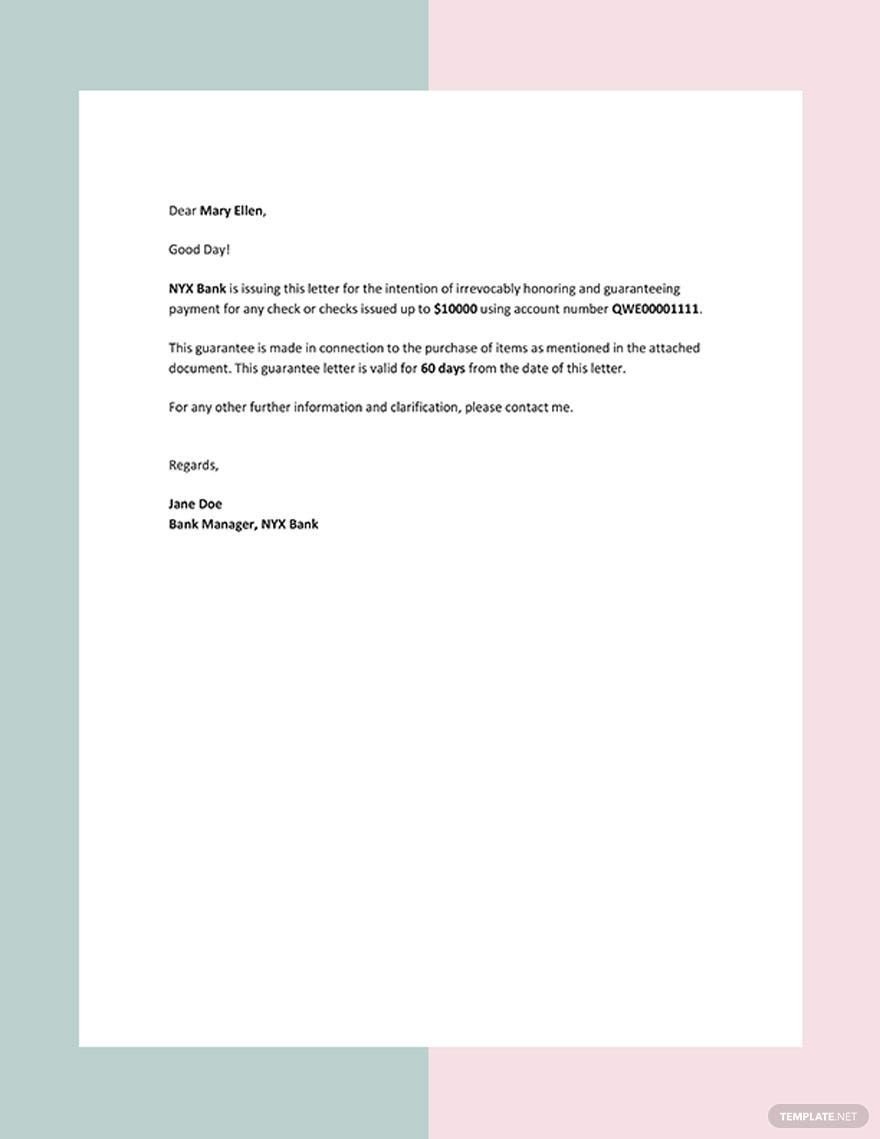

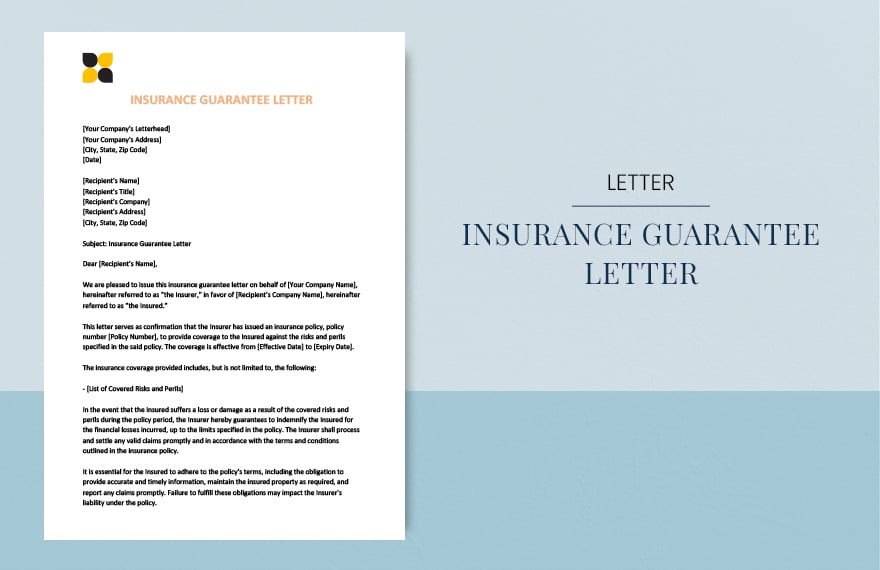

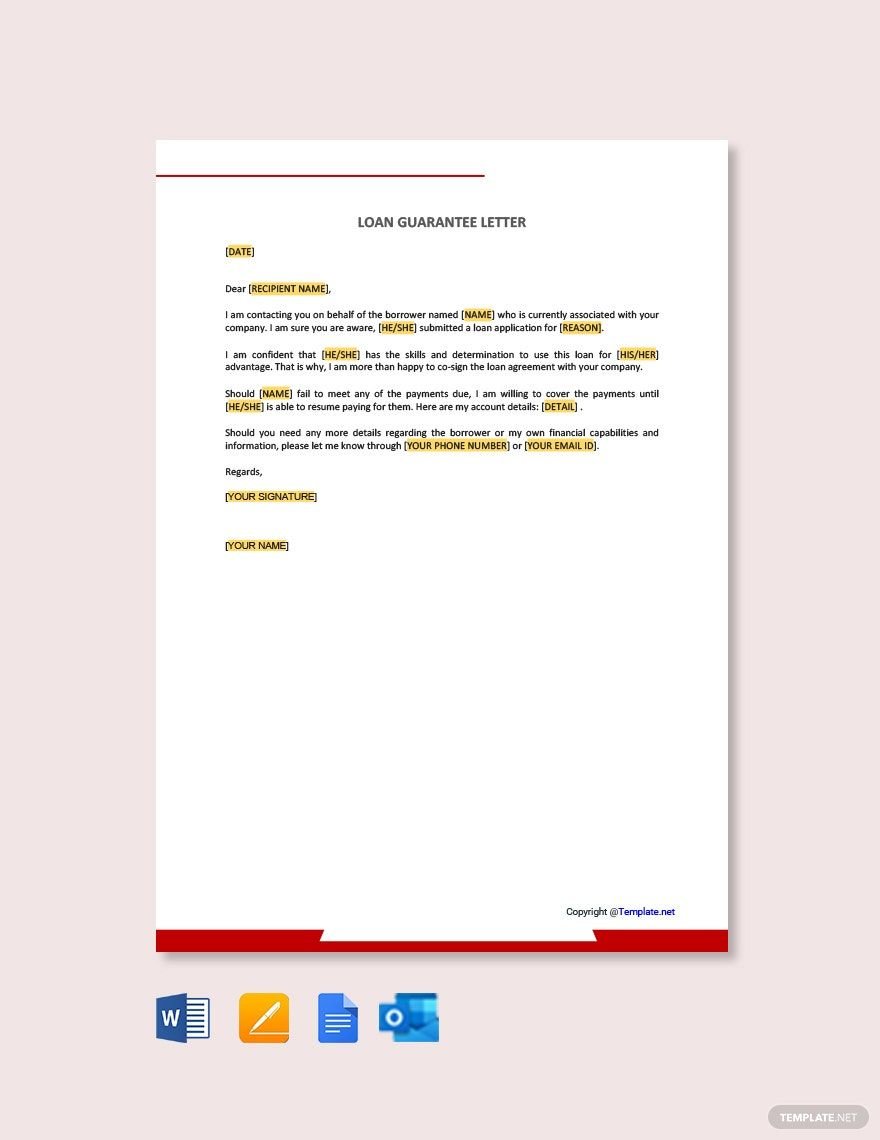

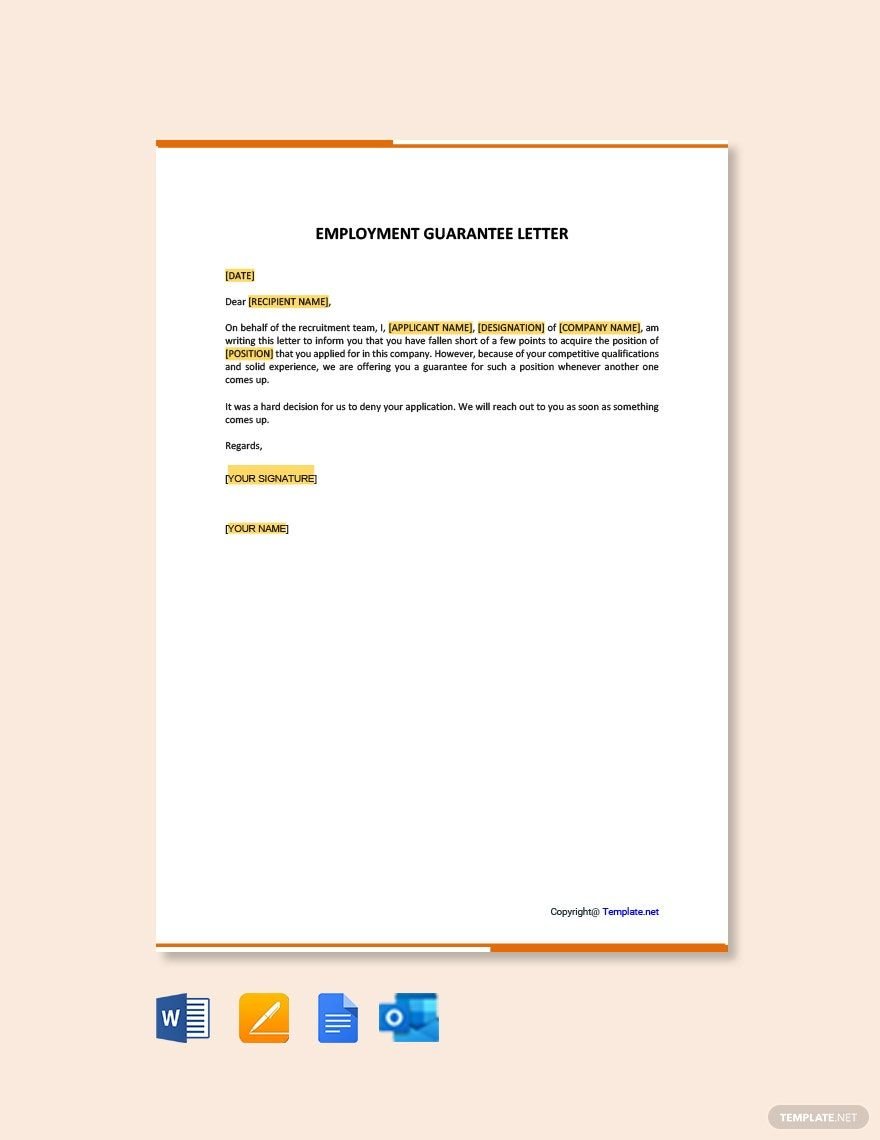

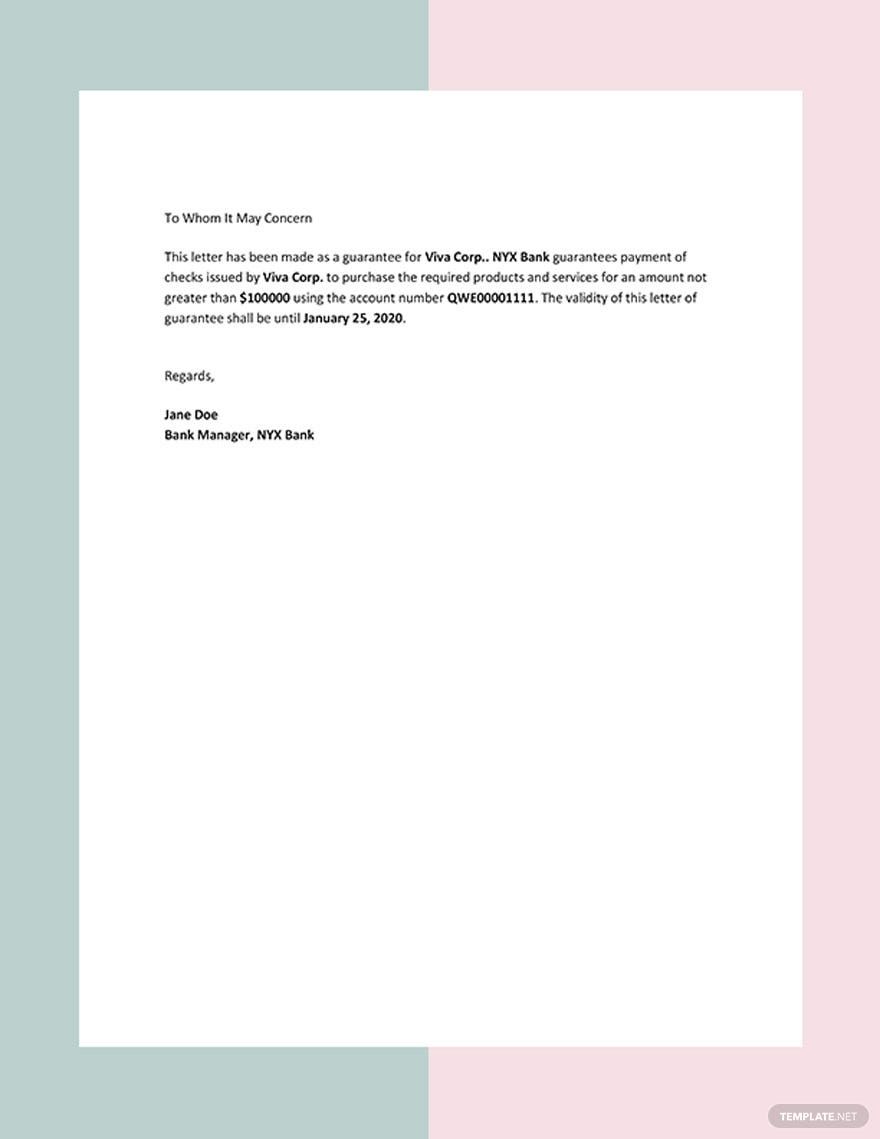

A guarantee letter is issued by the bank on behalf of a client who has entered into a contract to purchase goods. It lets the seller know that they will be paid even when the customer fails on payments. However, the client will have to apply for the guarantee, and if the bank is comfortable with the risk, then they are likely to back the customer. Write your letter in minutes using our ready-made Guarantee Letter Templates. Simply download the editable template that you need from our library, edit or customize them as you need, and print. They already come with original content, you only need to personalize them by adding your specific details. Get them now, subscribe, and start downloading!

How to Write a Guarantee Letter?

The guarantee letter is used in transactions where one party is uncertain of the other’s ability to meet their financial obligations. This is common in high-cost purchases like equipment or property. If you need to write one and you are confused about how to start, here are some tips:

1. Read and Understand All Required Paperwork

The responsibility of being a guarantor to someone else’s debt or payment is a great responsibility. You have to review all agreements and other documents related to the sale. Ask for copies of all relevant documents to help you assess the risks of guaranteeing the transaction to avoid problems later on.

