As much as we want clients to reach a settlement regarding the money they've owed, there will always be times when they are just unable to do so due to financial constraints. When this happens, a debt default letter is written and sent to inform the client of their failure. Here at Template.net Pro, we've got easily editable templates that you can download anywhere and anytime, and these can help you create a well-written debt and default letter. As long as you have a Google account, these premium templates are very easy to share and print. Get your hands on a template by simply buying a subscription.

What Is a Debts & Defaults Document?

In the world of finance, a debt default is a term used to define a client's failure to settle their payment within the given time. This document serves as a notice or memo to inform the client that their loan is overdue and that failure to settle it will lead to poor credit rating.

How to Make a Debts & Defaults Document in Google Docs

Maintain a professional and courteous image when giving reminding a client about loans that they have not yet paid. Refer to our list of guidelines below to learn how to create a well-written debt and default document using Google Docs.

1. Gather information and facts about the recipient

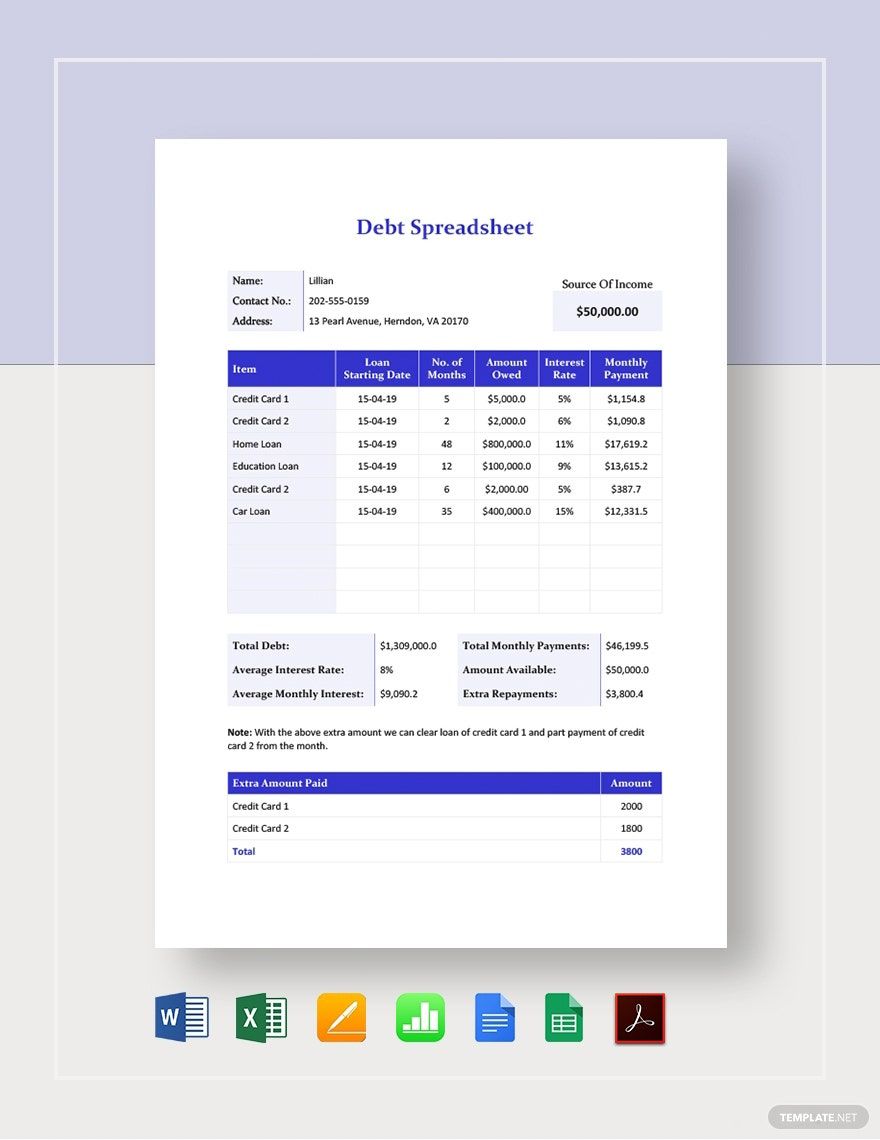

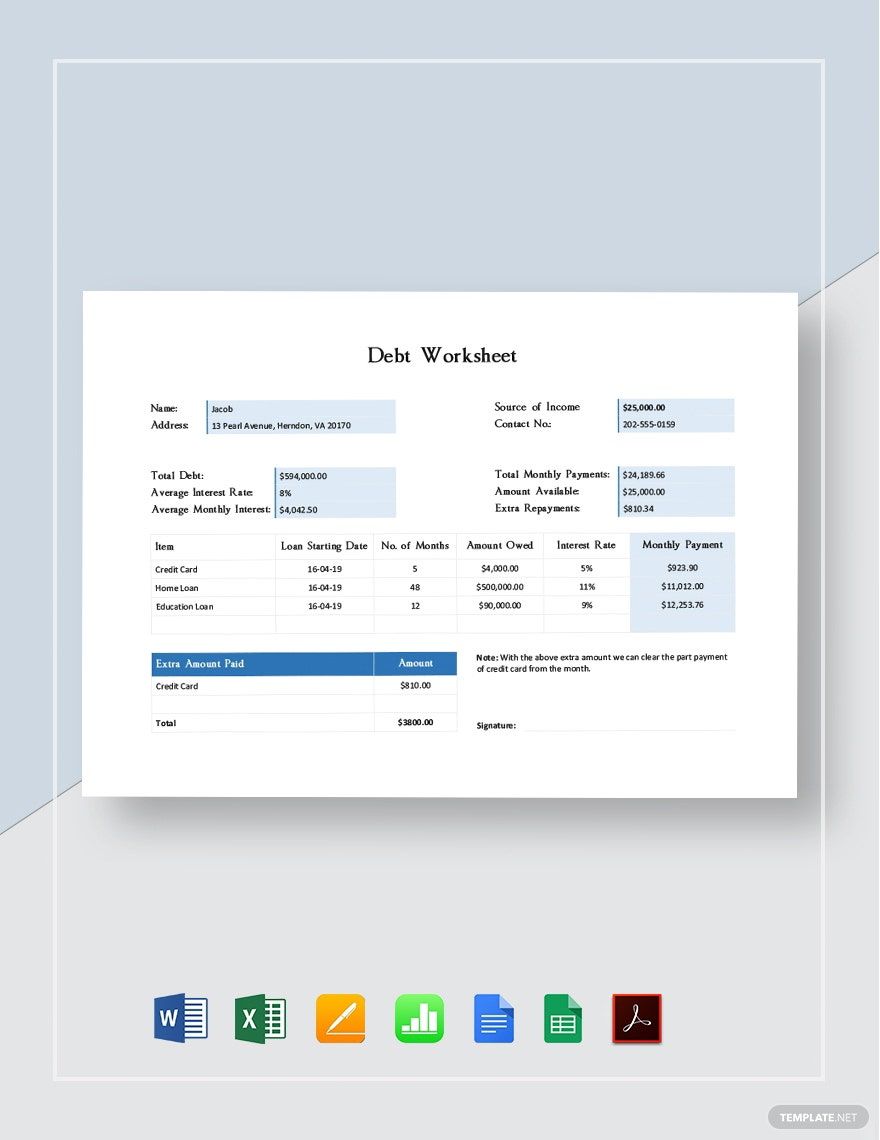

Gathering of data is usually done when sending a collection notice to a client, but it should also be done before sending them a debts and defaults letter. However, don't get information that you already have about the client, it should be relevant to the letter that you're sending. This information includes reasons as to why the client was not able to settle their payment as well as their personal income and credit status.

2. Write a draft of the letter, notice, or memo

