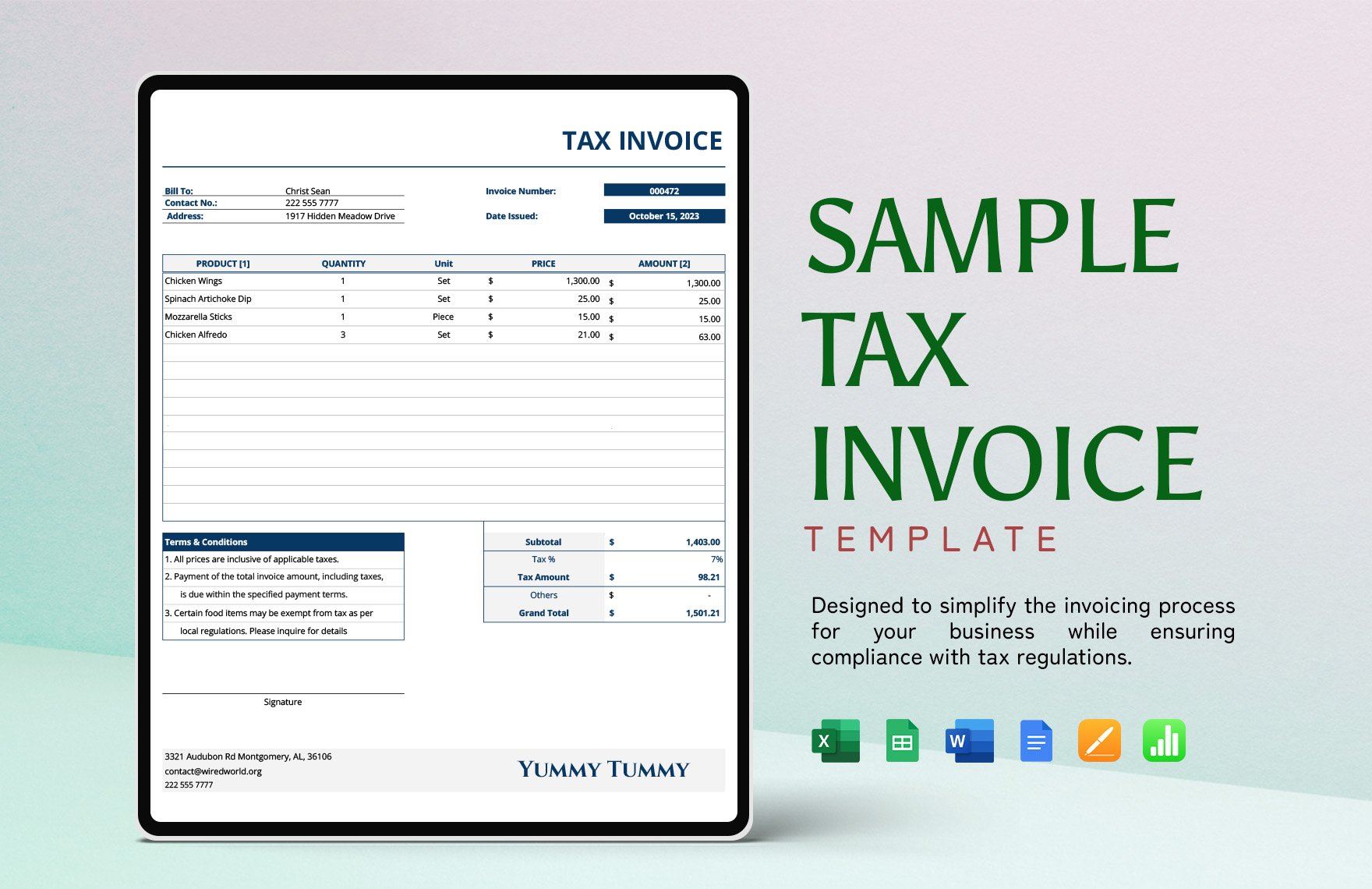

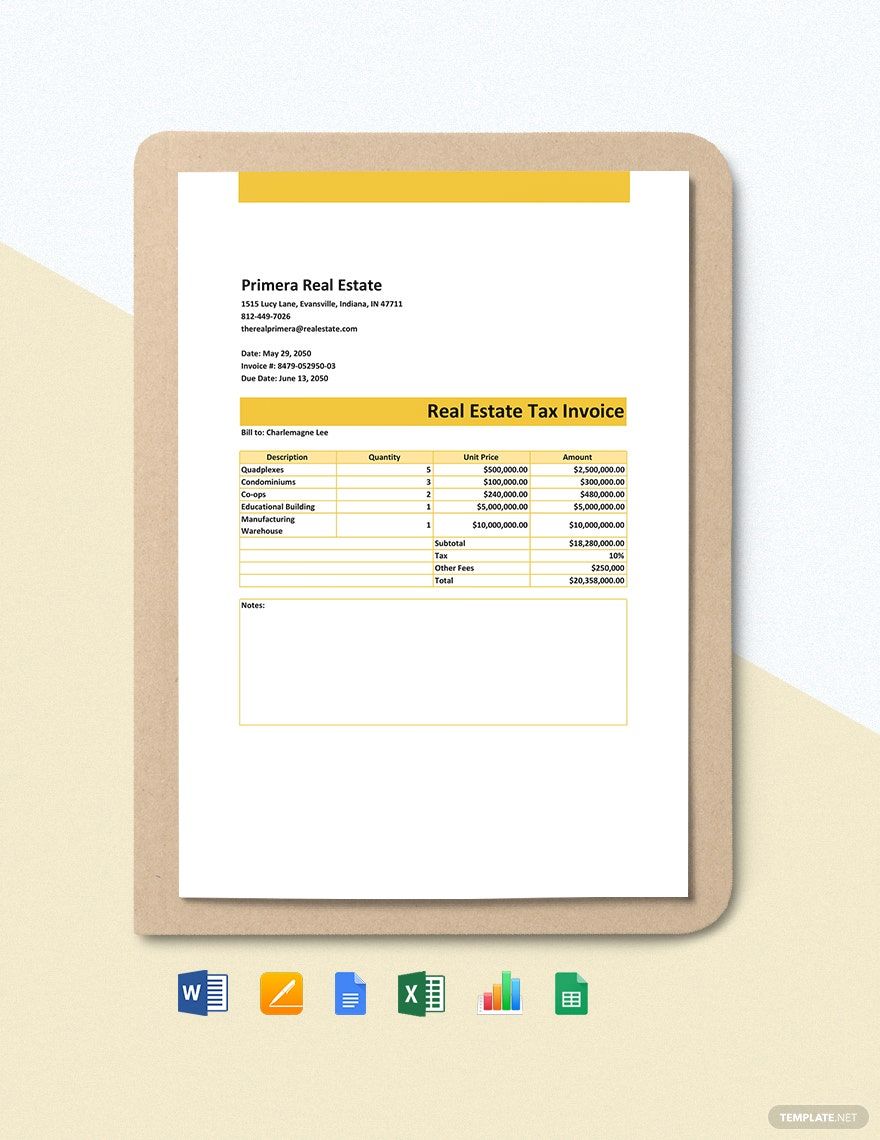

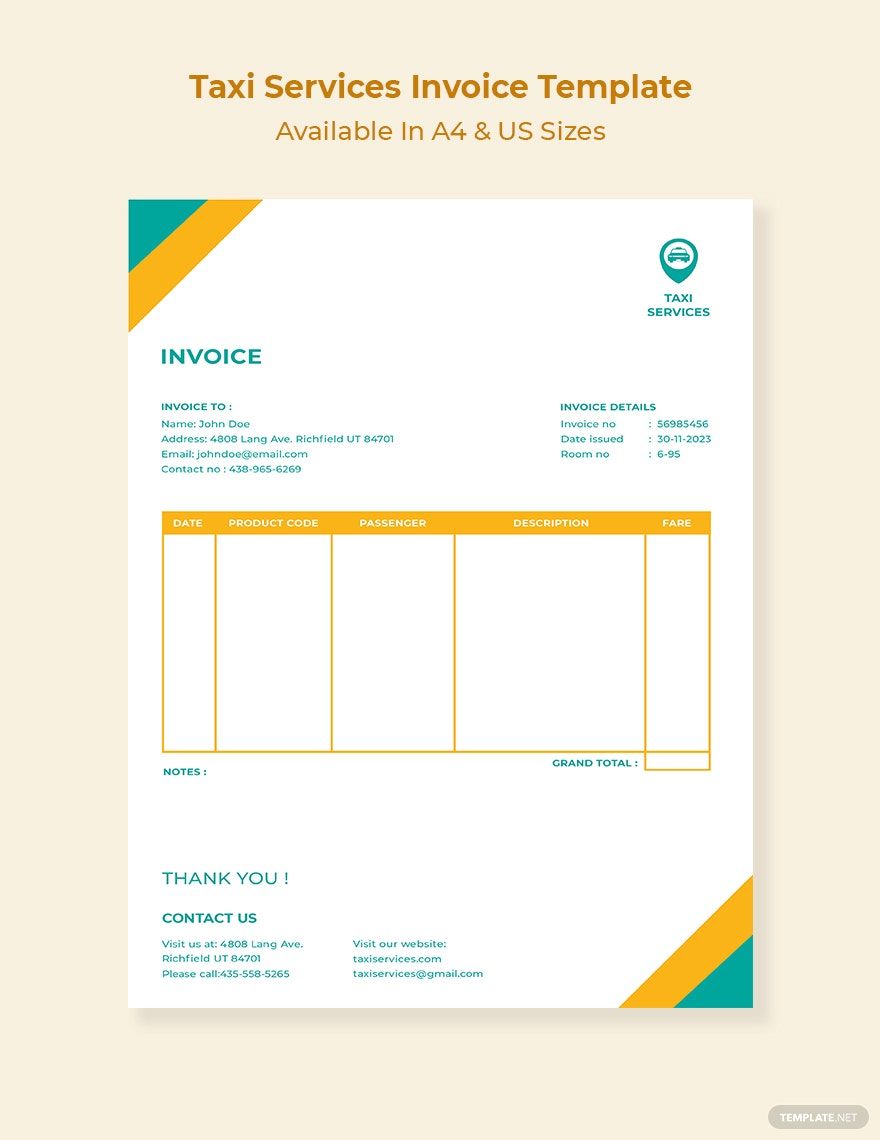

Your clients must be knowledgeable about the tax amount they should pay. So, you must prepare a complete document for that. To help save time, download from our collection of Tax Invoice Templates in Apple (MAC) Numbers. These templates are 100% editable. What are you waiting for? Download a template and excel in making an invoice!

