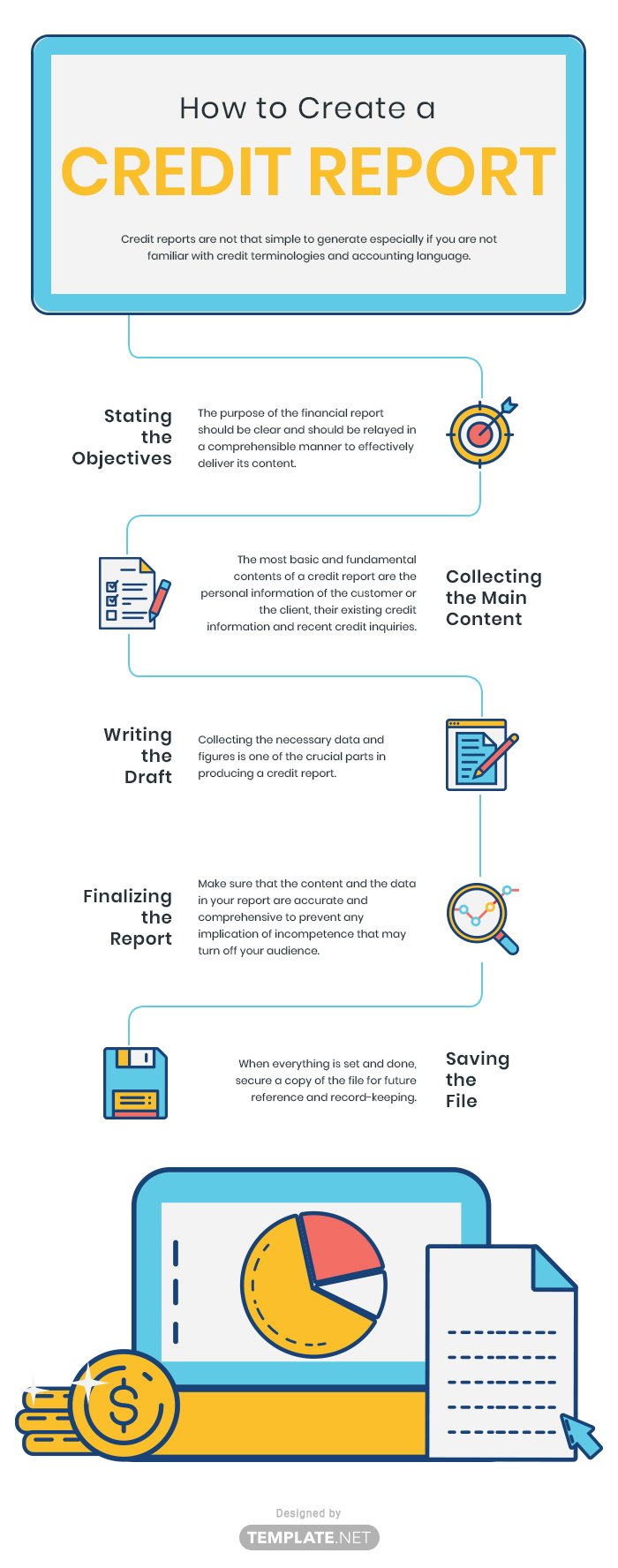

Credit reports are not that simple to generate especially if you are not familiar with credit terminologies and accounting language. It's better to do thorough research and/or consider hiring an accountant or a financial expert just to play it safe. The credit bureaus are basically the epitome of standards and quality in terms of producing credit report forms. But if your business or work required you to make one, here are some of the steps you need to follow to make a basic but concise credit report.

