Protecting your business from any form of deceit is essential if you want to thrive. And you can do so effectively with the help of a payment voucher. You can use the voucher as proof that monetary payment was made to complete a transaction or as a response to a vendor's invoice. As part of the accounting responsibilities, you should know how to create a professional payment voucher. And lucky for you, we have ready-made Payment Voucher Templates in Apple Pages that you can download and use. We guarantee that you can streamline and achieve success in every business transaction with these templates. Get our printable templates now!

Payment Voucher Template in Apple Pages, Imac

Ready Your Company for the Christmas Rush by Preparing Gift Vouchers and Gift Certificates For Your Loyal Customers. Template.net Offers Voucher Templates, Free for Download. It Includes Business Vouchers, Travel Vouchers, Payment Vouchers, and Cash Voucher Formats. Template.net Also Provides Cash Receipts Tailor-Made for the Holiday Season and Other Essential Events.

How to Create a Payment Voucher Templates in Apple Pages

Just like a coupon, businesses give their customers one-time spending vouchers to use in-store. Research gathered by Valassis shows that 90% of consumers use coupons one way or another during their purchasing transactions. If you're planning to use payment vouchers for this purpose, or use it a receipt of payment, we have some useful tips about creating payment vouchers in Apple Pages below.

1. Determine the Purpose

A payment voucher can function as a proof of monetary transaction, receipt of payment, and as a replacement for cash. Before you create the voucher, you should determine its specific purpose since it outlines the required details. Moreover, how you go about creating the voucher will be affected by its purpose.

