According to Bank L List USA, the United States has around 74 national banks in 2020, with JPMorgan Chase being the largest one. By national bank, this refers to those that have fully complied with the government’s policies. Here, we have an entire collection of Bank Organizational Chart Templates in Google Docs to help you visualize your bank’s structure. Without starting from scratch, you can create an impressive and informative diagram by taking advantage of high-quality and 100% customizable elements. Even if you’re simply updating an existing organizational chart, don’t hesitate to subscribe to our ready-made templates!

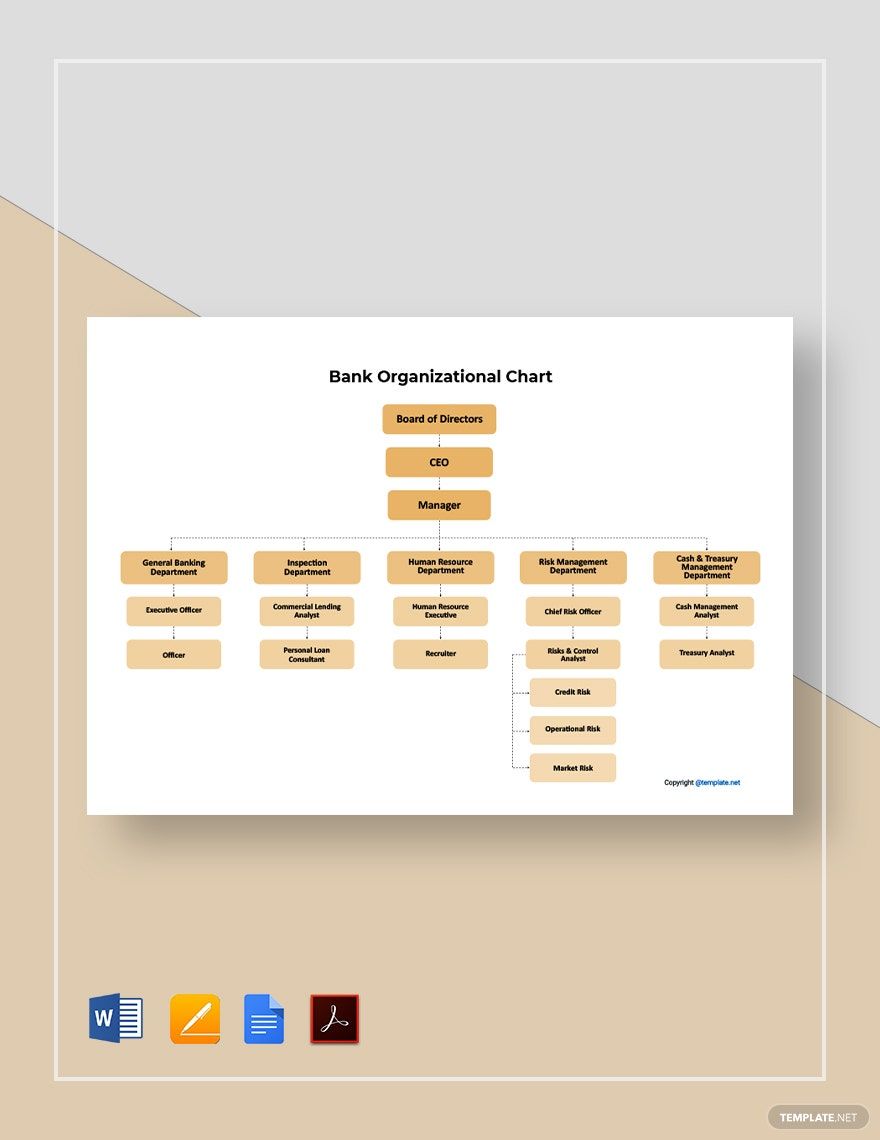

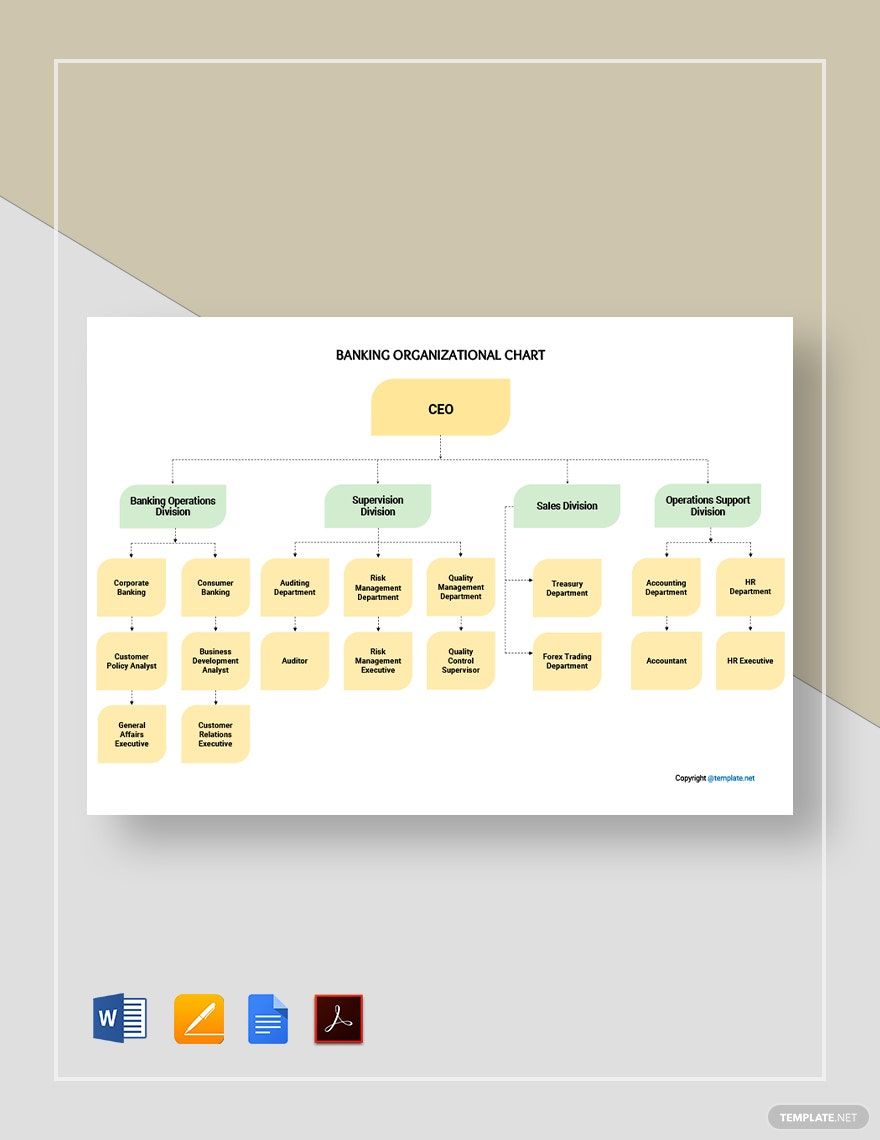

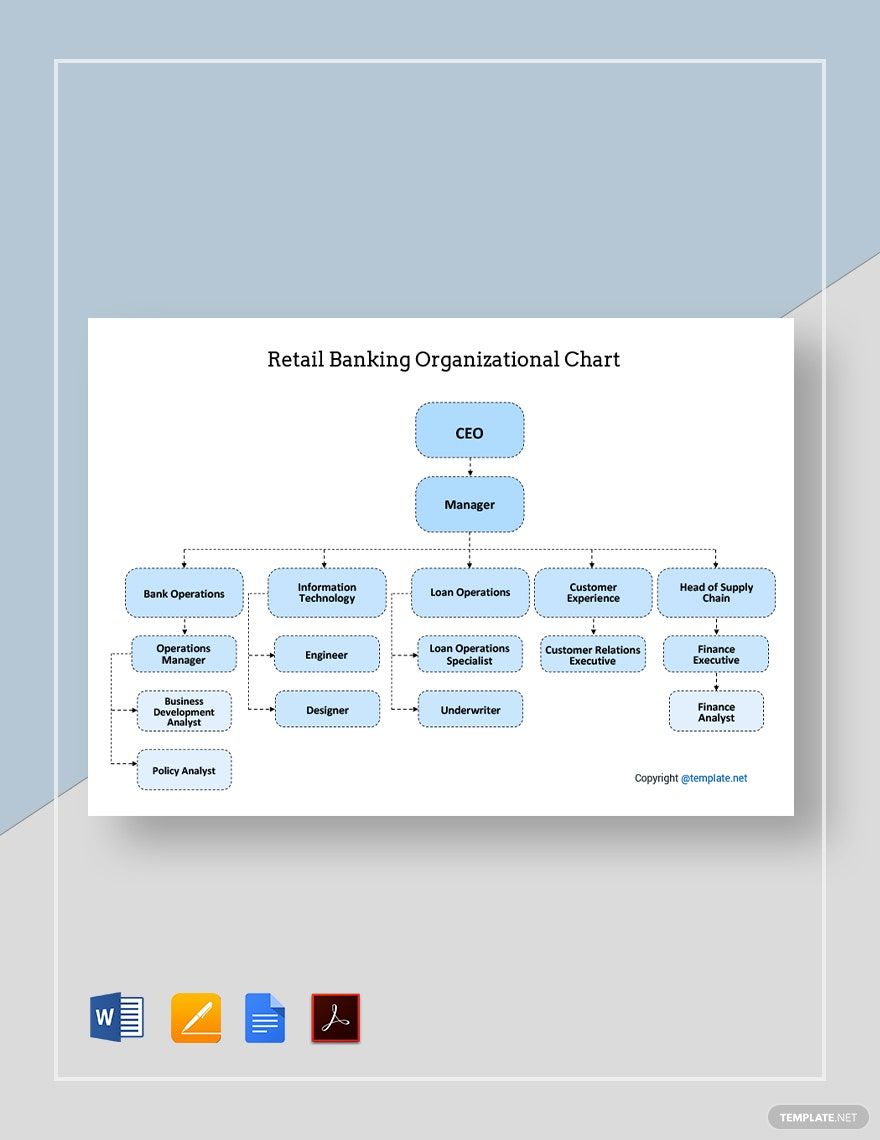

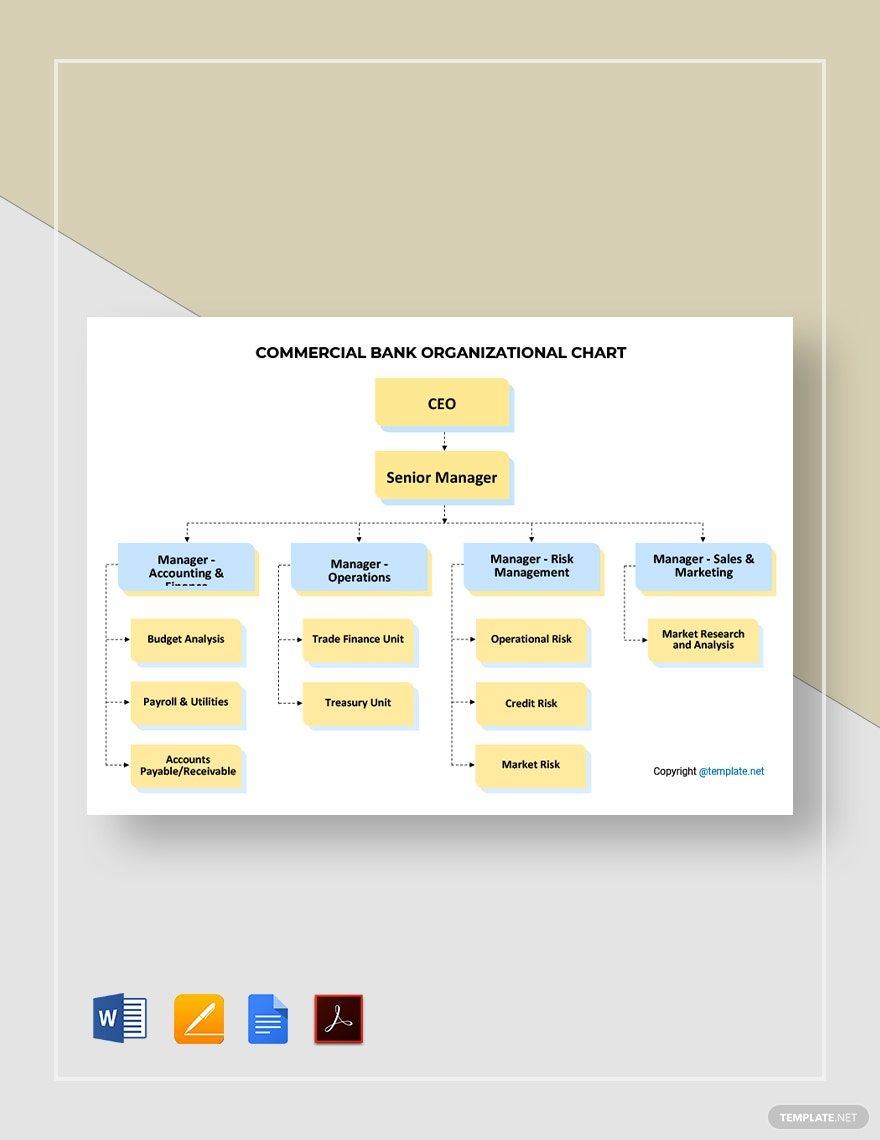

