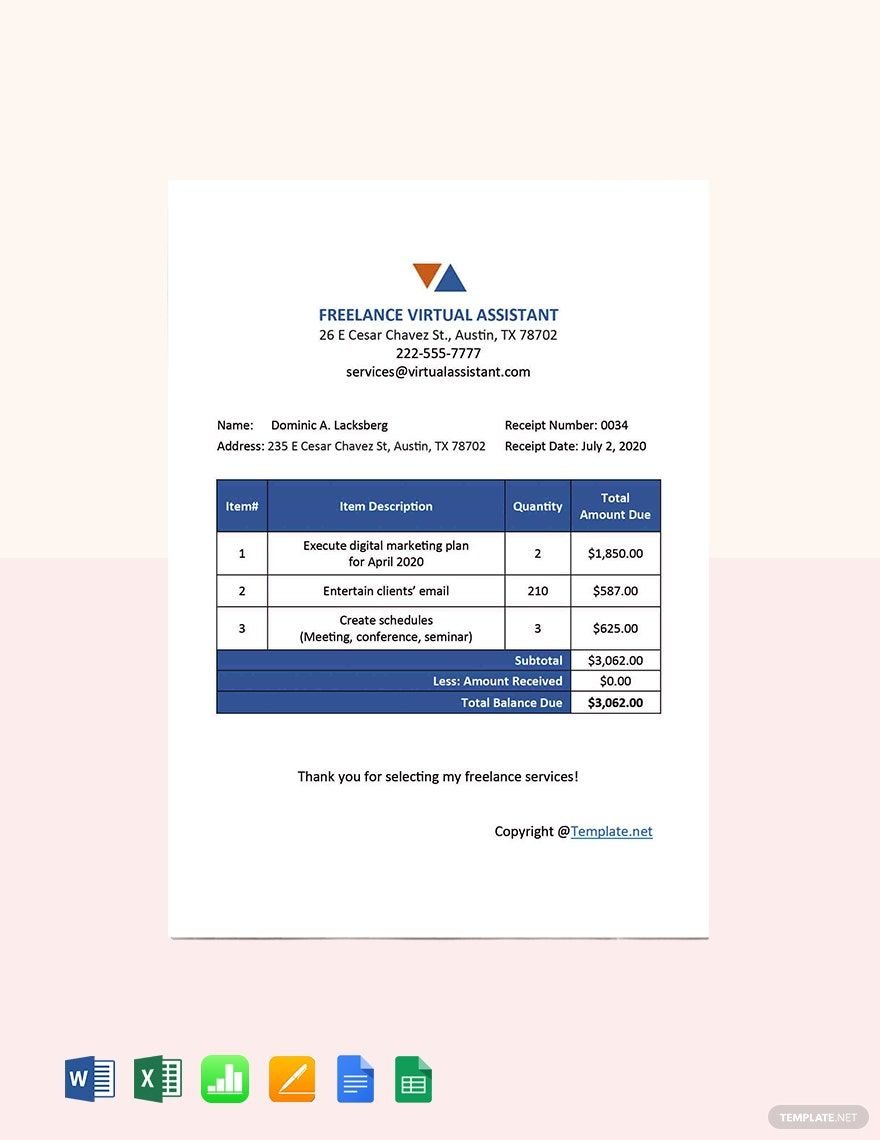

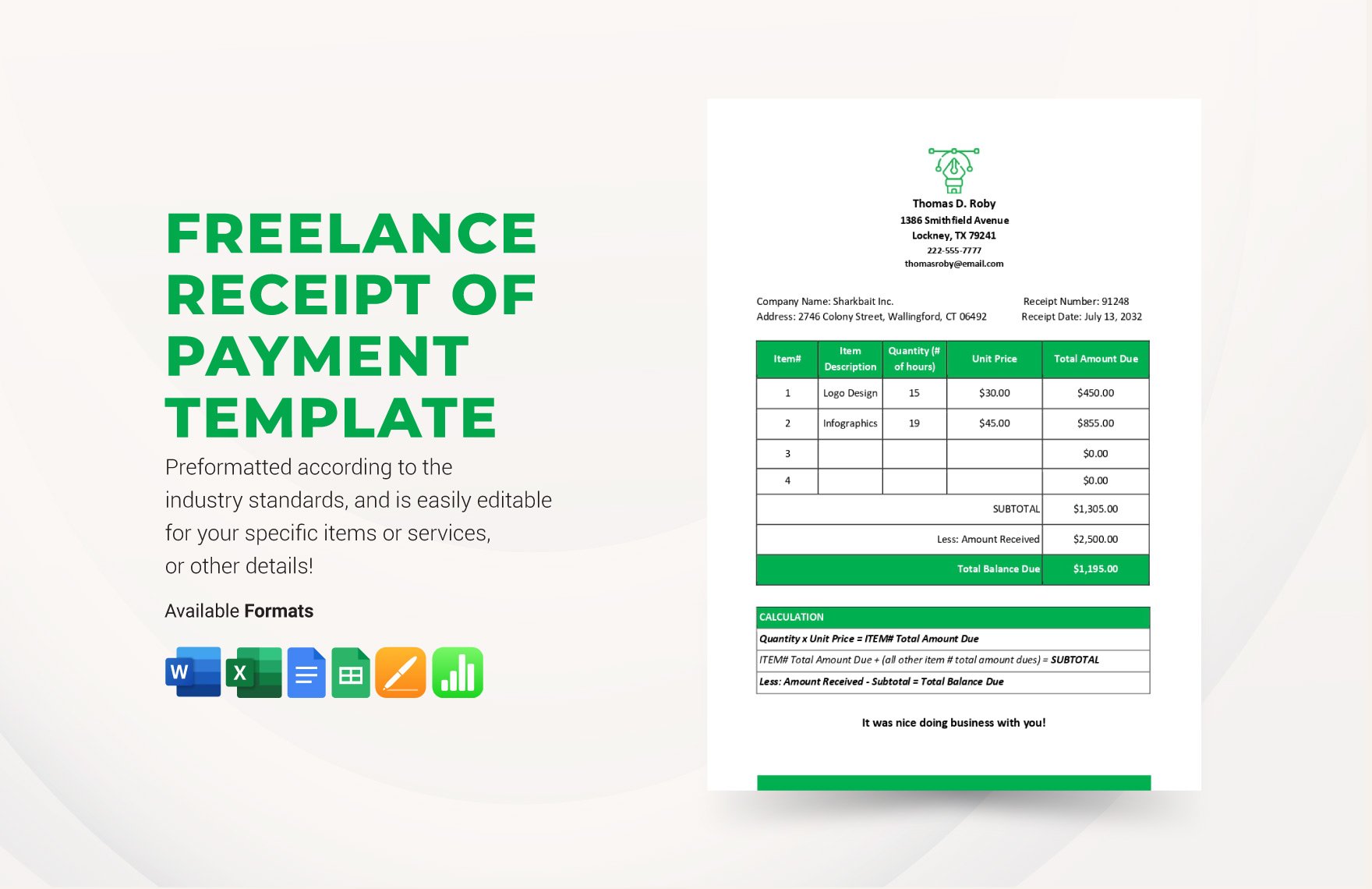

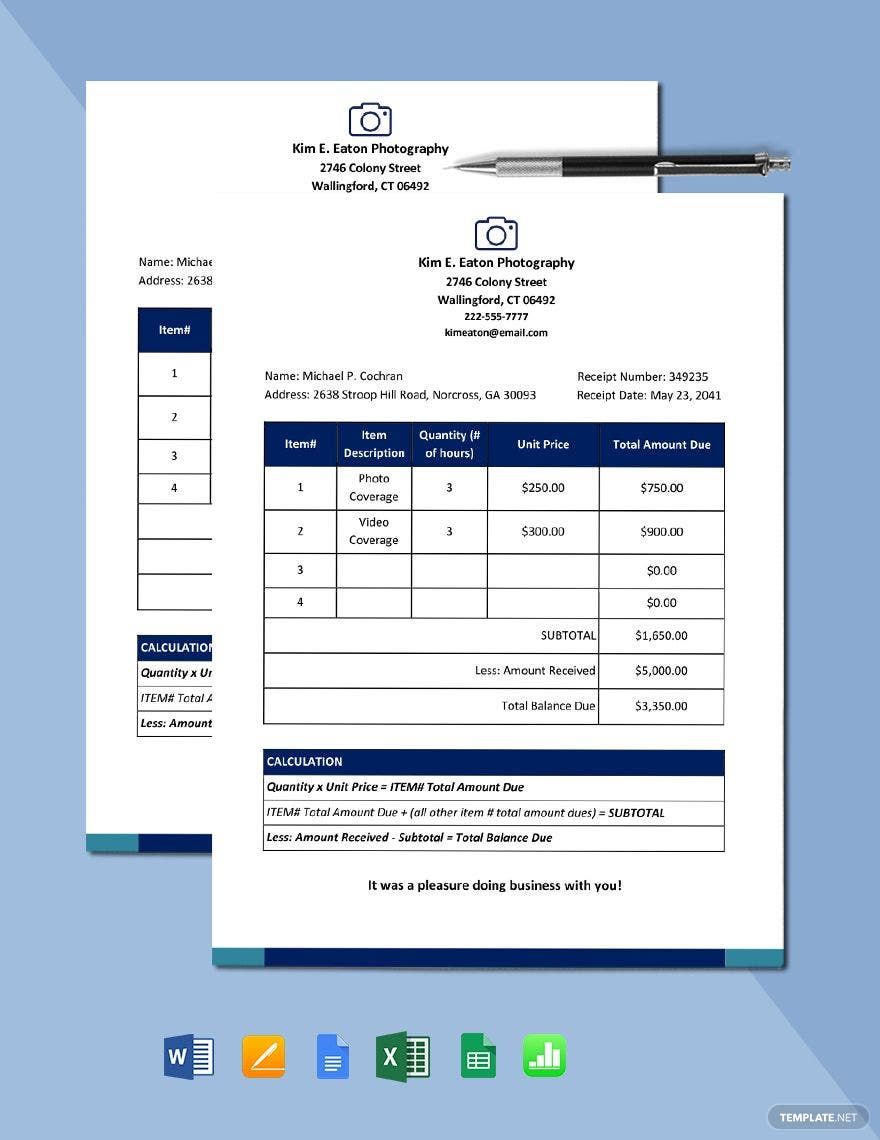

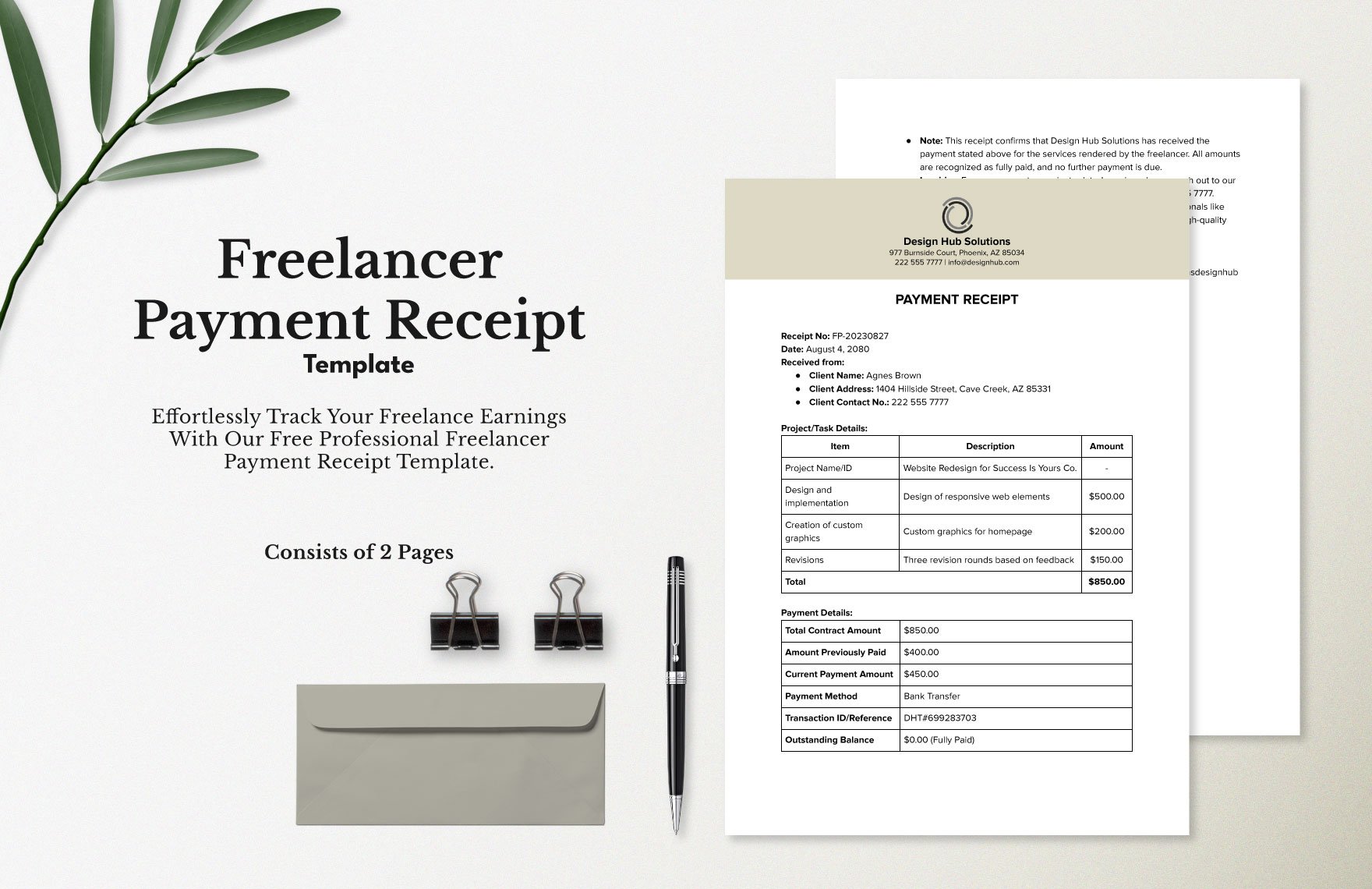

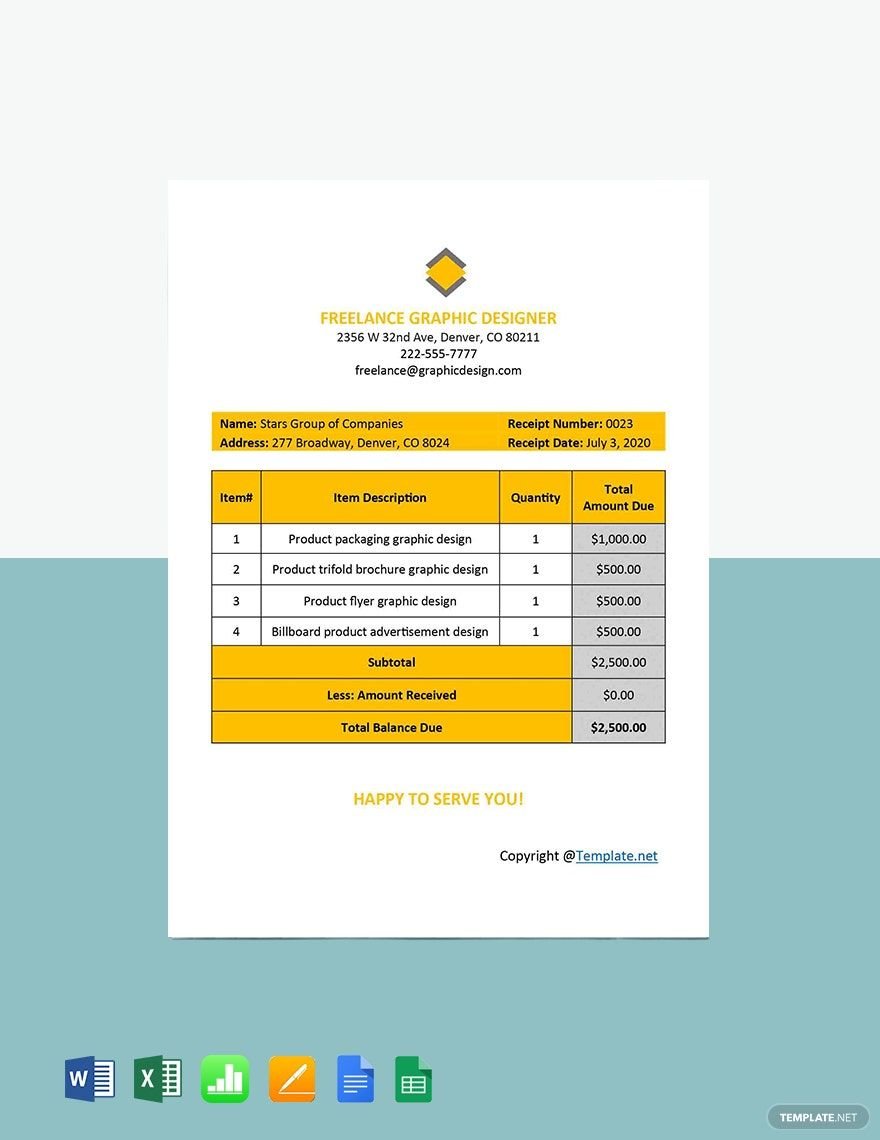

