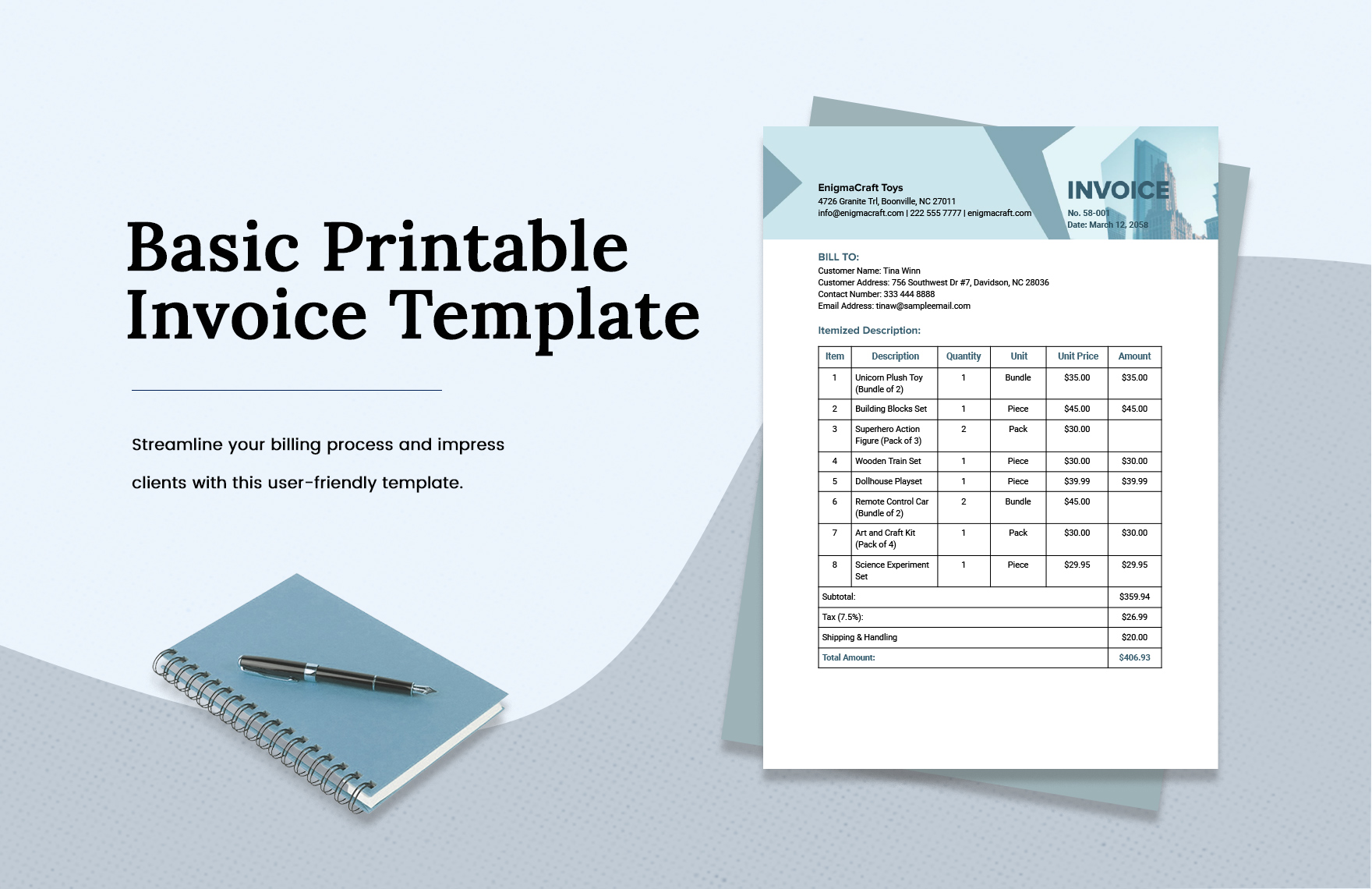

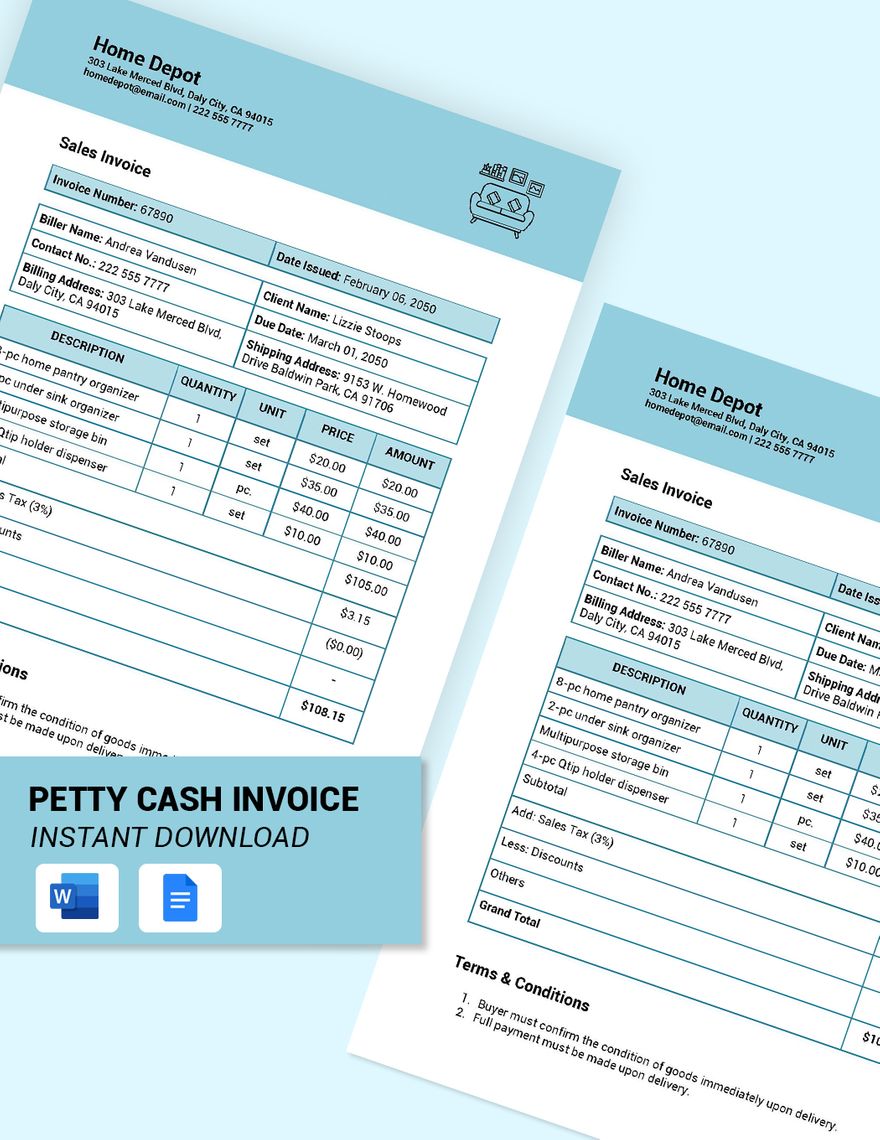

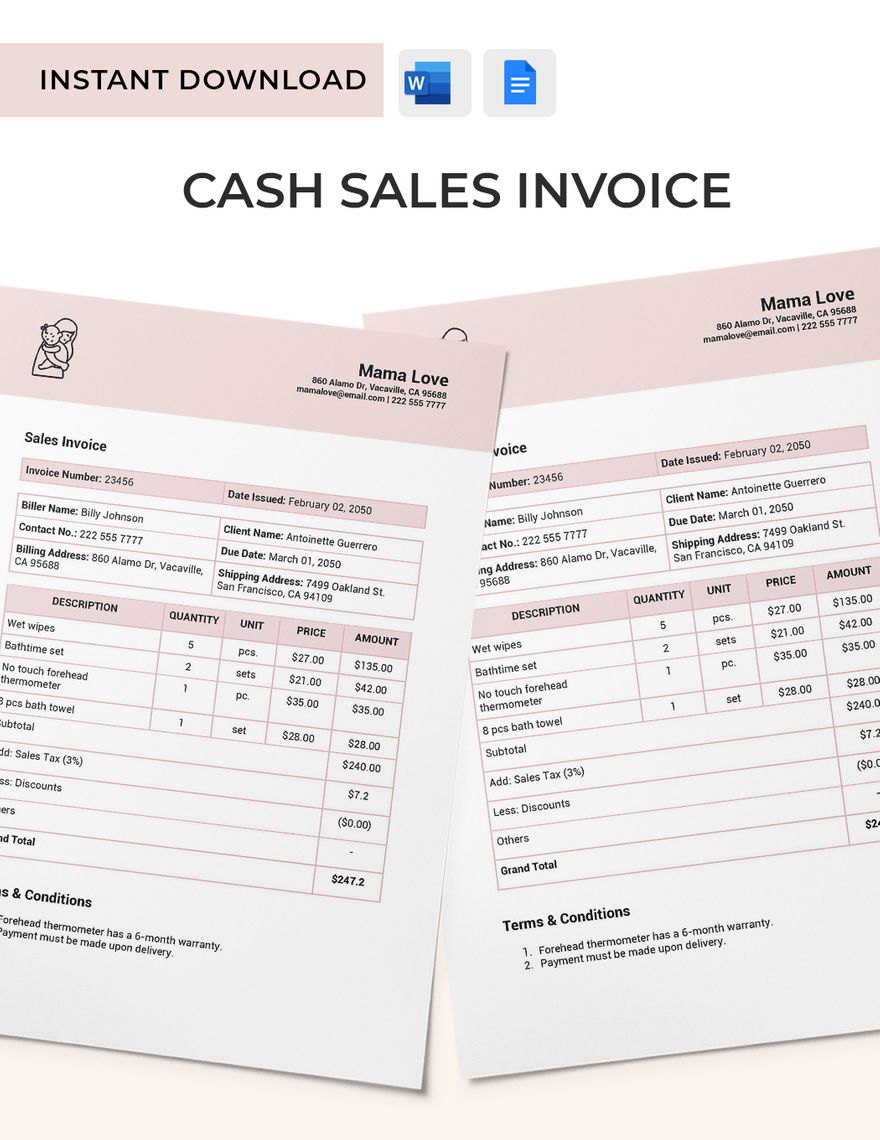

One of the primary purposes of a sales invoice is to maintain a record of the transaction. It serves a way to track the date of a product that was delivered, how much you spent, and any outstanding debt. The invoice represents an invaluable accounting device, and it can also track which employees make sales and the items they sell. Do you need a reliable tool for a better transaction? Let us help you out! We offer our easy-to-edit and print-ready Sales Invoice Templates! Our in-house experts have secured our materials, including our fonts and works of art. Available for download in Pages format. Get your subscription now!

