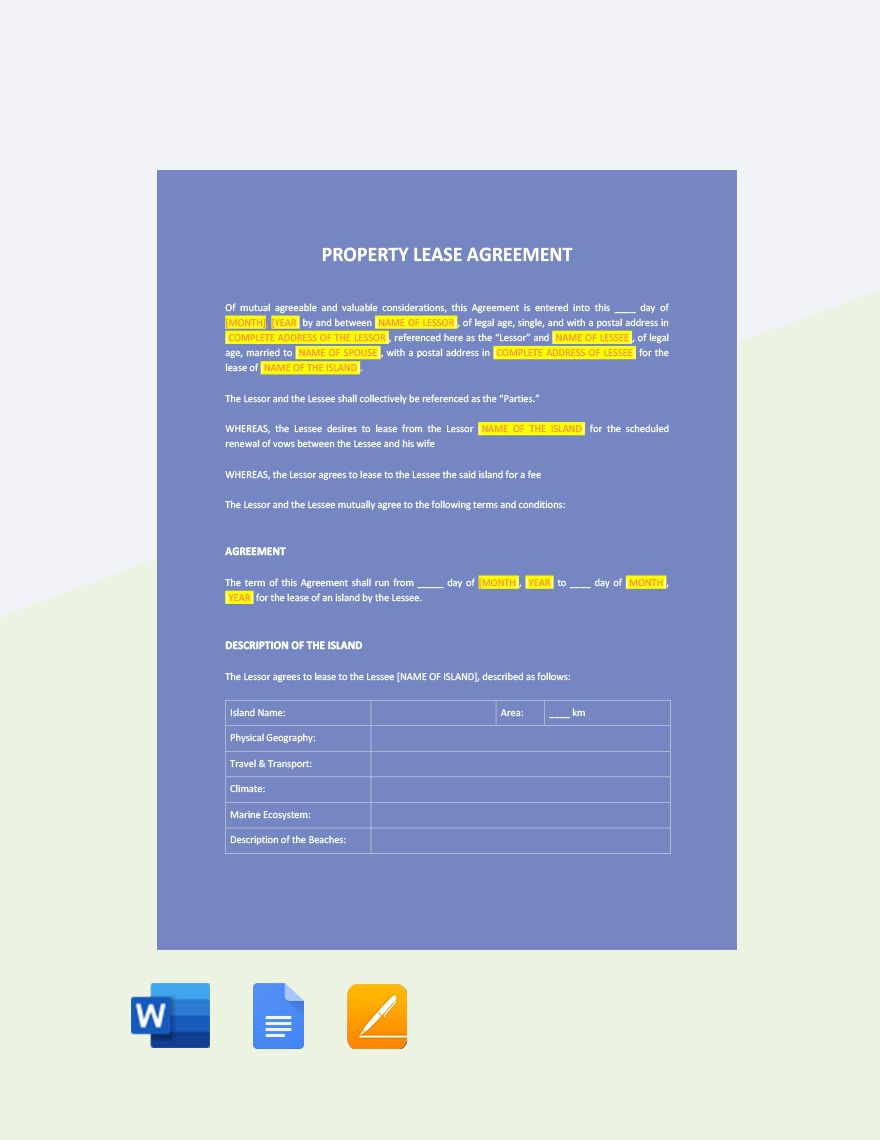

A lot of people nowadays are more materialistic than they should be. Even in intimate or business relationships, they want to feel safe about their material properties. With written property agreements, this document will help them secure their properties and equipment even after things go sour between them and the other party. Are you planning on writing one for a client? Save yourself some slack by using any of our Property Agreement Templates. These easily editable templates are guaranteed to help you make a well-written agreement in minutes. Don’t settle for less, subscribe to our agreement templates today!

FREE Property Agreement Templates

"Divorce Proceedings are Tricky. Organize Your Divorce Settlement With Template.net’s Free Printable Property Agreements, Simple Real Estate Settlements, and Property Lease Management Documents. Find These and More Such as Employee Contracts and Sales Performance Templates at Template.net. At Template.net, We Make Your Life Easier With Customizable Documents. "