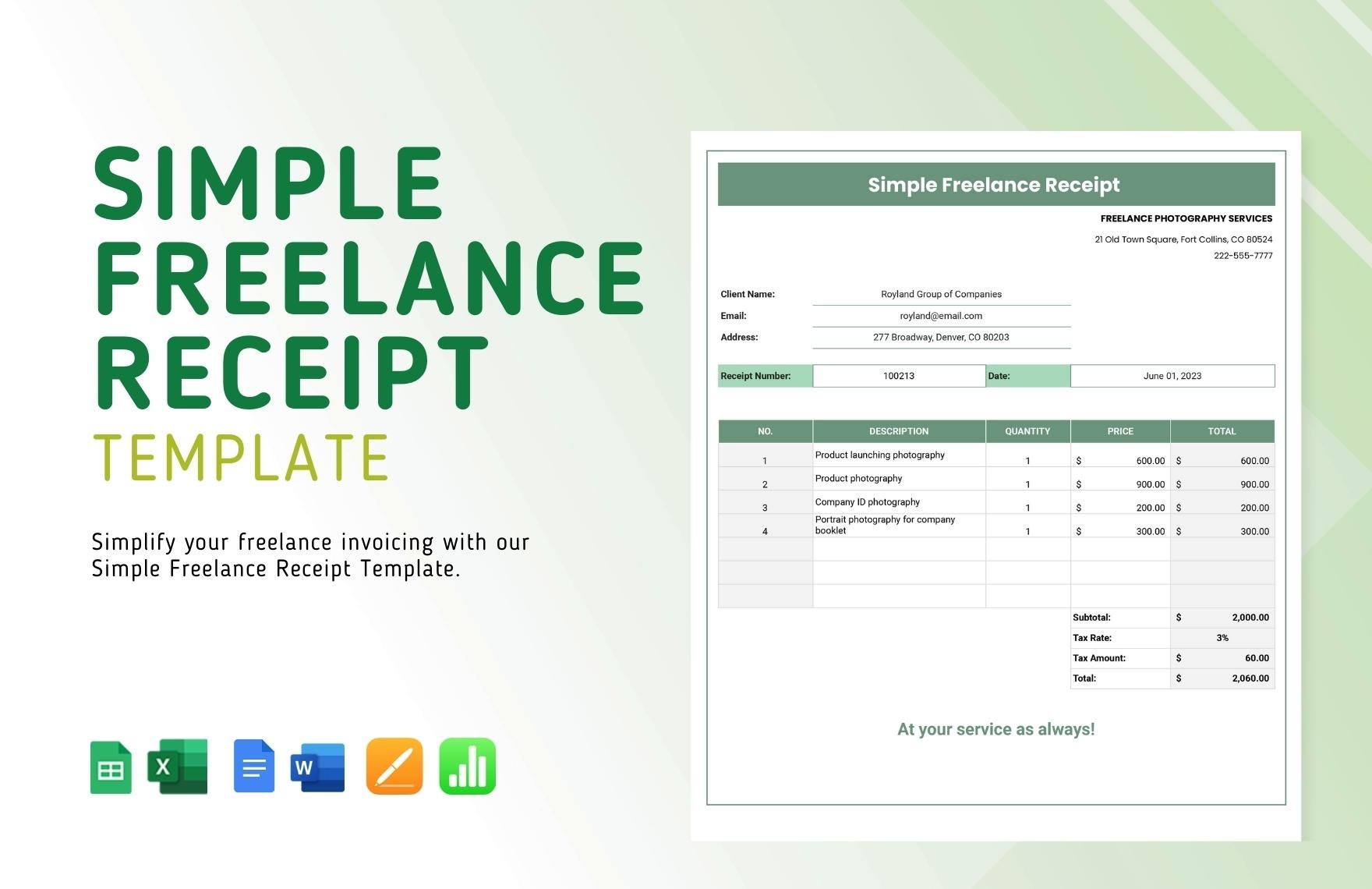

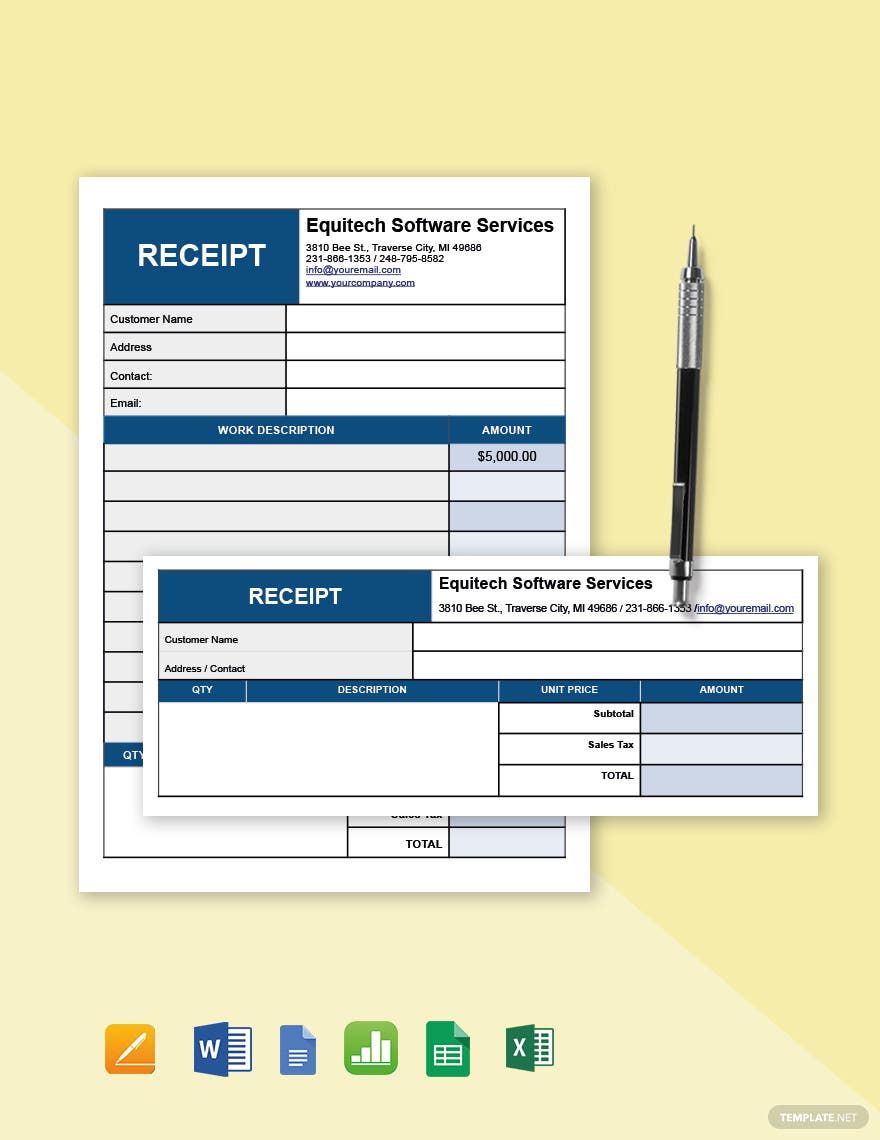

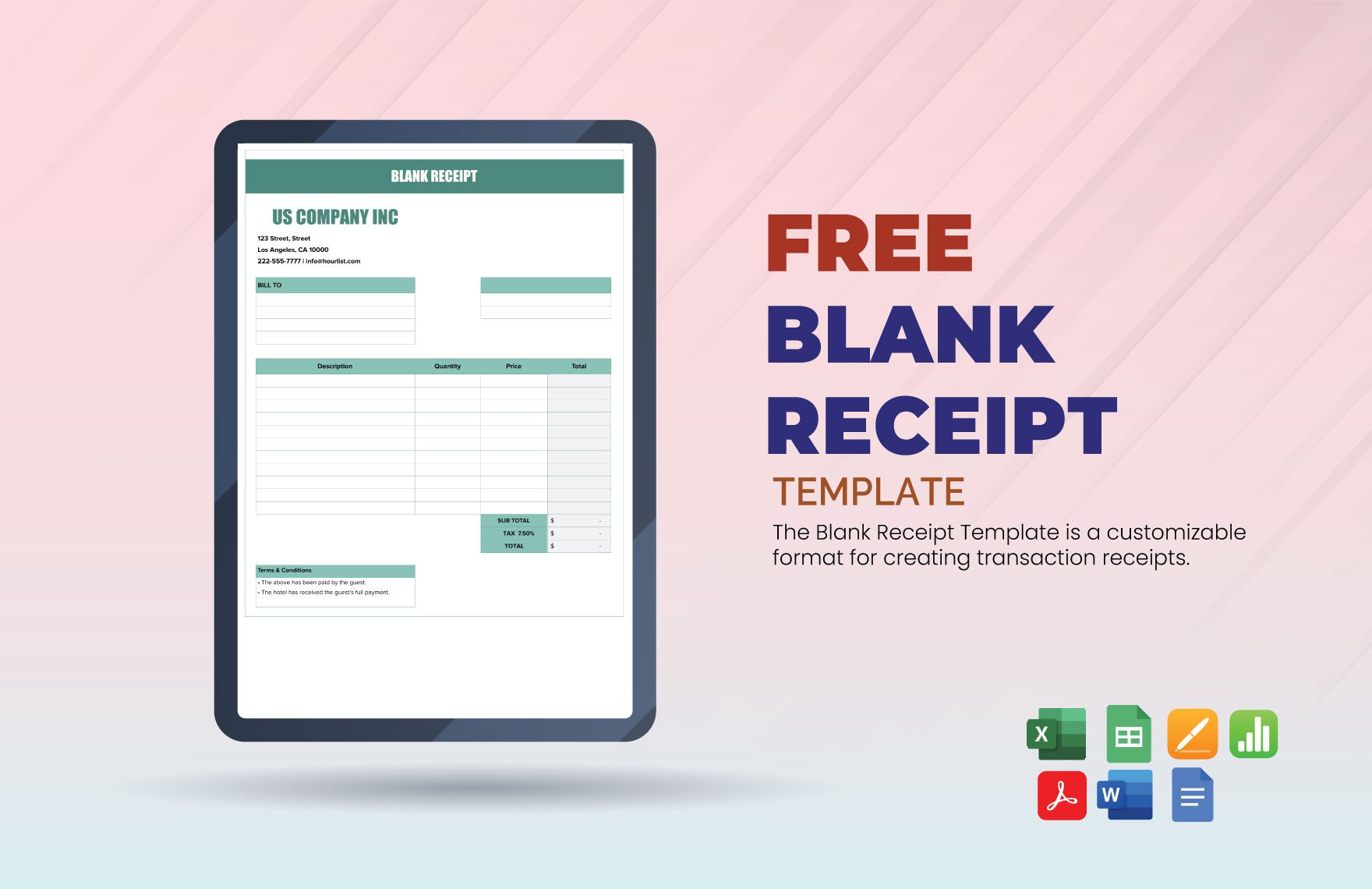

Receipts are one of the essential documents that you need in your freelance business. They are evidence of your clients' payment. Track your business' growth and tax returns using our Freelancer Receipt Templates. Choose the receipt that works best for you from our gallery of ready-made templates below. These samples are editable, printable, and downloadable easily. You can use their suggestive content and original artwork. What are you waiting for hen? Grab any of these 100% customizable templates now. Subscribe to start downloading now!

