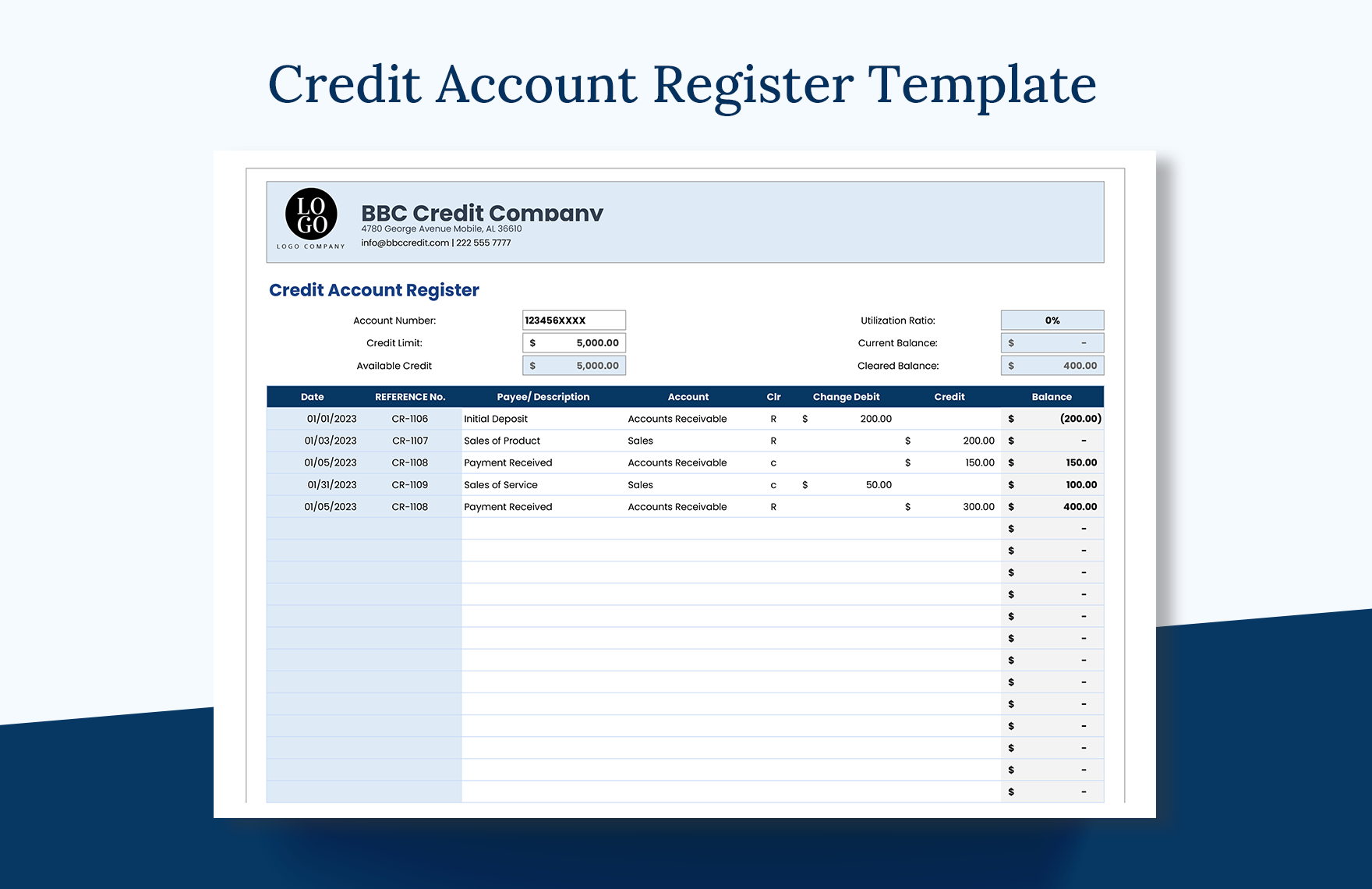

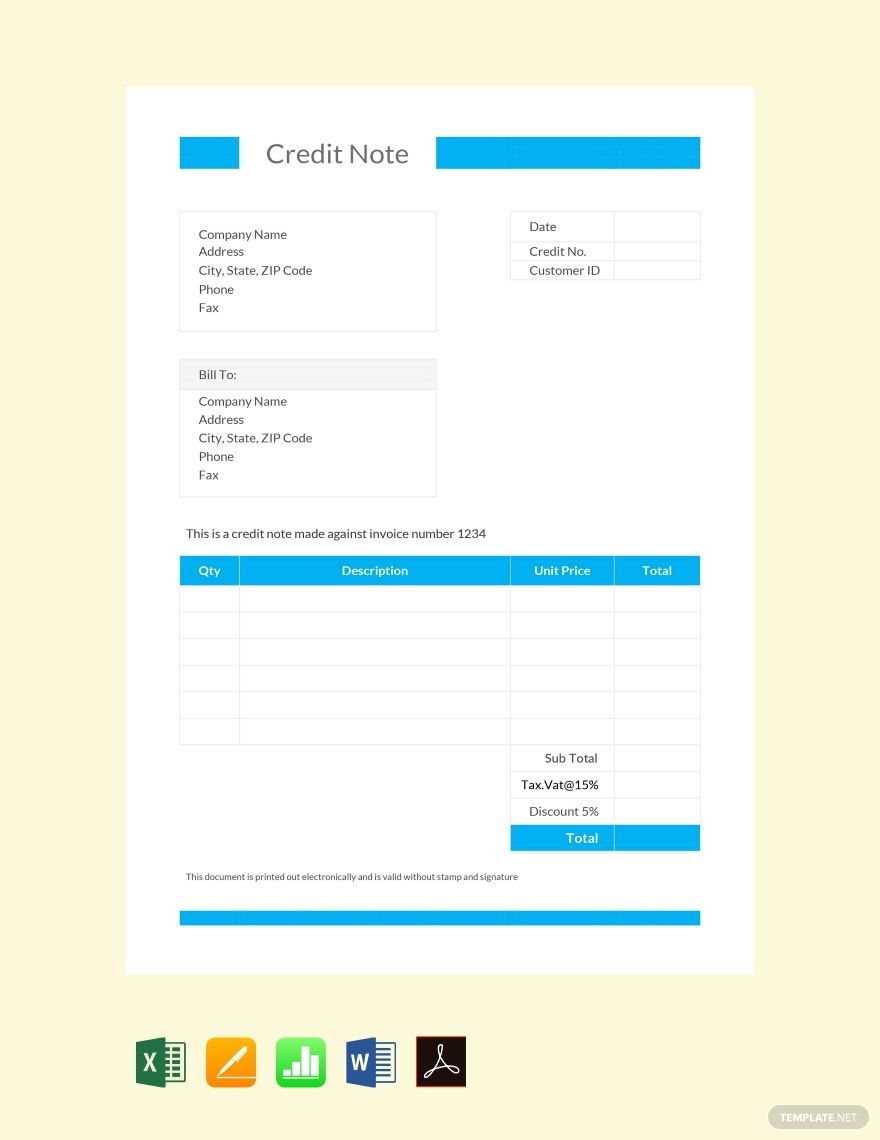

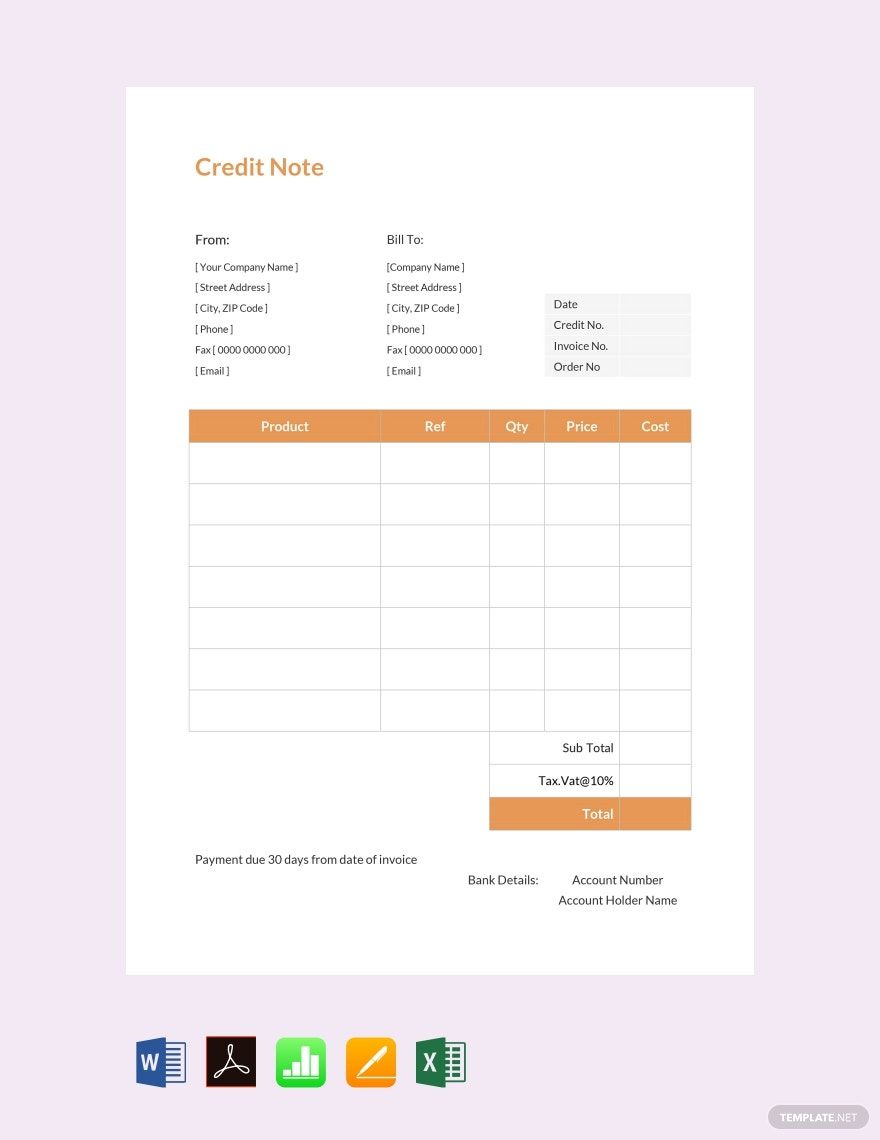

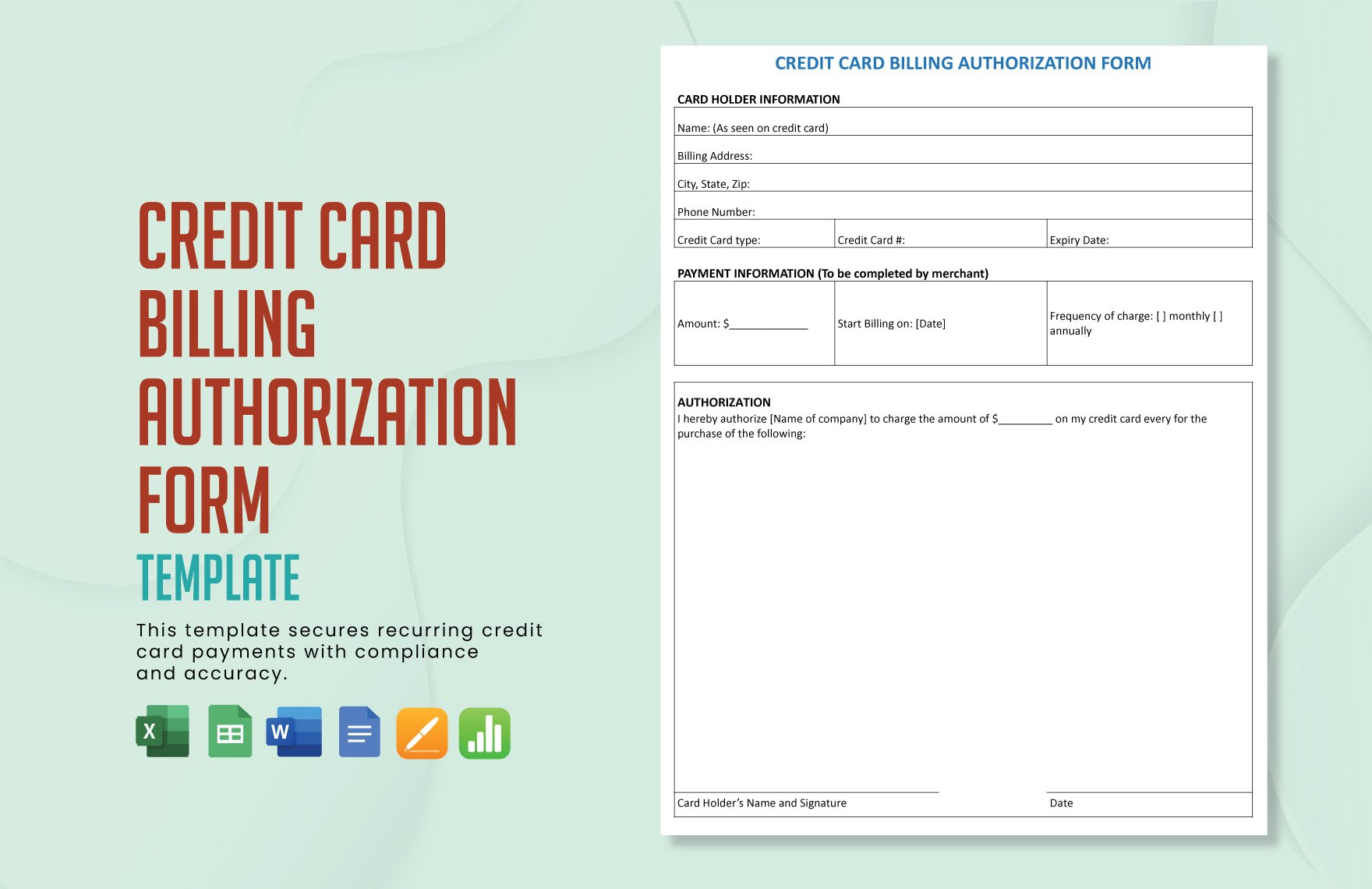

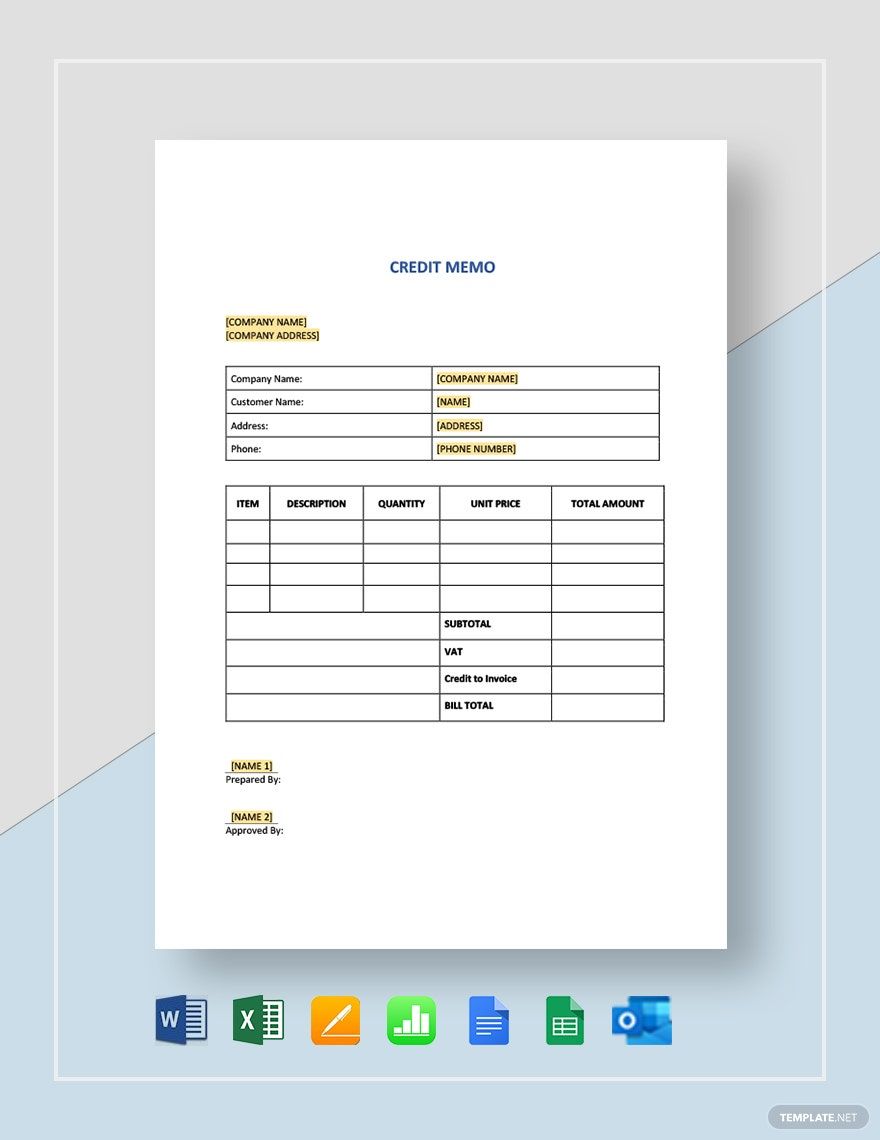

