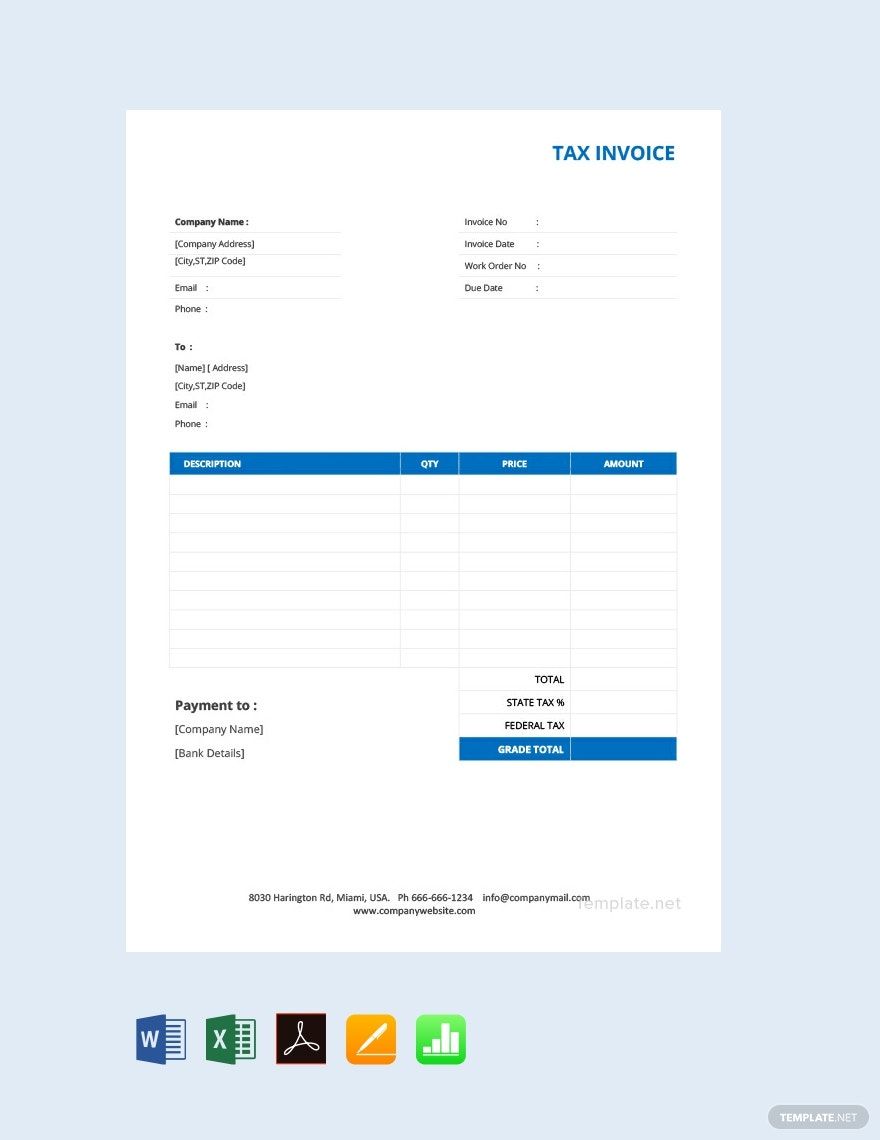

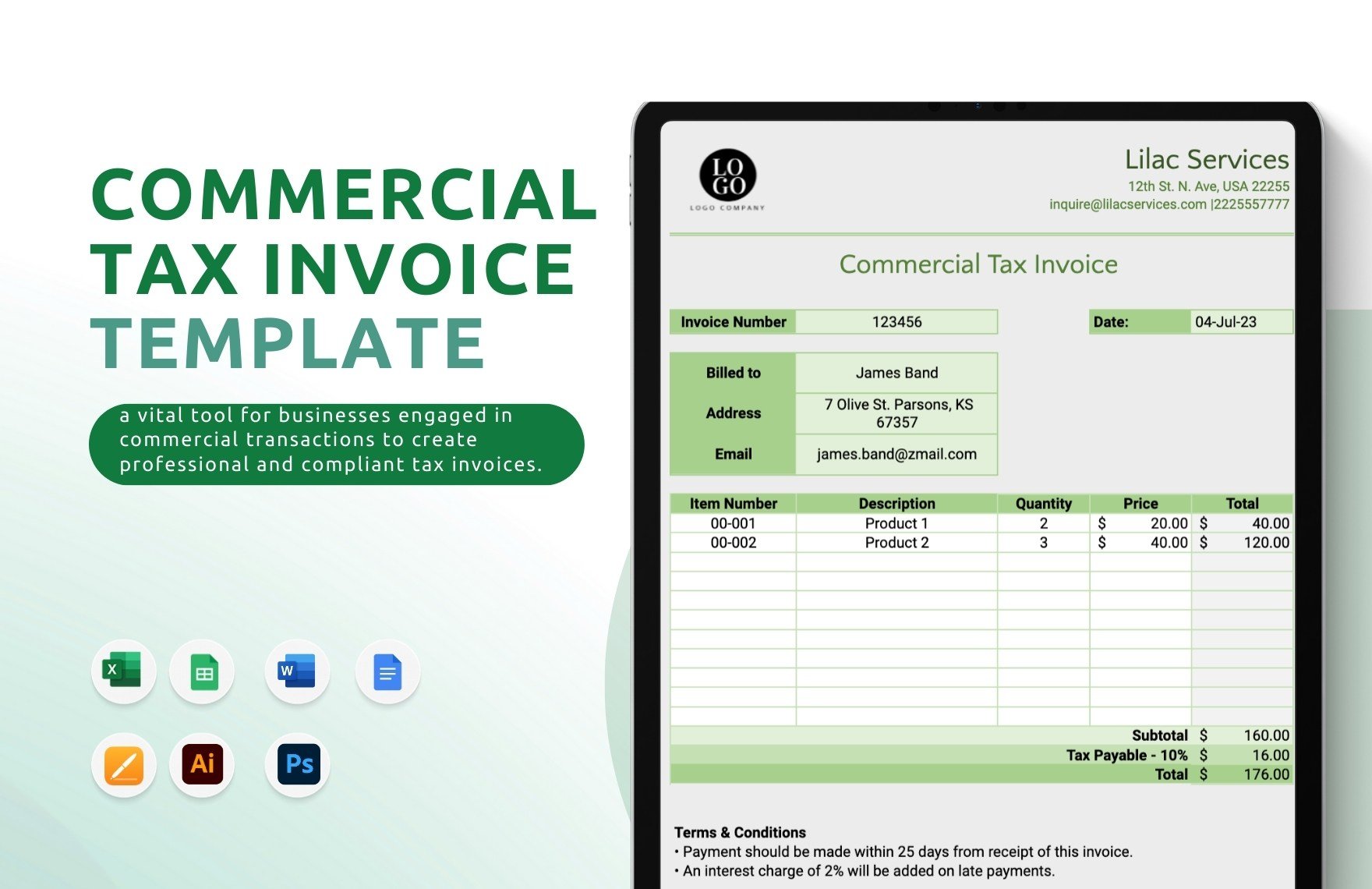

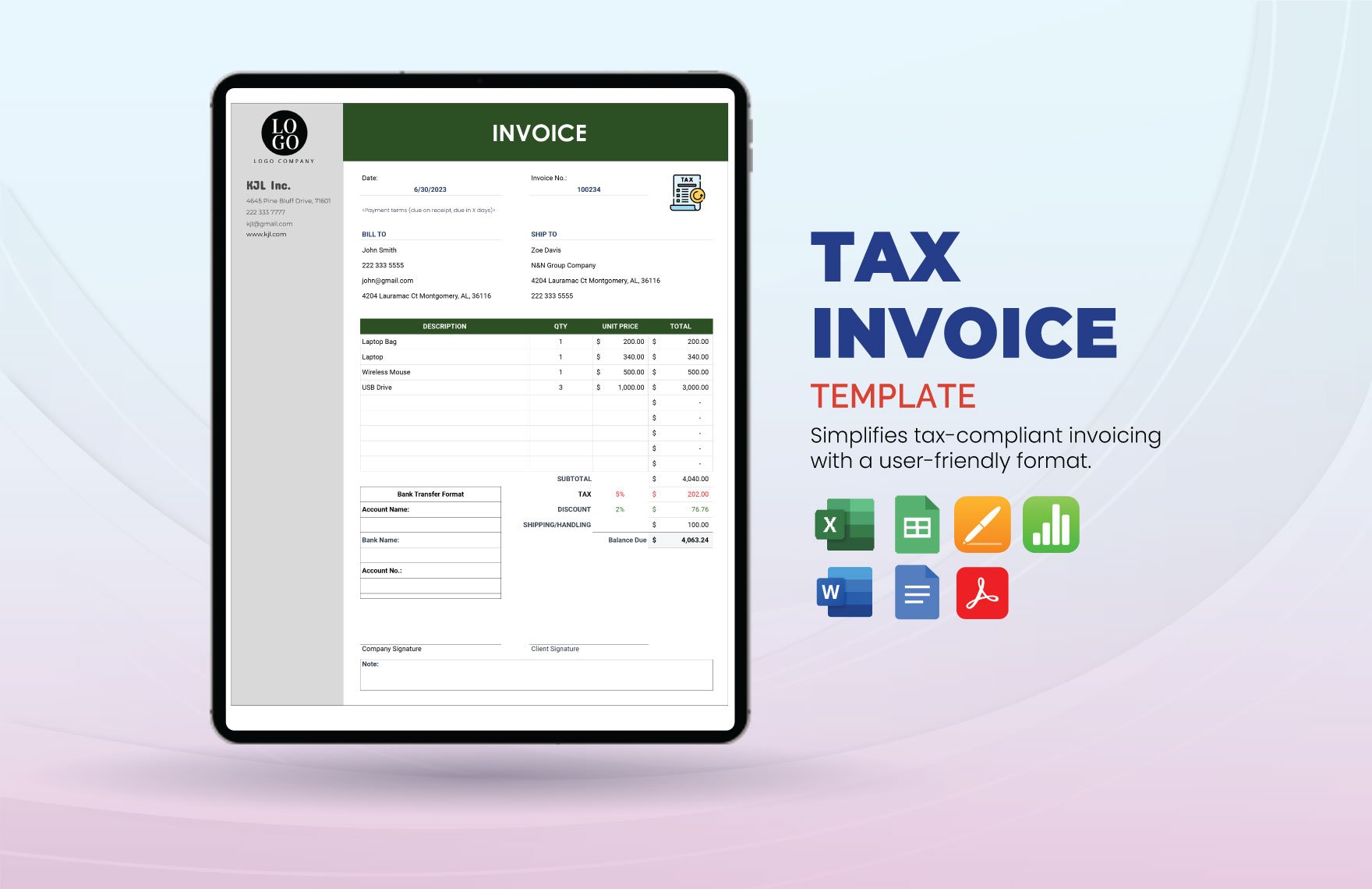

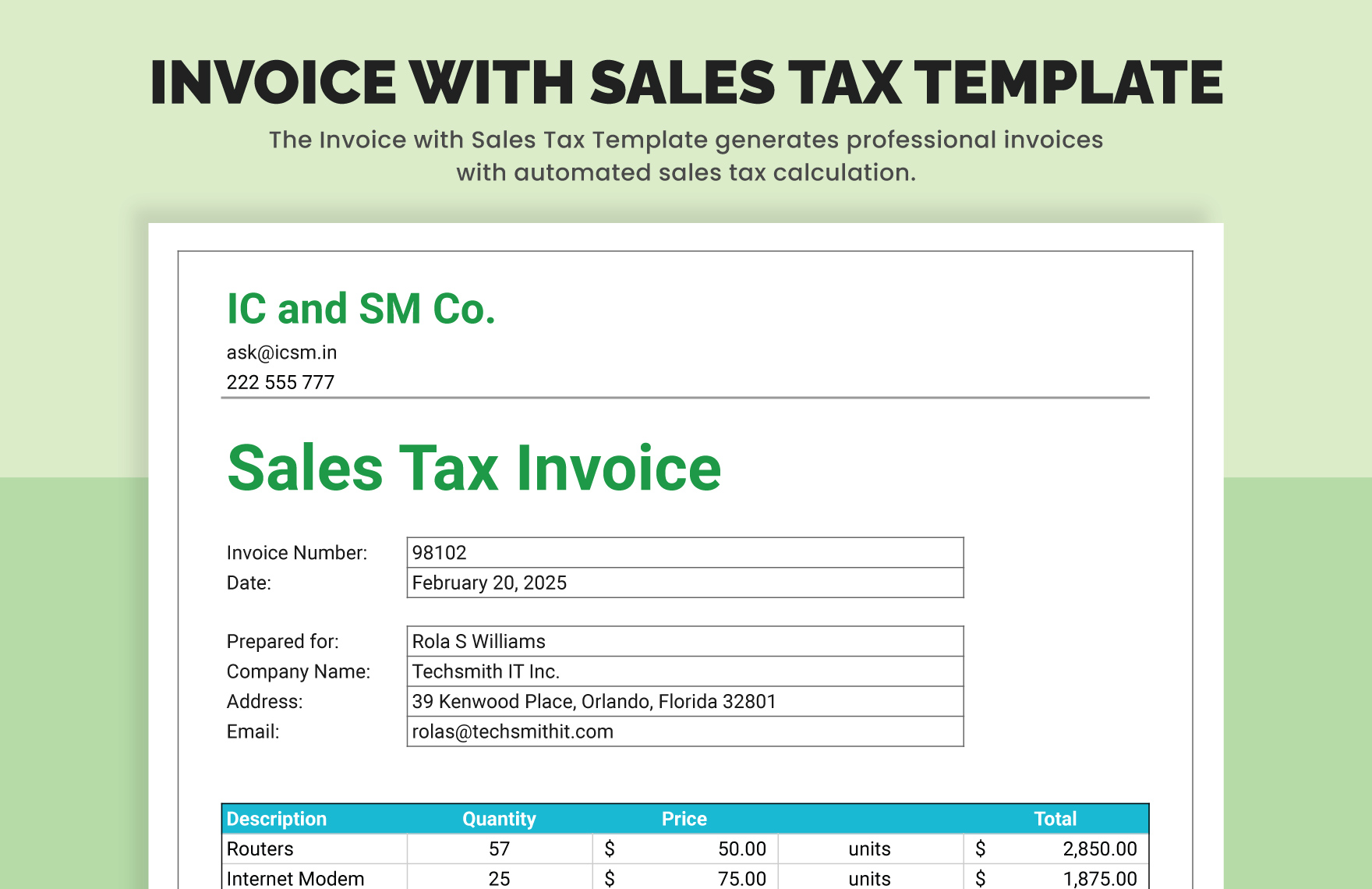