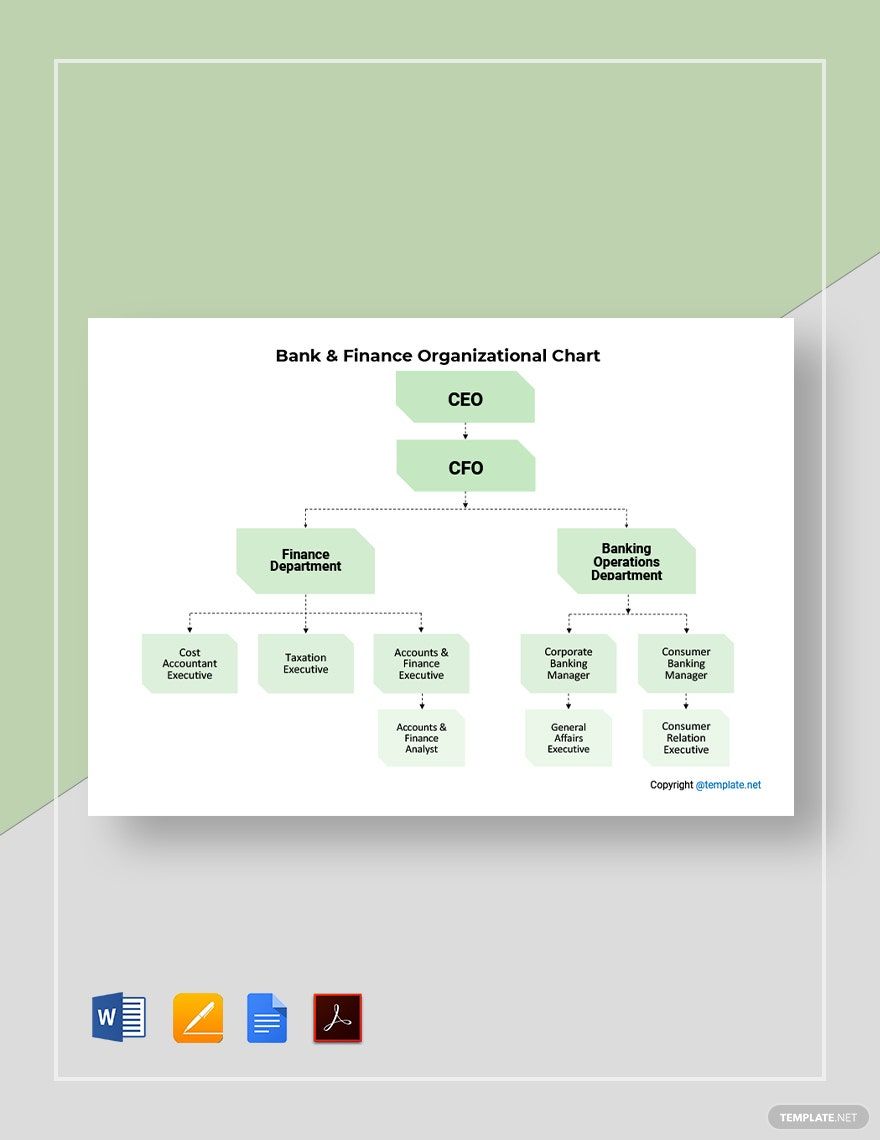

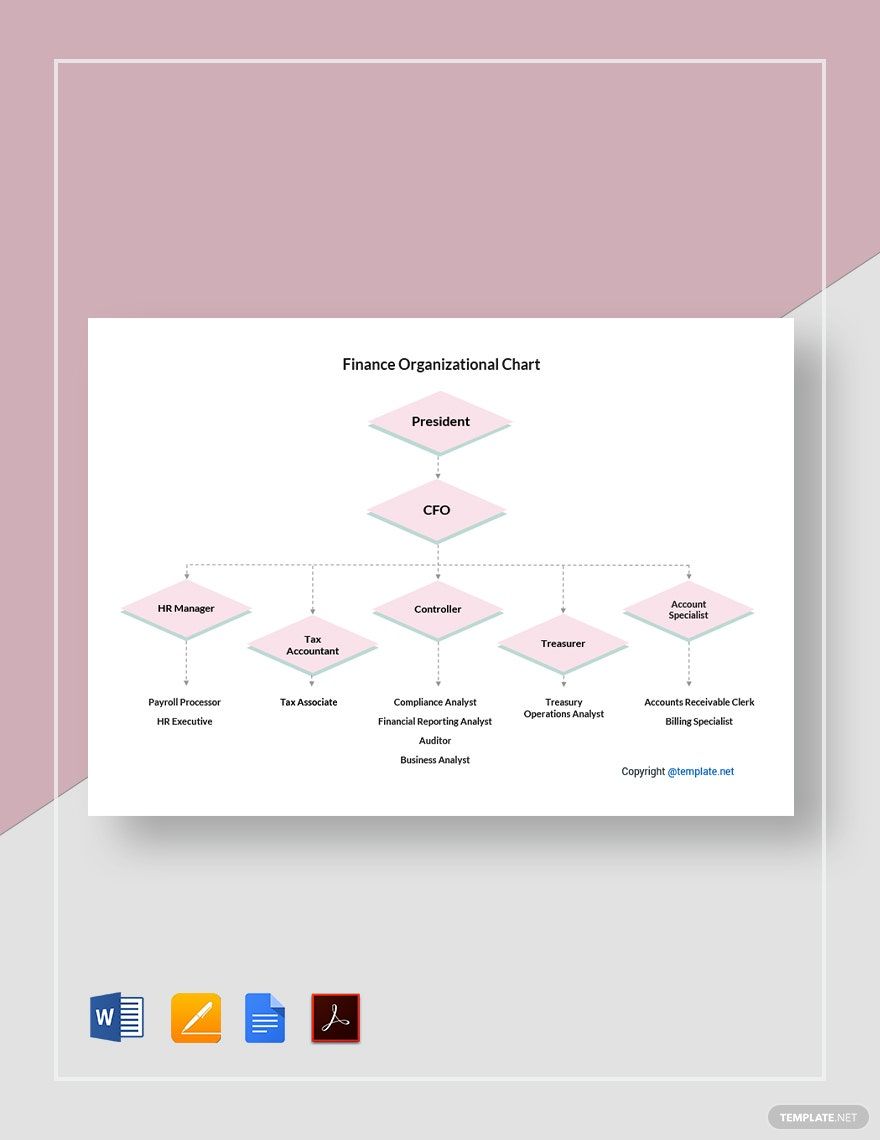

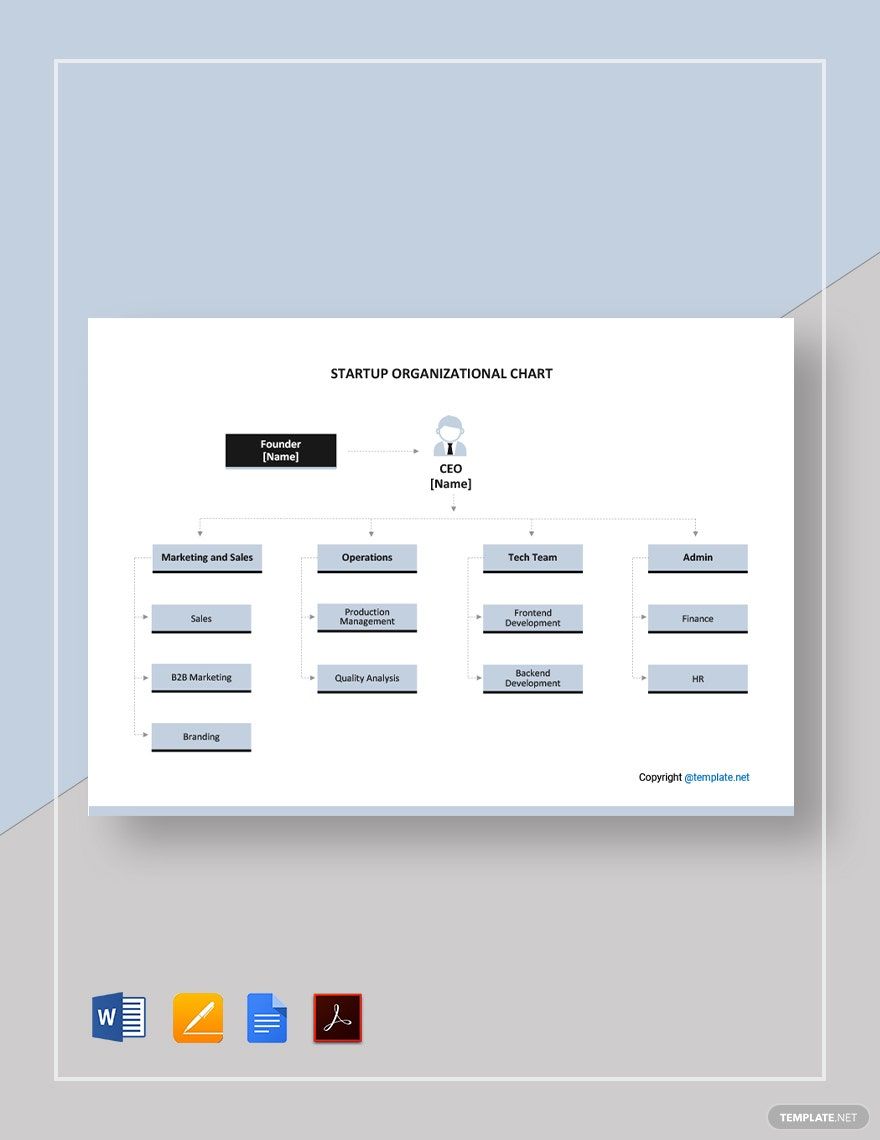

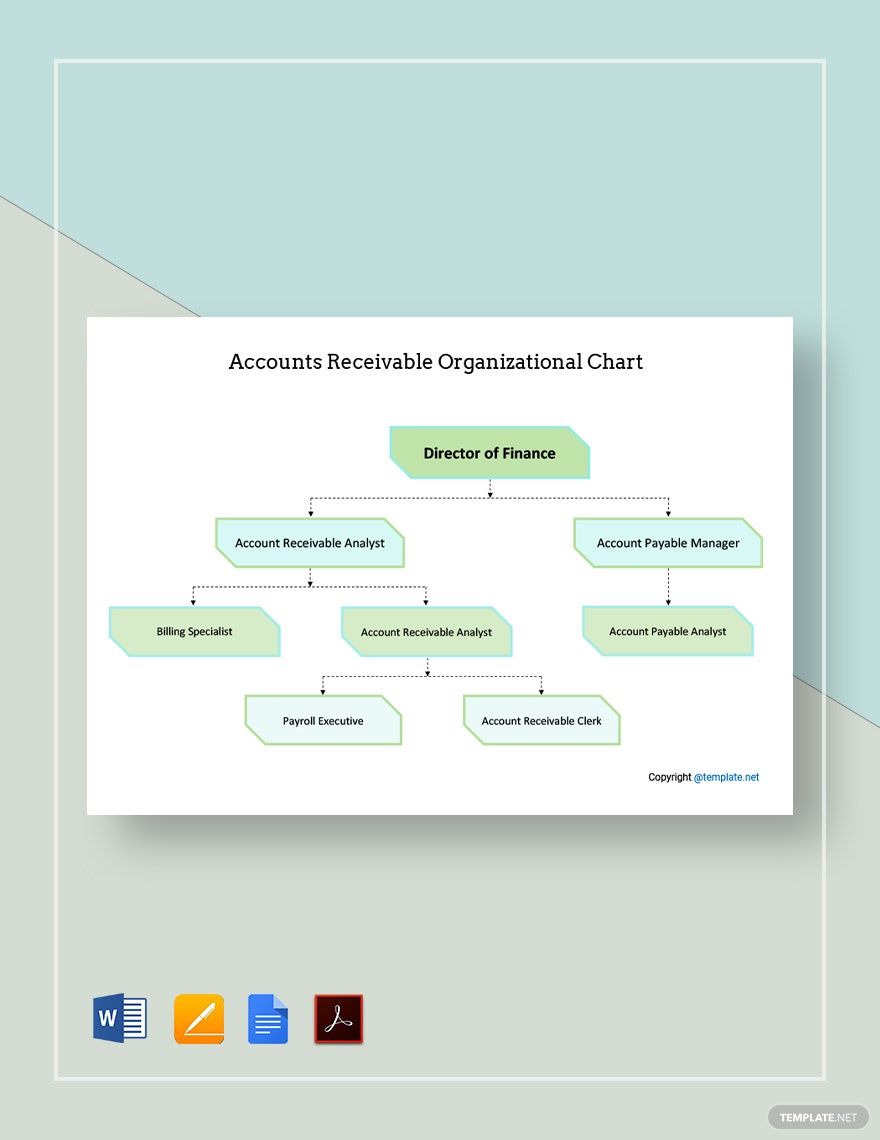

Bank Organizational Chart Template in Google Docs

Template.net Has a Wide Range of Bank Organizational Chart Templates That Include Different Departments Such as Brokerage and Loans. Use Template.net's Bank Organizational Chart Templates That Are Ready-Made for Banks and Financial Establishments. All Templates Are Fully Editable and Customizable in Google Docs. Download Free Diagram and Chart Examples, Input Your Content, and Print Right Away!