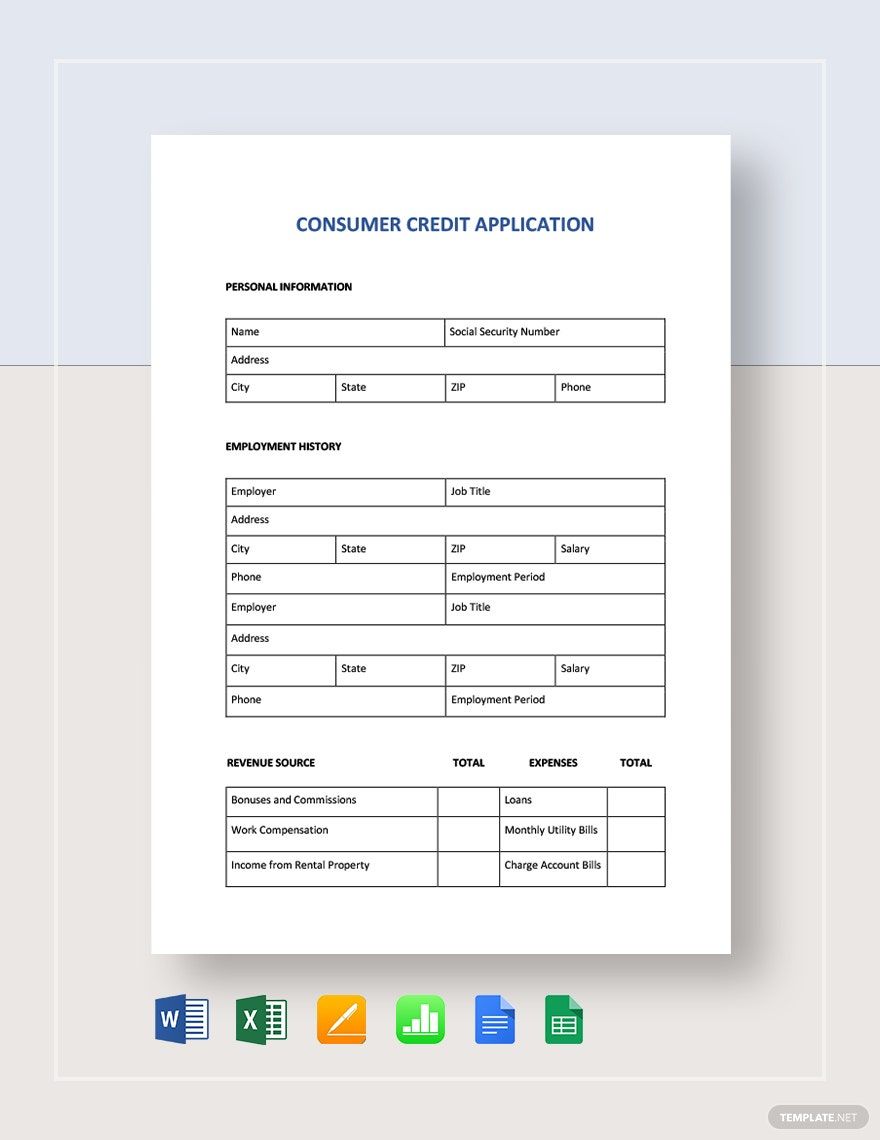

Are you in need of a credit and collection document for your business transactions but got no time to make one by yourself? Create a high-quality document by using any of our 100% customizable Credit & Collection Templates that you can download and edit in Microsoft Excel. Each easily-editable template comes with useful suggestive content that would help you improve your business processes and documentation. These templates are professionally-written for any purpose for more effective and efficient credit and collection management. If you need a document such as a credit memo, consumer credit application, or business credit application, you can surely find one here. Get one of these ready-made Credit & Collection Templates by downloading today!

