Planning your business’s monthly budget is an innovative way to secure your small business. As Leslie Tayne quoted on Life and Debt, ‘’Budgeting has only one rule: Do not go overboard.’’ Since business budgeting helps you plan your expense in an orderly manner, do not go over budget by downloading this Business Budget Template in Microsoft Word. We made business budget planning a lot easier by this template as it is 100% customizable and easily editable in the said file format. Moreover, it has original suggestive content that you can utilize effectively. Make haste and click the download button now!

How to Make a Business Budget in Microsoft Word

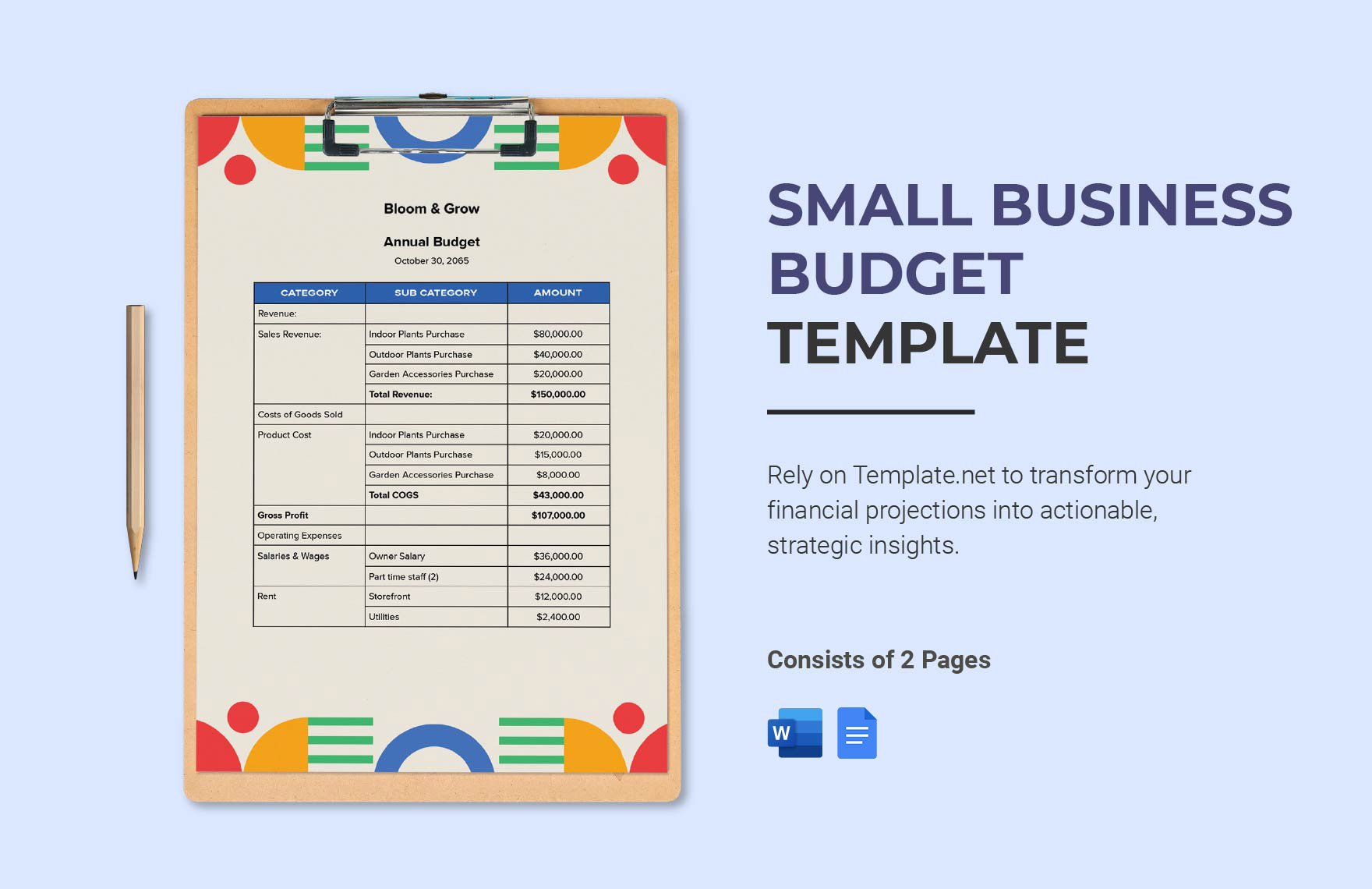

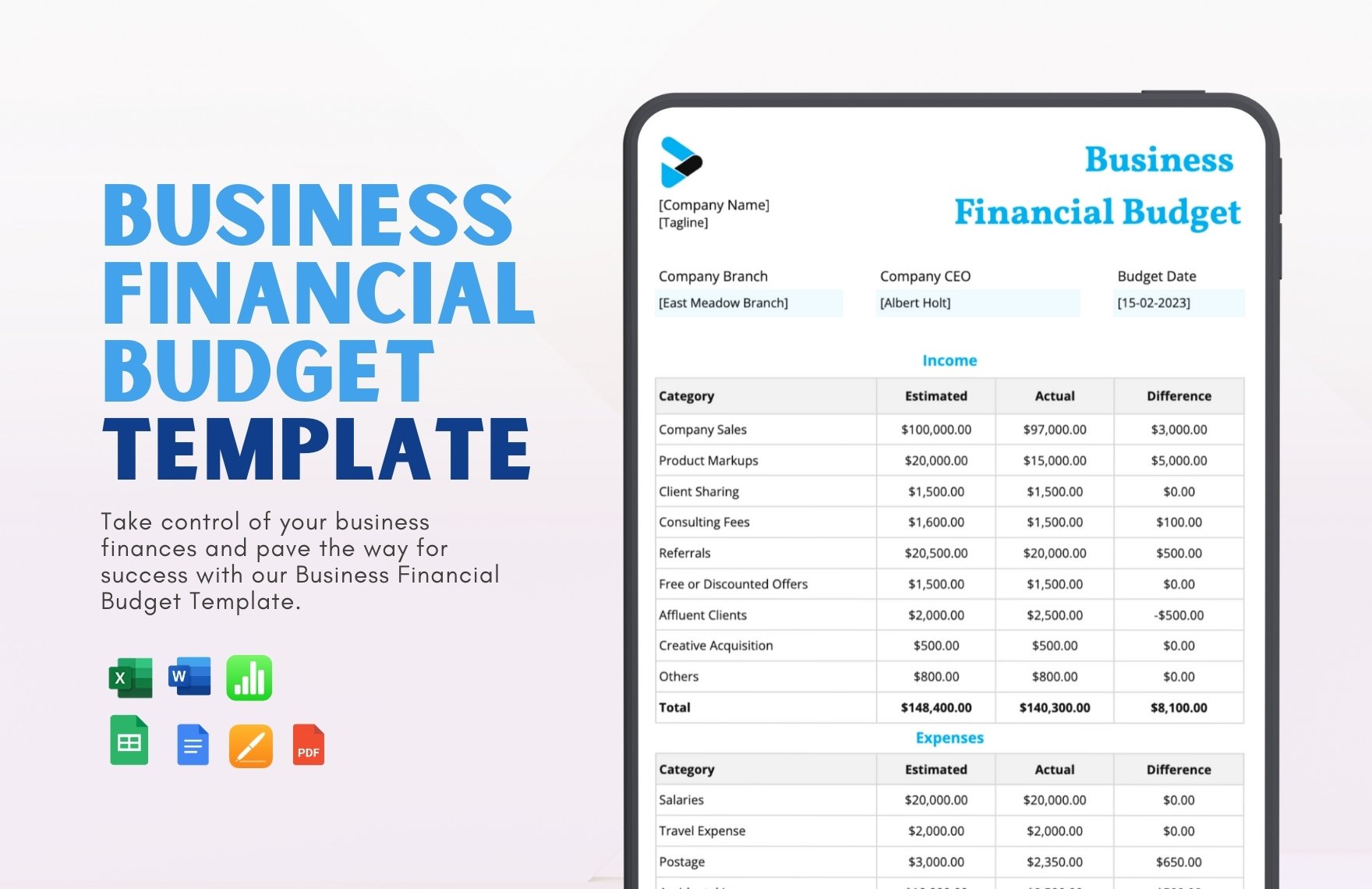

