Ease and erase doubts regarding you or your product's capacity by using our fully customizable Guarantee Templates printable in A4 or US paper sizes. Choose from the best guarantee letter templates the web has to offer and download your chosen file anytime and anywhere. Easily edit text and content of the template using MS Word, Google Docs, and Apple Pages operating system applications. Download now!

How to Write a Guarantee Letter

Sometimes, companies or landlords ask their clients for guarantors because they want assurance that they get their payment. And if you happen to be the guarantor, you need to write a simple letter to assure them that you will pay if the client fails. And writing a guarantee letter doesn't have to stress you out. In actuality, this kind of letter isn't complicated to write. And to help you with that, check out the tips below.

1. Establish a Formal Tone

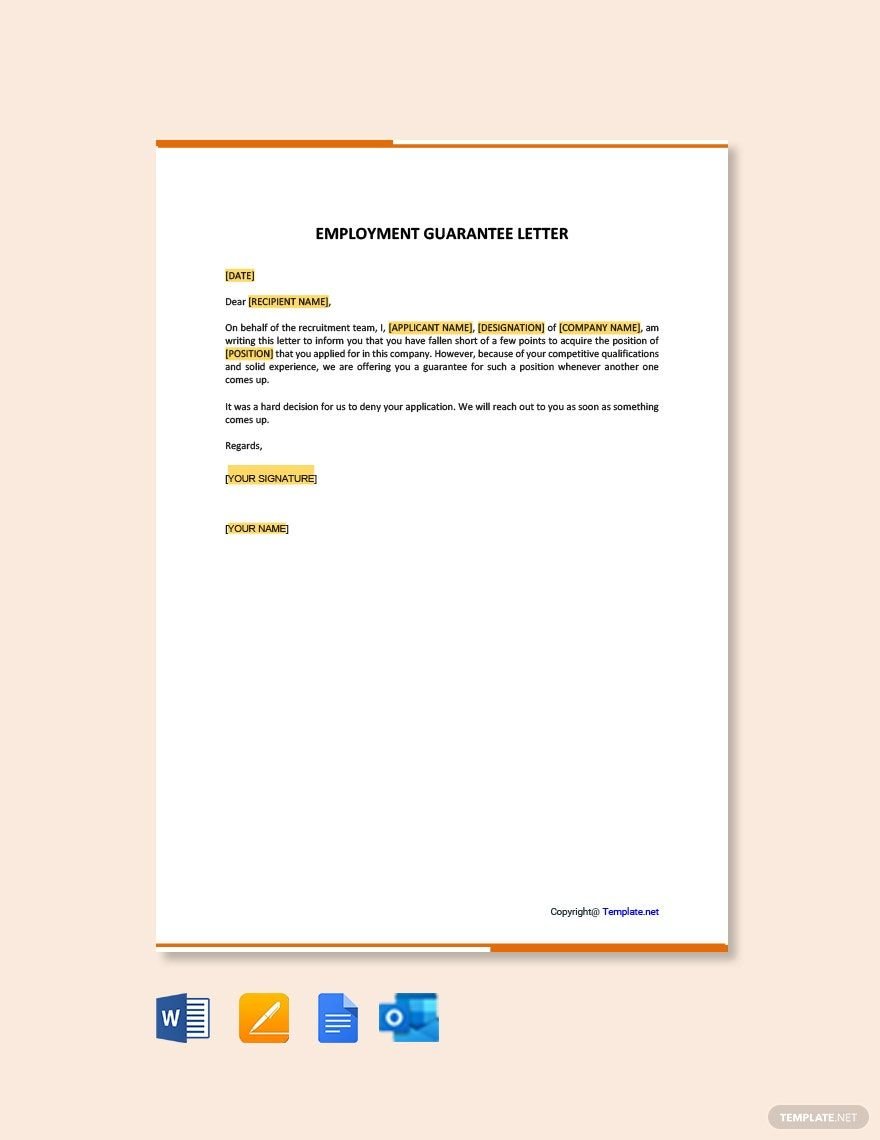

Whether you're a bank, a director, or anyone, you have to establish formality. And since you're writing to a business entity, you have to use a formal tone in your business letter. Formality can show that you are serious about your business. Don't write to the recipient as if you're speaking to a friend. It would help if you showed a formal boundary between the two of you.