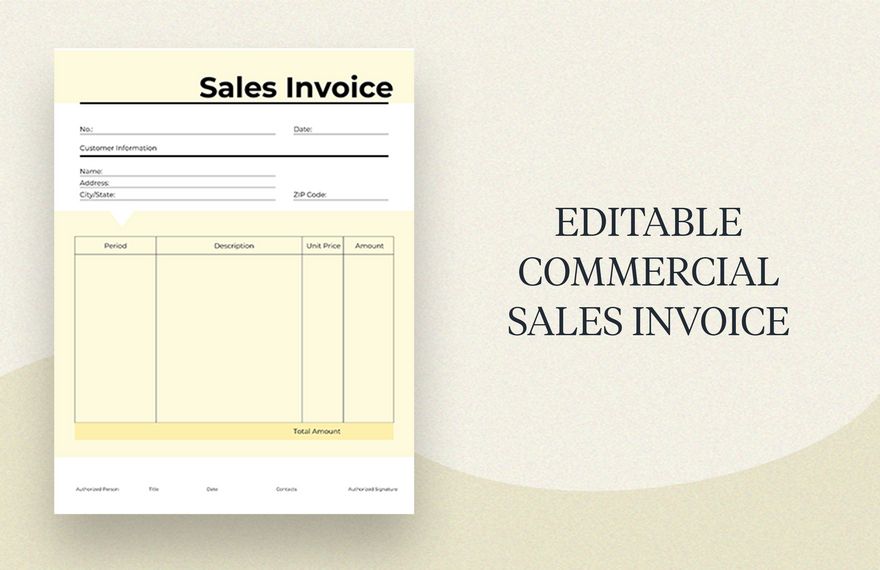

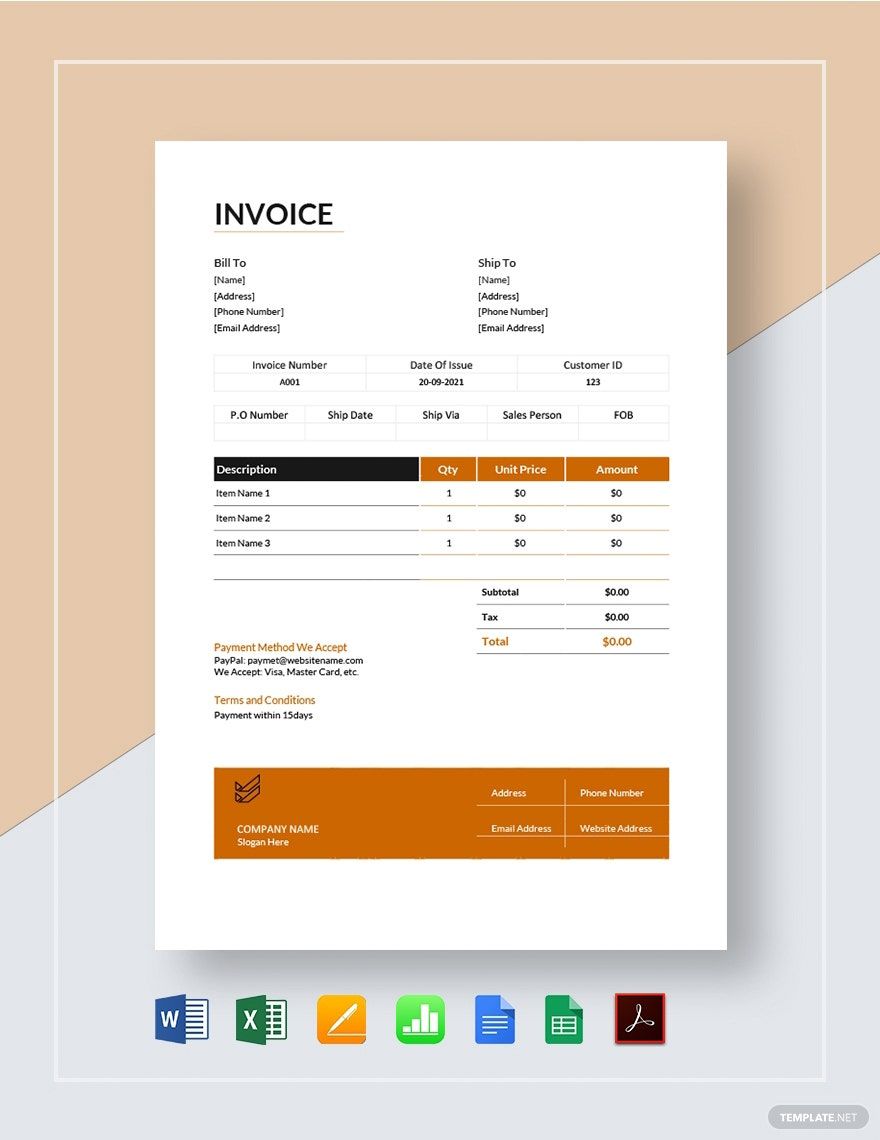

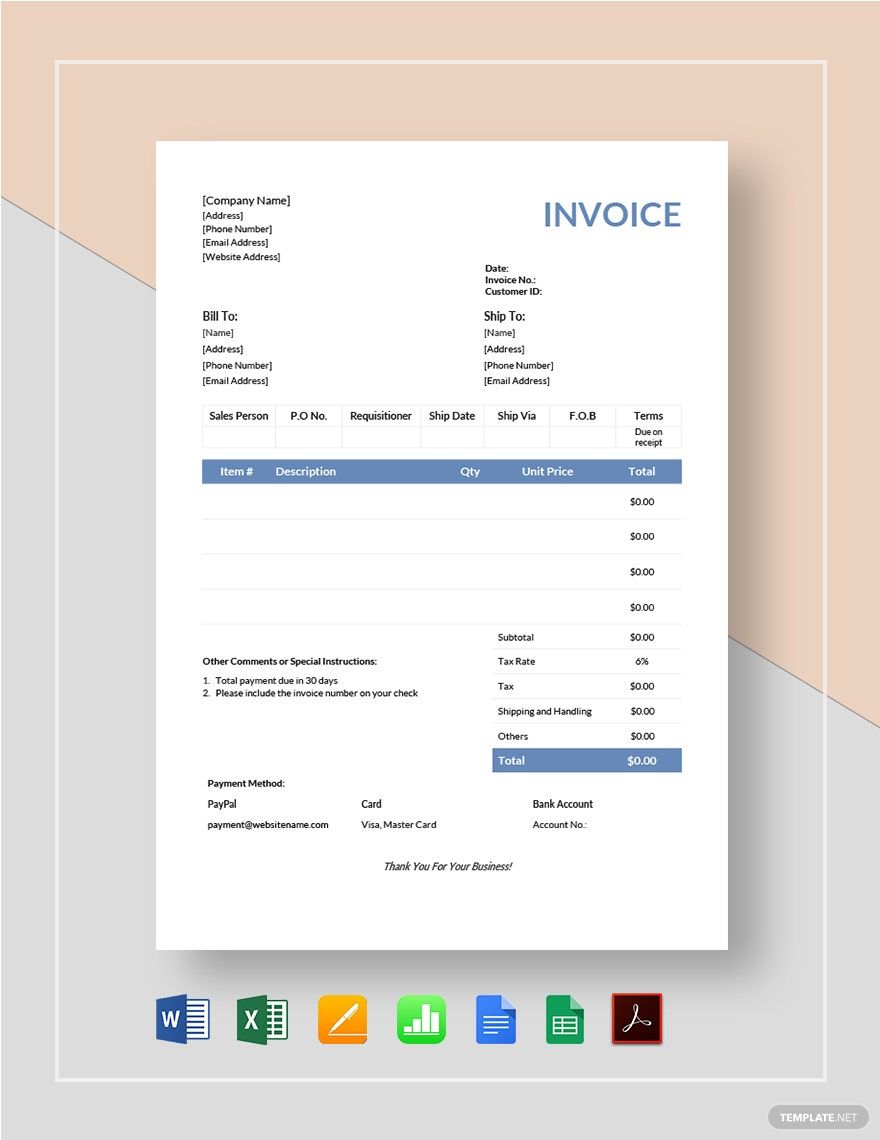

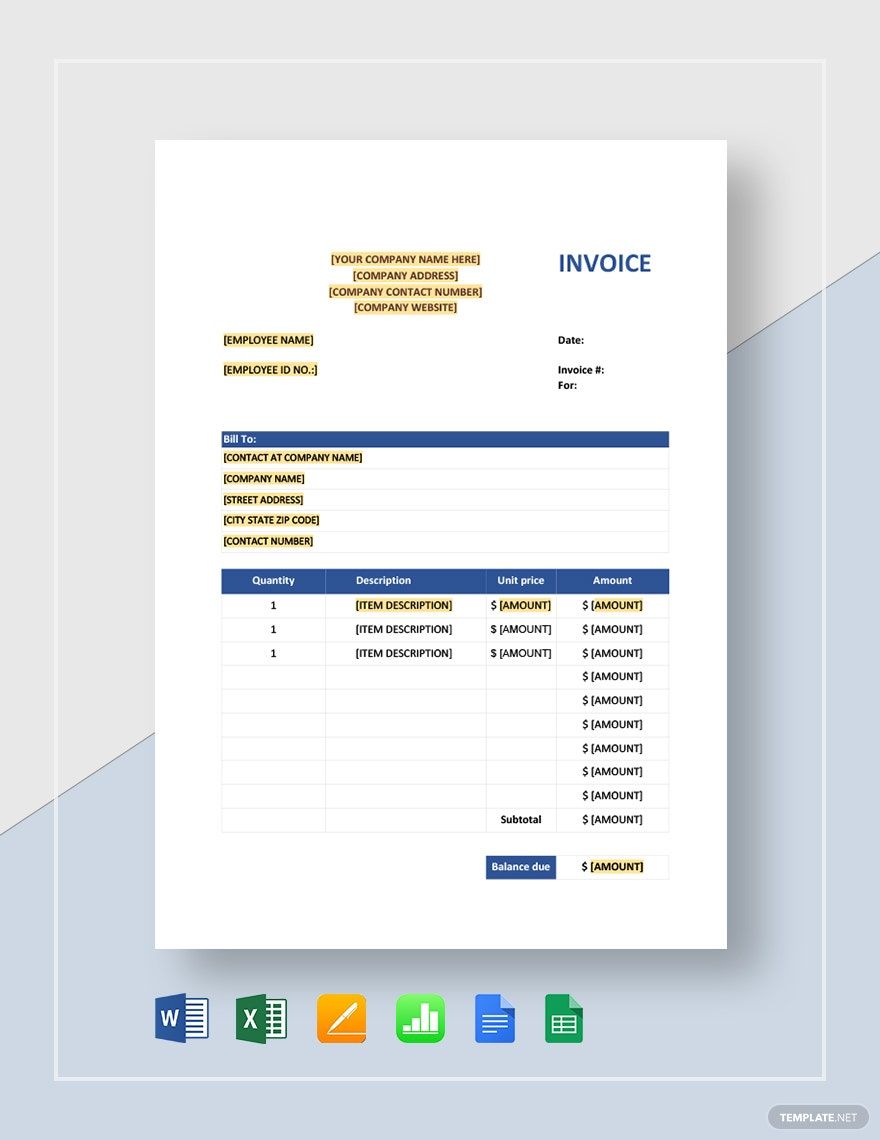