How to Create a Freelancer Receipt?

A freelancer receipt certifies that a client paid the freelancer for the services. Stanley H. Block Tax Services noted that you should keep business receipt records for checking your business' progress, developing financial statements, and making tax returns.

Receipts are crucial documents for your freelance job, make one today. Now, get your software ready and check out the smart tips to make one instantly.

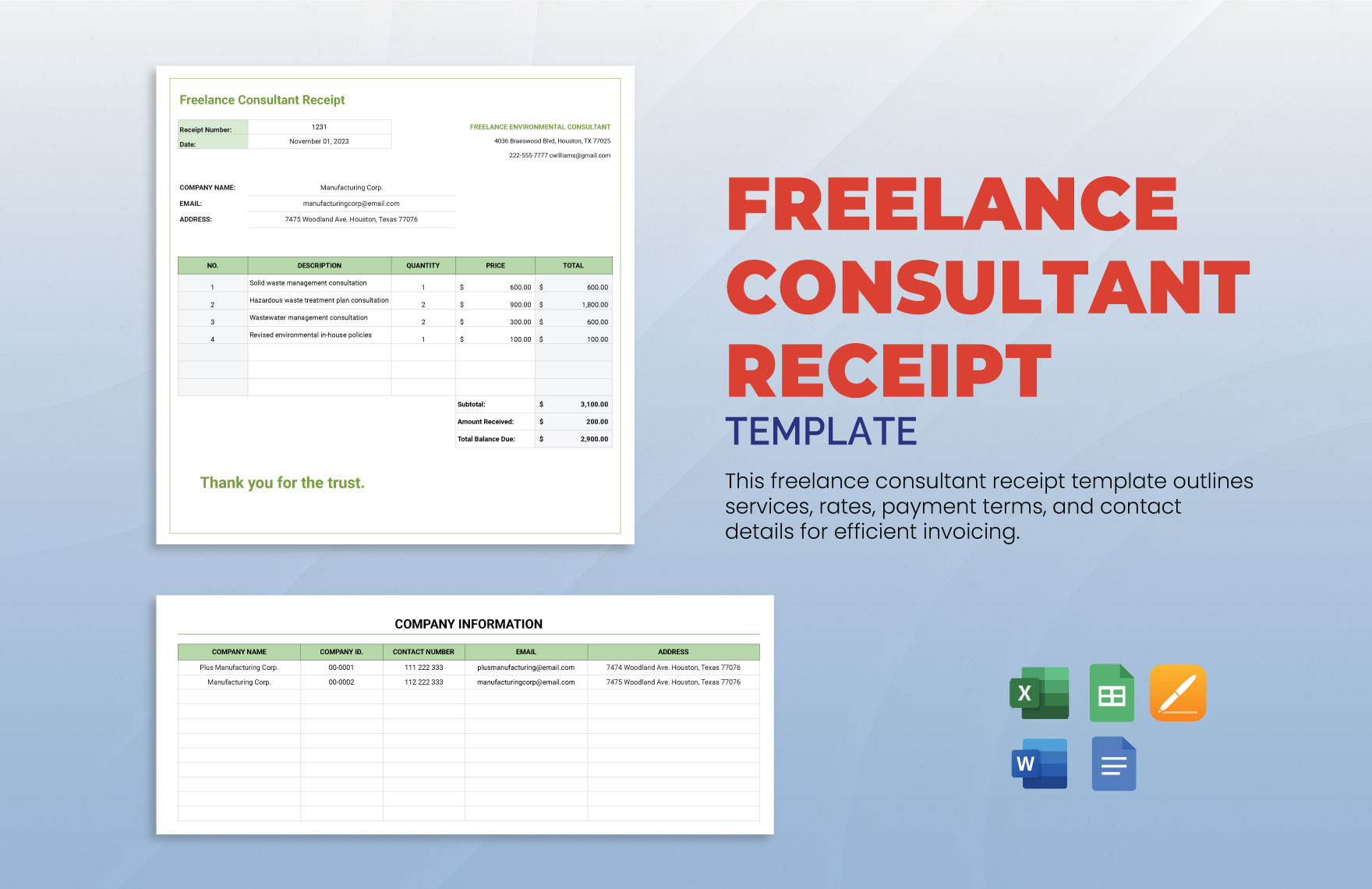

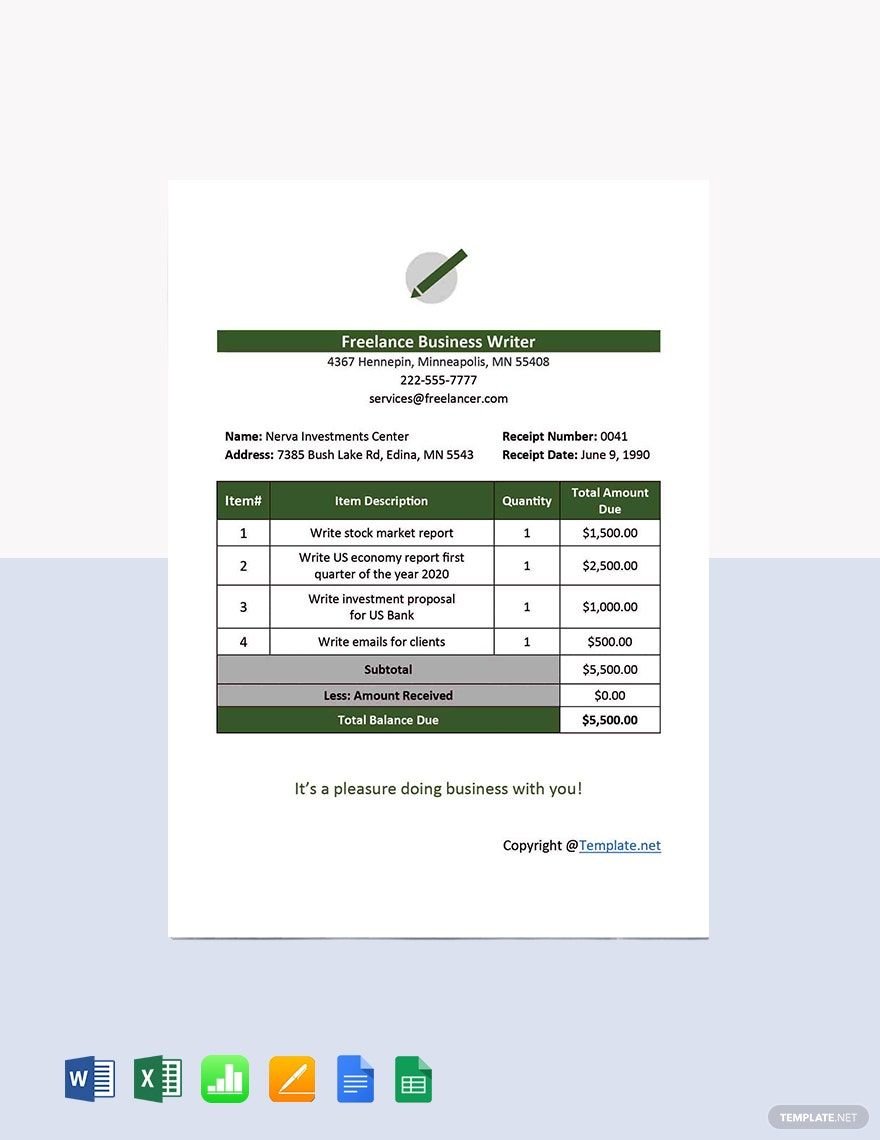

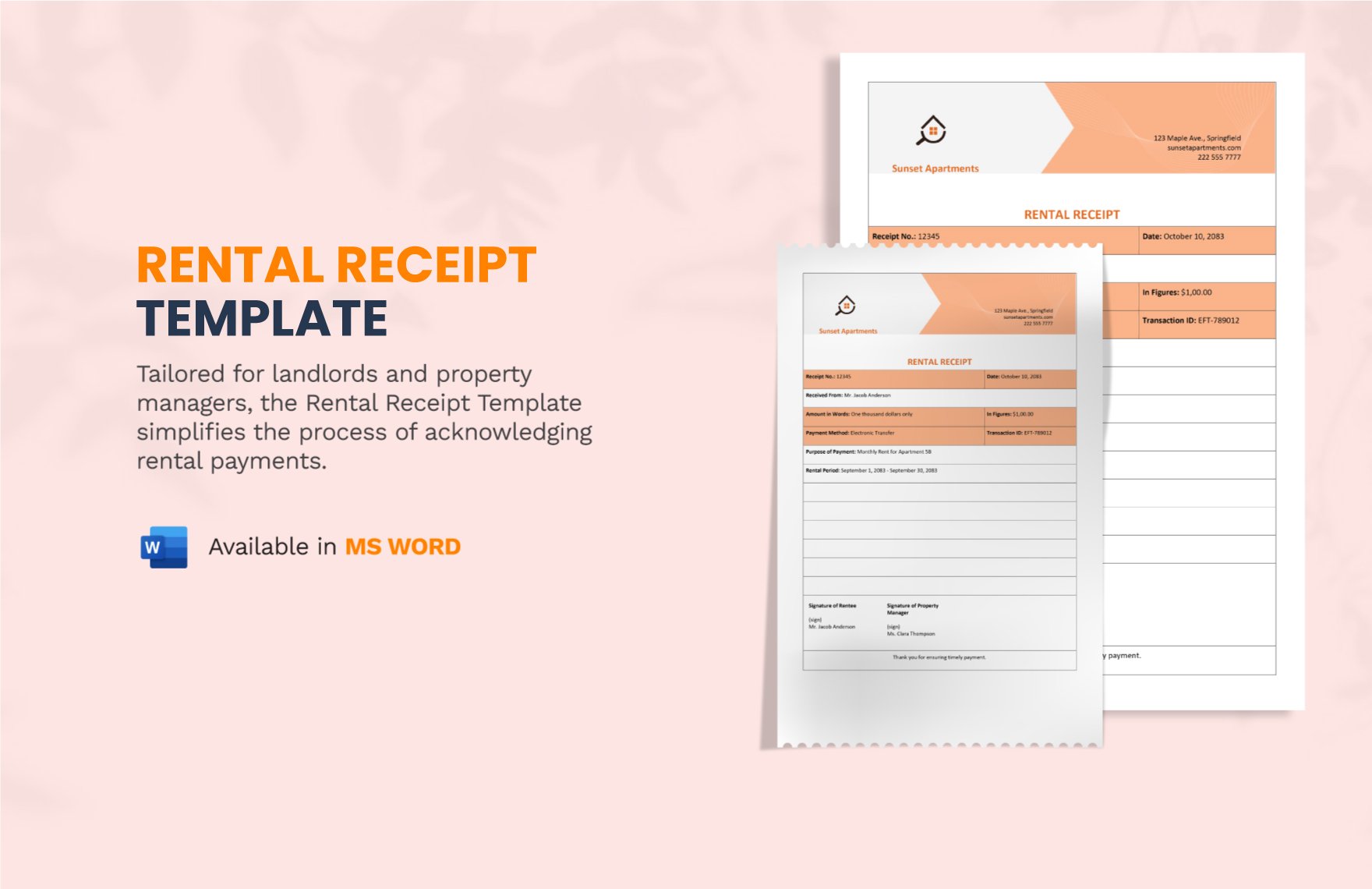

1. Provide Your Letterhead

Simple receipts aren't complete without a business letterhead branding. Usually, a letterhead will leave a mark on your clients because it's a reflection of your business. A well-made letterhead represents that you're a professional freelancer. Ideally, a letterhead contains your logo, name, business address, and contact details.