2. Practice Formal Writing

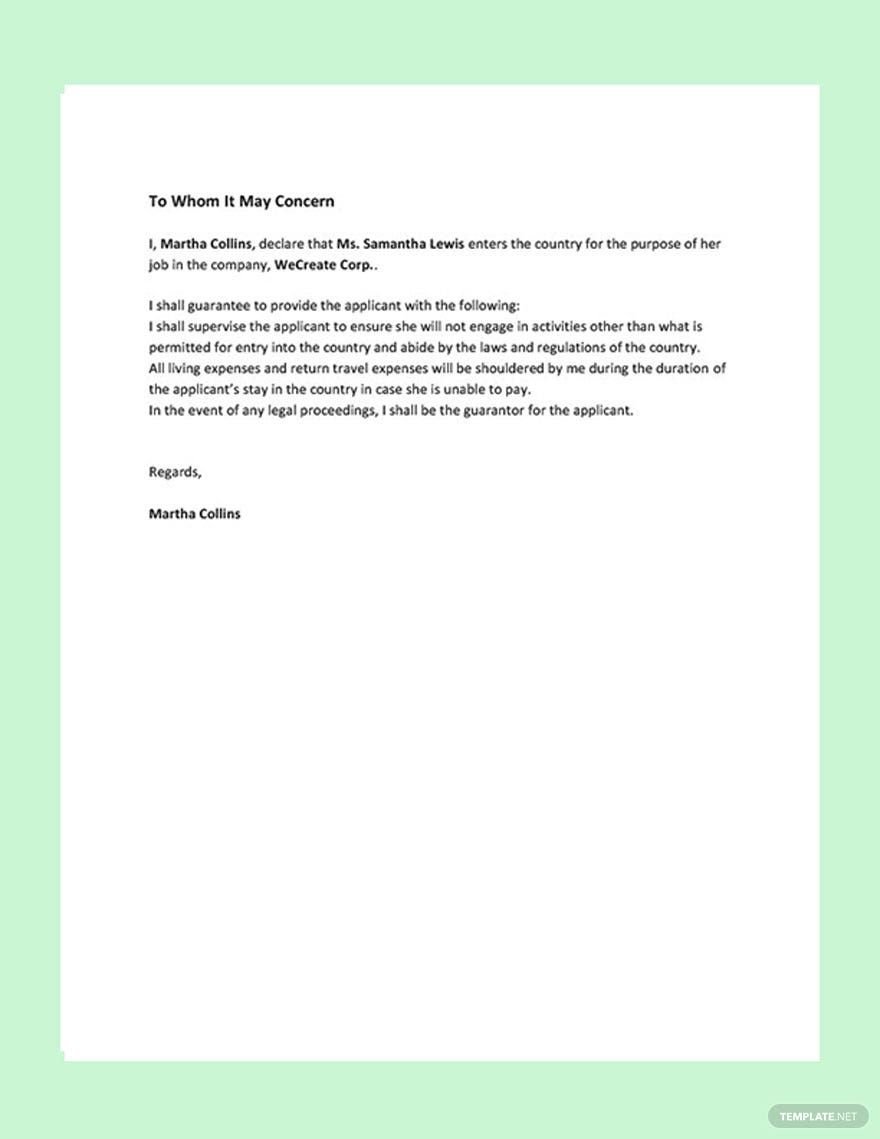

If you decide to move forward with the guarantee, compose a formal letter that identifies yourself and your relationship with the person whom you are supporting. Ultimately, discuss the reasons for taking on the financial responsibility of another person.

3. Supply All Necessary Information

Make a clear and concise statement regarding the transactions that you will guarantee. State clearly any limitations to your guarantee, whether it involves financial or time factors. Indicate all necessary information that is required from you, which may include bank account numbers, annual income, and even social security number.