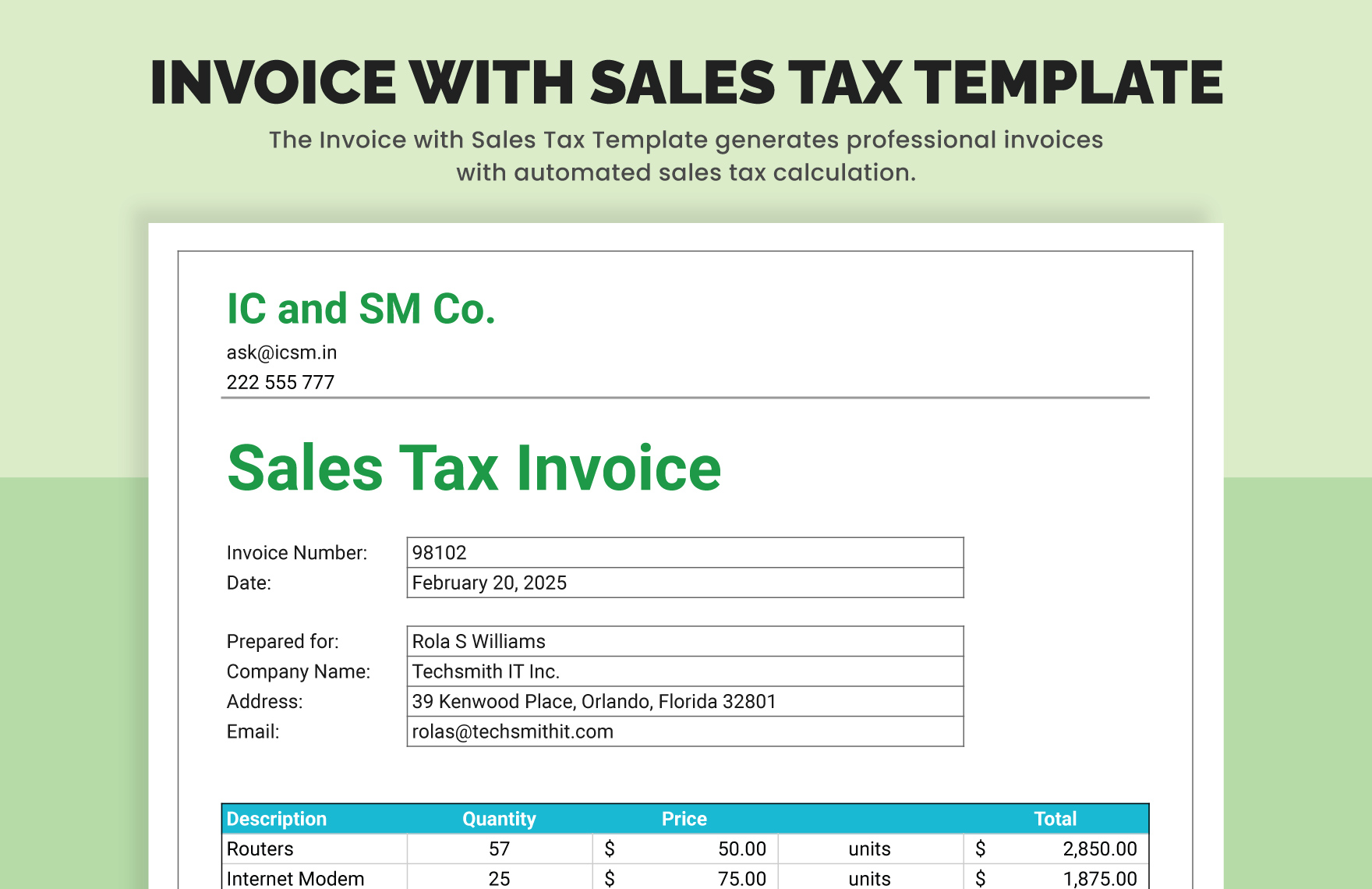

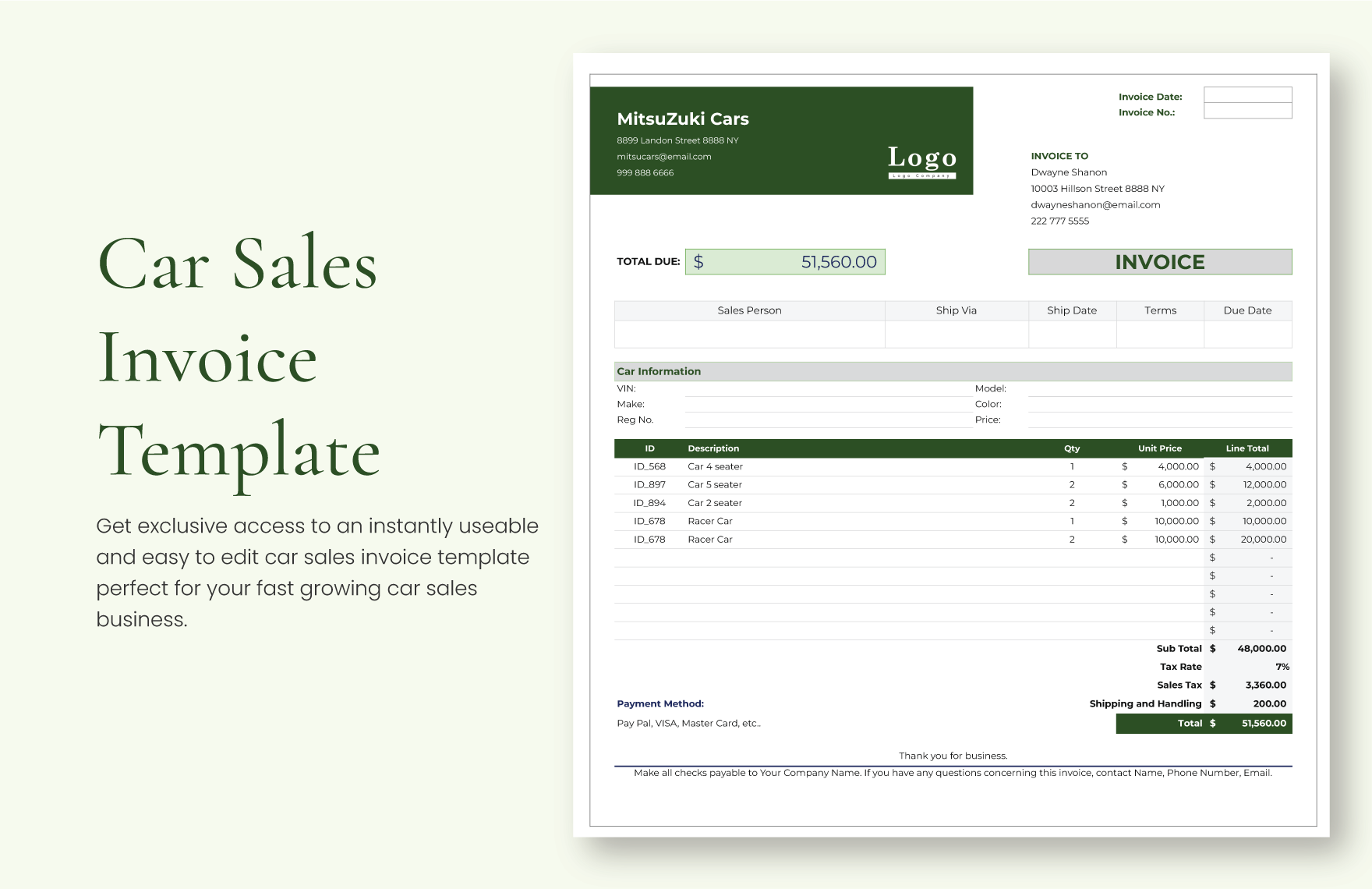

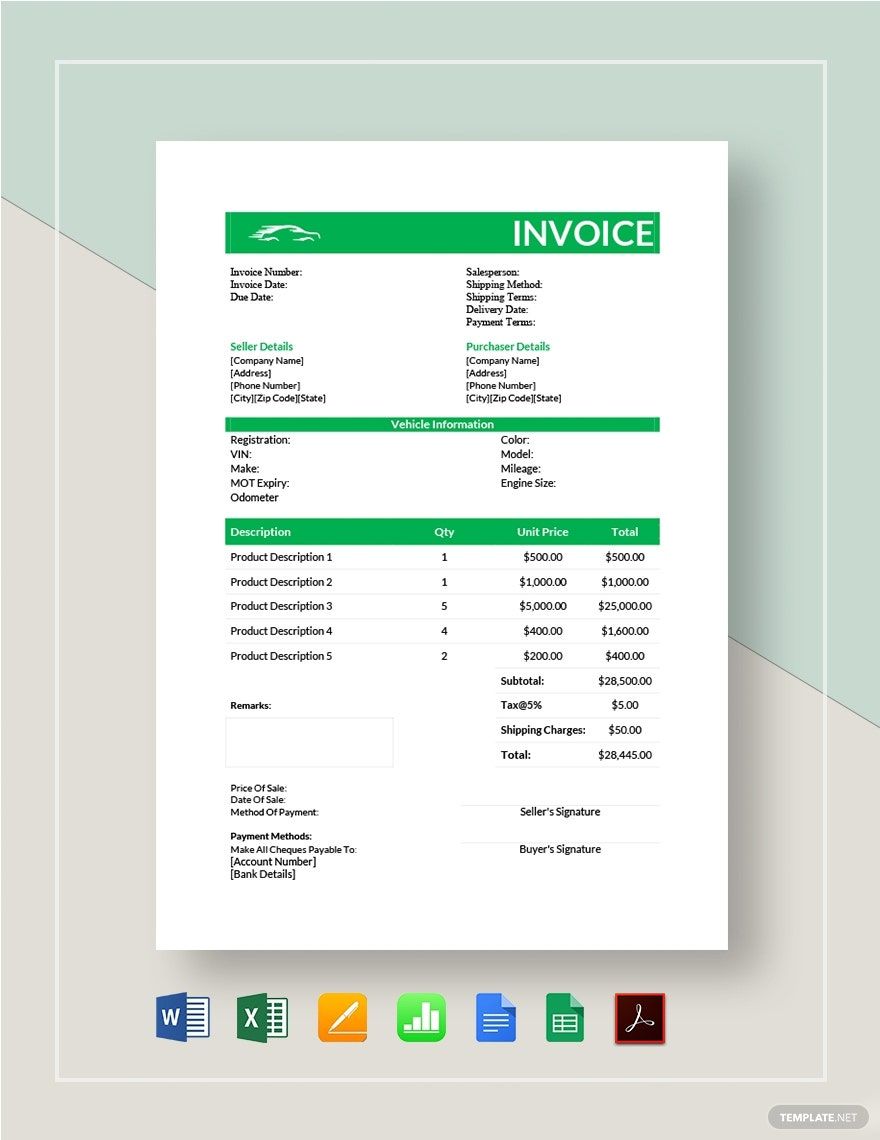

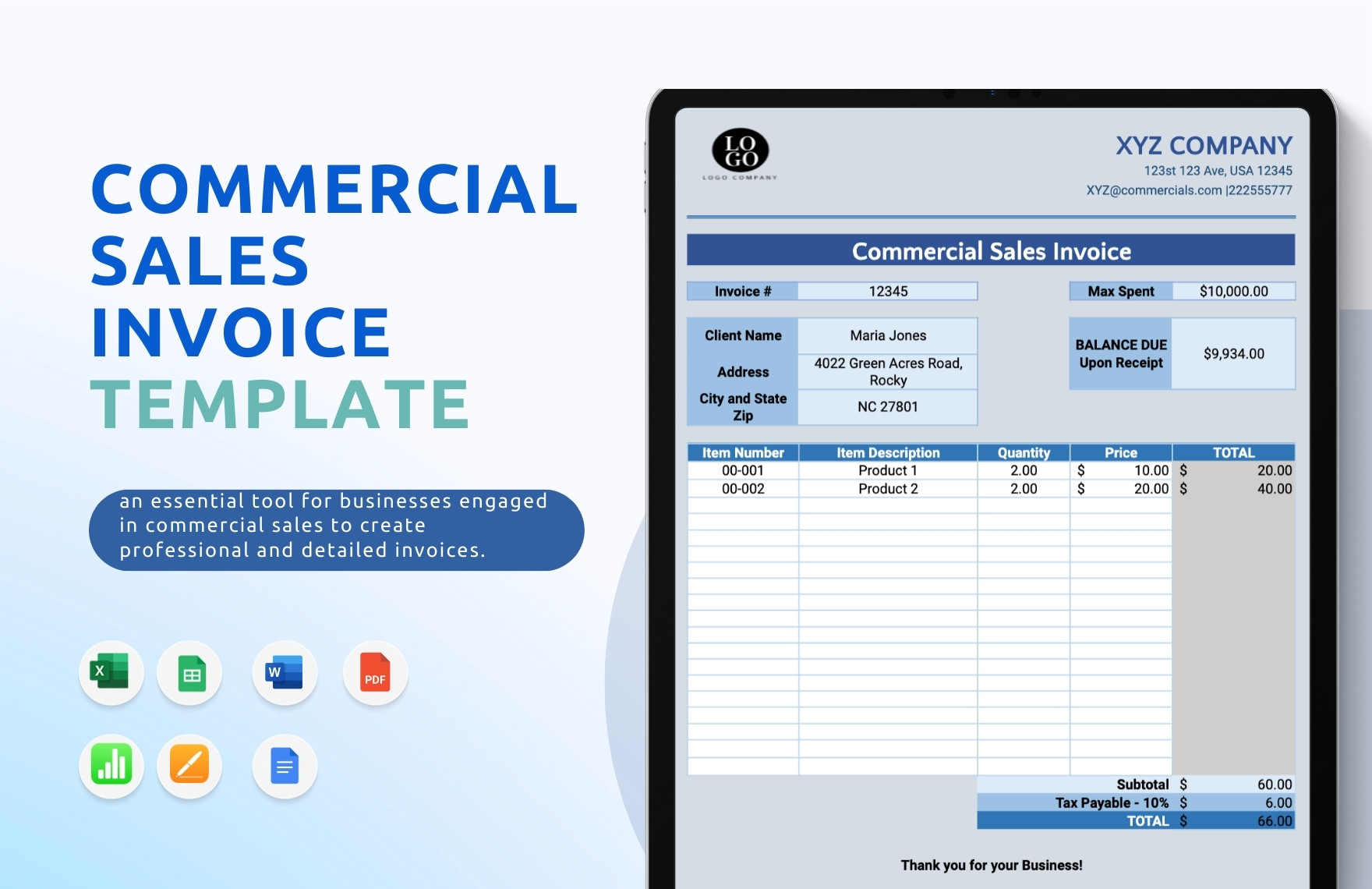

Sales Invoice Template in Apple Pages, Imac