1. Stating the Objectives

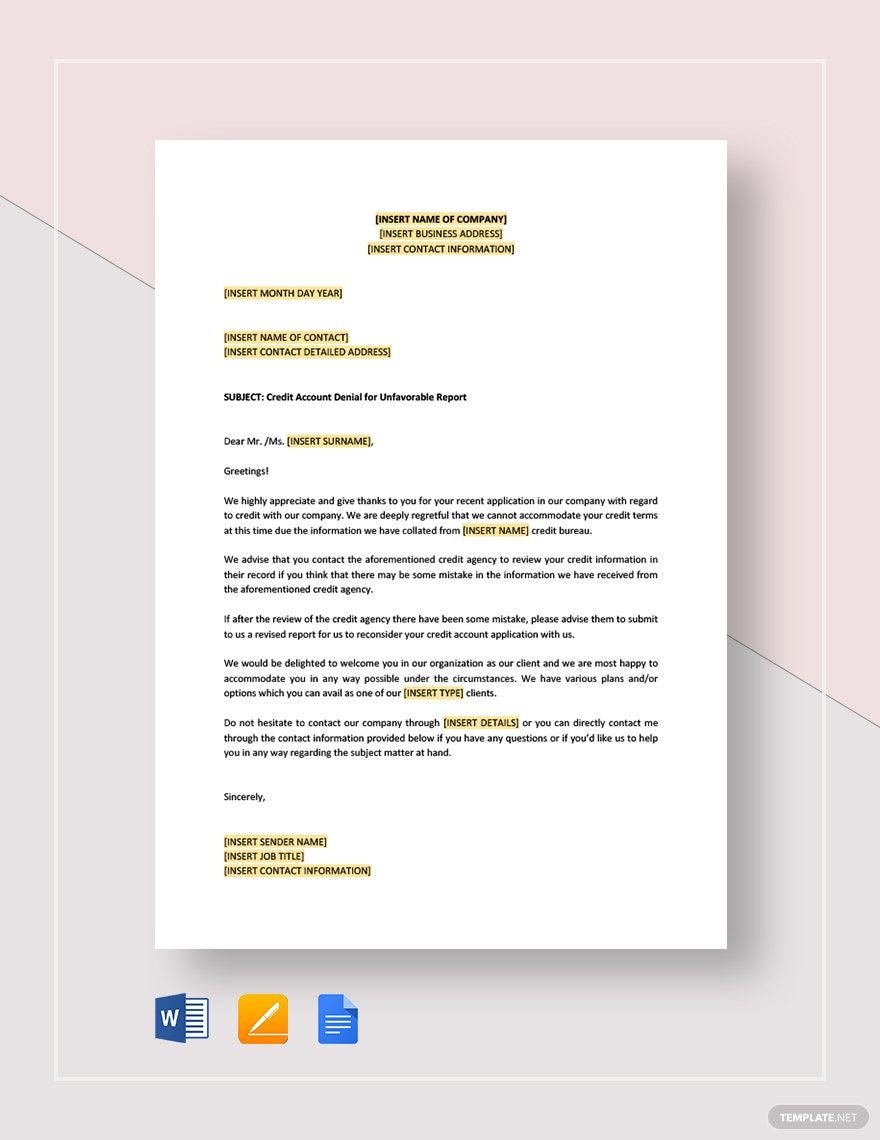

The purpose of the financial report should be clear and should be relayed in a comprehensible manner to effectively deliver its content. Since this report contains some personal and private matter, be sure to completely understand the requirements and the legal provisions that come with it to avoid conflicts and misinterpretations.

2. Collecting the Main Content

The most basic and fundamental contents of a credit report are the personal information of the customer or the client, their existing credit information, closed accounts, payment history, public records, and recent credit inquiries. Based on a research made by a reliable credit site, 35% of FICO score is determined through the payment background of an individual that includes their current payments made, late payments, how much they owed, and others.

