Writing a complex accounting document such as a financial statement is a tedious task. But fret not for we have the solution to your dilemma! You will find various editable financial statement templates in Apple Numbers file format here at Template.net. These templates are easy to use; these are complete with simple layout and format, and pre-written contents. We have also provided professionally created balance sheets, income statements, cash flow statements, and shareholders' equity to keep track of the income, expenses, and other financial activities within your business. These templates are absolutely perfect for your weekly, monthly and annual audit reports. Avail of our subscription plans to gain access to our printable templates today!

Finance Statement Template in Apple Number, Imac

Evaluate Your Financial Performance Using Our Free Finance Statement Templates in Apple Numbers. Assess Startup Costs, Budget, or Divident Income Portfolio Using Our Profit and Loss Statement, Final Account, and Other Templates Available Below. Easily Edit Like Editing a Gantt Chart in Apple Numbers Using a Template. Download Templates Now!

How to Prepare a Financial Statement in Apple Numbers

As mentioned, it is not an easy task to create a financial statement for your business. But it is extremely necessary to do so to keep track of the financial performance of your business. To help make an effective financial statement, we have an easy guide for you to follow:

1. Create the Balance Sheets

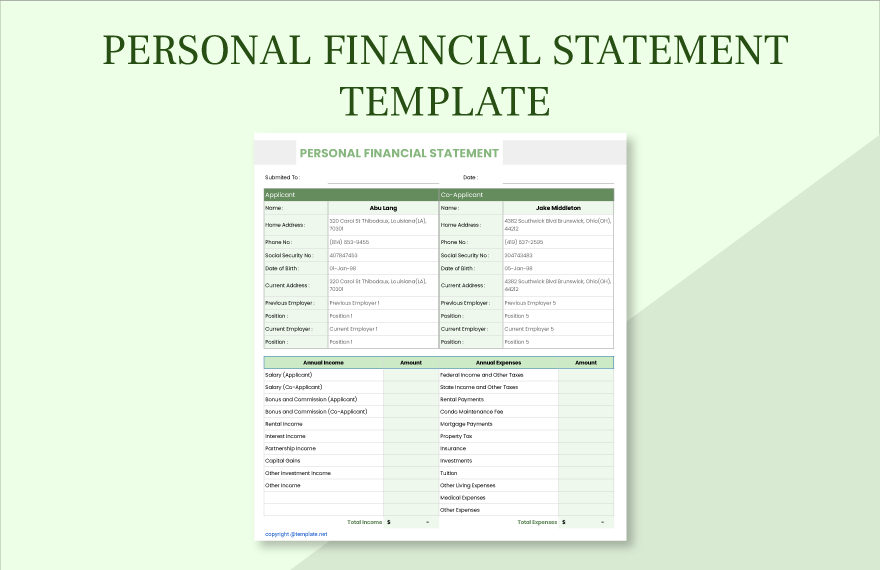

The balance sheets provide a comprehensive component of your document that that will allow the reader to have a clear idea of the financial status of your business during a certain period of time. Here is a detailed explanation of the three elements of a balance sheet:

Assets are basically the things that you own that have value. These are things that you can sell or can be used by the company to manufacture products and provide the services you offer. It includes physical property, such as cash, plants, trucks, equipment, inventory, and also intangible things such as trademarks patents, and investments. Liabilities are the monetary value of what you owe to other companies or financial institutions. This includes the money you loaned from a bank, rent for a building, money owed to suppliers, payroll you owed to employees, environmental cleanup costs, or unpaid taxes. And shareholders' equity is your net worth or the amount you be valued if you sell all your assets and paid off all your liabilities.