Tax Invoice Template in Apple Number, Imac

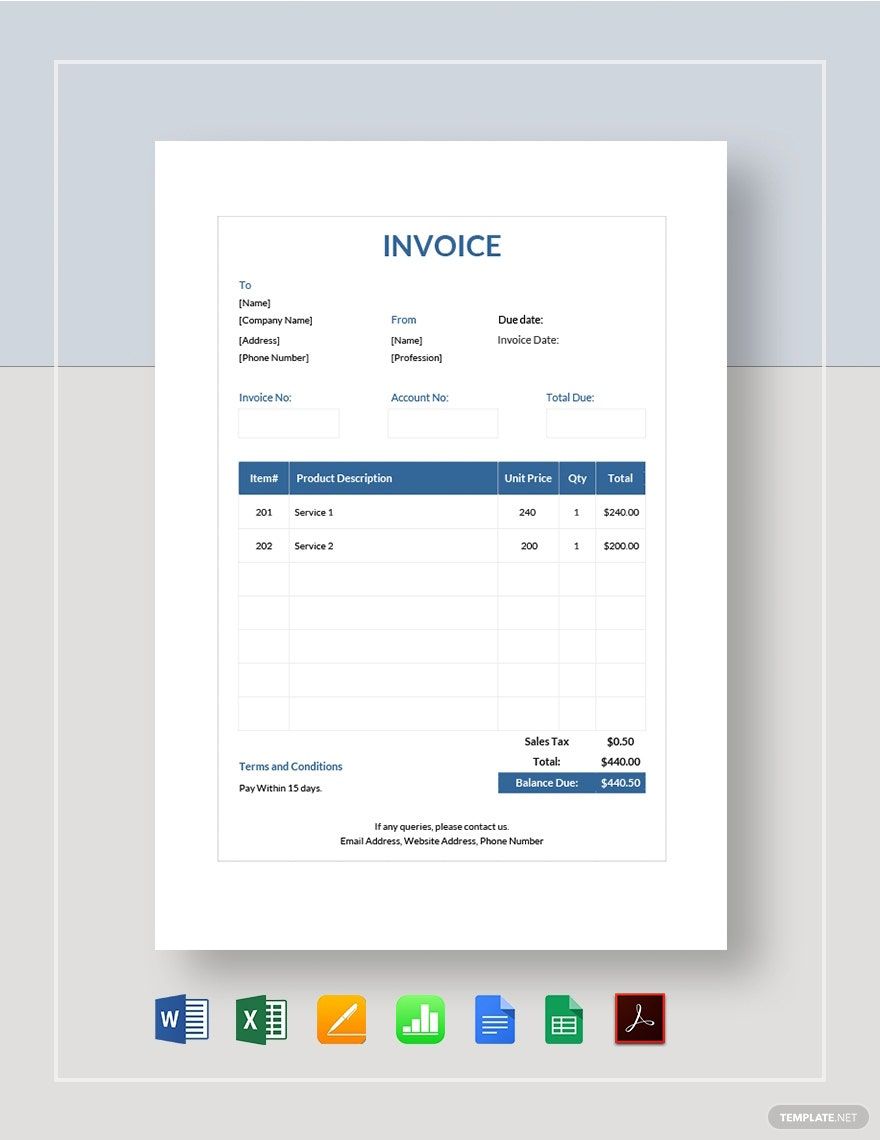

With Your Apple Macbook Pro or Macbook Air, Take Advantage of Template.net's Free Tax Invoice Apple Numbers Templates. Use Our Samples to Create Commercial Invoices, Service Invoices, and Sales Invoices, and Calculate Tax Bills. Simply Edit the Contents and Print Your Invoice. We Also Have Income Tax Spreadsheet Templates That Are Available in MS Excel. Download One Today!

How to Create a Tax Invoice in Apple (MAC) Numbers

The Tax Foundation reported in 2016 that 140.9 million people in the U.S. were paying taxes. And like any law-abiding citizen, your business must also request your clients to pay for taxes. And you can easily request tax payment by sending your clients simple tax invoices. And to help with that, check out the tips below on how to create a tax invoice.

