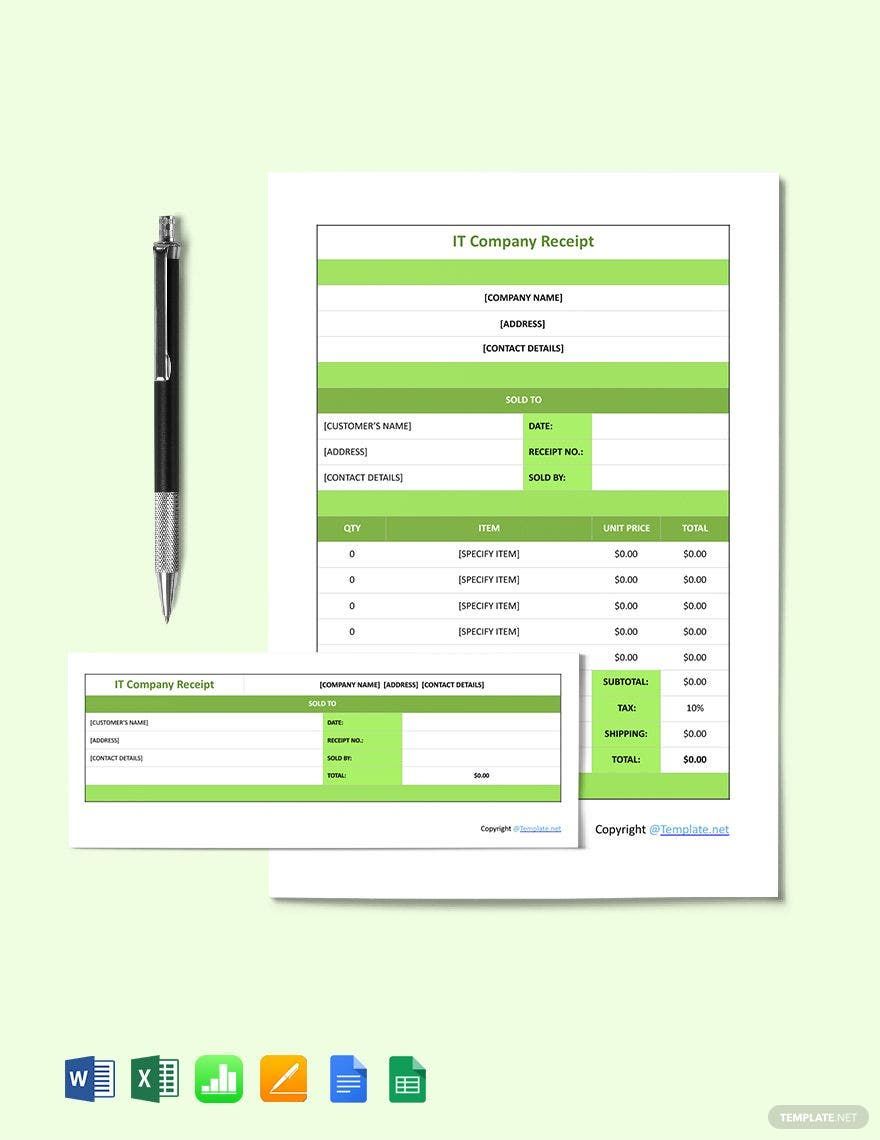

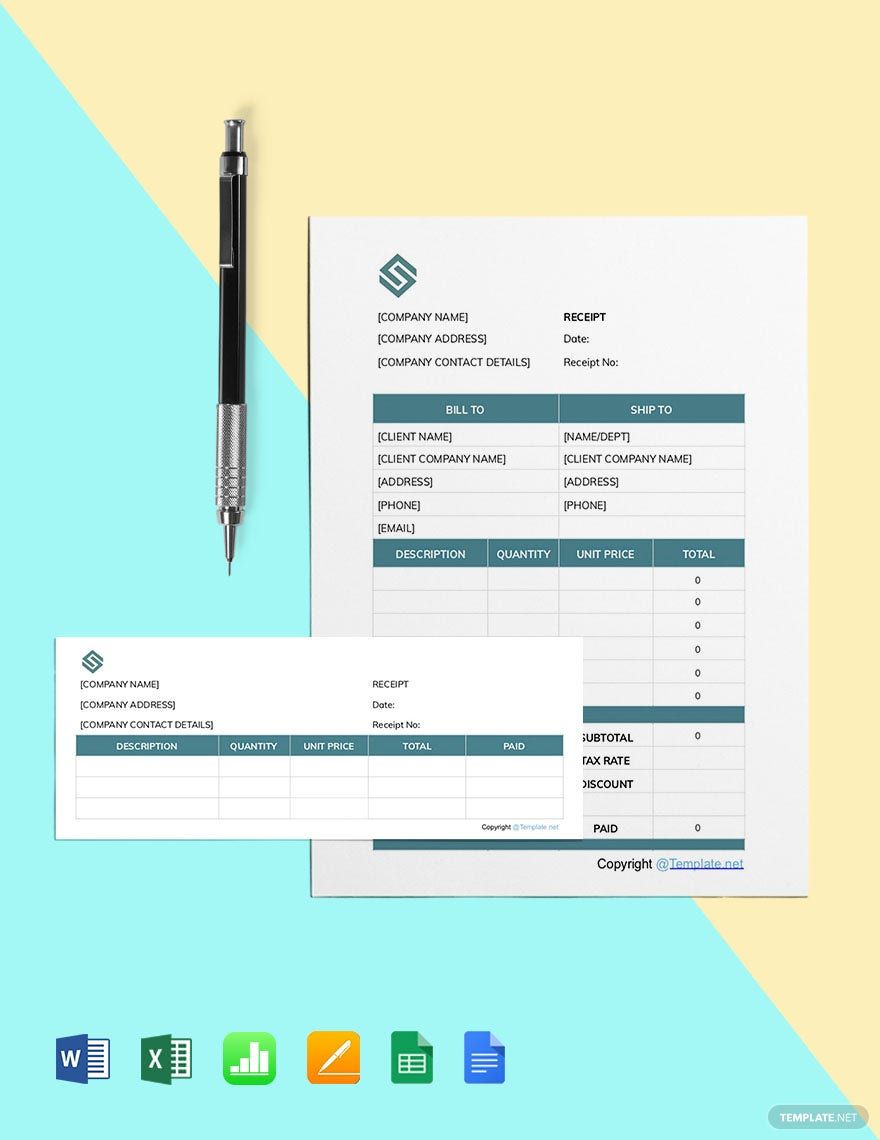

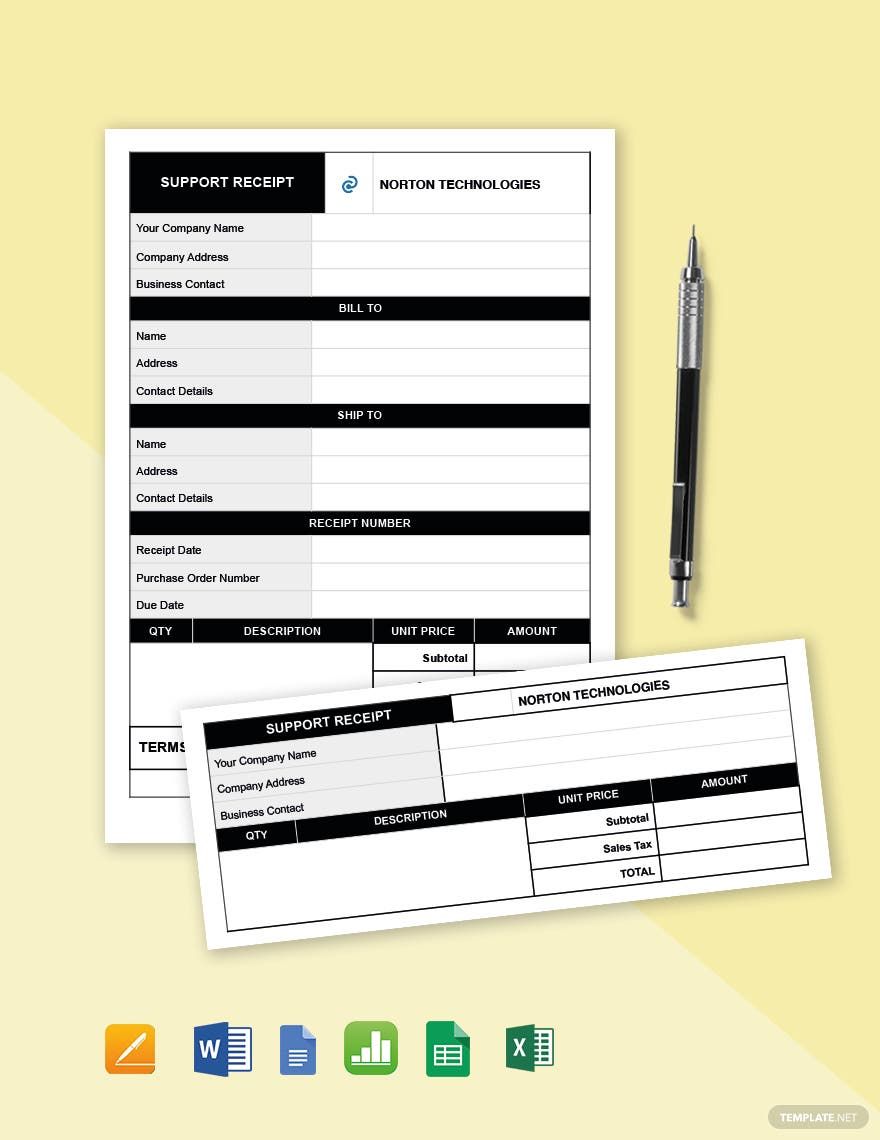

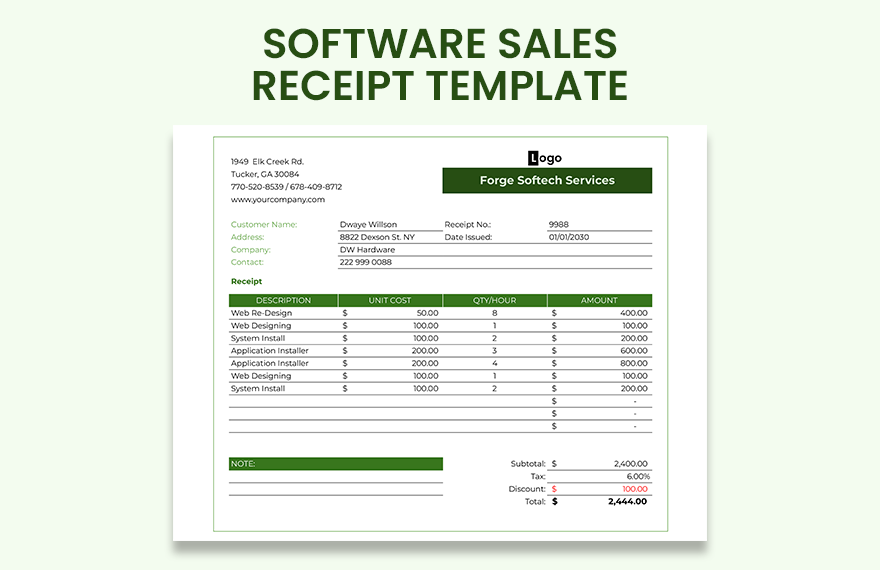

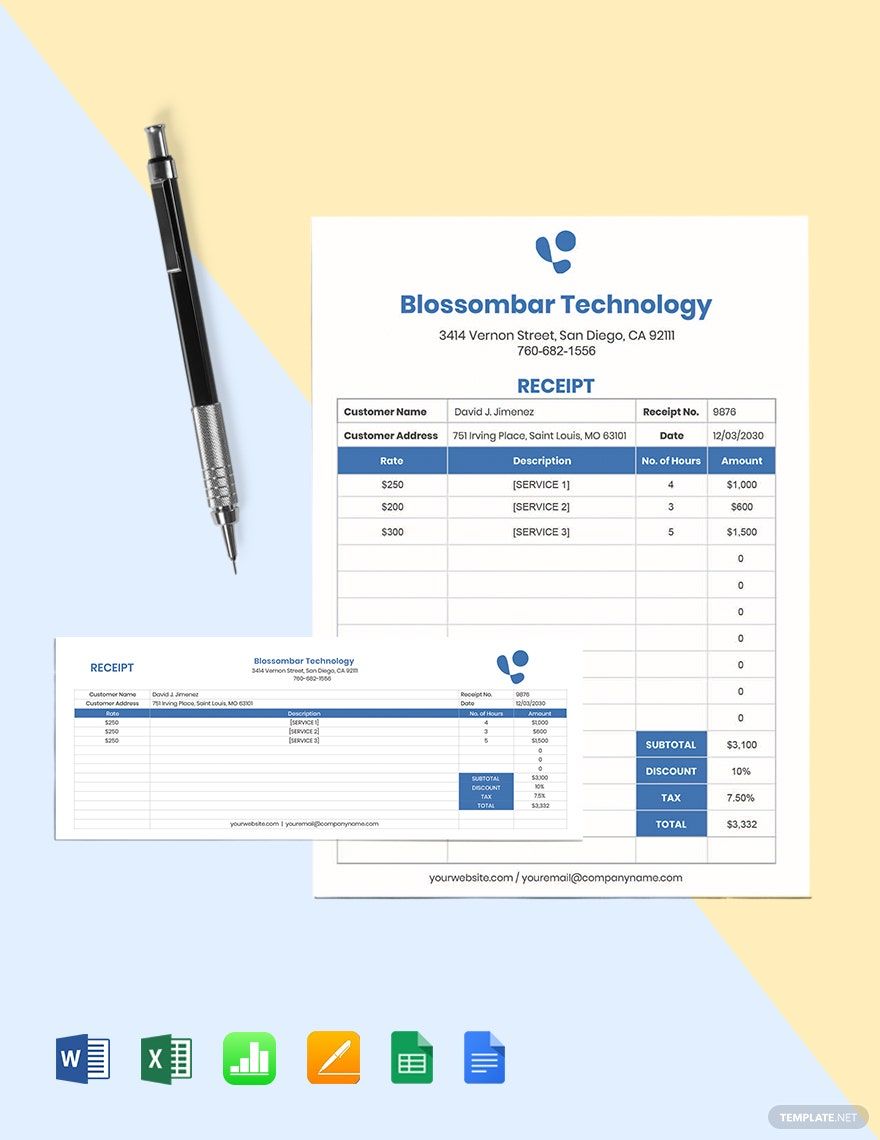

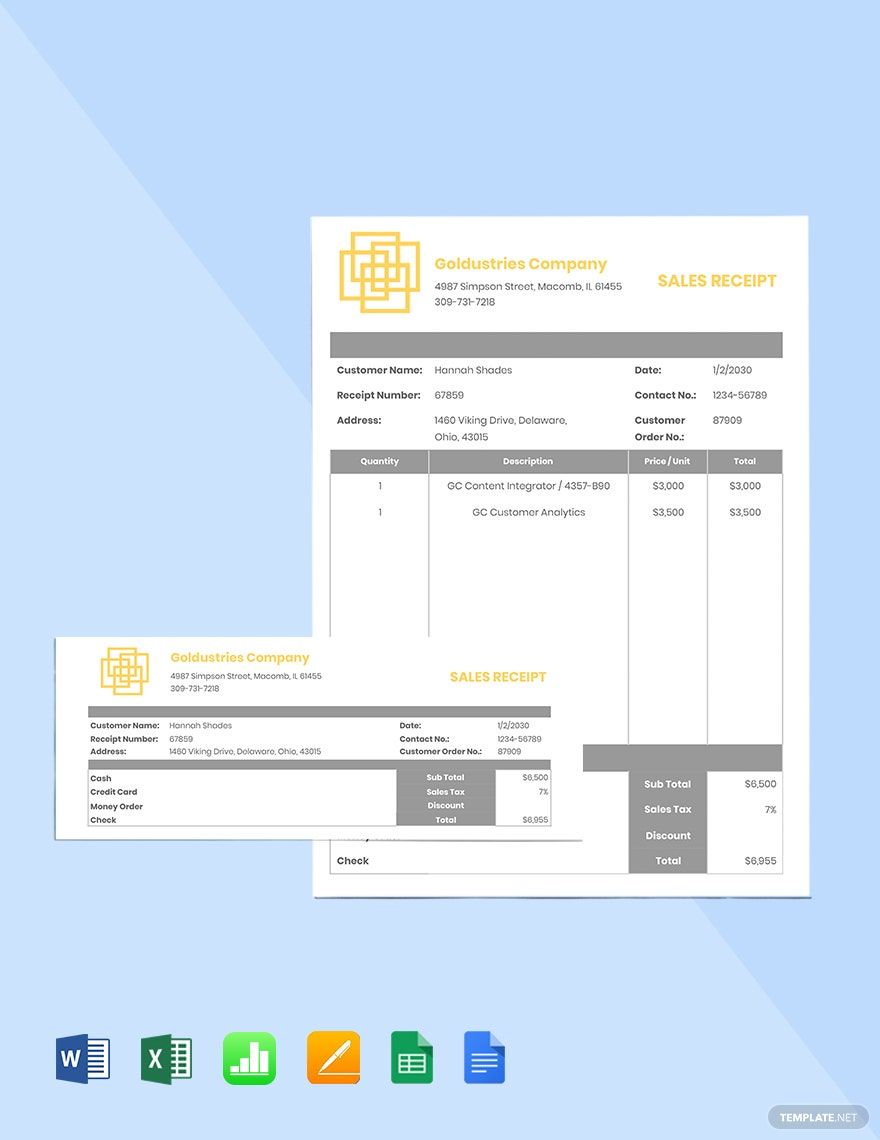