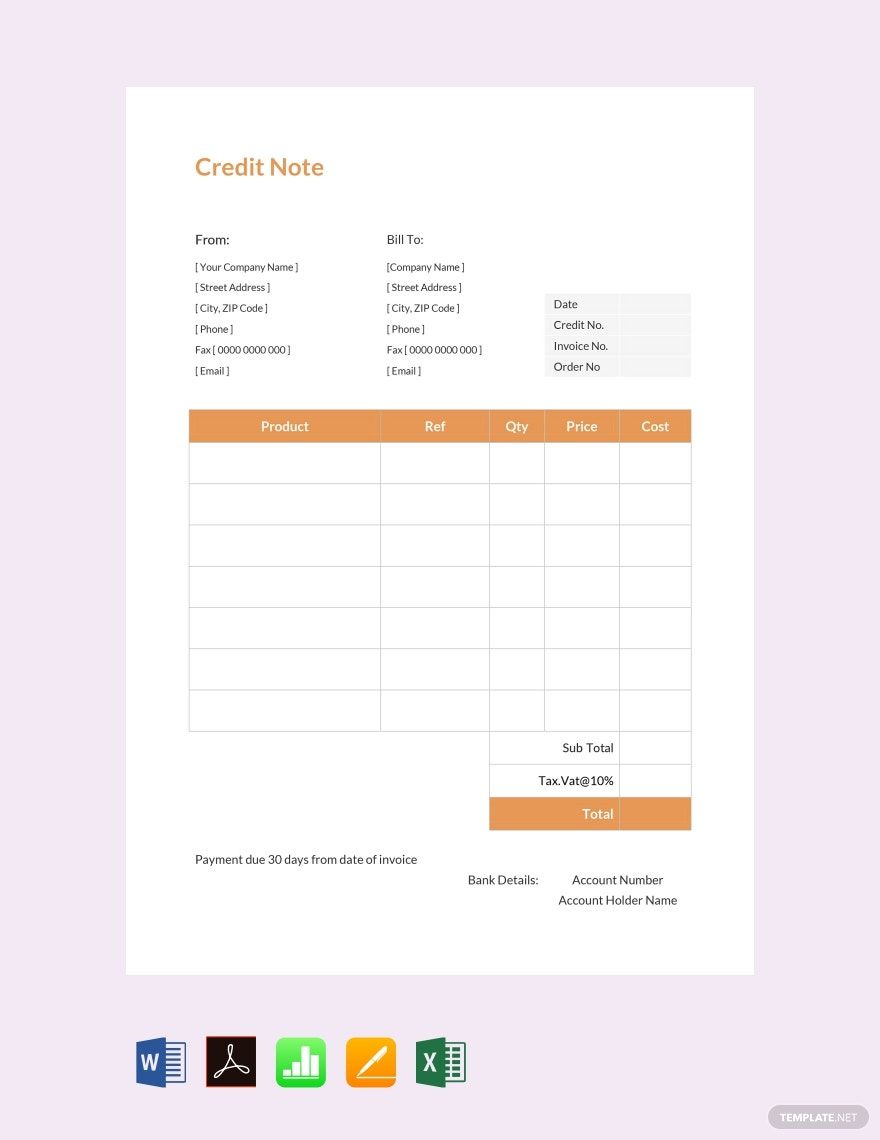

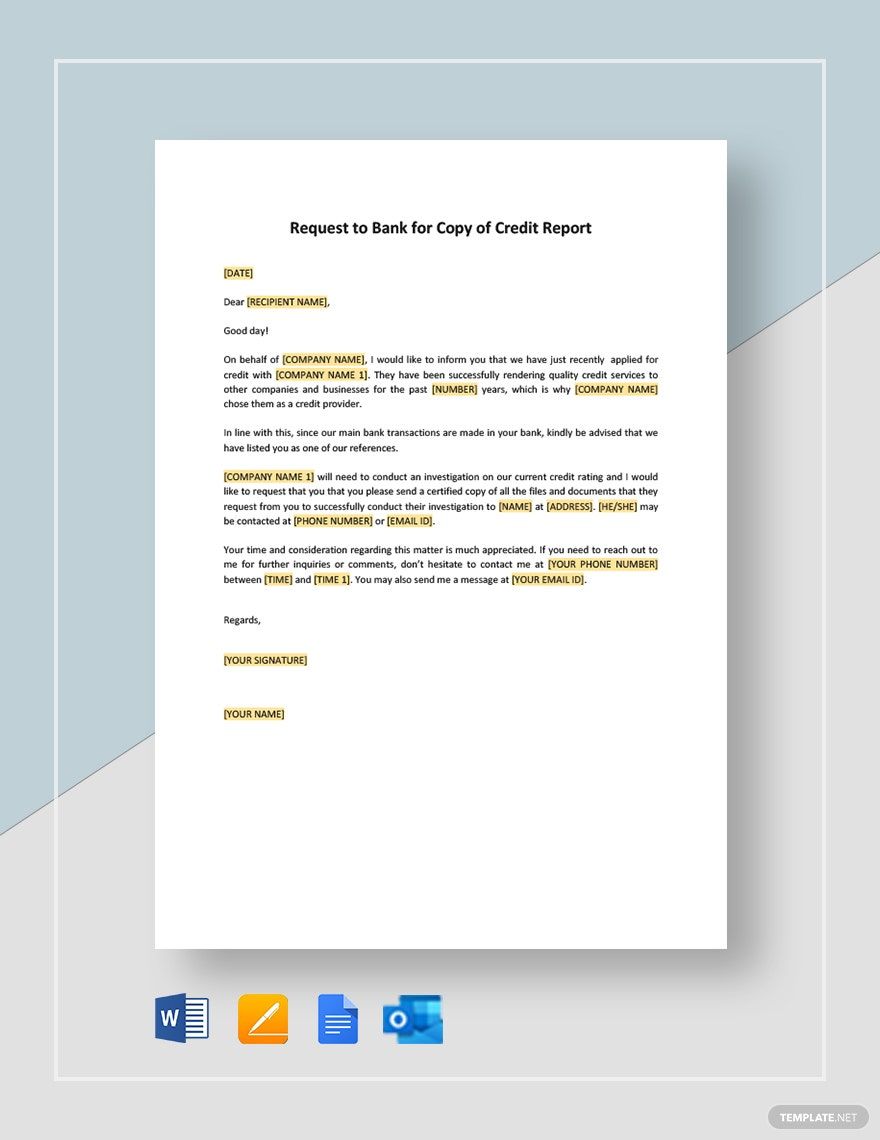

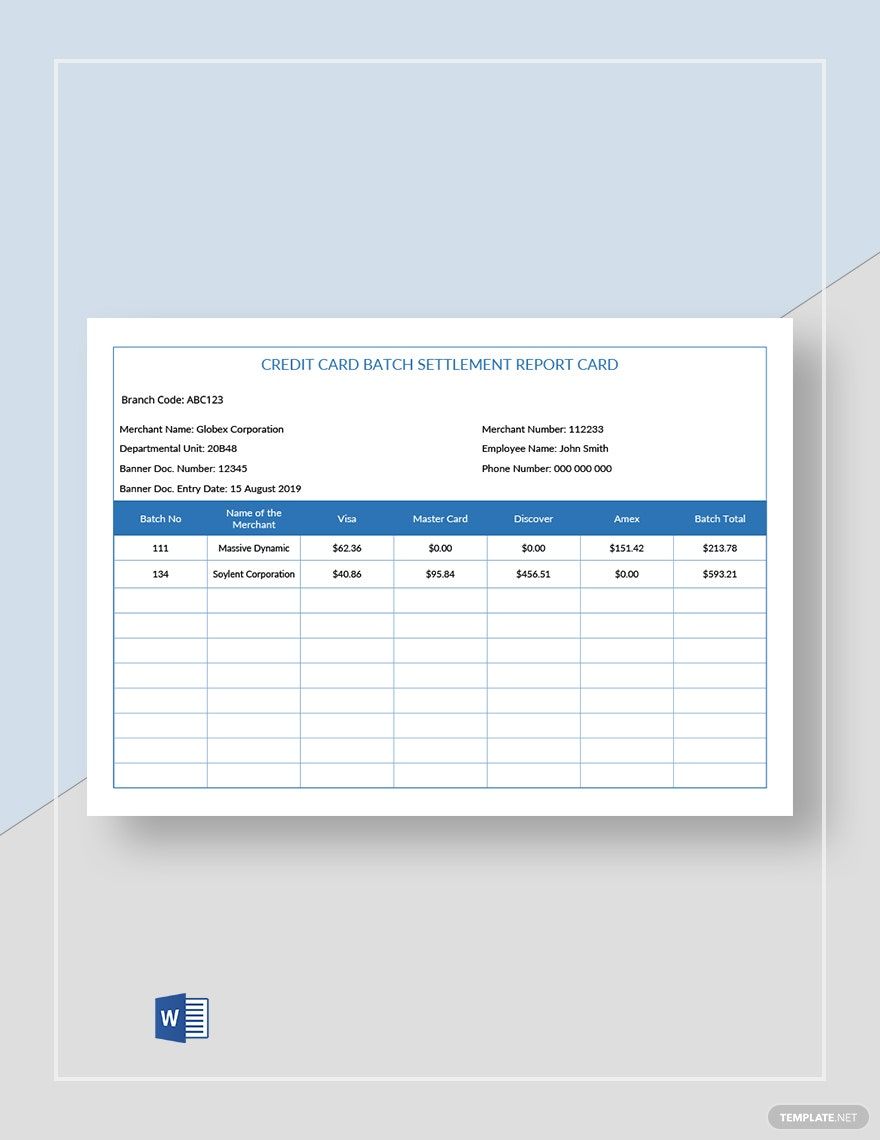

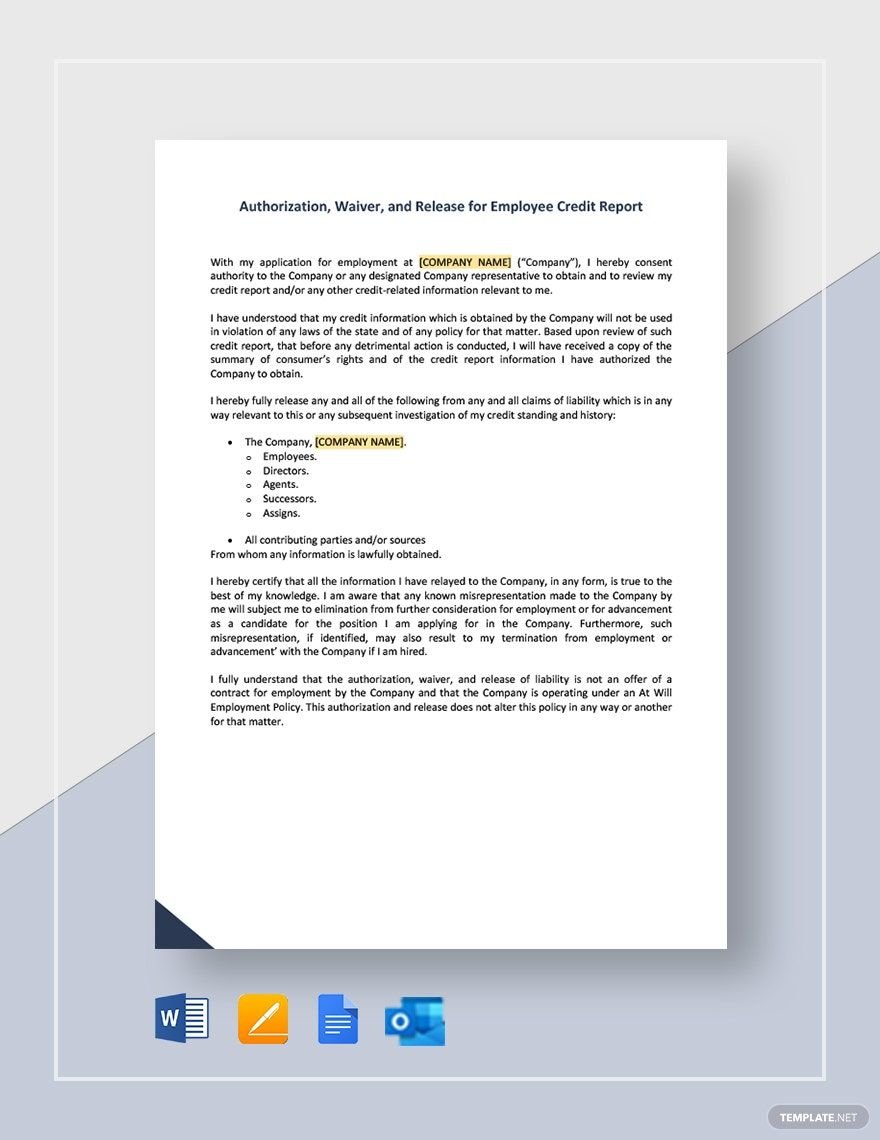

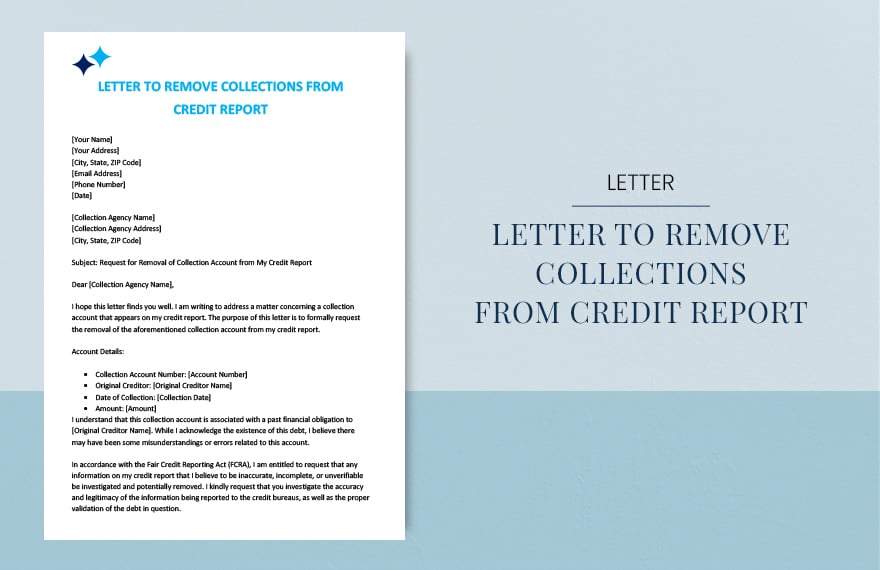

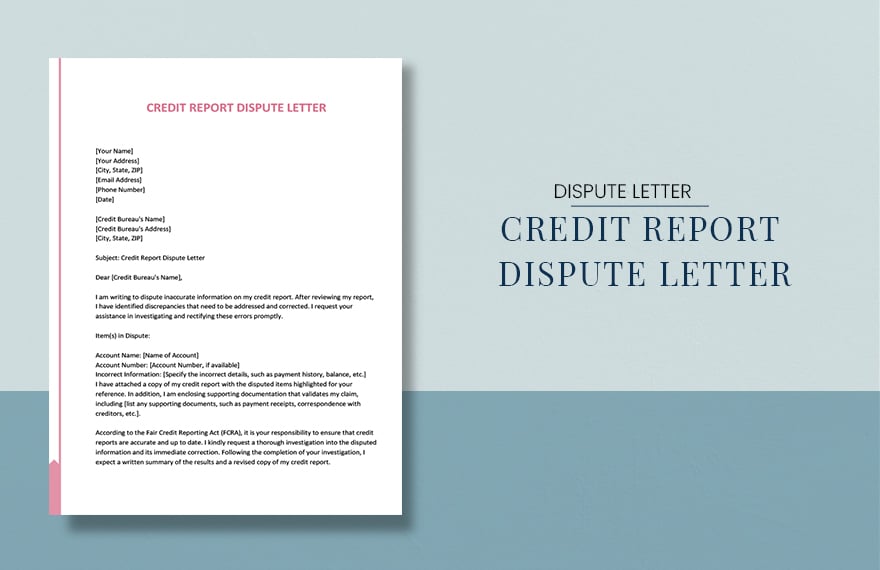

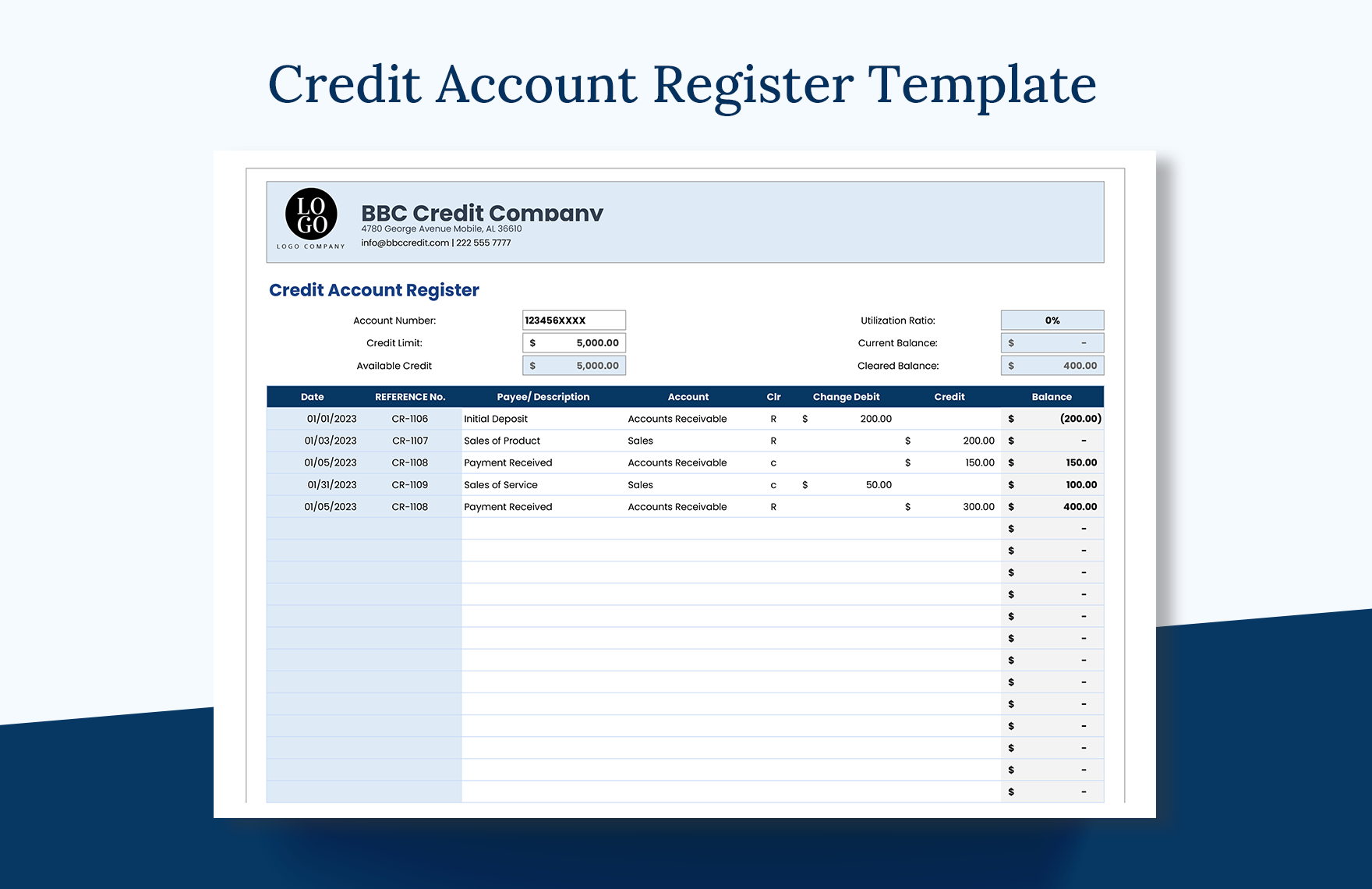