2. Be Persuasive

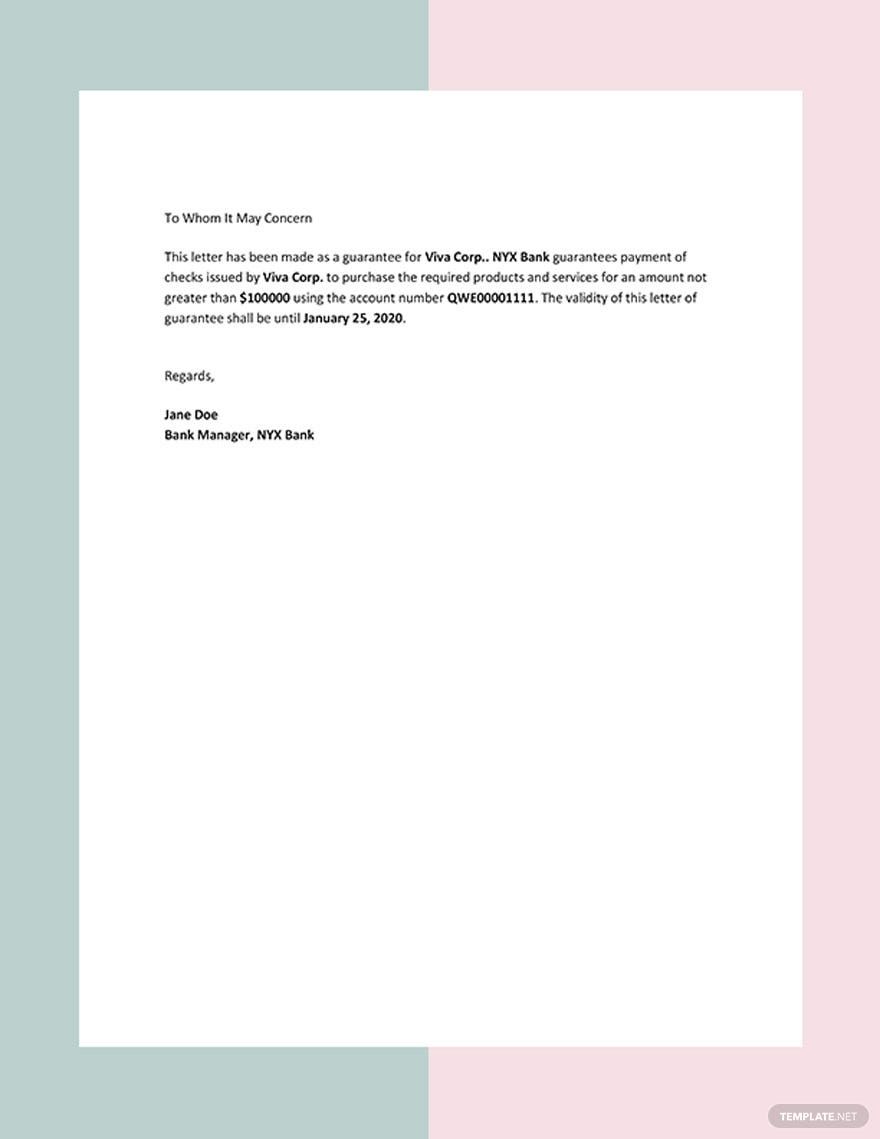

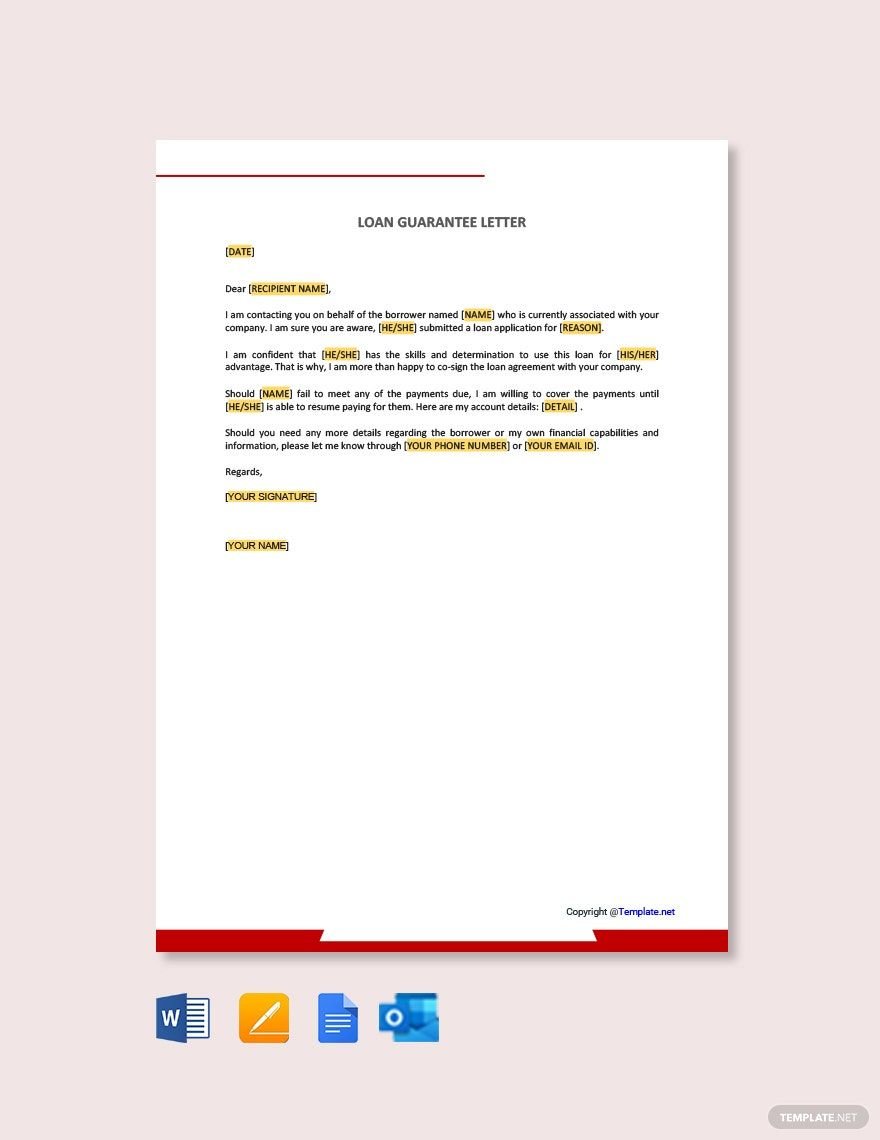

Since you're trying to convince the recipient that you will pay on behalf of the customer or client, you need to explain how and when on the formal letter. For example, you can say that if there is any problem with that the client causes, you will compensate for it. Another example is that you can say that you will pay the client's rent when he fails to. This way, you can persuade the recipient to take you as the guarantor.