- Business Plans

- Receipts

- Contracts

- Manual Templates

- Note Taking

- Forms

- Recommendation Letters

- Resignation Letters

- Birthday

- Outline

- Quotation

- Charts

- Handbook

- Family Tree

- Surveys

- Workout Schedule

- Study Guide

- Ebooks

- Chore Charts

- Training Manual

- Research

- Screenplay

- Wedding

- Lesson Plan

- Brief

- Organizational Charts

- Syllabus

- School Calendar

- Attendance Sheet

- Business Cards

- Student

- Review

- White Paper

- Essay Plan

- Vouchers

- Timeline Charts

- Reference

- Estimate Sheet

- Mind Map

- Cover Letters

- Interview

- Posters

- Report Cards

- Fax Covers

- Meeting Minutes

- Roadmaps

- Cookbook

- Curriculm Lesson Plan

- Bibiliography

- Rental Agreement

- Legal Templates

- Party

- Pleading Paper

- Pay Stub

- Classroom Seating Charts

- Sub Plan

- IT and Software ID Card

- Event Proposal

- Likert Scale

- Doctor Note

- Labels

- SOP

- Comparison Charts

- Project Reports

- Daily Schedule

- Weekly Calendar

- Customer Persona

- Medical

- Coupons

- Resumes

- Invoices

- Christmas

- List

- Executive Summary

- Marketing

- Budget

- Meal Plan

- Friendly Letters

- Itinerary

- Reference Letters

- Church

- Letters of intent

- Reading logs

- Assignment agreement

- Mothers day card

- Retrospective

- Simple loan agreement

- Rent Receipts

- One page business plan

- Weekly Reports

- Offer letters

- Prescription

- One page proposal

- Case brief

- Roster

- Log Sheets

- Music

- Schedule cleaning

- Printable survey

- Internship report

- Fundraising

- Research proposal

- Freelancer agreement

- Delivery note

- Madeline hunter lesson plan

- Training

- Social media calendar

- Catalogs

- Grant proposal

- Affidavit

- Lean business plan

- Schedule hourly

- Mon disclosure agreement

- Bill of lading

- Sitemap

- Campaign

- Education

- Cash Receipts

- Introduction letter

- It and software profile

- Business case

- Annual Reports

- Personal letter

- Calendar Google Docs

How to Structure a Bank Organizational Chart in Google Docs

According to Hyperfish, both large and small business entities can benefit from organizational charts. Indeed, these basic diagrams have proven themselves worthy even in the world of banking. If you’re looking for guidelines to help you make an organizational chart for your bank, then look no further. Check out the list below, it’ll provide you with everything you need.

1. Understand the Bank’s Structure

Understanding the bank’s organizational structure is a must when creating an organizational chart. Why? It’s where the chart is based on. A standard organizational chart is basically an illustration of the structure. This will provide you with details about the hierarchies and different departments of the bank.

2. Choose a Type that Best Represents Your Organization

This should come after understanding the structure, and you probably already know why. By this time, you now have a clearer picture of the bank and its employees. And because organizational charts come in various types, you should refer to your understanding of the structure to choose a type that best represents it.

3. Specify Titles or Positions and Relationships

When adding the content of your company organizational chart, you shouldn’t just settle with writing the employee’s names. Make sure to also include their respective positions or full titles. And for the relationships, make it distinguishable by using solid lines (direct relationship) and broken lines (indirect relationship).

4. Keep Everything Together on One Page

As much as possible, keep your chart’s contents on one page only. If you feel like the bank’s structure is too big, then simply make the necessary adjustments to the layout. You can either rearrange the details or resize them, what’s important is that your organizational chart doesn’t go over one page.

5. Add Visual Enhancements to the Chart

Just because people see banks as formal entities, it doesn’t mean you should shy away from adding visuals to your presentation. One way to draw people’s attention towards your organizational chart is by adding simple colors and graphics. However, use colors sparingly to keep audiences focused on the chart’s important details.

Frequently Asked Questions

What is a bank organizational chart?

A bank organizational chart is a diagram that illustrates a bank’s organizational structure. Like other organizational charts, this one also lays out the bank’s employees and how their relationships work.

Why are organizational charts important?

- It helps in assigning responsibilities to employees.

- It improves coordination among employees.

- It enables you to see the company’s structure clearly

What are the types of organizational charts?

- Flat organizational chart.

- Hierarchy organizational chart.

- Matrix organizational chart.

What are the top 3 banks in the US according to assets?

The data below is taken from the Business Insider.

- JPMorgan Chase - $2.74 Trillion.

- Bank of America - $2.38 Trillion.

- Citigroup - $1.96 Trillion.

What are the different employees in banks?

- Bank tellers - These employees are responsible for providing direct service to customers.

- Loan officers - They educate and assist customers about matters pertaining to loans.

- Bank managers - They supervise reports and manage other bank employees.

- Bookkeepers - They are responsible for auditing the bank’s financial records.

- Customer service representatives - These employees assist customers in creating, modifying, and closing bank accounts.