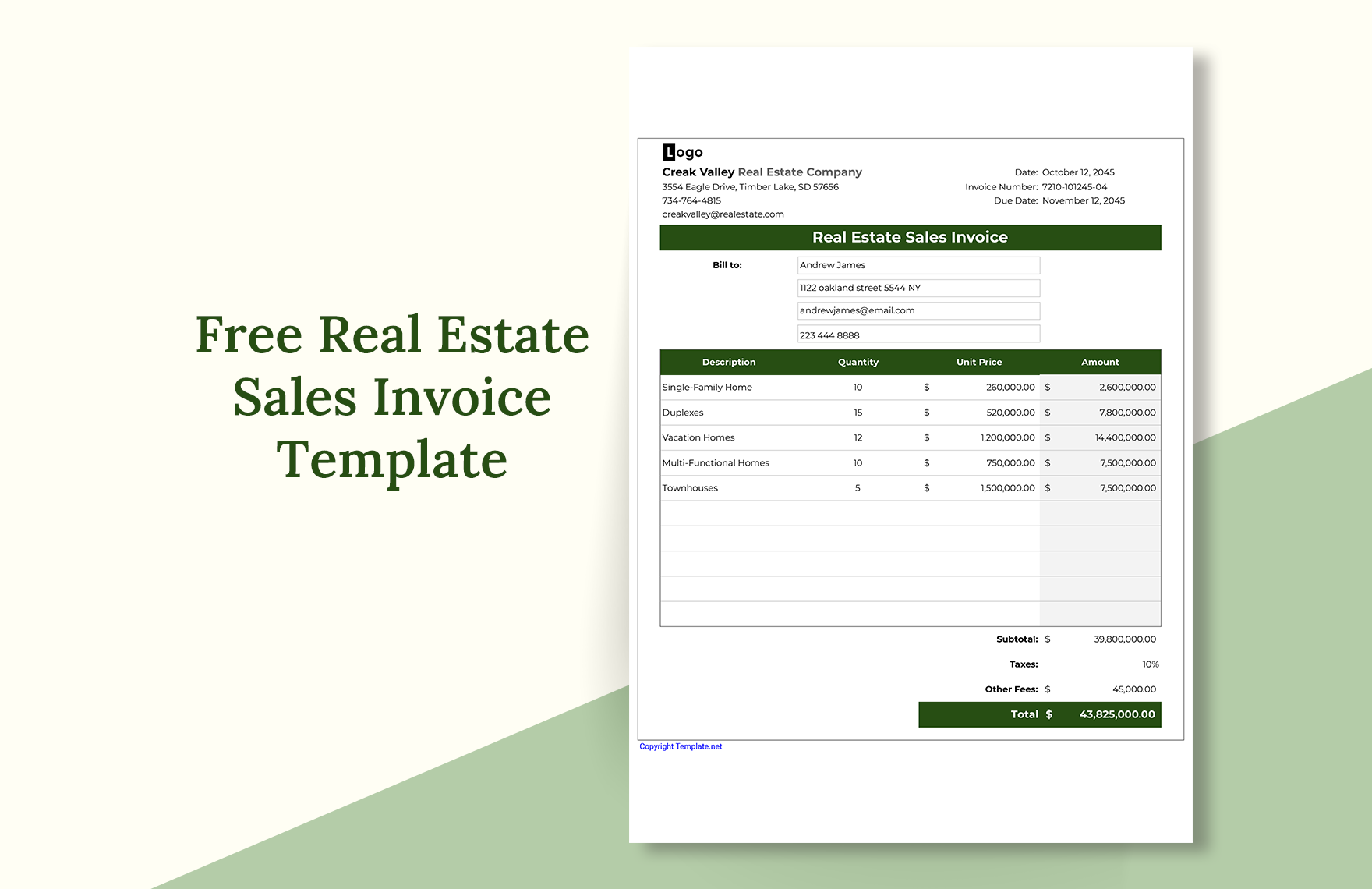

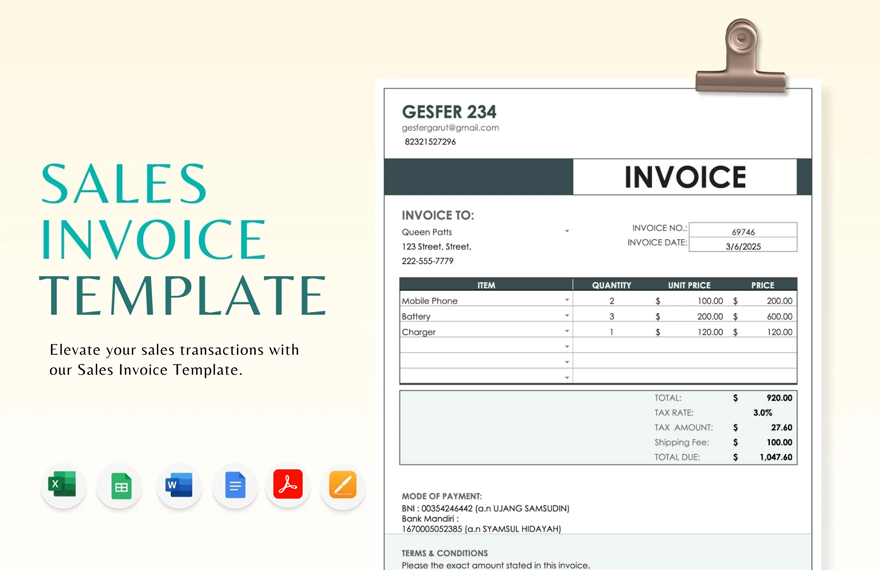

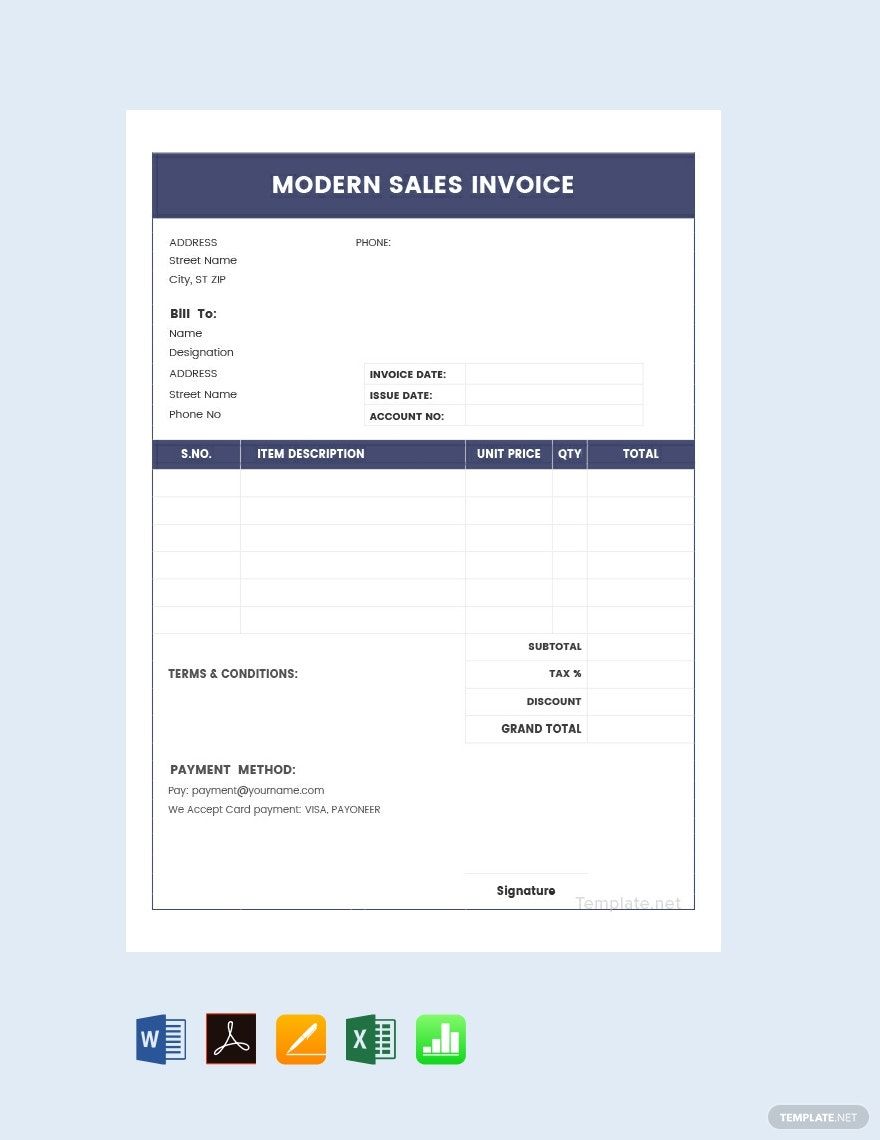

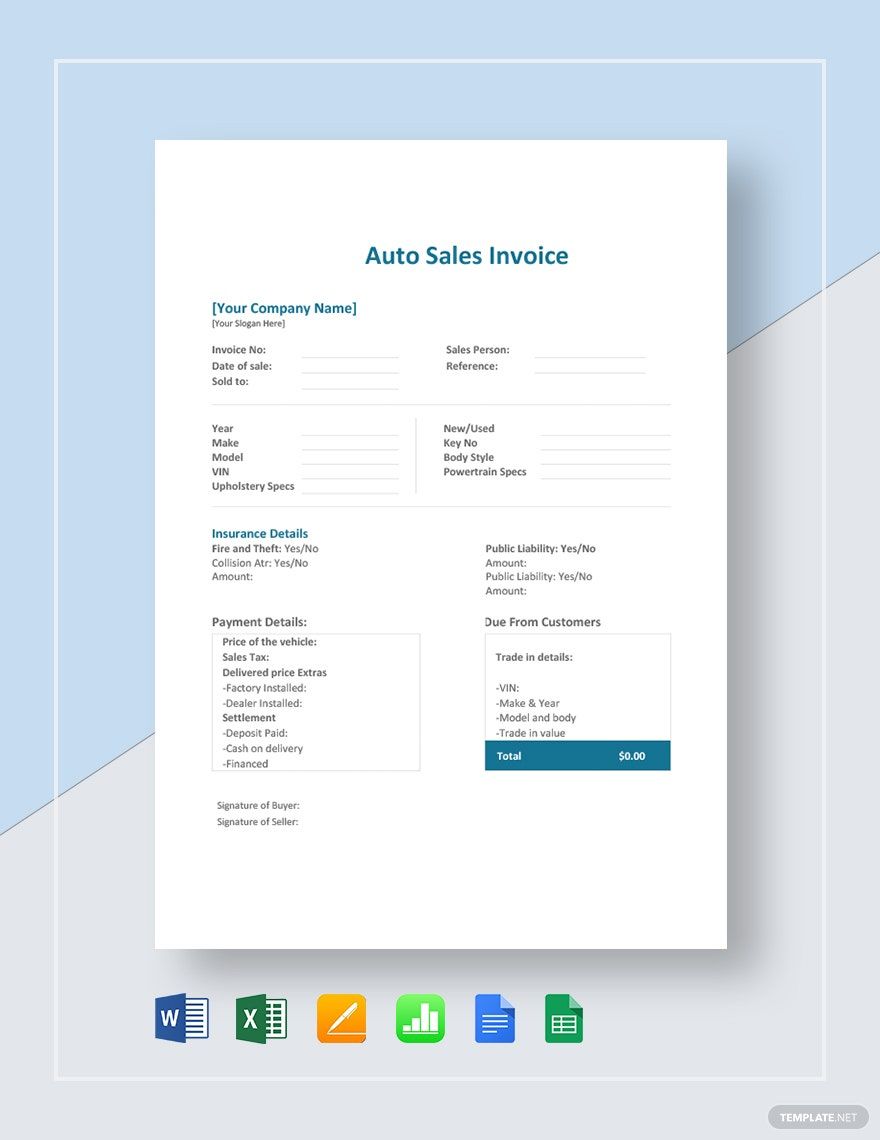

Send Clients Well-Made Commercial Invoices with Template.net's Free Sales Invoice Apple Pages Templates. Each Real Estate Sales Invoice and Proforma Invoice Comes with Editable Text and Design Elements. You Can Download Our Samples in MS Excel as Well. Aside from Invoice Documents, We Also Have Rent Receipts, Payments Receipts, and Proposal Templates. Download Now!