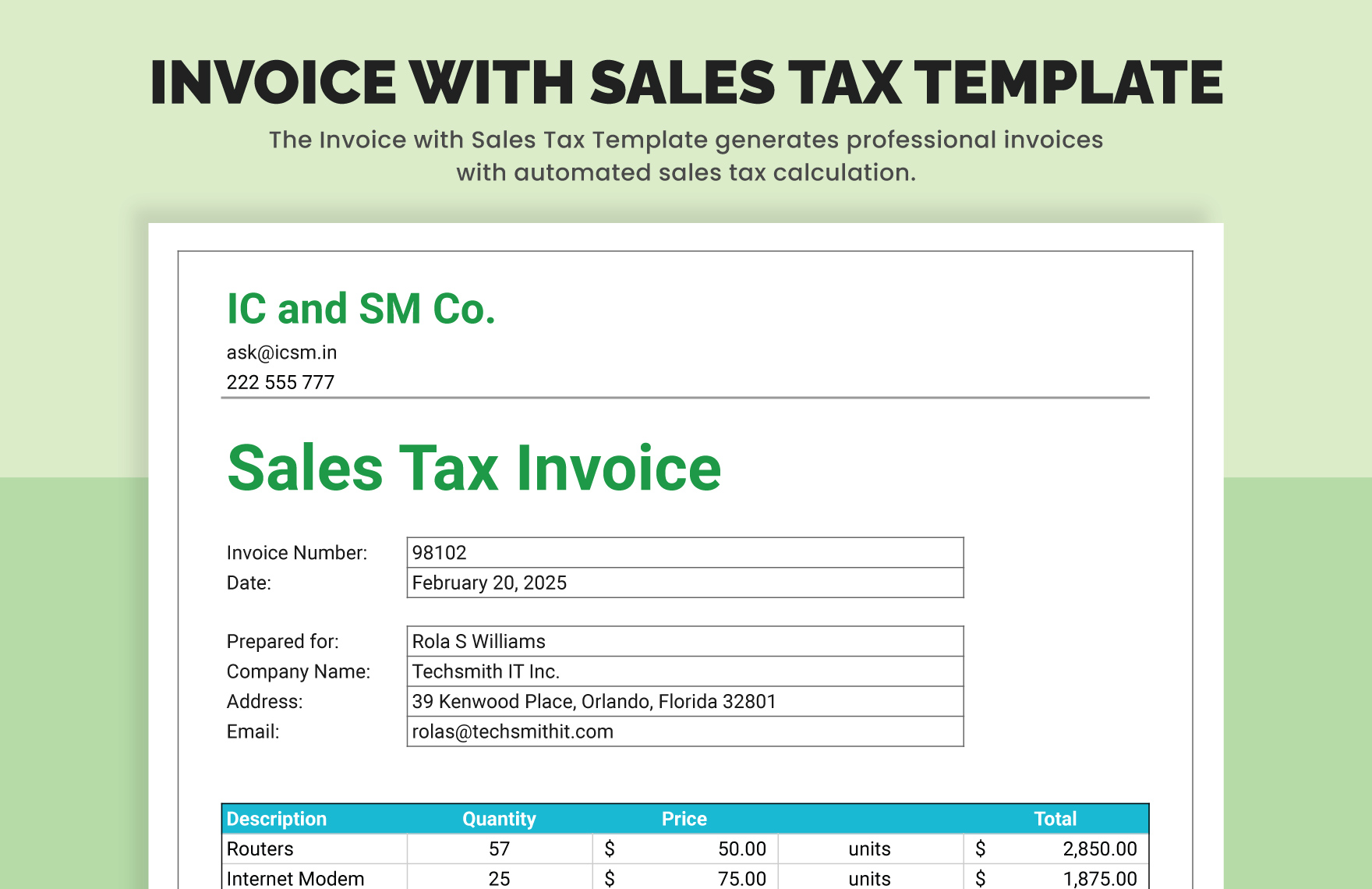

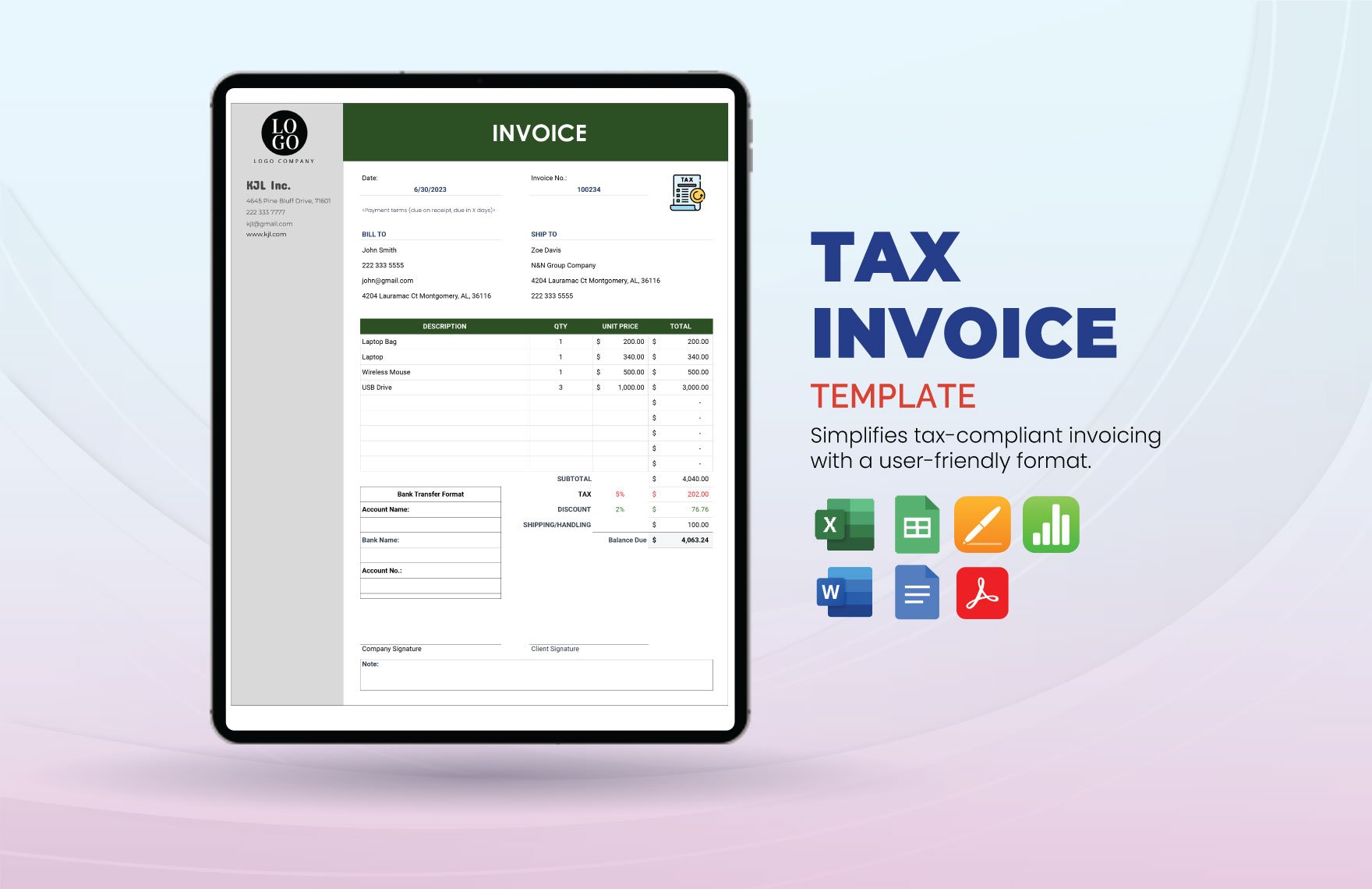

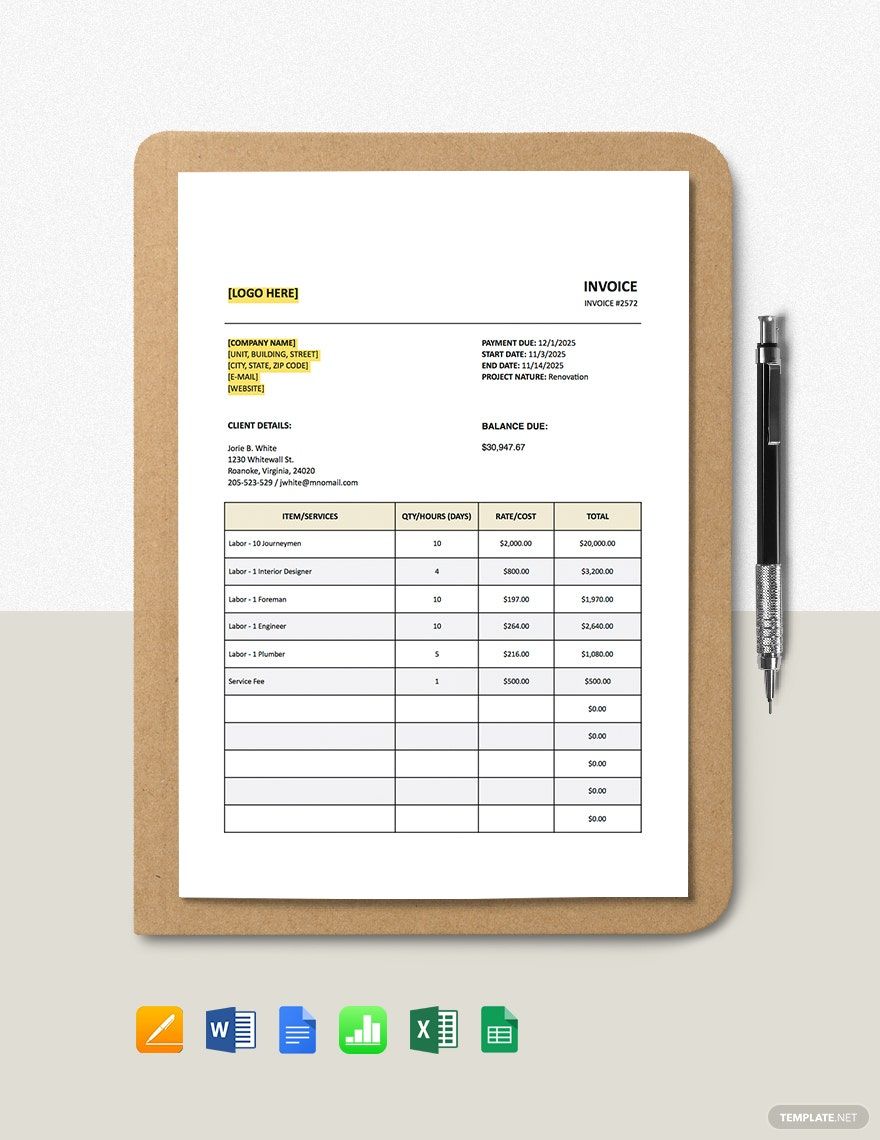

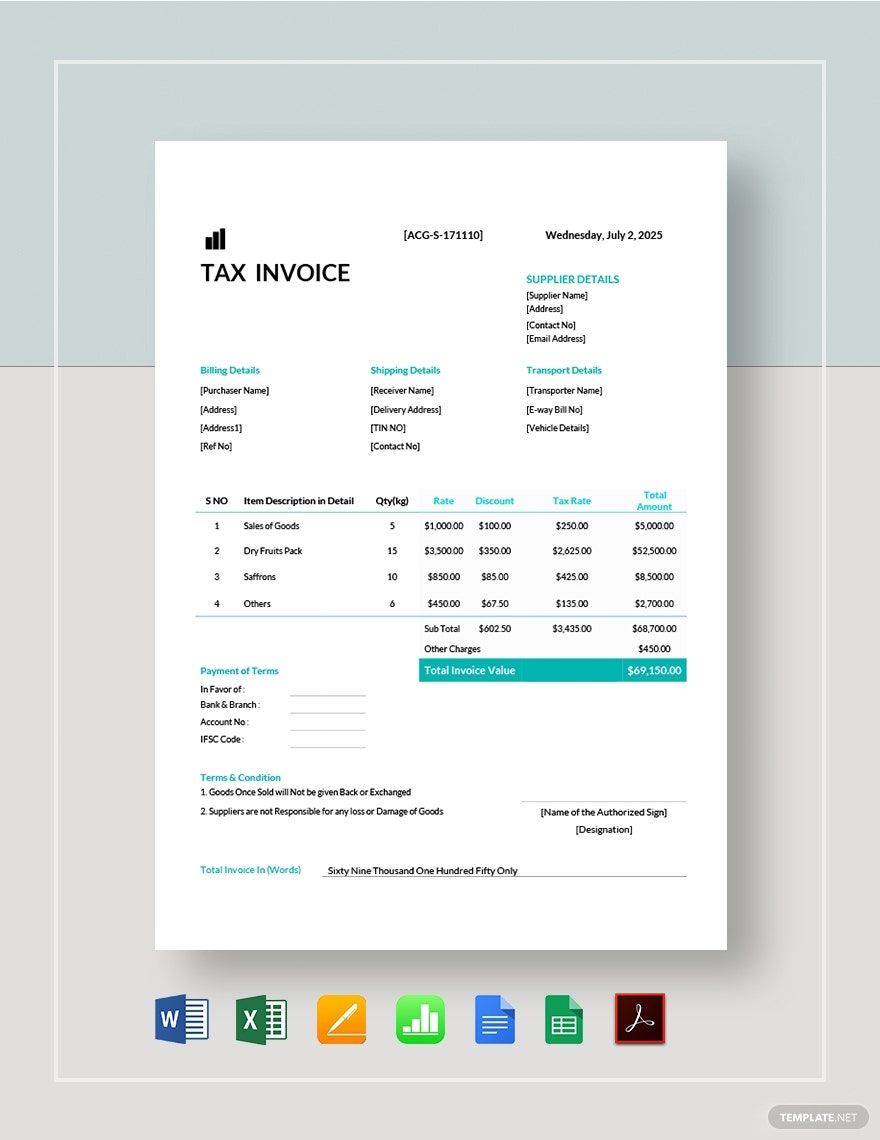

1. Put Your Company Letterhead

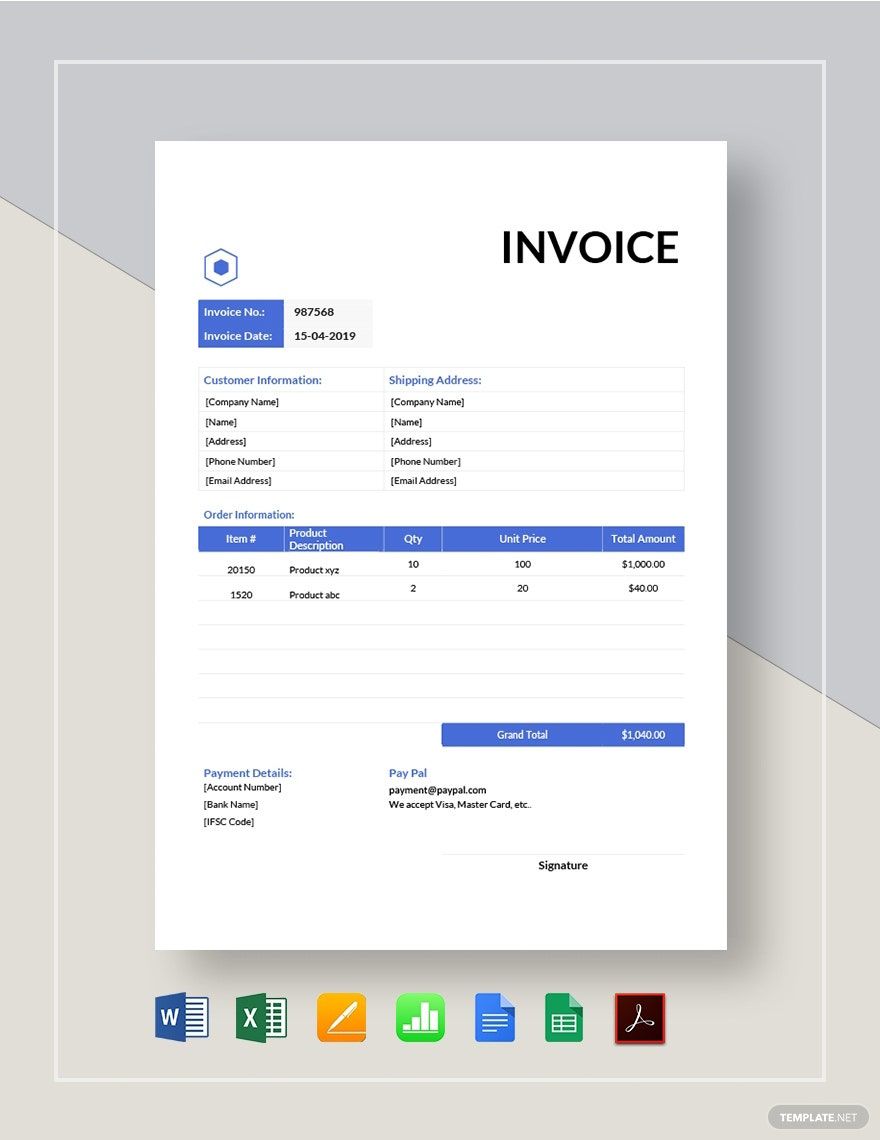

Every invoice must contain a company letterhead, just like receipts. And if you want the classic invoice format, you can place your company letterhead at the header of the document. Your letterhead must have your logo, company name, address, and contact information.

2. Add the Client's and the Invoice's Details