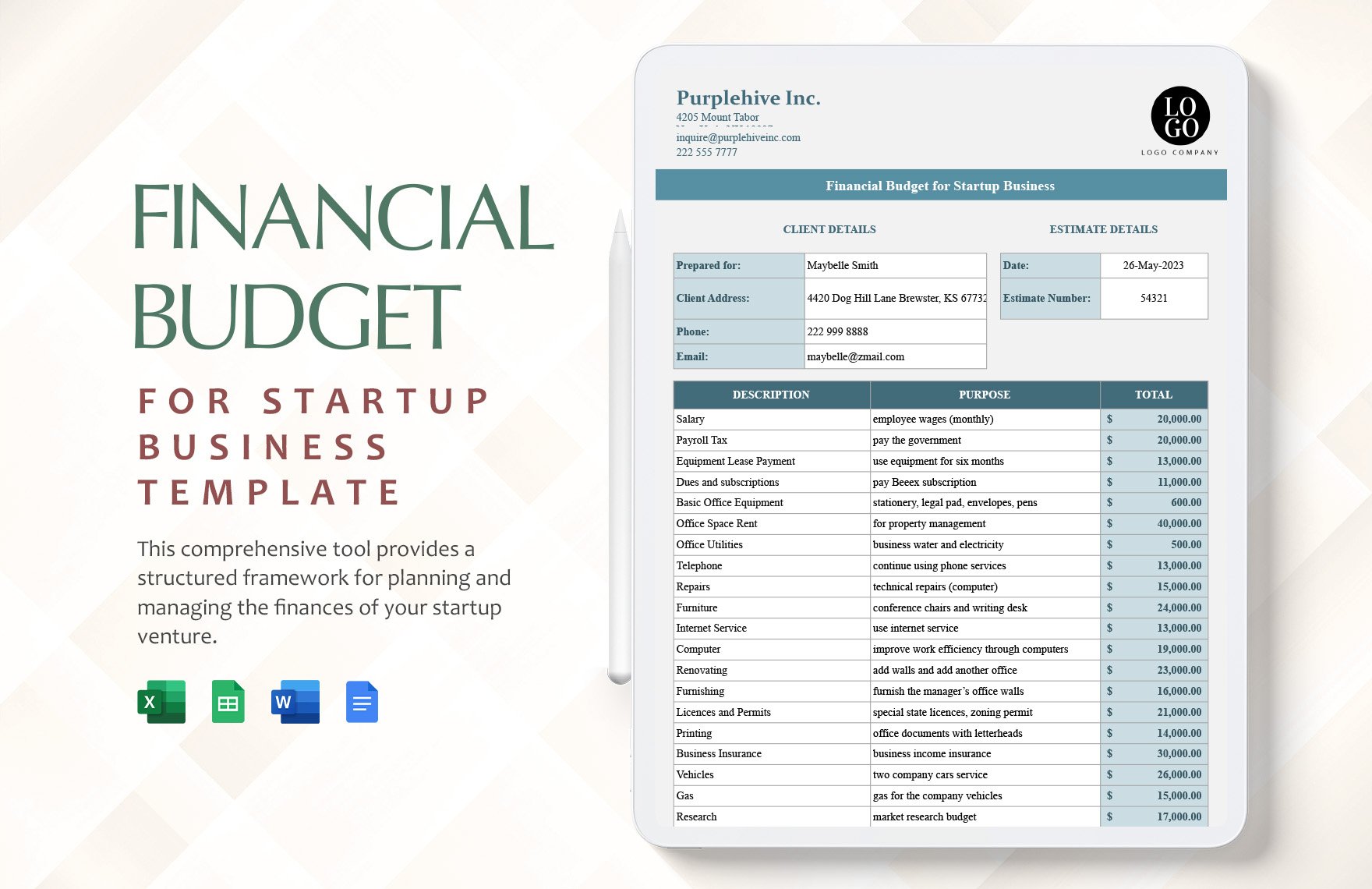

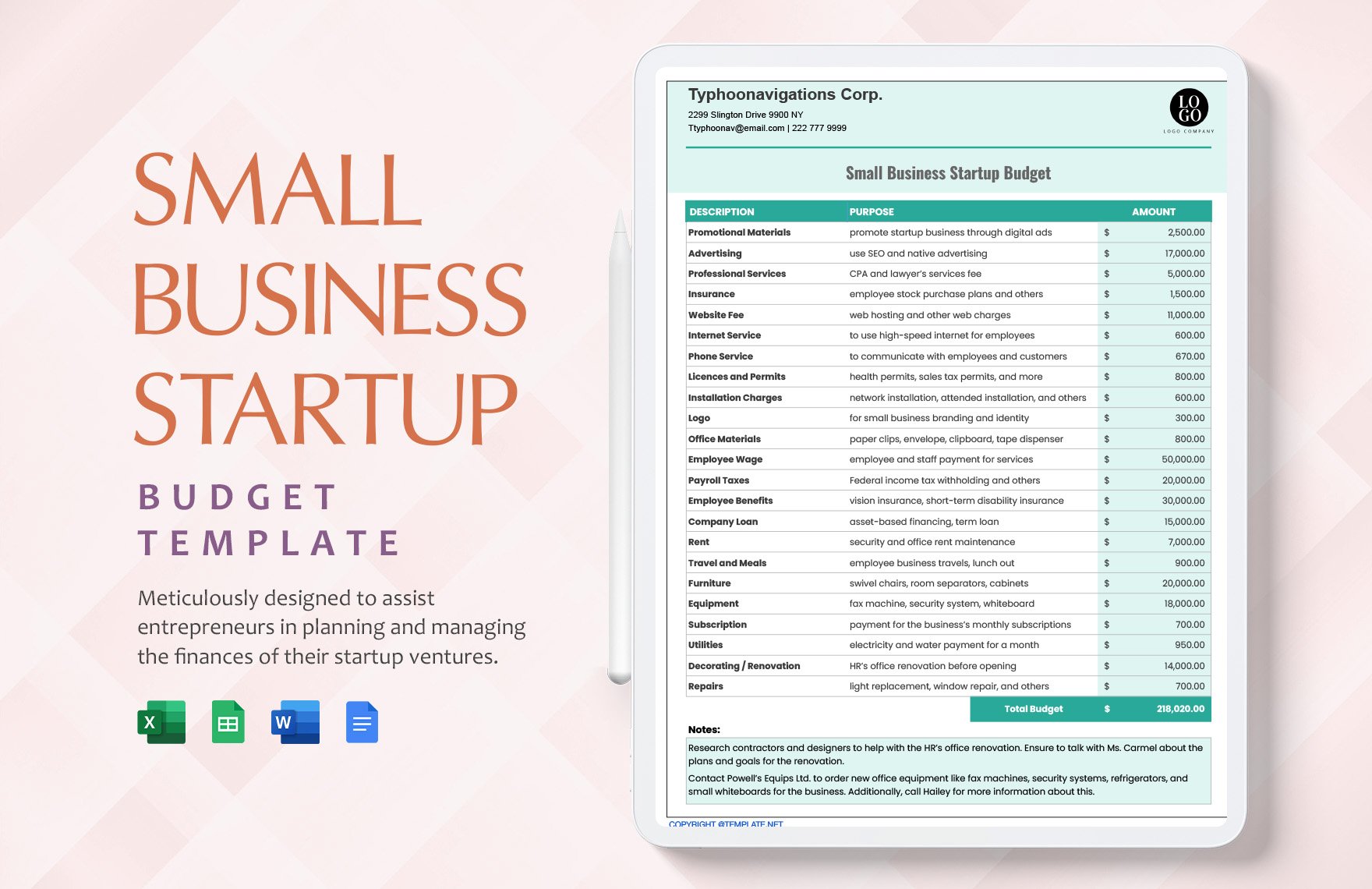

Every great business financial plan comes with a start-up budget. As finance is one of the essential factors for your business to run, you would need to plan it in a strategic way. But, according to a survey from Clutch, 61% of small businesses did not have an official documented budget. So, if it happens that you belong to this percentage, follow these simple tips that you can follow in making a printable budget.

1. Discuss with your Budgeting Team

Business is a team effort, and budget is not an exemption. It would be recommended that you would discuss this matter with your budgeting team. In that way, no one is left out and the perspective of everyone is heard and addressed.