How to Create a Sales Invoice in Apple Pages

A sales invoice is an essential and standard document used by all kinds of companies. Furthermore, invoices may serve as legal documents if they include retailer and customer names, description and price of products or services, and payment terms. Below will be your guidelines in creating a simple invoice.

1. Choose an Invoice Template

Most of today's business software systems have excellent invoicing capabilities with an option to customize your invoice. Plan a draft to figure out what kind of invoices would fit with your company before making a sales invoice. Be realistic.

2. Include Contact Details

One of the most important things you need to do is to handle your clients better. Customers' information is necessary for your document to know who and where your clients reside. Failure to collect this information can hold up payment processing for weeks. With that irresponsible act, it will possibly mislead your business and will leave negative impressions.

3. Assign Terms and the Due Date

Assigning your invoice terms to allocate your customers means you are evaluating how long they have to pay. Upon failure to pay before the due date, you can apply late charges. Make sure to choose flexible and justified due dates for your clients.

4. Explain What the Invoice Is For

If you offer services, you would probably want to provide a detailed explanation of the provided services and what the customer will receive in return. It's important to let your clients understand the description of the product for them to see you as a reliable source.

Frequently Asked Questions

What are the various types of receipts?

There are various types of receipts for different purposes. As a person in the business world, it is essential to have enough knowledge to determine between external financial statements and internal financial statements. External statements include receipts acquired from external sources, such as bank statements, expense reports, tax assessments, and purchase invoices. On the contrary, internal statements include receipts obtained within the company. These include commercial letters, wage rosters, proof of transfer, and transcripts of outgoing invoices.

What should I include in an invoice?

An invoice is an essential document that you should devise effectively and professionally. To do so, you need to include essential elements. These elements are the vital information of the company, header, unique identifier, invoice number, date, list of services and goods, itemized fees, terms, and the total amount due.

What is the main purpose of a receipt?

Receipts are useful for both nonprofit and profit organizations. In a transaction, the seller should always issue a receipt to the purchaser. The primary purpose of documenting the operations is to provide information to the customer regarding the purchase. Keeping receipts is also helpful when it comes to internal accounting. Besides, industries require a receipt when offering returns and exchanges.

What are the differences between an invoice and a receipt?

Receipts and invoices are crucial instruments in the process of a transaction. Compared to a receipt, an invoice is a much more complicated document. It is a document issued to authorize the sale. It includes the name and address of the people involved in the transaction, details of the goods, date, discount, and the delivery location. On the other hand, a receipt only functions to acknowledge that the other party received the services or goods they purchased.

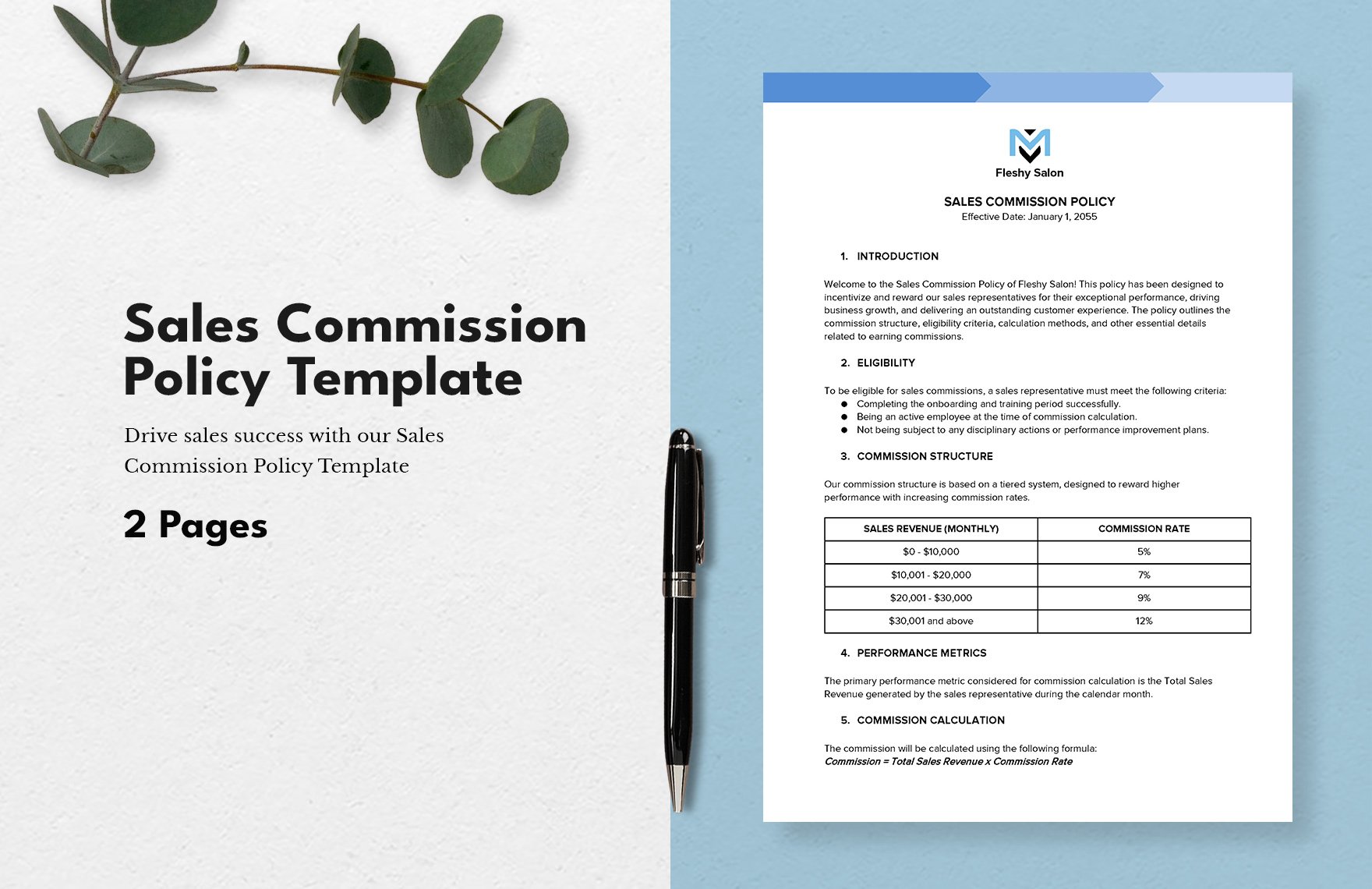

What are the types of invoices?

There are different types of invoices: commercial invoice, timesheet, standard invoice, progress invoice, pro-forma invoice, utility invoice, debit memo, recurring invoice, and pending invoice.