Credit & Collection Template in Excel

Creating Credit and Collection Files From Scratch Can Be Tiring and Time-Consuming. With Template.net's Free Credit & Collection Templates in Microsoft Excel, You Don't Need to Start with a Blank Page. Create Petty Cash Books, Daily Cash Flow, and Accounts Receivable. Using Our Templates Will Make Creating Receivables, Trade Receivable Formulas, Ratio Periods, and Average Reports Convenient. Download Now!

- Project Report

- Commercial Invoice

- Hr budget

- Reconciliation

- Grade Sheet

- Hotel budget

- Manufacturing

- Career roadmap

- Construction quotation

- Real estate

- Schedule

- Reports

- Inventory

- Hr dashboard

- Restaurant spreadsheets

- List

- Ecommerce

- Analysis

- Report Cards

- Travel agency

- Hr calendar

- Travel quotation

- Call Logs Sheet

- Maintenance

- Construction bid

- Contractor estimate

- Project roadmap

- Medical invoice

- Product roadmap

- Daily Report

- Documents

- Notes

- Repair estimate

- Attendance Sheet

- Church

- Catering

- Hr templates

- Rental

- Rent Receipts

- Medical

- Student budget

- Vehicle invoice

- Construction cost estimate

- Annual Report

- Overtime sheet

- School invoice

- Monthly Reports

- School Reports

- Charts

- Business itinerary

- Construction schedule

- Marketing gantt chart

- Dissertation gantt chart

- Balance sheet

- Restaurant budget templates

- Gantt Charts

- Customer

- Hotel invoice

- Travel agency invoice

- Kitchen cleaning schedule

- Food budget

- Restaurant receipts

- Preventive maintenance schedule

- Construction

- Event gantt chart

- Catering invoice

How to Create a Credit and Collection in Microsoft Excel

Credit and collection document helps monitor the financial processes such as the interest increase to pay the loan, how much credit the consumer gained or lost from a loan, and collecting due debts. According to a trusted source, it is concerned with accounts receivable, facilitating credit managements, disputes, collections, and other related business processes. A credit and collection document also comes with policies that include guidelines, the terms and conditions for supplying goods on credit, customer qualification criteria, procedures, and steps to be taken by consumers. It is facilitated by a collector of a debt recovery agency or a collections analyst. The collectors are the ones working with the collection letters, dispute letters, and other credit collection documents.

There are many kinds of credit and collection documents. Depending on your purpose, you can easily create one by using Microsoft Excel. Here are the following steps for you to be guided.

1. Determine the Purpose of the Document

As you start, you must know the main purpose of the document. Determining the specific purpose of the document will help you clarify the main reasons for its goals. Once you have determined the purpose of the document, you will be able to determine the document's general content and it will help you with the overall flow of the document.

2. Choose One of the Credit and Collection Templates

Now that you have determined the purpose, it is time for you to choose one of the credit and collection templates that you can find online. Since there are many kinds of credit and collection templates, choose the suitable credit and collection template that would relate to your main purpose. For example, your purpose is to make a consumer credit application, choose the template with the designated name and contents. If you also need to compose letters, you can also download a credit and collection letter template.

3. Supplying the Valid Information

This is the most important part of creating a credit and collection document. By using Microsoft Excel, supply all the valid information into the credit and collection document. Provide the name of the consumer, the consumer's address, and the contact information. You must also include the bills, amount dues, order information, due dates, and the terms and conditions. You can also add the instructions on how and where the consumer can pay. According to stats, 61% fall delinquent on the payment is mostly due to invoice errors, incomplete details, and more.

4. Proofreading Every Detail

After the process, do not forget to proofread the whole document. You must check if there are some errors committed in the document. Revise the document if it has errors with punctuation, spelling, and even sentence constructions. Since credit and collection is a formal business document, everything must be well-written.

5. Sending the Document to the Consumer

After proofreading, send the credit and collection document to the consumer. Make sure they are sent earlier on the due date. The consumer needs to make a payment as soon as possible. After a few days, call the consumer for a follow-up and ask them if they are able to receive the document. If the consumer is not responding with the notification, adhere to the organization's terms and conditions to send some final notice or any other actions.