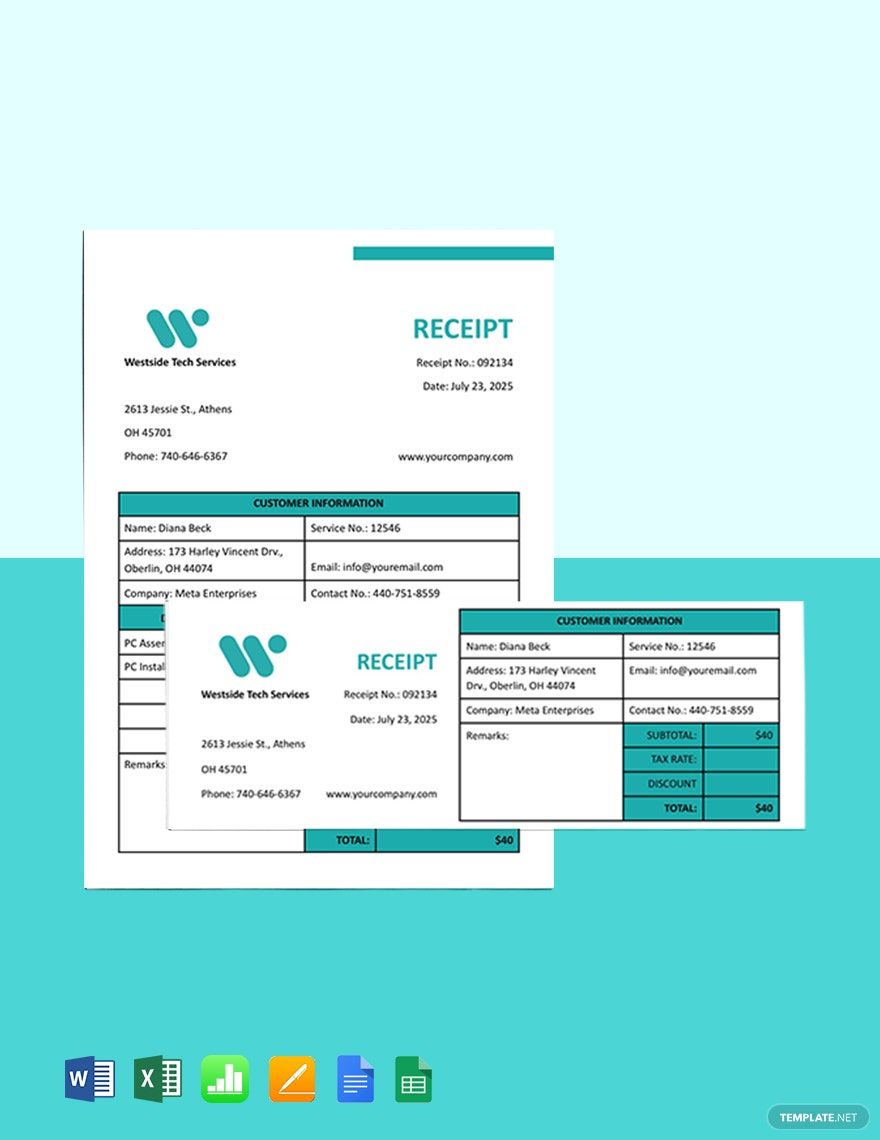

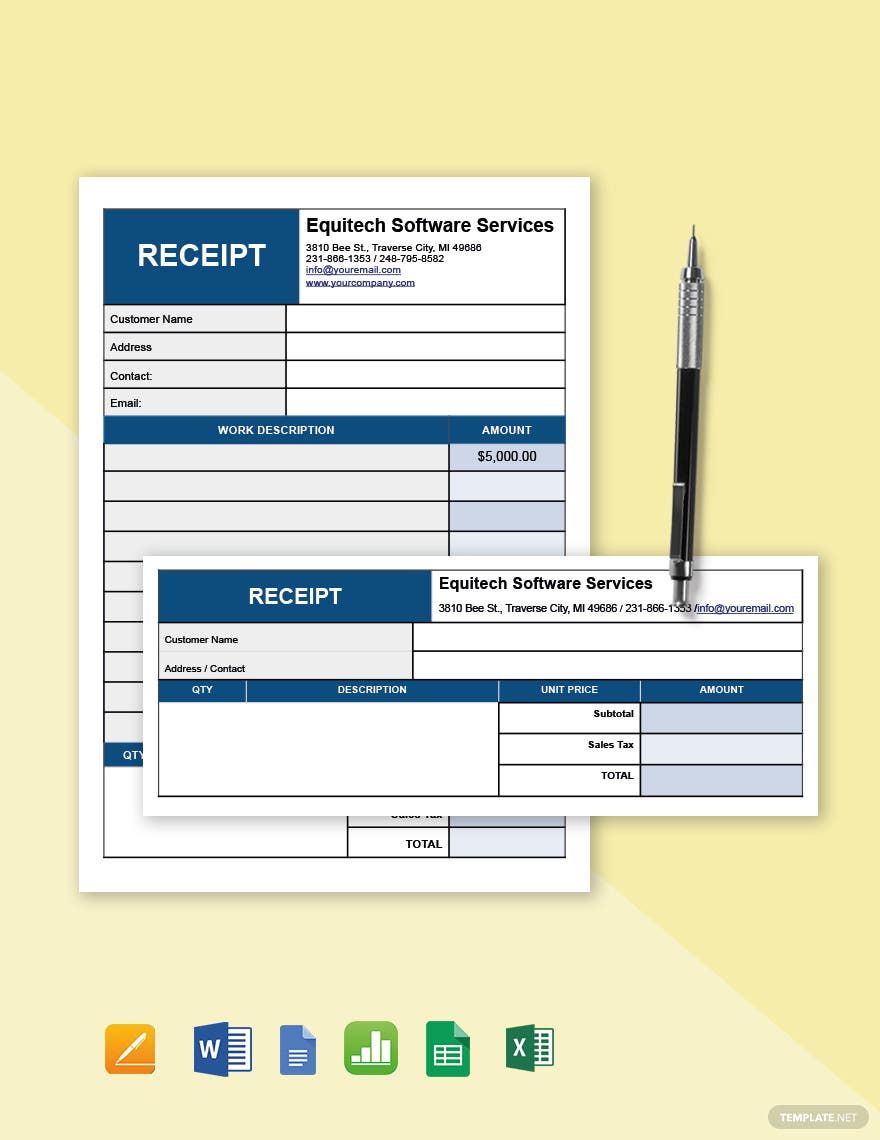

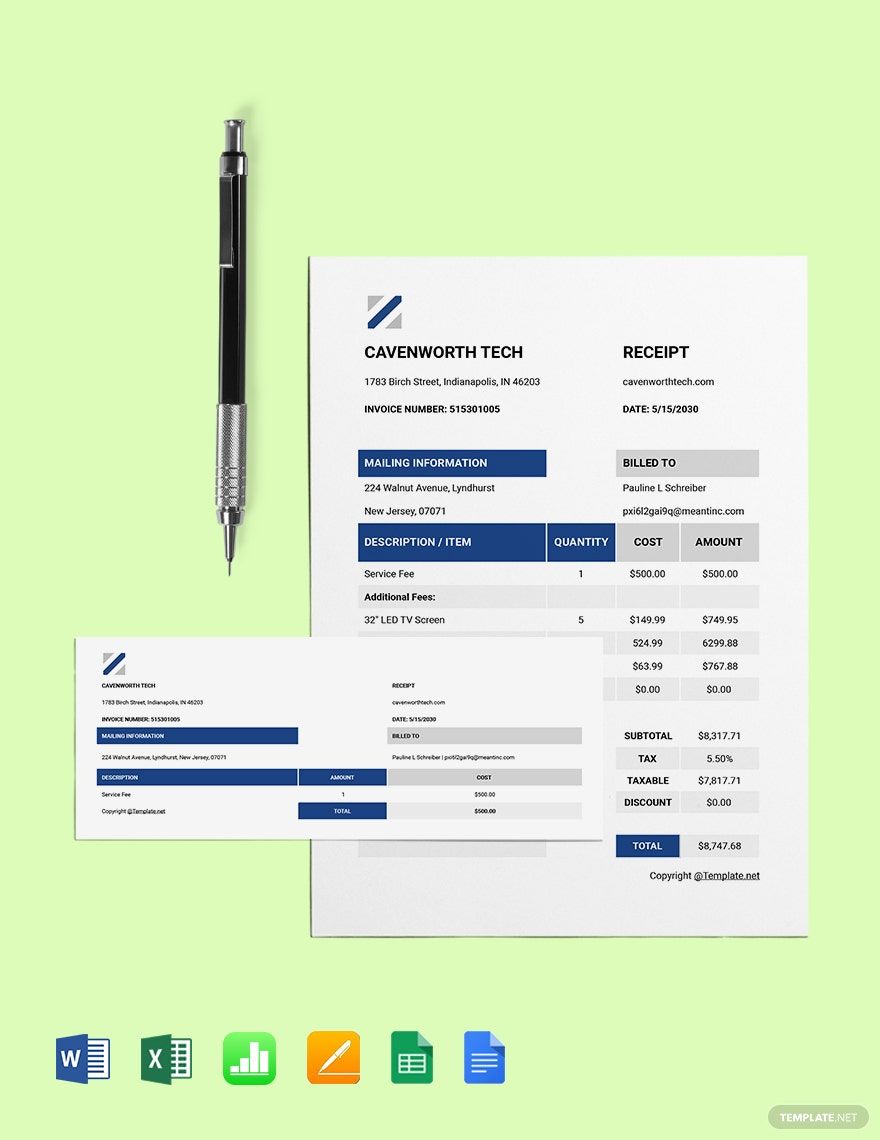

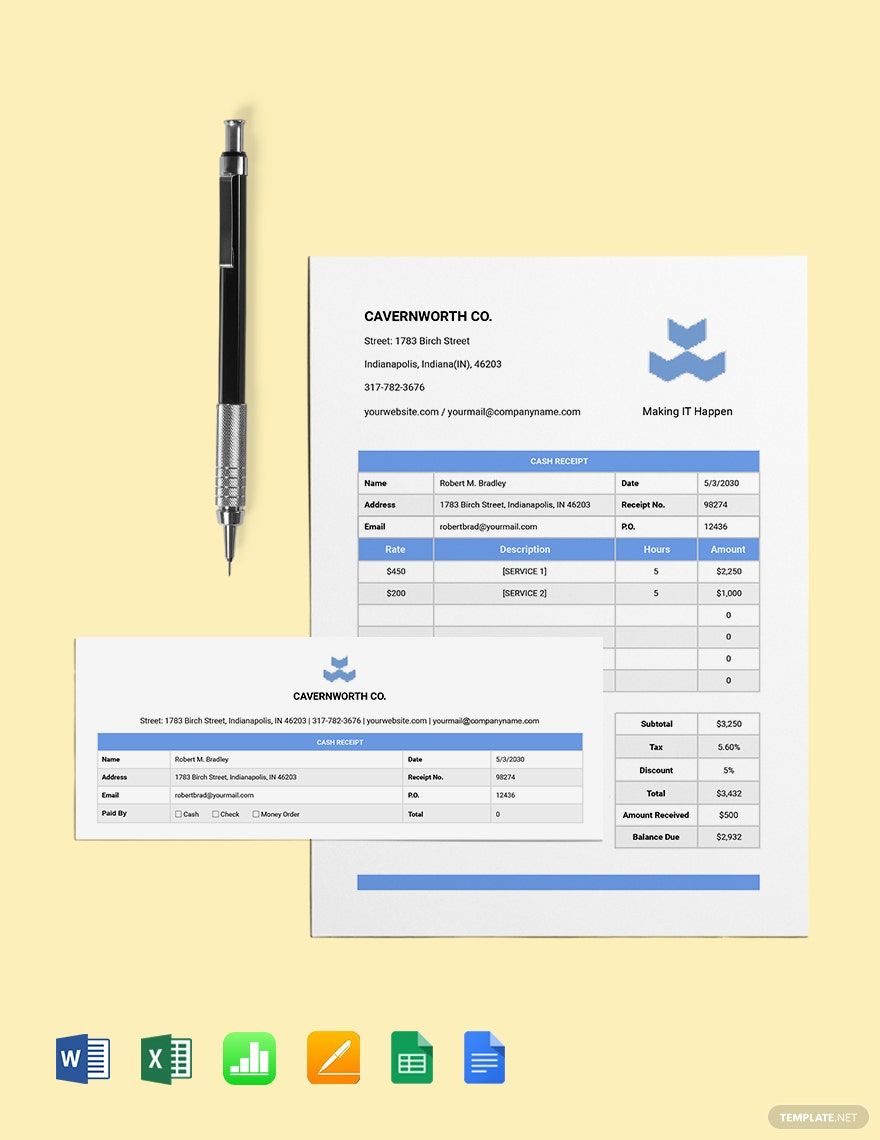

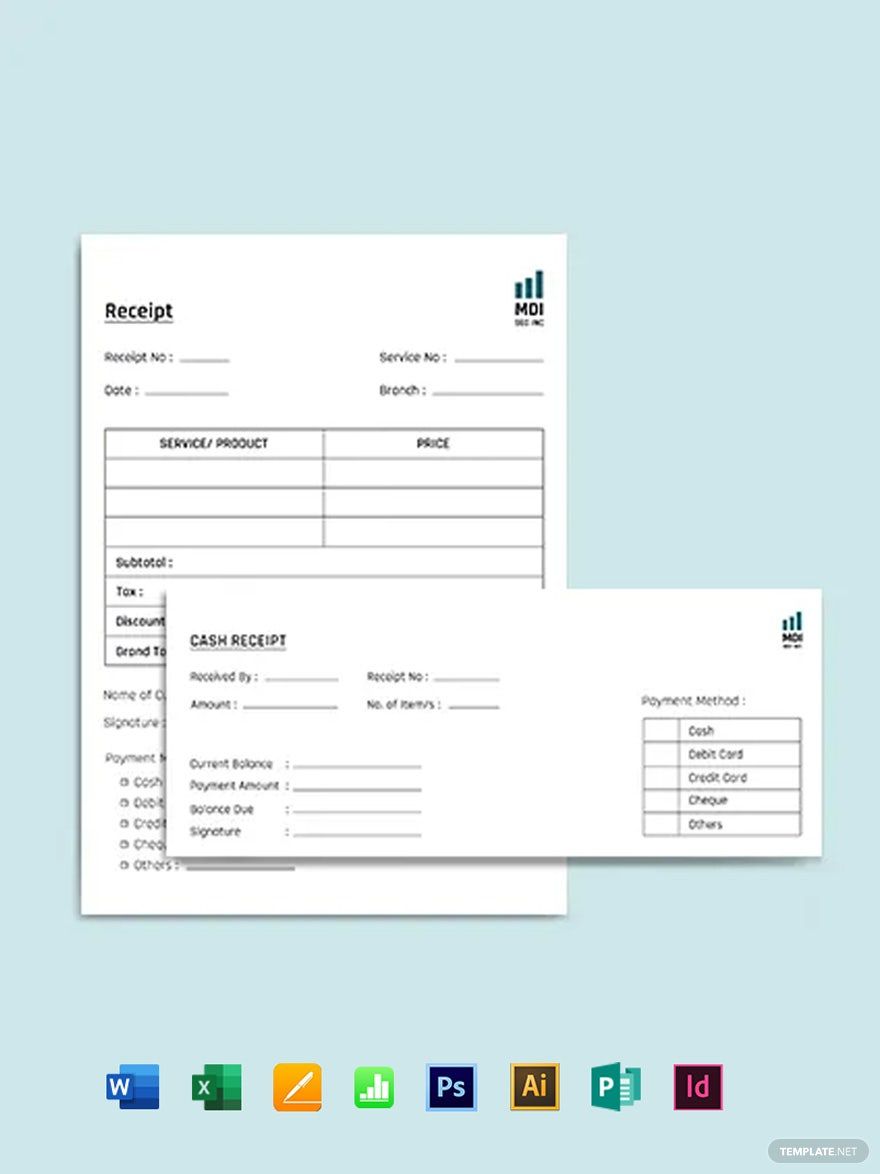

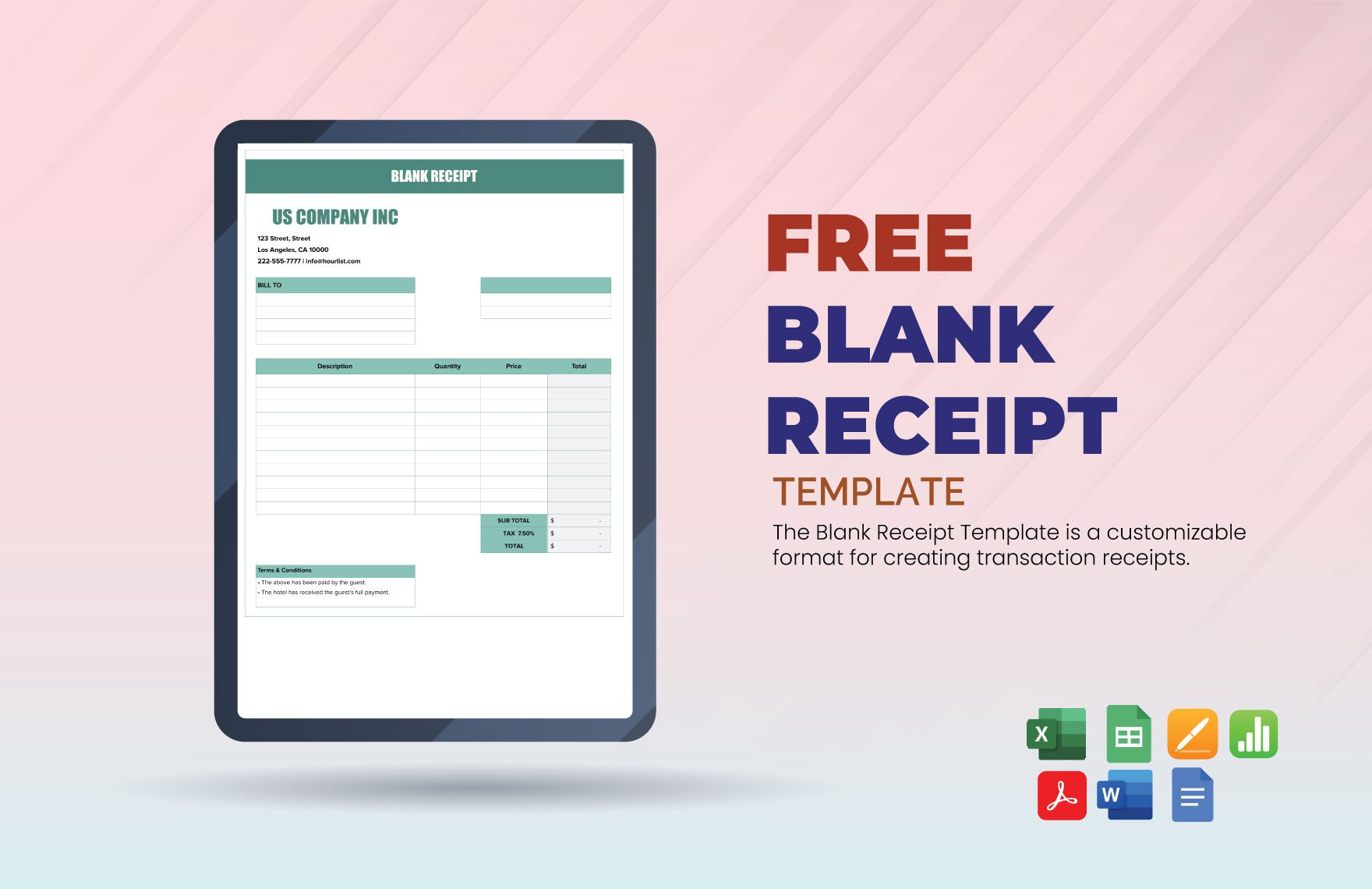

Accounting is an essential part of any business; it helps to track and record costs, expenses, revenue, bills, etc. Tracking these expenditures helps the business to grow. A vital part of accounting is receipts that itemize customer purchases, which is critical for keeping track of transactions. If you need this document for your business, we have a collection of IT/SW Receipt Templates ready to cater to you. The templates contain all the essential headers that you and your customers would like to see in it. They are easily editable, customize, and printable too. Having them will save your time and effort from making it yourself from scratch. They are also available in different file formats like Microsoft Word, Apple Pages, Google Docs, Apple Numbers, Microsoft Excel, and Google Sheets. Do not ponder any more and get these now. Subscribe now to start downloading!

FREE IT and Software Receipt Templates

Keep Tabs of Your Expenses, Billings, Payments, Cash Receipts, Sales Receipts, Cash Flow, and Other Financial Transactions of Your IT and Software Business. Accomplish This Easily and Quickly When You Download and Use Our Free Editable and Simple IT and Software Receipt and Tax Invoice Templates in Word Document and Other Formats on Template.net!