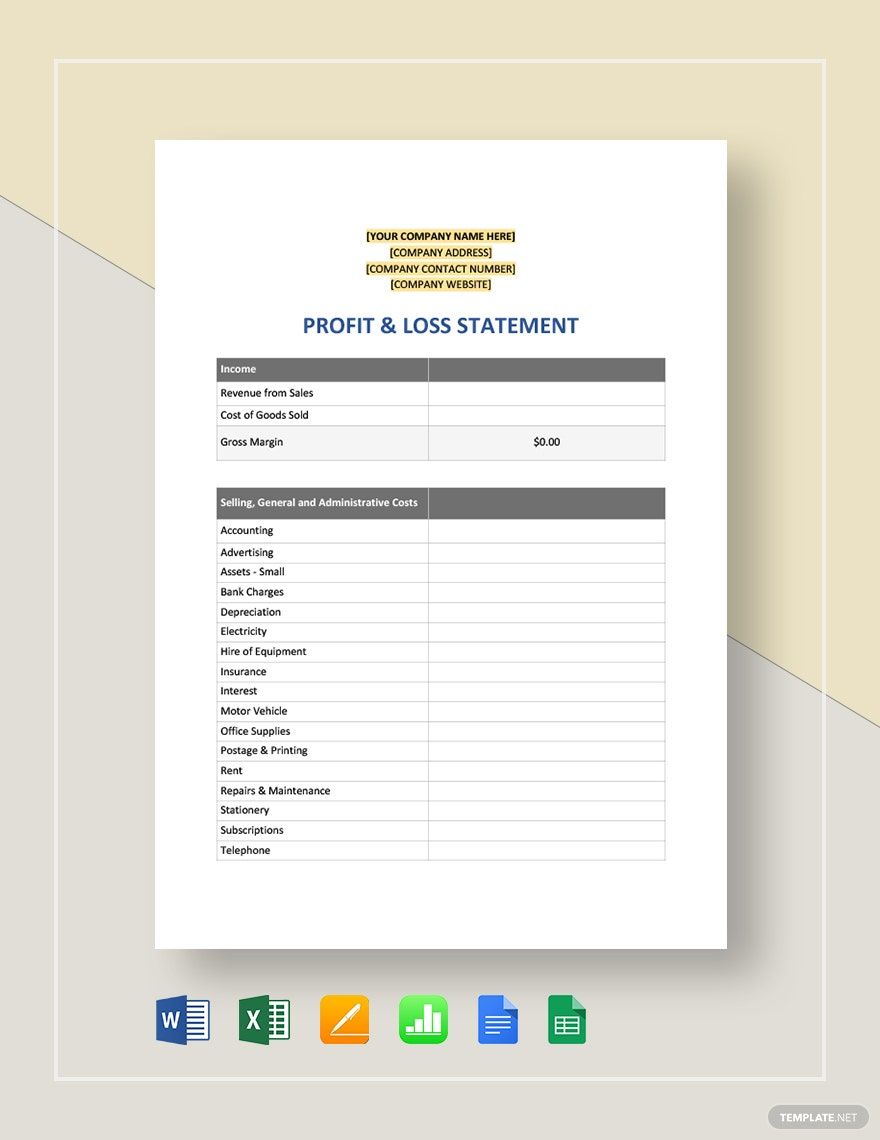

2. Prepare the Income Statements

To let employees and internal and external investors know the income you have earned within a specific point in time, then, you need to write a thorough income statements. The income statement is a report that provides how much revenue the company earned during a specific month, period or year. It also shows the costs and expenses the company has spent in order to achieve that income. The bottom line of the report shows the net earnings and/or losses of the company.

To prepare the income statements, you need to start from the top where the total amount of sales made during the accounting period. As you go down, you make deductions for costs and expenses made relevant to earning that revenue. The amount you get after all the deductions is your revenue and/or losses for the accounting period.