2. Identify Essential Content

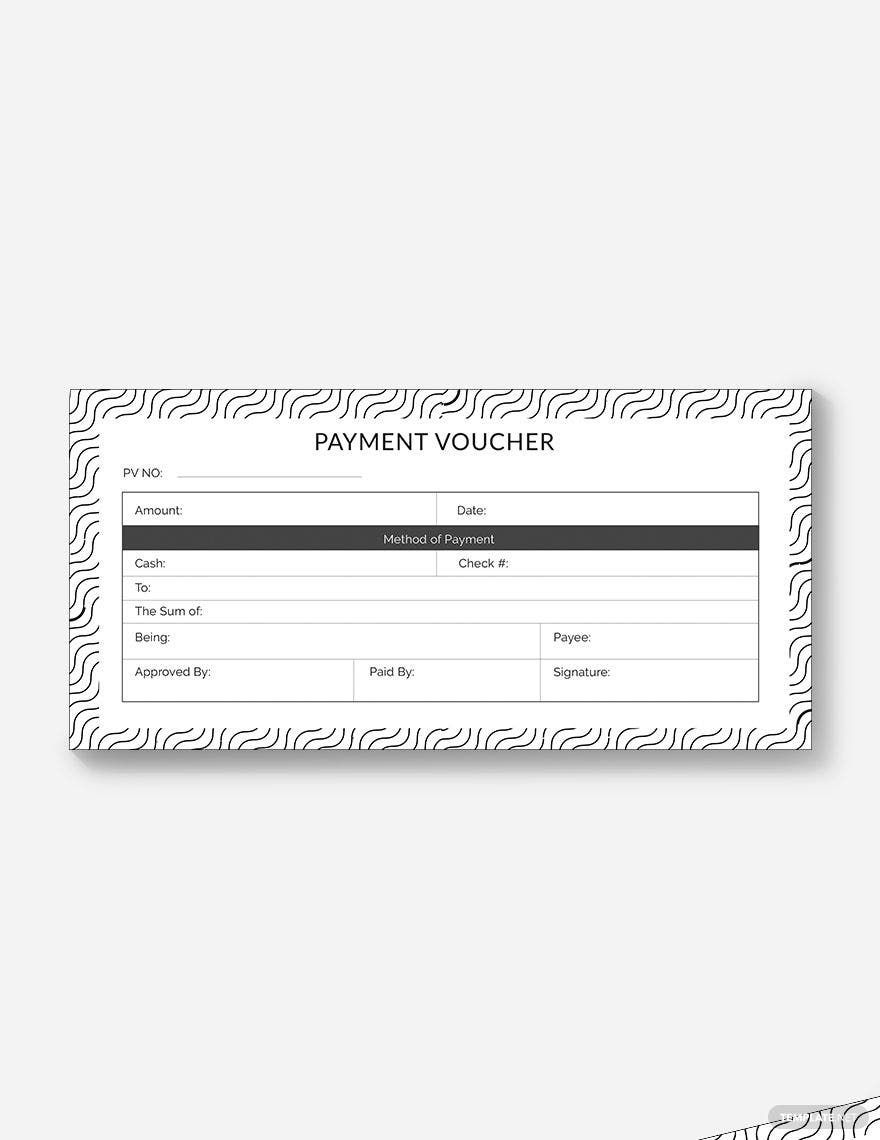

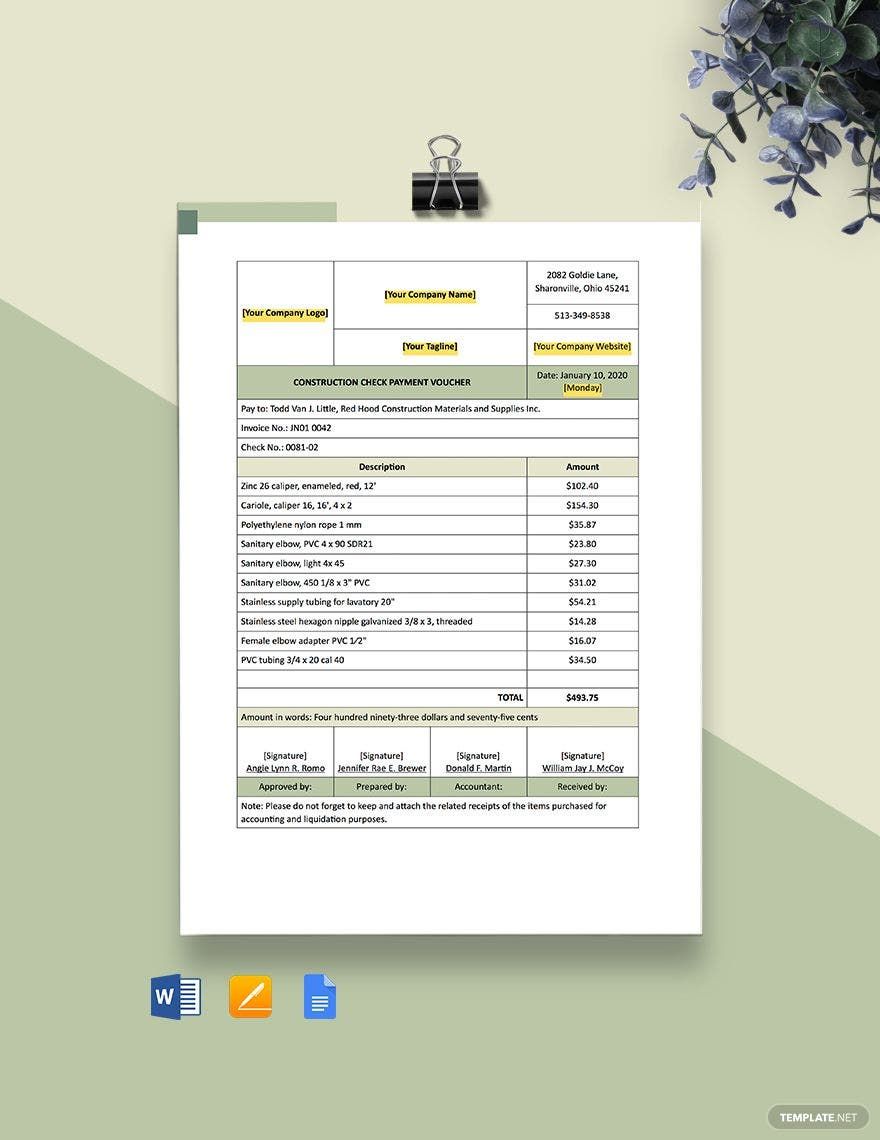

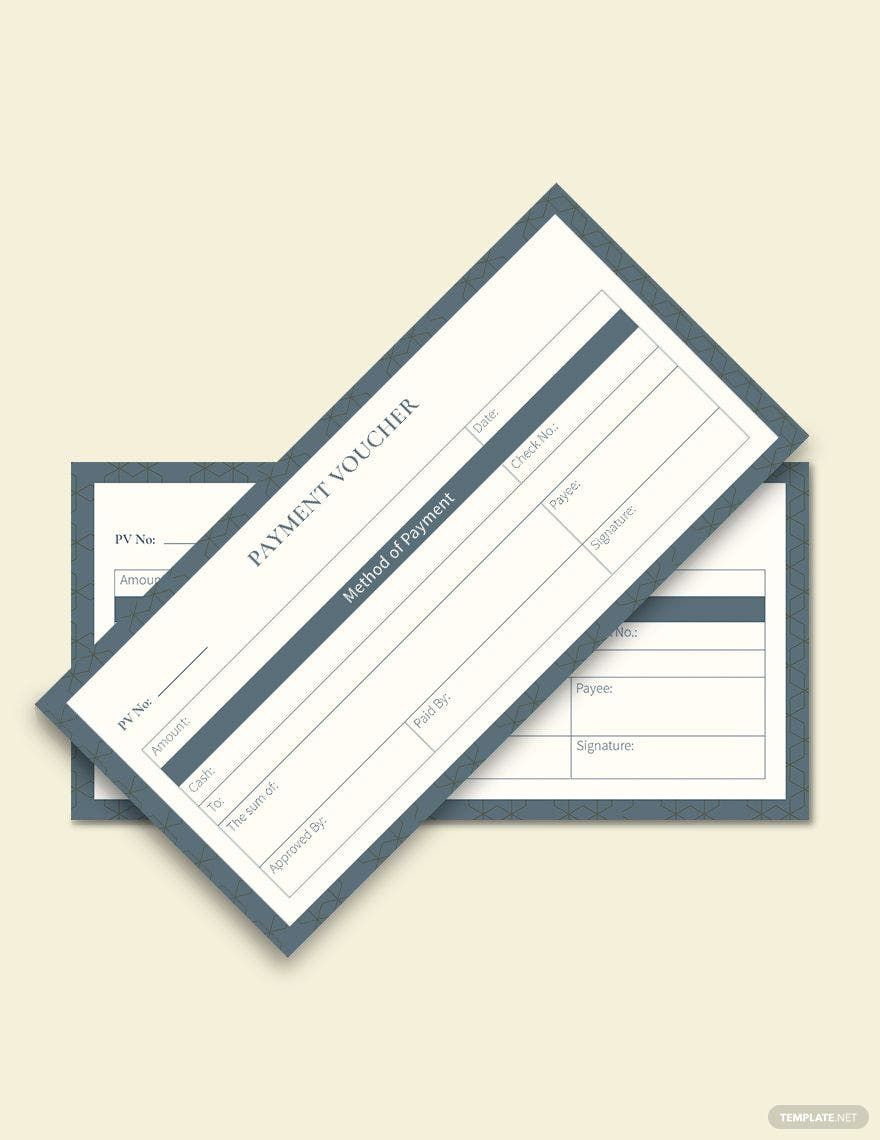

Regardless of the payment voucher, however, there are some parts and details that are consistent. The details you include should always present the cash value of the voucher, name of payor and recipient, check value, and so on.

3. Use a Clear Format

The format of your payment voucher should make way or highlight your details. Hence, it is necessary to use a clear and professional format. You can use tables so that you can have different rows and columns that you can use separators. Maintain a continuous flow for all your information to make your voucher comprehensive and easily readable.

4. Embed Unique Codes

Codes ensure that you avoid any type of fraudulent cases using your vouchers. You can automatically generate the codes by using the accounting system that is specifically assigned for vouchers. Using codes will also help you track your vouchers as you do an audit of your company's finances.

Frequently Asked Questions

What are the parts of a voucher?

A voucher must have the name of the type of voucher on the topmost part, date, serial number, revenue stamp, amount, signature, and removable stub for receipt of payment. However, it is important to note that these parts are mostly required for payment vouchers used for account payables.

What are the types of vouchers used in accounting?

The following are the types of accounting vouchers:

1. Debit or Payment voucher – This serves as a record of the cash or cheque payment; the bank where the cheque is credited from will outflow the required amount.

2. Credit or Receipt voucher – This voucher records the record cash or bank receipt.

3. Non-cash or Transfer Voucher – This voucher is typically used as documentary evidence; the cash or funds of the bearer is not affected.

4. Supporting Voucher – This serves as documentary evidence for previous transactions.

What is the difference between a voucher and invoice?

An invoice is a bill that lists the quantities of the items for a specific transaction, on the other hand, a voucher is an internal document used to document the accounts payable to get the proper approval to pay the invoice.

Who makes a payment voucher?

A payment voucher is created by the accounts payable department of a company. The accounting department also creates gift vouchers since they need to keep track of all the finances of the company.

What are the advantages of a voucher?

By using a voucher several invoices at once and also help make the audit trail for payables more straightforward and traceable. On the other hand, a gift or discount voucher is used as a replacement for cash, which helps consumers as they shop.