- IT & Software Website

- IT Agreement

- IT and Software

- IT and Software Banner

- IT and Software Brochure

- IT and Software Certificate

- IT and Software Checklist

- IT and Software Document

- IT and Software Envelope

- IT and Software Estimate

- IT and Software ID Card

- IT and Software Invoice

- IT and Software Letterhead

- IT and Software Newsletter

- IT and Software Policy

- IT and Software Poster

- IT and Software Presentation

- IT and Software Print

- IT and Software Profile

- IT and Software Purchase Order

- IT and Software Quotation

- IT and Software Real Estate and Admin

- IT and Software Report

- IT and Software Roll Up Banner

- IT and Software Scope of Work

- IT and Software Stationery

- IT and Software SWOT Analysis

- IT and Software Timeline

- IT and Software White Paper

- IT Company

- IT Company Contract

- IT Deployment Plan

- IT Graphics

- IT Organizational Chart

- IT Professional Resume

- IT Project Proposal

- IT Resume

- IT Software Organizational Chart

- Form

- Form Design

- Form

- Form Layout

- Work form Home Invoice

- Work Form Home Order

- Work form Home Quotation

- Accident Report Form

- Admission Form

- Aircraft Form

- Airplane Form

- Application Form

- Appraisal Form

- Attorney Form

- ATV Form

- Authorization Form

- Basic Form

- Basic Order Form

- Bicycle Form

- Bike Form

- Bill Form

- Form

- Order Form

- Business Form

- Camper Form

- Car Form

- Carolina Form

- Cat Form

- Change Form

- Cleaning Form

- Cleaning Services Form

- Company Form

- Complaint Form

- Consent Form

- Construction Employee Form

- Construction Form

- Construction Order Form

- Construction Request Form

- Form

- Customer Service Form

- Dakota Form

- Dog Form

- Education Form

- Employee Appraisal Form

- Employee Form

- Employment Application Form

- Employment Form

- Equipment Form

- Evaluation Form

- Event Form

- Expense Form

- Firearm Form

- Freelance Form

- Freelancer Form

- Furniture Form

- Gun Form

- Health Form

- Horse Form

- HR Form

- Incident Report Form

- Information Form

- Inspection Form

- Interview Form

- IT and Software Form

- Jet Form

- Kitten Form

- Livestock Form

- Massachusetts Form

- Medical Form

- Mobile Form

- Form

- Order Form

- Moped Form

- North Form

- Personal Form

- Printable Form

- Property Form

- Purchase Order Form

- Quiz Form

- Real Estate Form

- Registration Form

- Release Form

- Request Form

- Restaurant Form

- RV Form

- Sale Form

- Form

- Order Form

- School Form

- Scooter Form

- Service Form

- Form

- Order Form

- Ski Form

- Software Form

- South Form

- Startup Form

- Student Form

- Tractor Form

- Training Form

- Truck Form

- University Form

- Used Form

- Virginia Form

- Waiver Form

- Work Form

- Work From Home Form

- Work Order Form

How to Make an IT/SW Receipt?

Word of mouth is not enough proof for the completion of transactions, and one can't deny the fact that receipts are credible proof of purchase. In fact, back in 7500 BC in Jericho, a ball of clay was given to represent the completion of a trade. From there, the significance of receipts was forged to what it is today. If you want to create a receipt for your IT/SW business, we have provided easy tips that you can refer to below.

1. Note the Essential Information

Receipts help in recording all the payment details for each transaction, but for recordkeeping, to be accurate you need all the essential information in your receipt. Determine what information per transaction is important, e.g., name of customer, number and types of items purchase, the amount for each item and total, etc.

2. Decide on a Layout

A receipt can either be in a portrait or landscape layout. You have to determine which layout is best to use to ensure you can include all the information you need in your receipt. You can test each layout to identify what is the better option for your needs.

3. Incorporate Recordkeeping Features

The primary purpose of a receipt is for accounting and recordkeeping. Hence, the importance of ensuring your receipts has recordkeeping features. Your cash receipts can have a unique receipt number, billing number, item SKU/UPC, special codes, etc. to ensure the accuracy of all your receipts and records.

4. Include Company Branding

Aside from recordkeeping, your receipt is also an excellent marketing tool. By incorporating your company branding in the payment receipt, your customers can provide reliable recommendations to other potential customers. You can include your company name, address, contact information, signs, logo, etc.

Frequently Asked Questions

How Are Receipts Recorded?

Your accounting department should have a cash receipts journal which records each cash transaction. Using the receipts, you should log each transaction paid in cash in the said journal. It is important to remember not to include the sales tax in each transaction in the cash receipt journal; they should be recorded in the sales journal instead.

What are the Essential Parts of a Receipt?

The following are the essential parts of a receipt:

1. The item name and SKU/UPC

2. Quantity of product or service

3. Price of each product or service

4. Total price

5. Rate of sales tax and the amount of the sales tax

6. Total price including the tax amount

7. Required business registration number

8. Business name

9. Date, time, and address of the transaction

10. Contact information

11. Signature of sales personnel

What is the Importance of Receipts to Businesses?

Receipts help monitor your business's progress every accounting period, which helps in the preparation of financial statements. They also ensure that you can separate the taxable from the nontaxable income to identify your actual deductions. By the end of the tax year, you can legally claim all your returns if you have all the receipts of transactions. Also, receipts help you avoid any violations should there be an IRS audit on your returns.

What is the Best Receipt Printer?

Impact printers, also called a "dot matrix" printers, uses a ribbon to print ink physically onto the page. On the other hand, thermal printers apply heat to a thermal paper, which is then inked with heat-responsive chemicals. Thermal printers are more expensive but quieter and don't need old-fashioned ribbon paper. But for the most part, impact printers are cheaper.

Can a Receipt be Handwritten?

Yes, a receipt can either be handwritten or typed. You can also issue a receipt electronically or on paper.