If there's one good way to ensure that all the relevant details are included in a document, it's creating a draft of the message or content. This way, you can keep reviewing the content while writing it and there is a big enough room for making the necessary revisions. Another benefit of doing this is that it also minimizes the risk of committing errors in the content.

3. Create an account in Google

This is only applicable if you don't have a Google account yet, and using Google Docs does require you to have a Google account. If you don't have one, simply register for a free account. If you're running an organization, you may sign up for either a G Suite or a Cloud Identity Account, both of which are paid and are intended for corporate use.

4. Start writing your actual debts and defaults document

After creating an account, you can start writing your debts and defaults letter using Google Docs. Simply open your web browser (preferably Chrome) and then log in to your Google account. Afterward, look for Docs from the drop-down Apps icon on the upper-right corner of the window. From there, click on the plus sign on the lower-right corner to open a new document.

5. Proofread the content written in the document

Although the written draft does minimize the risk of committing errors to the content, you should make it a habit to proofread your work nonetheless. And while Google Docs already has a built-in grammar and spelling checker, it's sometimes flawed which means you will have to proofread the content yourself. Doing this is important since it ensures that your debts and defaults document is free from any error and can be considered valid.

6. Print and send the document

Lastly, print a copy of your debts and defaults document so you can send it to its corresponding recipient. However, if you plan to have your document printed someplace else, you can share it directly through Docs or Drive if the printing company has their own Google account. If not, you might have to save it in PDF and then attach it to your email.