After placing your letterhead, it's now to personalize the invoice by adding the client's details and its distinct information (invoice number, start date, due date, and end date). These details will help you distinguish one transaction from the others in your business.

3. Write the Details

The simple invoice you'll issue your clients must bear complete transaction details. These details must include the services' or products' descriptions, prices, quantity, and total payment. Providing complete details will help your business steer away from potential problems with your clients.

Next, don't forget to write total, tax, GST tax, discount, and the grand total. You must carefully calculate every amount to avoid disputes.

4. Include the Payment Terms

When you and your client have a good understanding of the payment details, you can establish a better relationship. To achieve this, you must write reasonable and clear payment terms in your business invoice and leave no room for confusion.

Frequently Asked Questions

What is the difference between a tax invoice and an invoice?

Tax invoices contain Goods and Services Tax (GST) amount payable, but a basic invoice doesn't have it.

What is the invoice number for?

An invoice number is a number that is unique and distinct to every transaction. Businesses can use the invoice number to track different transactions with their clients.

What are the different types of invoices?

Invoices come in different types and functions, and the list below contains some of its types.

- Debit Invoice

- Credit Invoice

- Recurring Invoice

- Commercial Invoice

- Tax Invoice

- Sales Invoice

- Proforma Invoice

What is an invoice and what is it used for?

An invoice is a transaction document that you receive after receiving the products or services from a seller or service provider. The invoice will serve as a request for payment.

What happens if you don't pay an invoice?

Not paying an invoice can lead to consequences. The company can charge you with late fees, stop working with the project, or worse sue you. So, you need to pay your invoice.