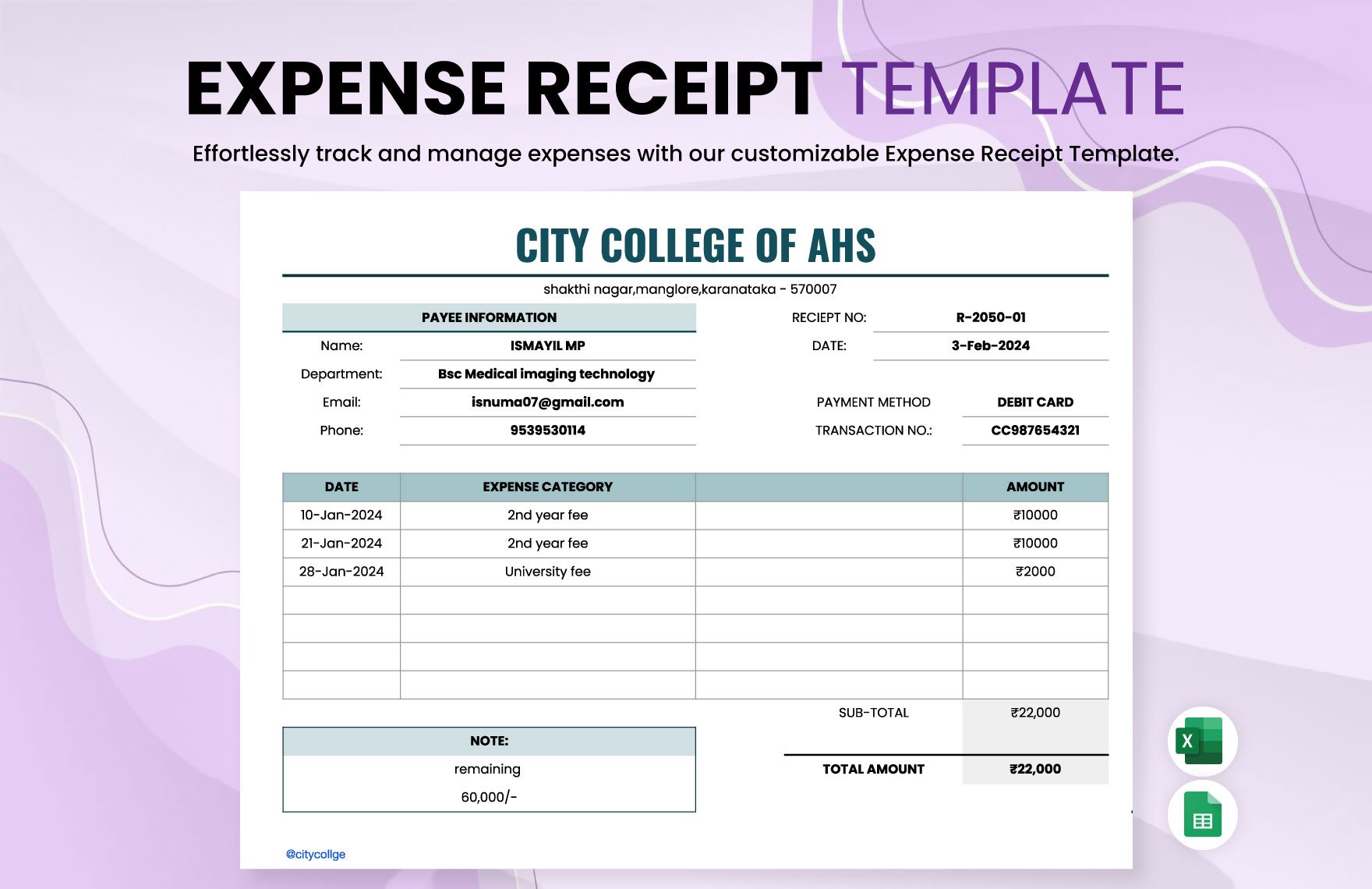

2. Write the Client's Info

To avoid giving the receipt to the wrong client, you need to personalize it like a tax invoice. Write the client's name, address, receipt number, and date to distinguish it from other documents.