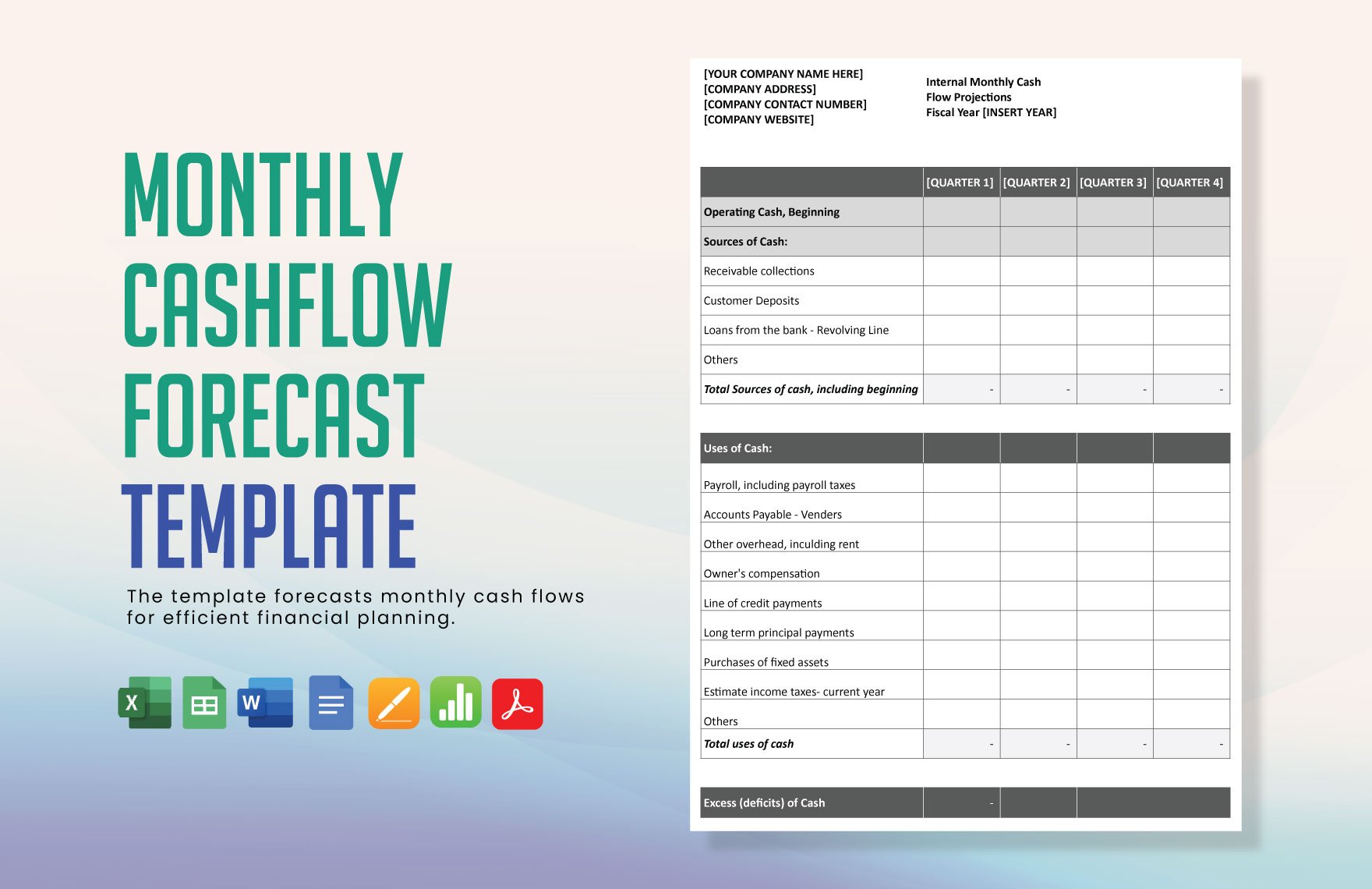

3. Provide the Cash Flow Statements

The inflows and outflows of your business' cash are reported in the cash flow statements. This report tells you whether the business has generated cash to pay for expenses and purchase assets. Here are the three parts of a cash flow statement:

First, the operating activities analyze the cash flow from your business' net income and losses. Second, the investing activities show the cash flow from investing in activities like purchases or sales of long-term assets and securities investment. Lastly, all the cash flow for selling stocks and bonds or borrowing from banks, and paying back loans are included in the financing activities.