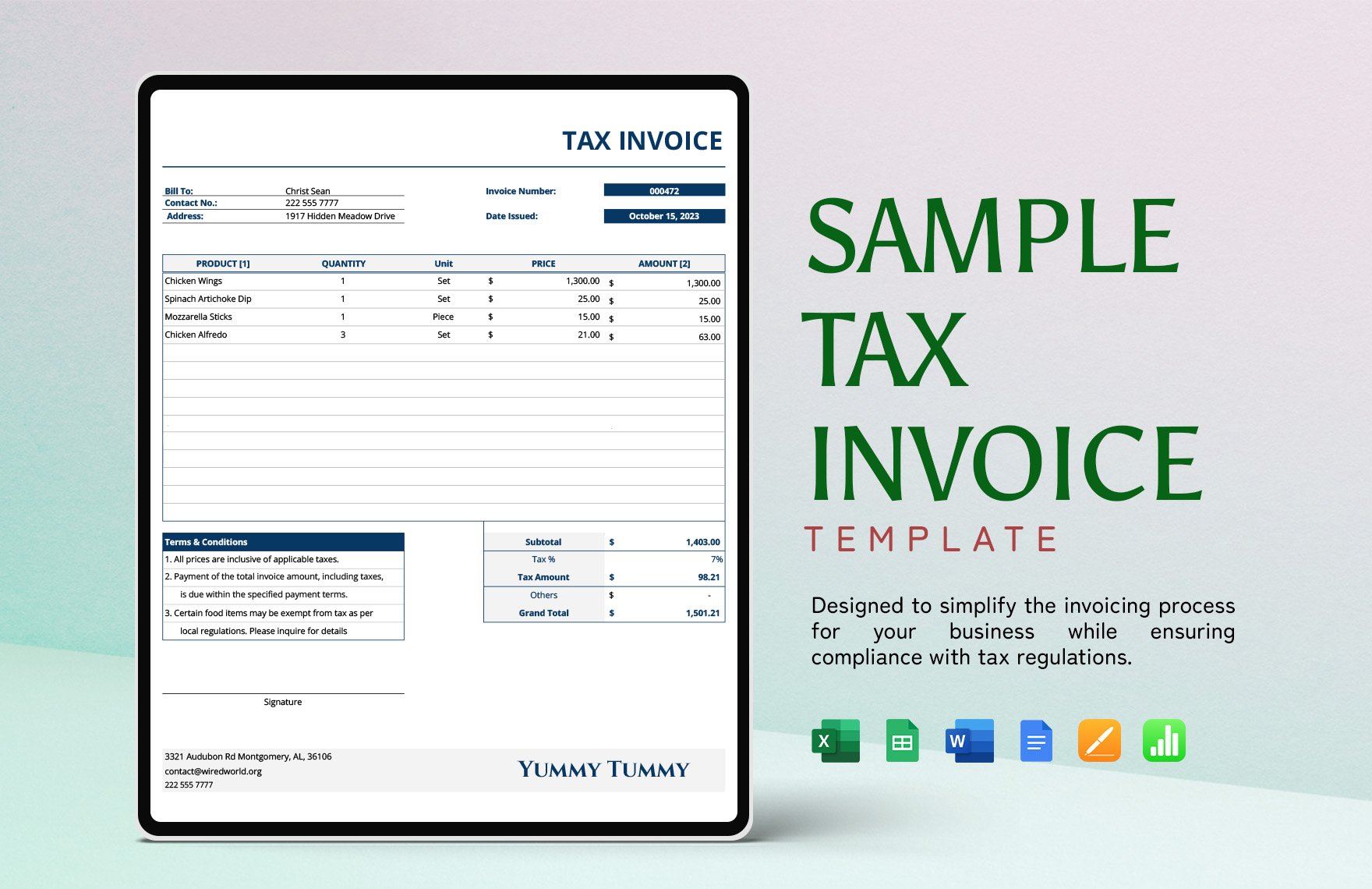

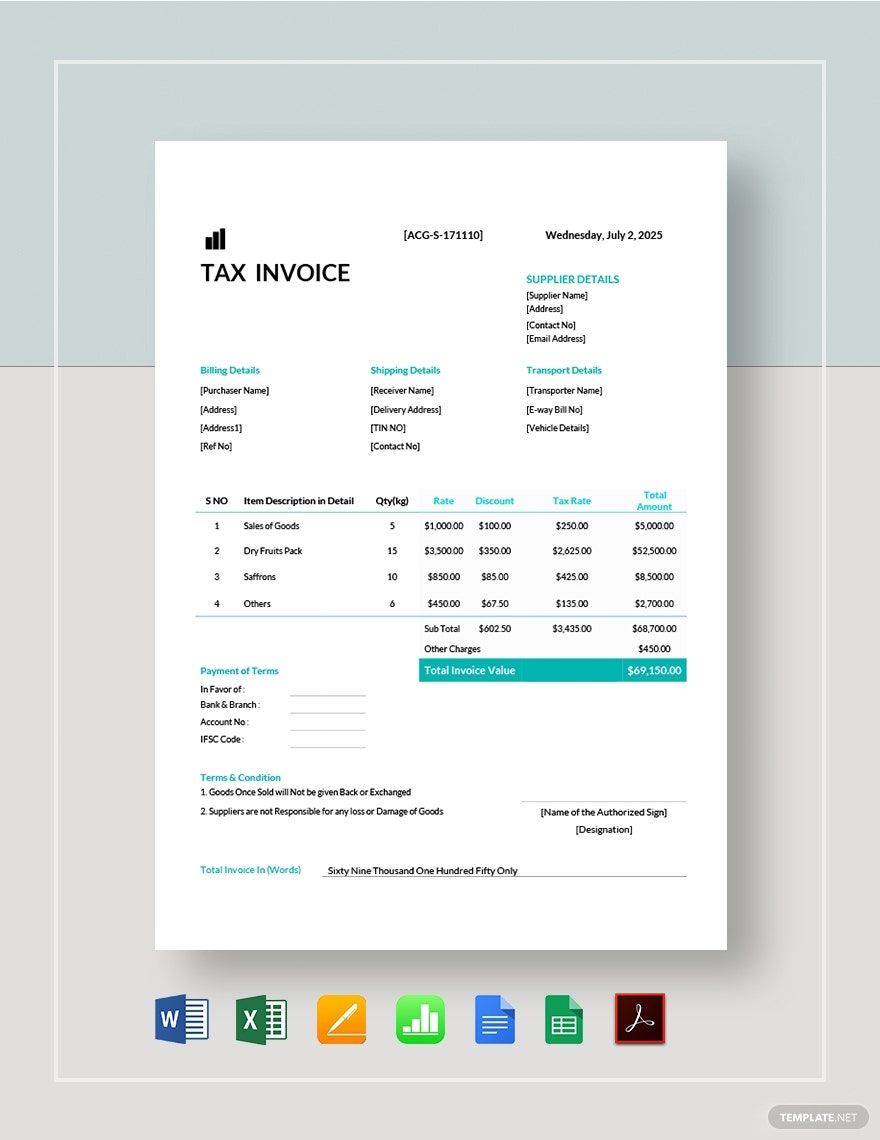

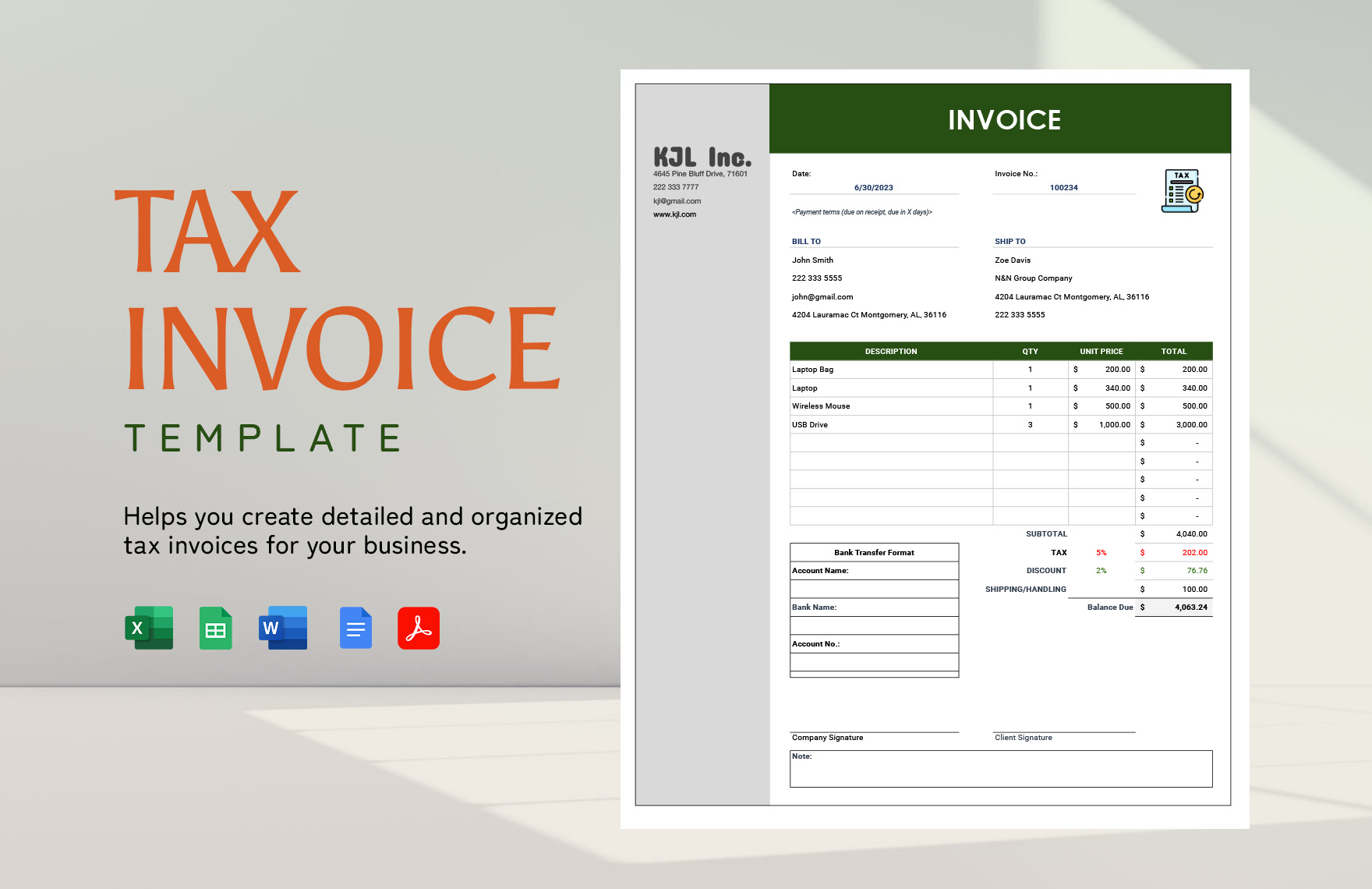

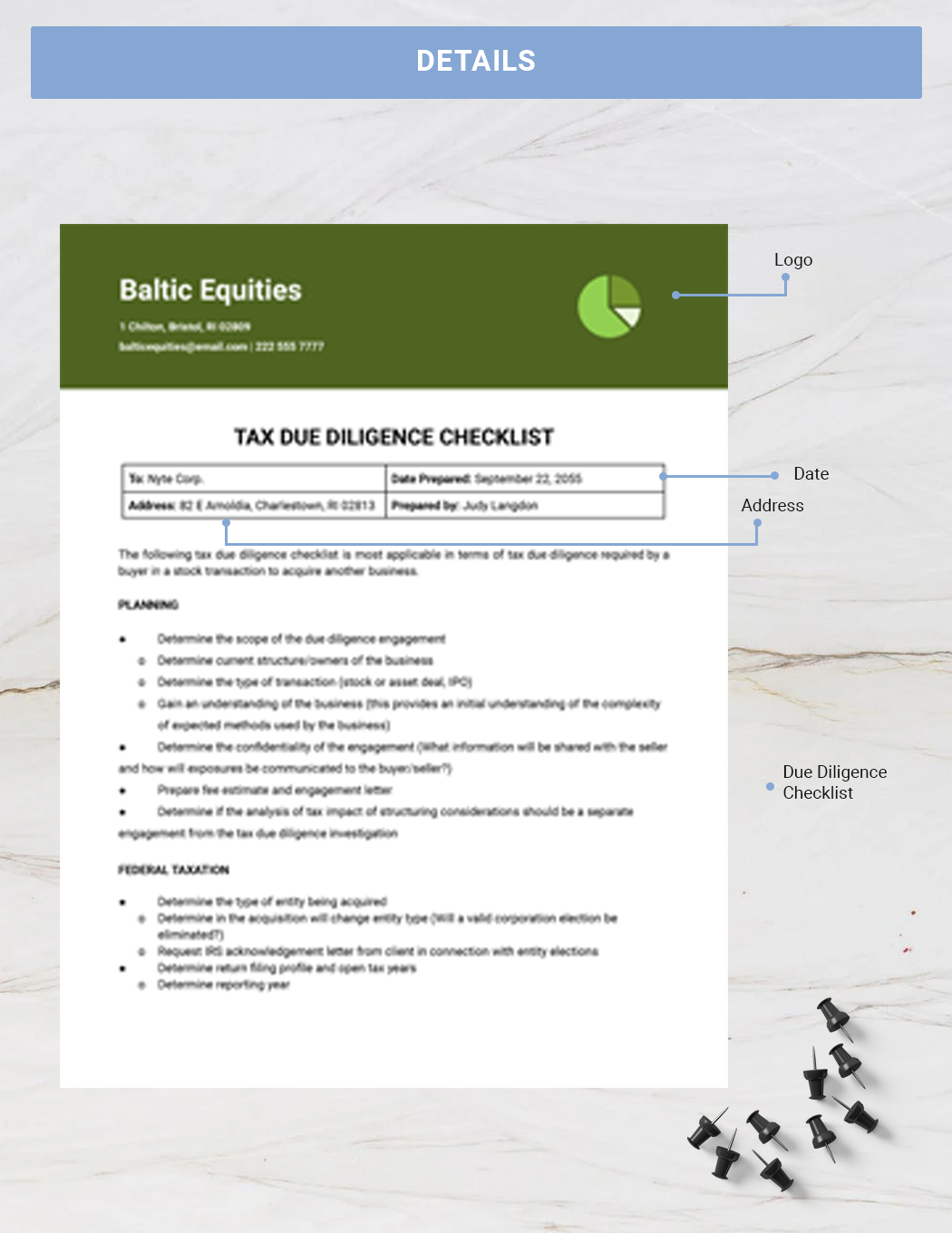

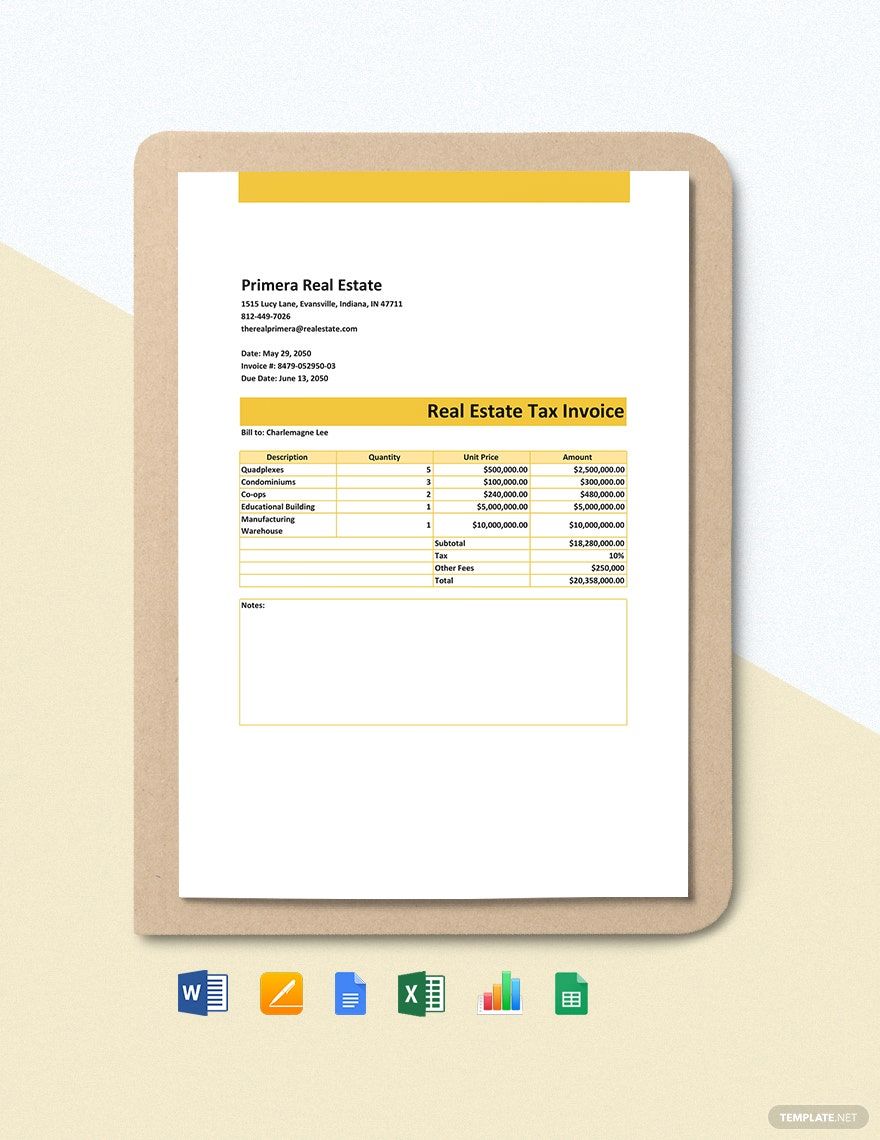

Regardless of how small or how big your business is, every business needs to charge various rates of taxes for every product they sell and every service availed and report it to the government. One of the most important of these invoices they generate from their sale is the tax invoice. When you make an on-the-table sale for certain products, the customer needs an invoice so they can claim their tax credits for the purchases they make. We have a huge collection of Tax Invoice Templates on our website that can be of great help to you.