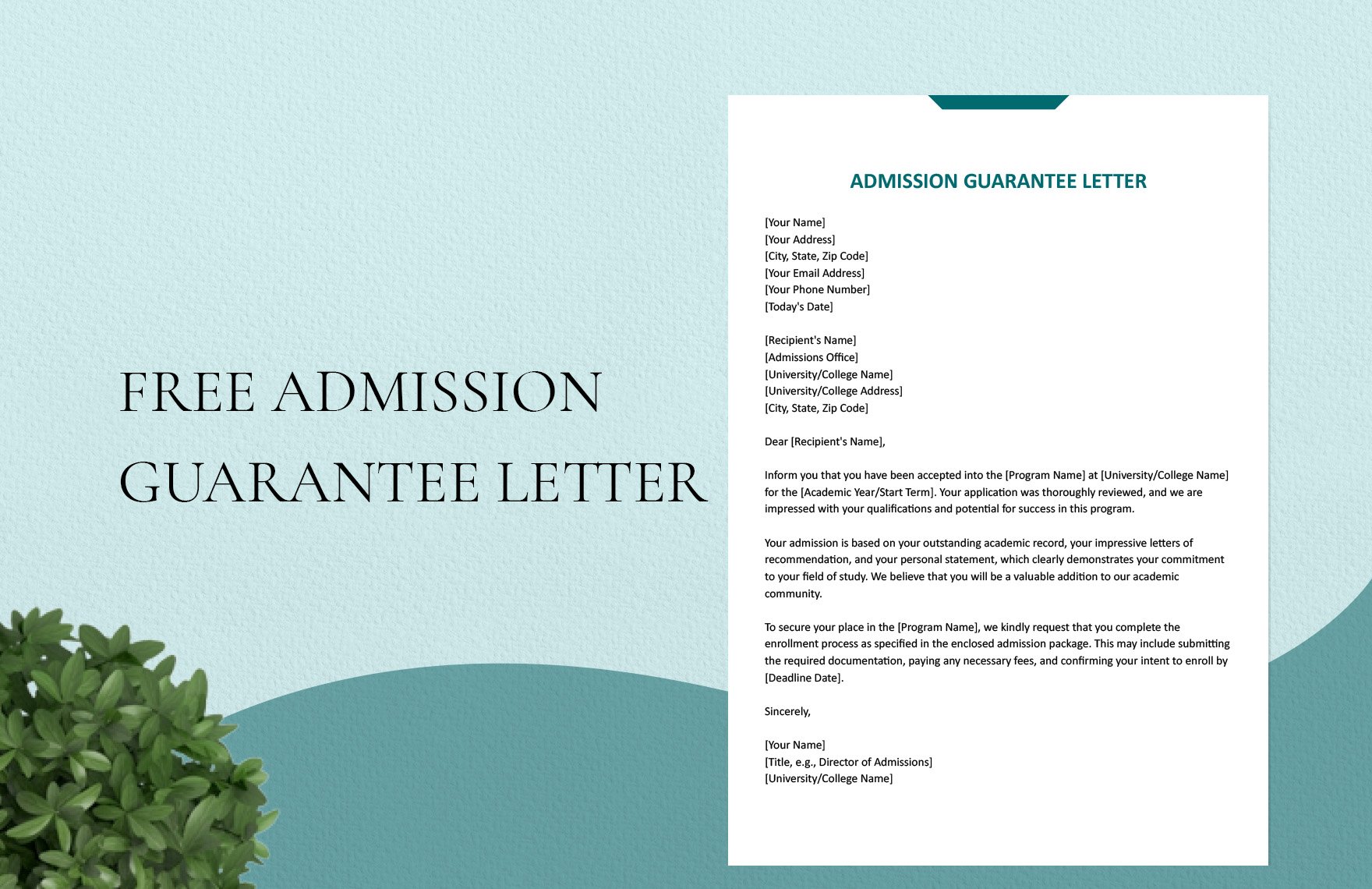

4. Make the Letter Presentable

Use a personal or company letterhead to make the guarantee letter look official for the transaction. Use good quality paper and utilize proper office fonts as it is a formal document. Don’t forget to employ the services of a notary public to sign and stamp the letter if required by the company or entity asking for the guarantee letter.