3. Keep the Letter Concise

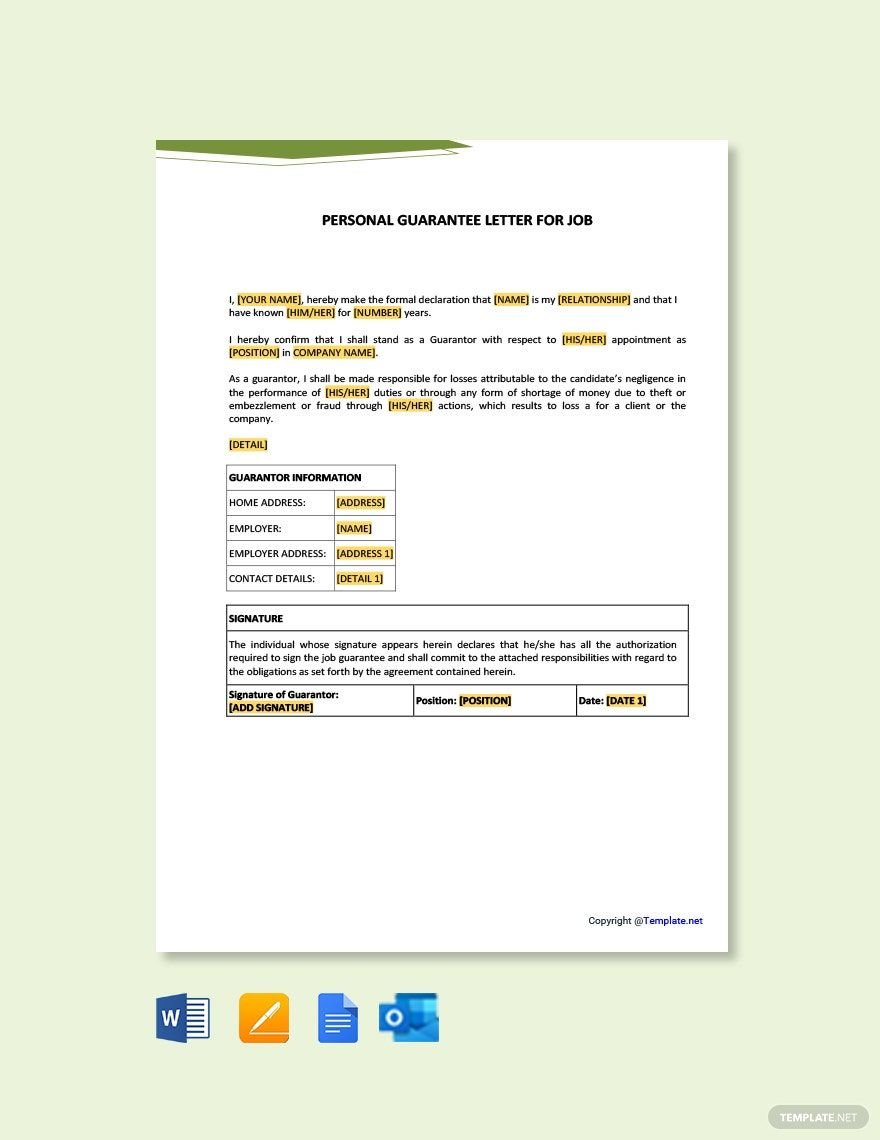

You don't have to write a long parental guarantee letter, personal guarantee letter, or any guarantee letter. All you need is to keep your printable letter's sentences concise, so it becomes more readable on the recipient's part.

4. Provide the Important Details

Your document must include all the essential information like your name, address, products or services covered by the guarantee, dates, and signature. These should be present to avoid any dispute.