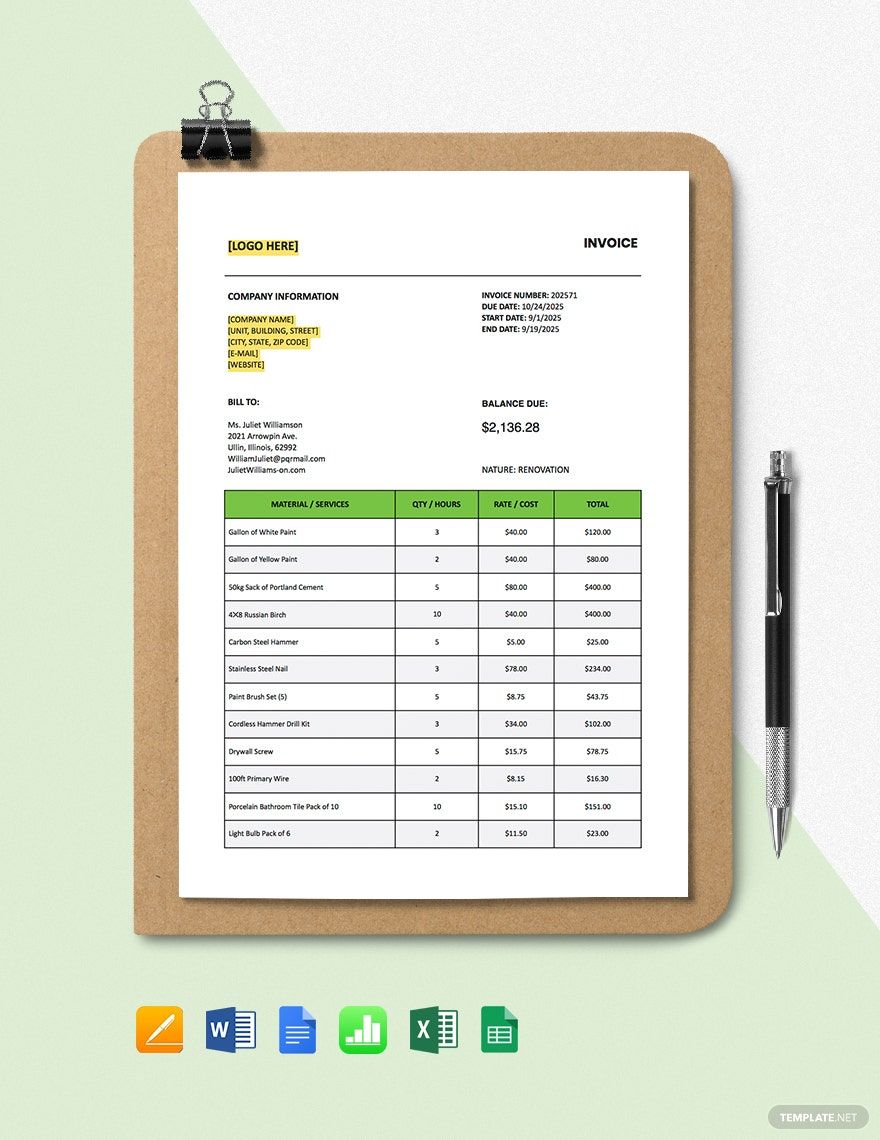

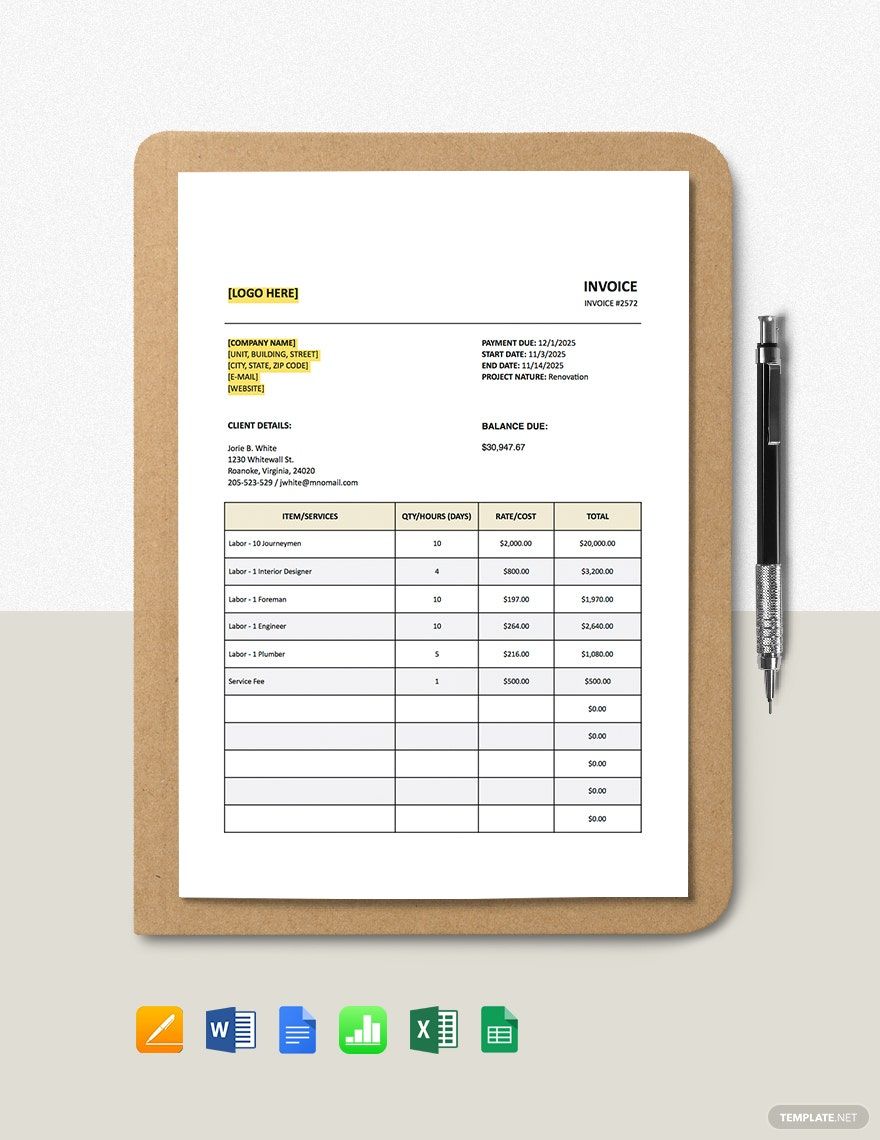

What is a tax invoice you ask? Well, a tax invoice can be defined as an invoice that is sent by a registered seller/dealer to the person who purchases the goods, showing the amount of tax that should be paid for the products separately. It includes all the details like the description, quantity, value of goods and services, and the total tax charged. If you are a registered trader and buyer, then every year you must file your tax returns and for this, a tax invoice is mandatory.