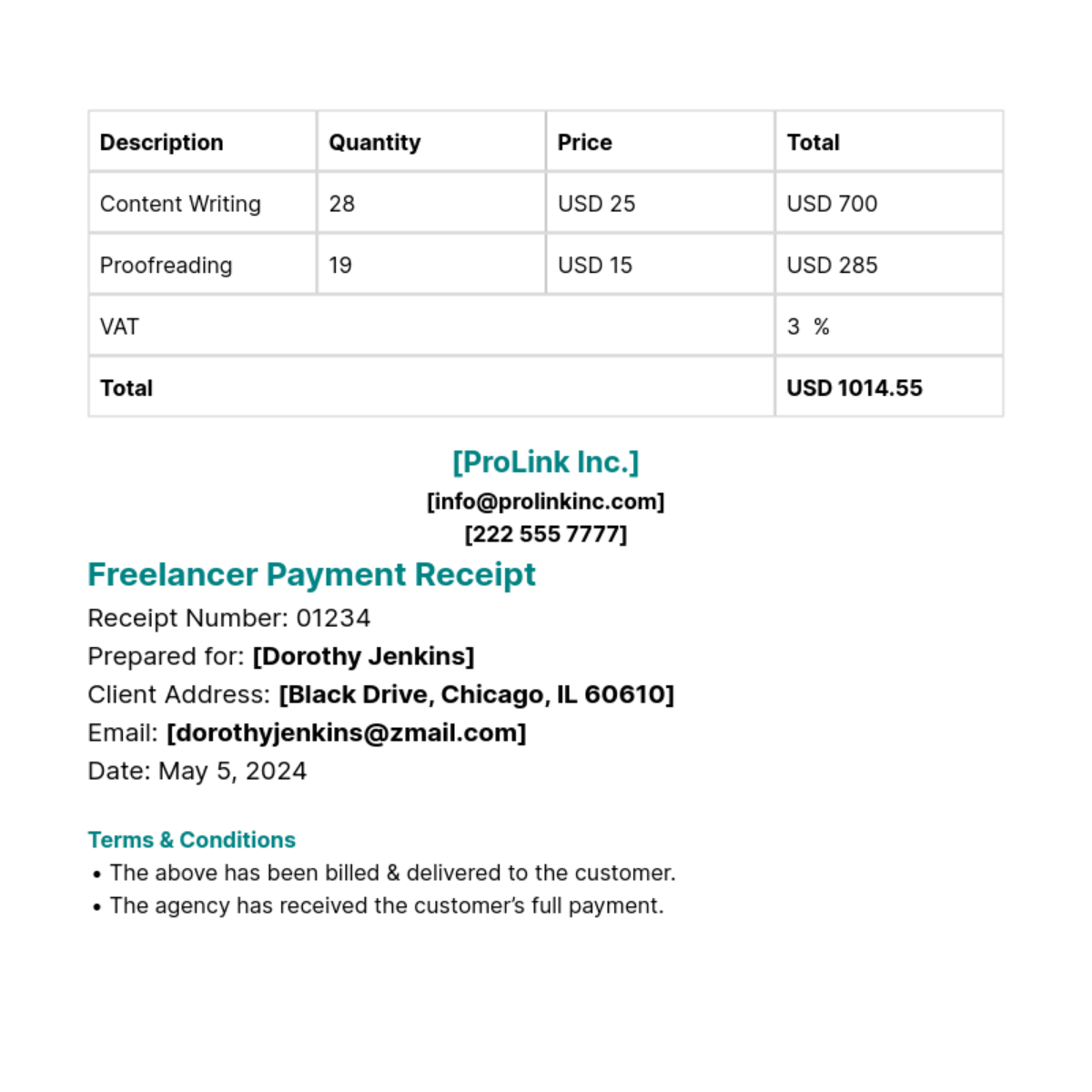

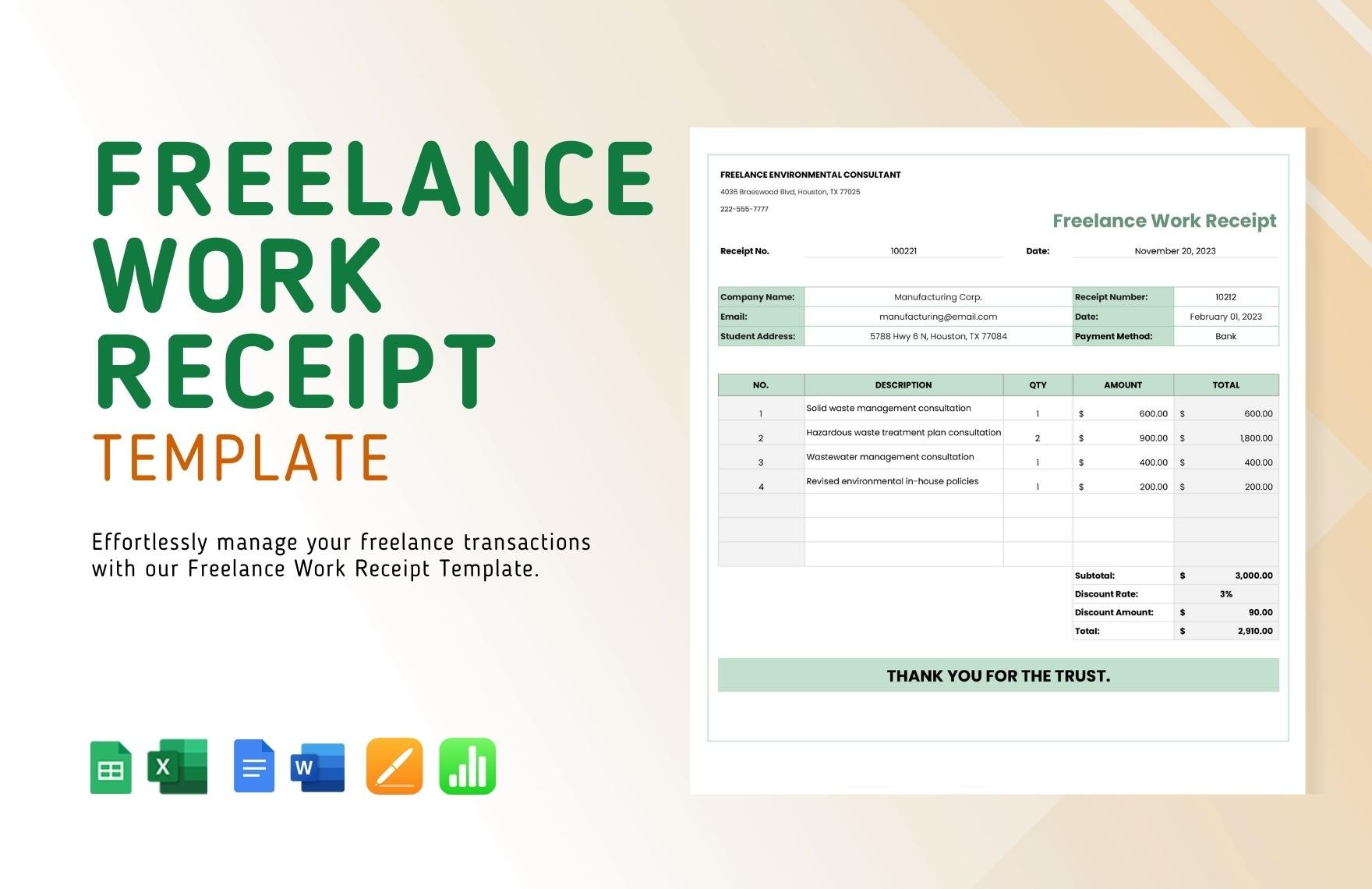

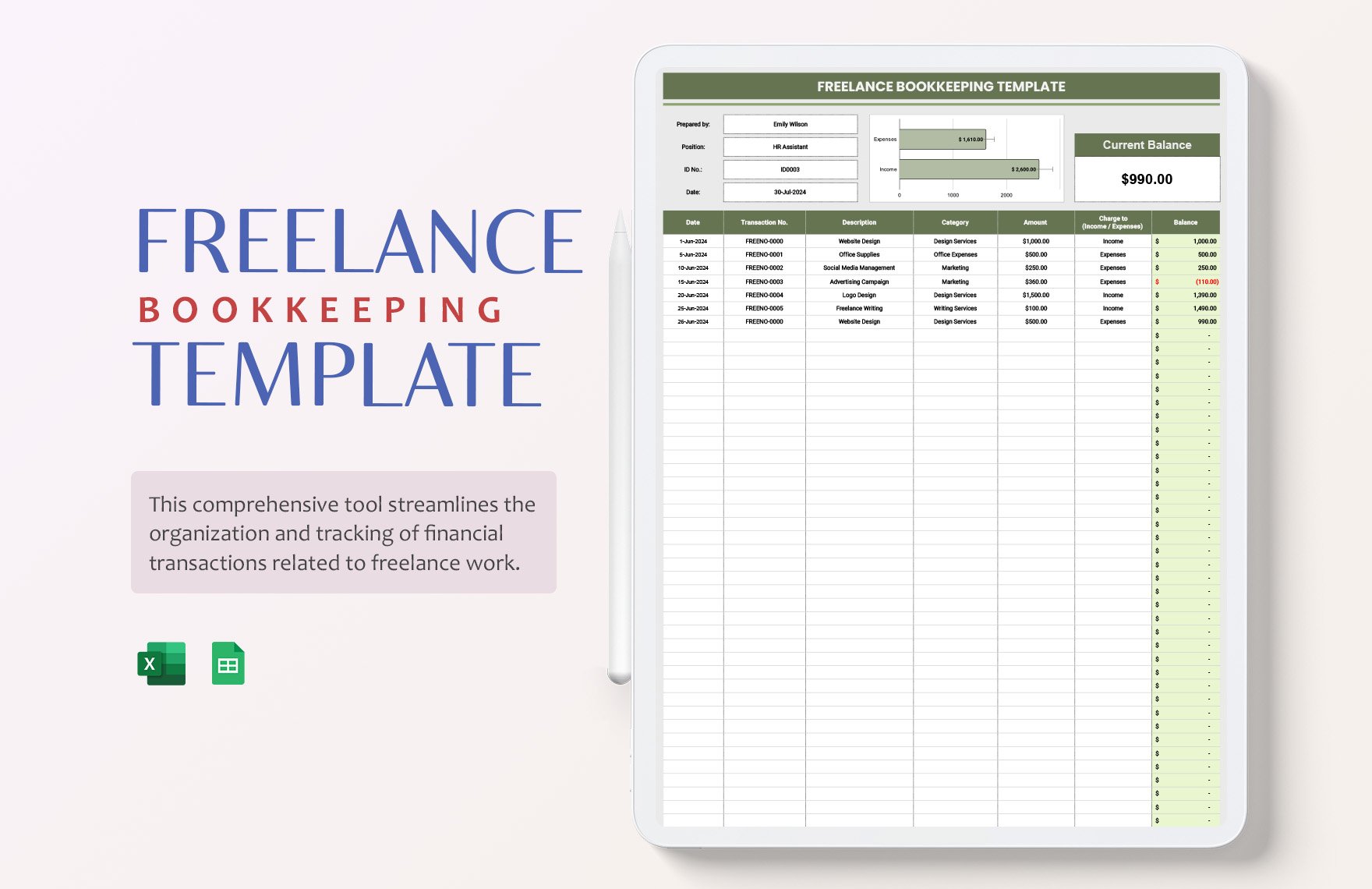

3. Record the Services and Prices

Whether you're in freelance writing, graphic design, or videography, you have to provide the details of your services on the sample receipt. Create sections for the services, quantities, and prices. Then, specify and fill each of them.

4. Include the Total Payment

Provide accurate details of how much the client paid you since this is crucial information. Don't make a mistake since this detail is vital in preparing your deductible expenses and financial statements later. Additionally, ensure that the figures are right. As you know, money matters are sensitive to you and your client.

5. Leave a Positive Note

Personalize your cash receipt by adding a positive note below it. You may say, "Thank you for the trust," or "It was nice doing business with you." These little notes aim to the emotions of your clients and will leave a positive impression on them.