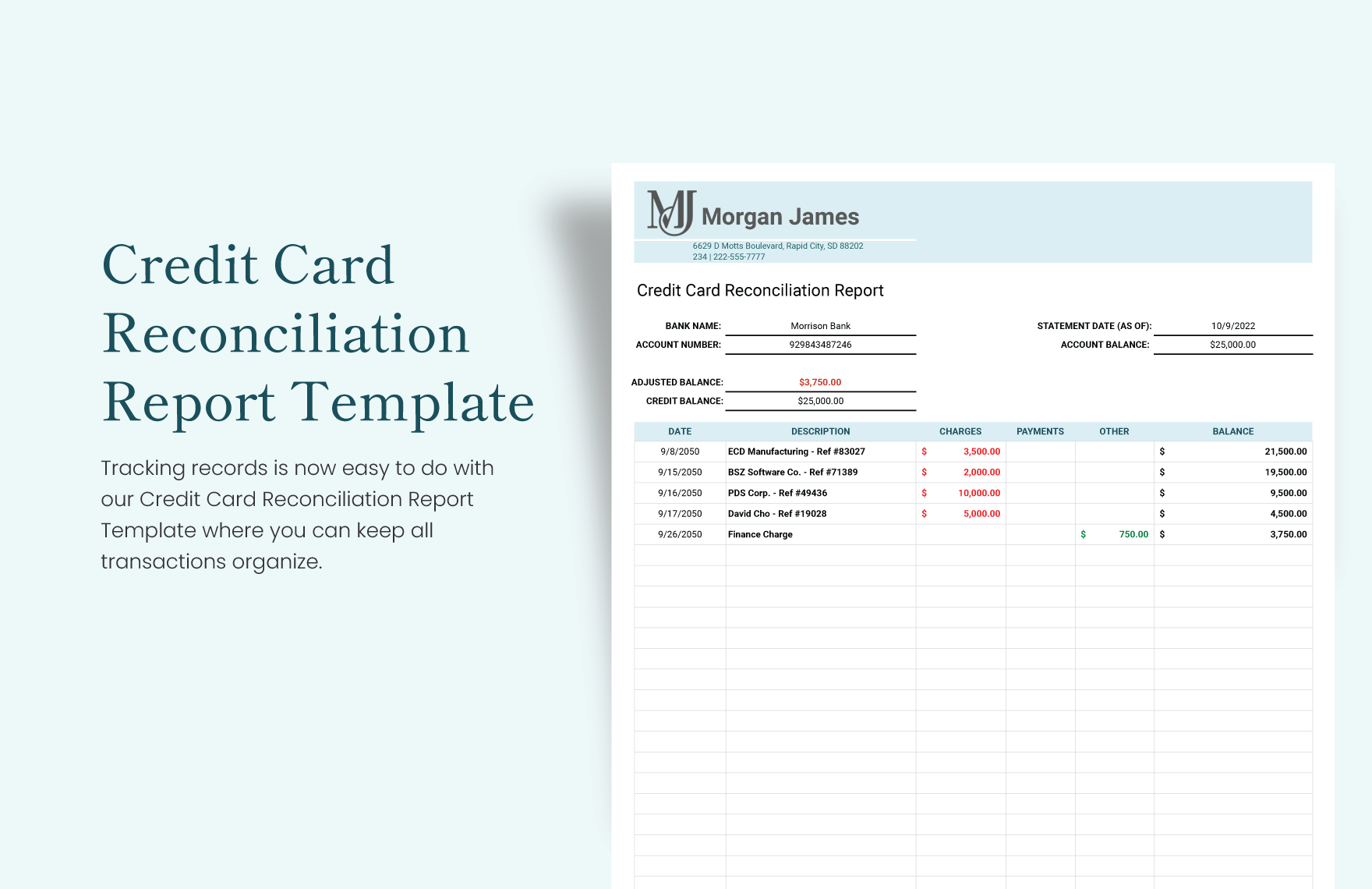

3. Writing the Draft

Collecting the necessary data and figures is one of the crucial parts in producing a credit report. Carefully review all the client's credit history, FICO score, credit rating, and other factors relating to their financial and/or credit information to prevent any disputes or escalations. Use a ready-made credit report template in making your rough draft or follow the standard report structure and format used by your company report just to make it more professional. Add images, diagrams, graphs, and tables if deemed appropriate to enhance the quality and effectivity of the report.

4. Finalizing the Report

Make sure that the content and the data in your report are accurate and comprehensive to prevent any implication of incompetence that may turn off your audience. Read every single detail of the report to spot any writing or formatting errors that you missed during the drafting phase of your simple report.

5. Saving the File

When everything is set and done, secure a copy of the file for future reference and record-keeping. Compile and organize the documents in folders or simply save it on the database of your computer or any data storing devices. You might need to do some timely revisions of the report to keep up with the latest updates and upgrades in the business.