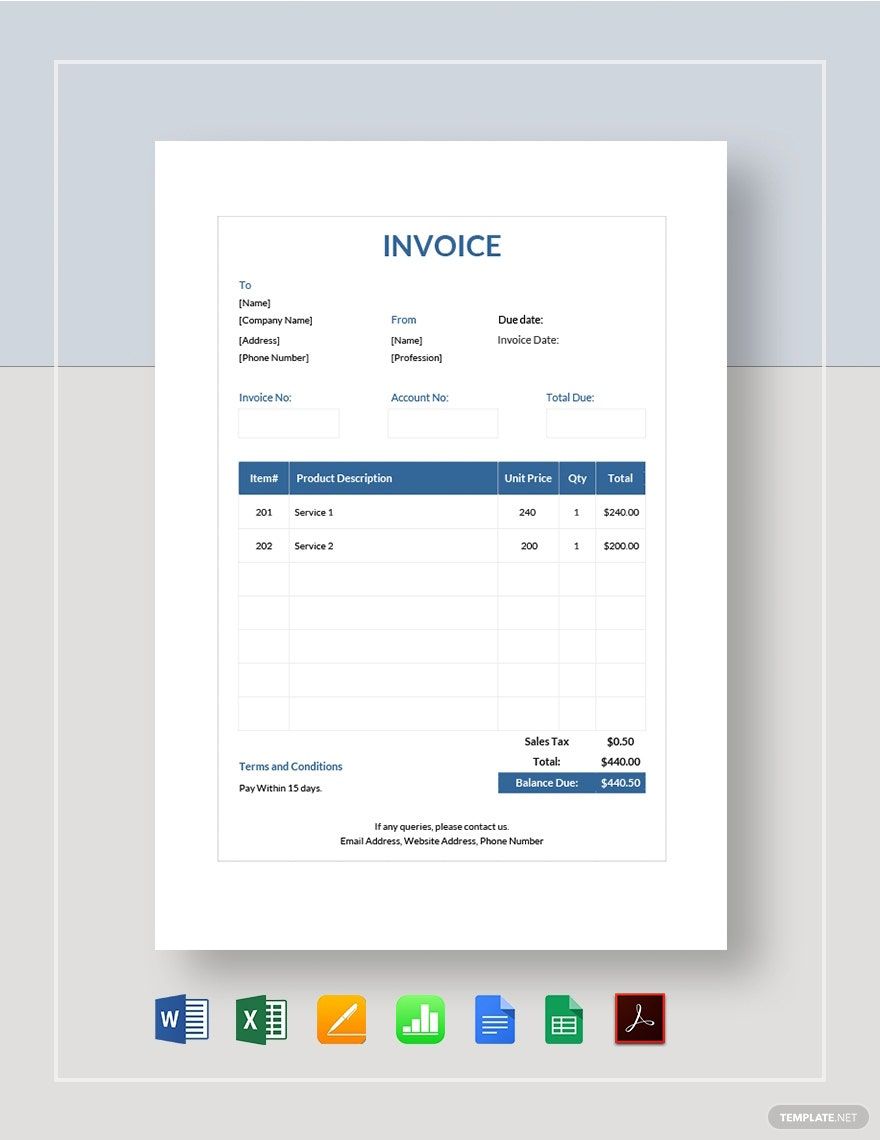

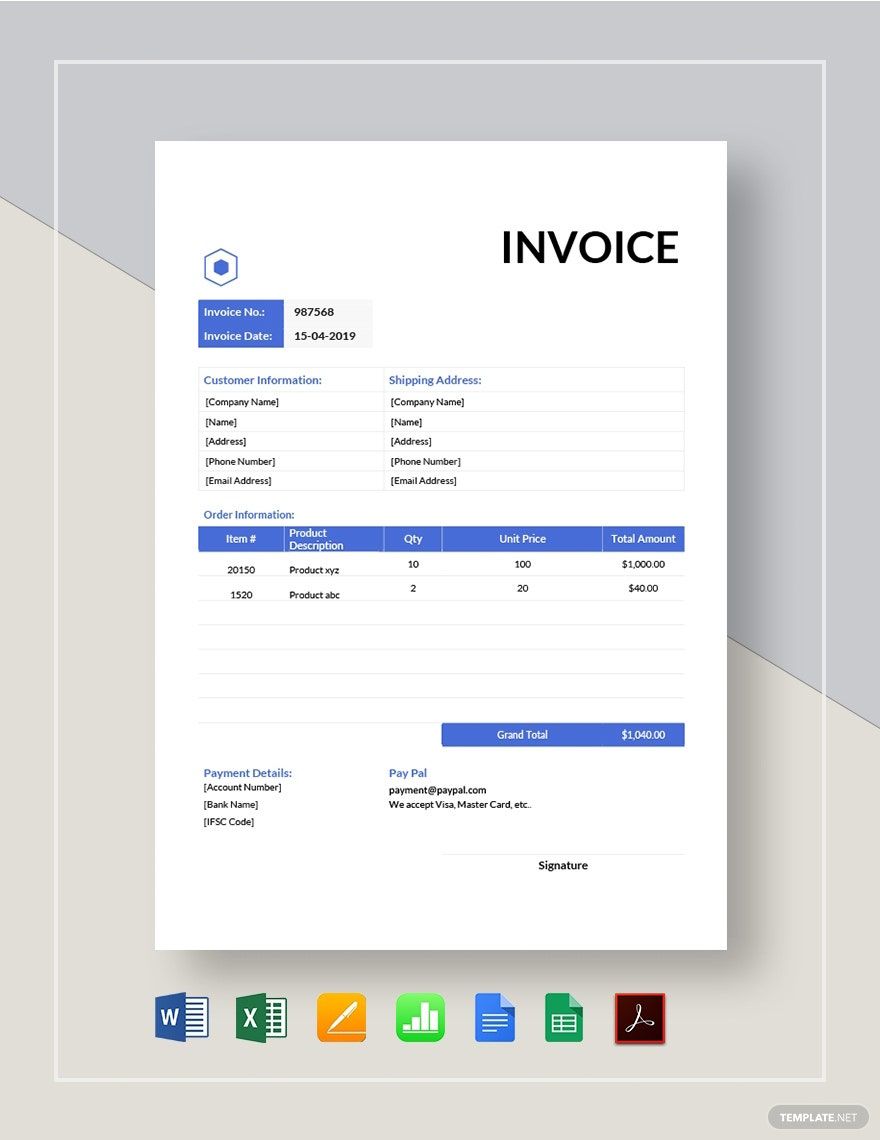

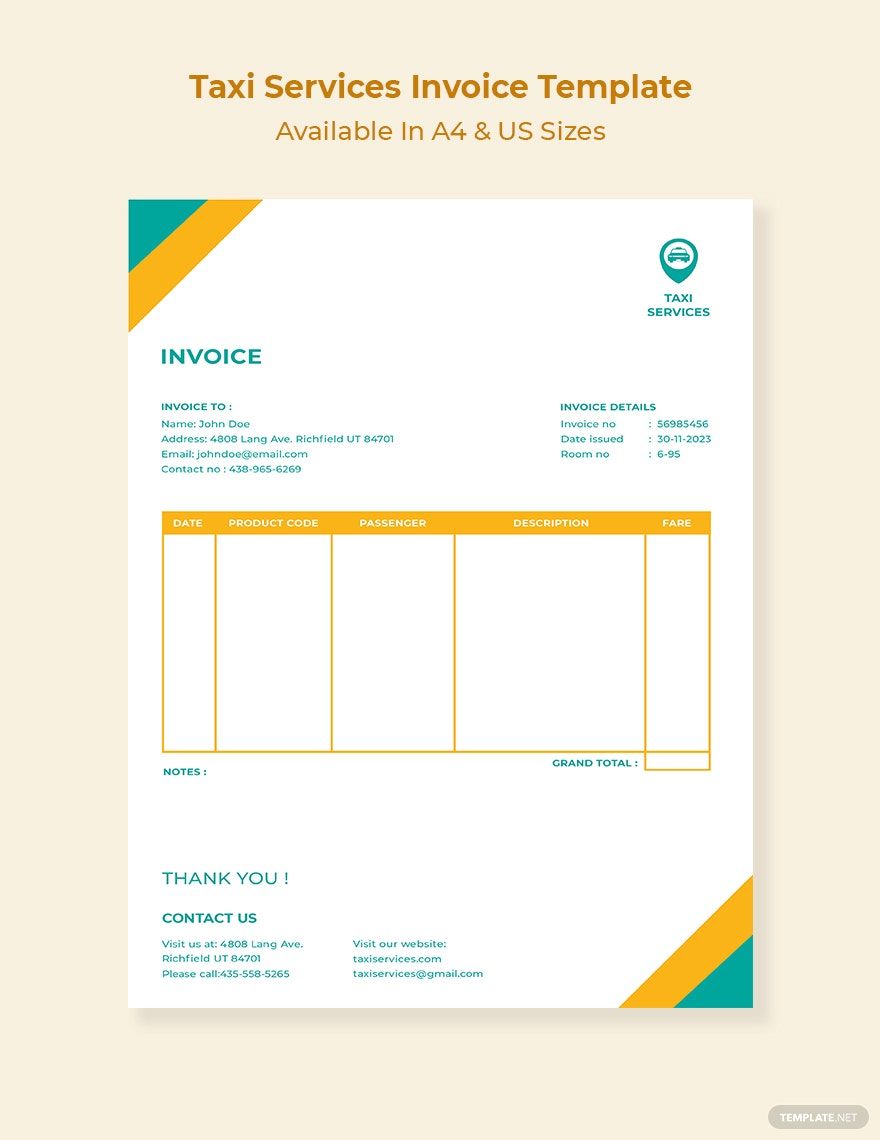

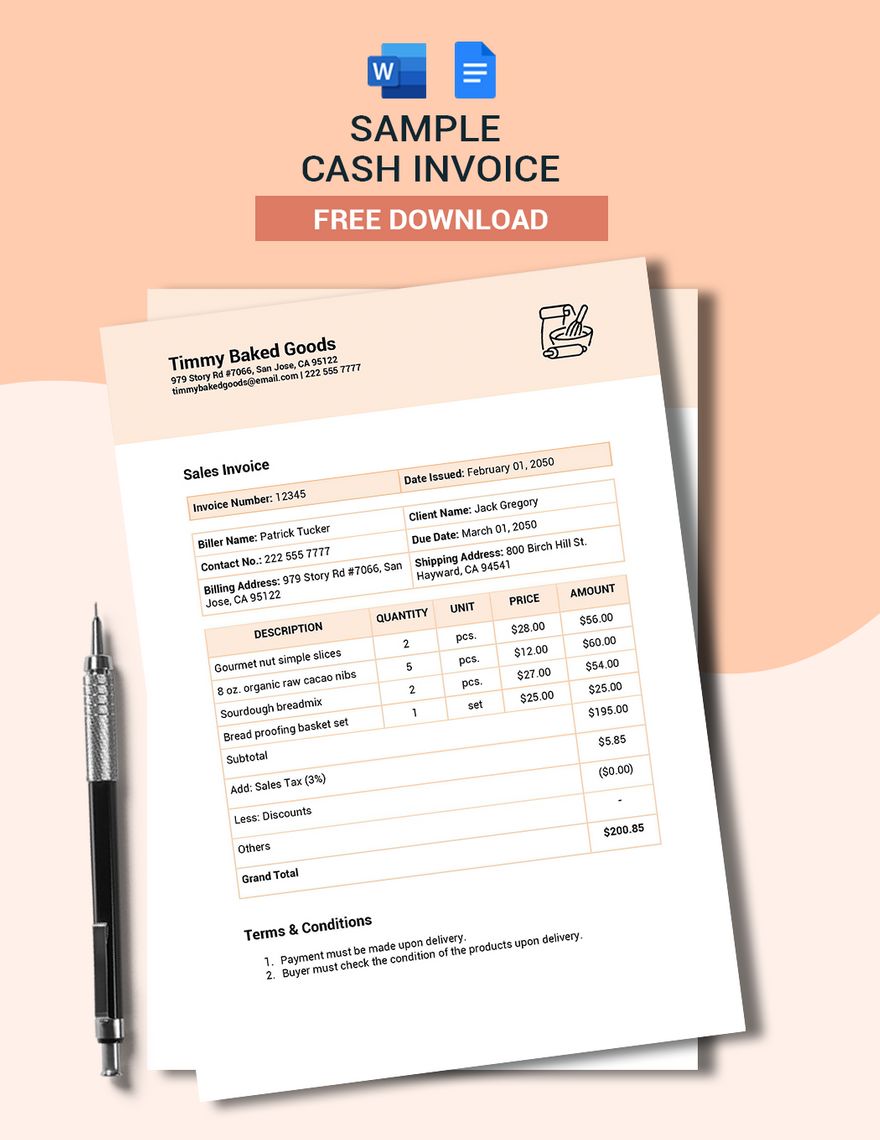

Defining an invoice is easy - it is a request for payment for a sale made, provided by the seller to the customer. It includes credits, discounts, taxes, prices, and total due. To help you make invoices of any kind so you can save plenty of time and effort on your side, we have simple invoices templates on our website. You do not have to take the pain to create these templates from scratch. Try them out now!