2. Know your Numbers

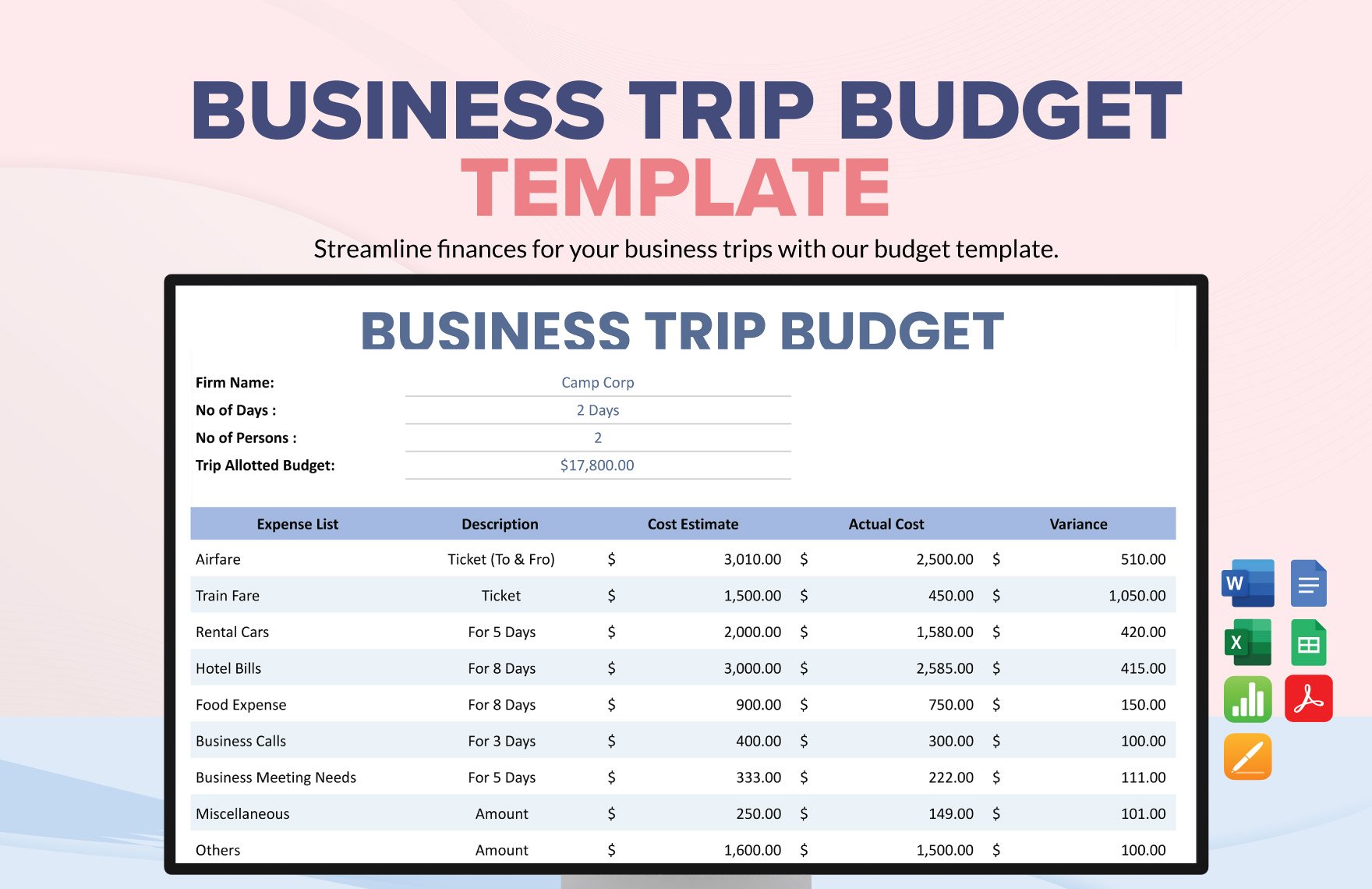

Let’s get this straight: you are making a business budget to manage your expense, so you need to make sure that you know the exact expenses that you need and the income that you make. Do this by consulting your bank statements and financial files. Remember that there are some expenses that are intermittent, but you can come up with a calculated and averaged amount by subtracting it to your income.

3. Stick to Reality

It would be hard for you if you would design your budget into a specific number. Rather, you should develop it according to past results and future predictions. Analyze your financial results before the current sales budget and point out factors that would be beneficial for you in making your recent budget.

4. Make your Budget Flexible

You might find your budget not enough in the process, but do not worry! It is okay for you to amend your budget, in fact, you would need to amend it several times. If you find something that would danger you to go overboard with your budget sheet, then look for others that would be under the budget and complement them.

5. Know Financial Relationships

Of course, you cannot disregard the financial relationships existed. With that, be careful as to what list of items that you would change. You might experience the domino effect, and instead of making your budget better, it might end up worst.