The best kind of loan agreement is one that protects your interests as the lender while making sure that the borrower is not being taken advantage of. A few agreement-making tips are shared below to help you write the best loan contracts ad finance documents for your lending business.

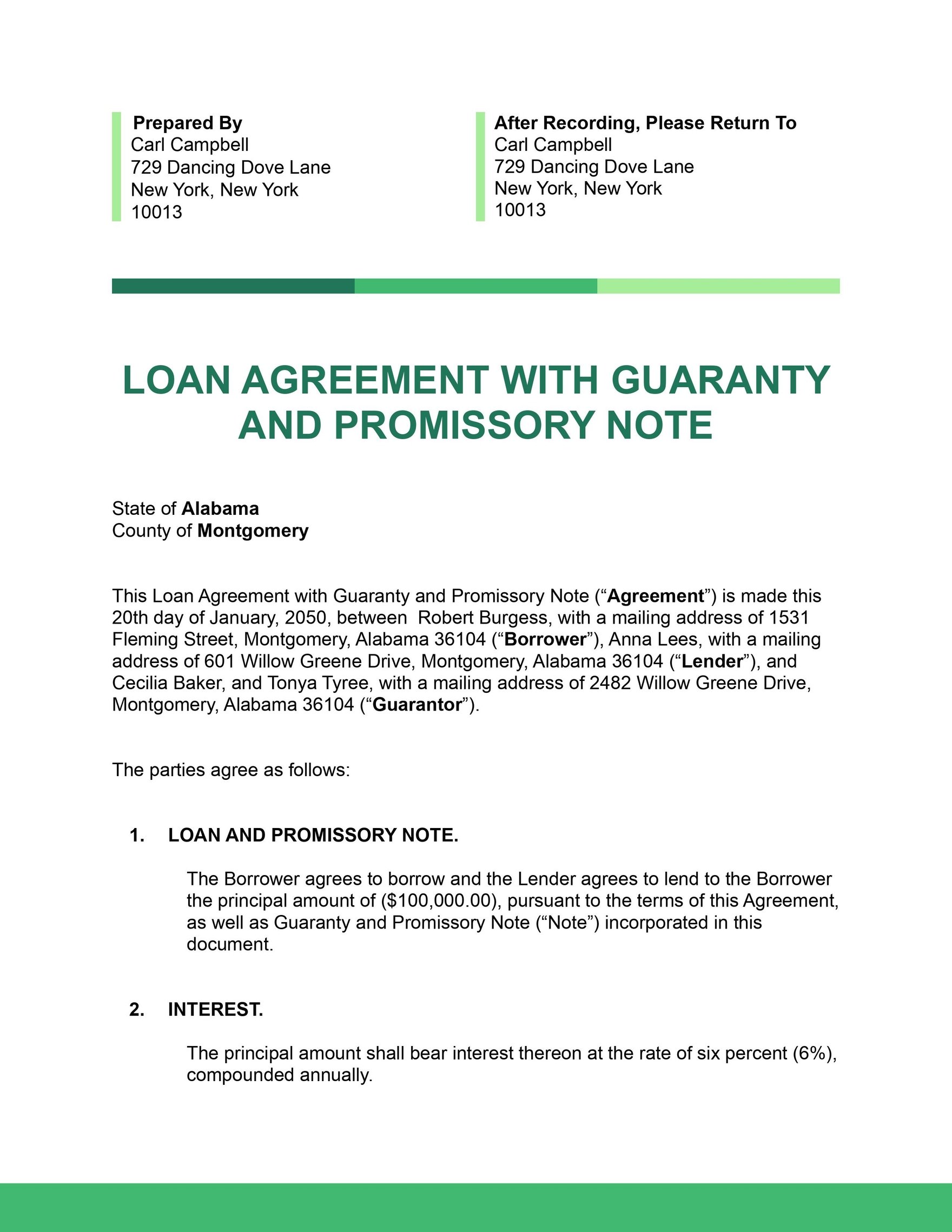

1. Be Clear on the Loan Terms

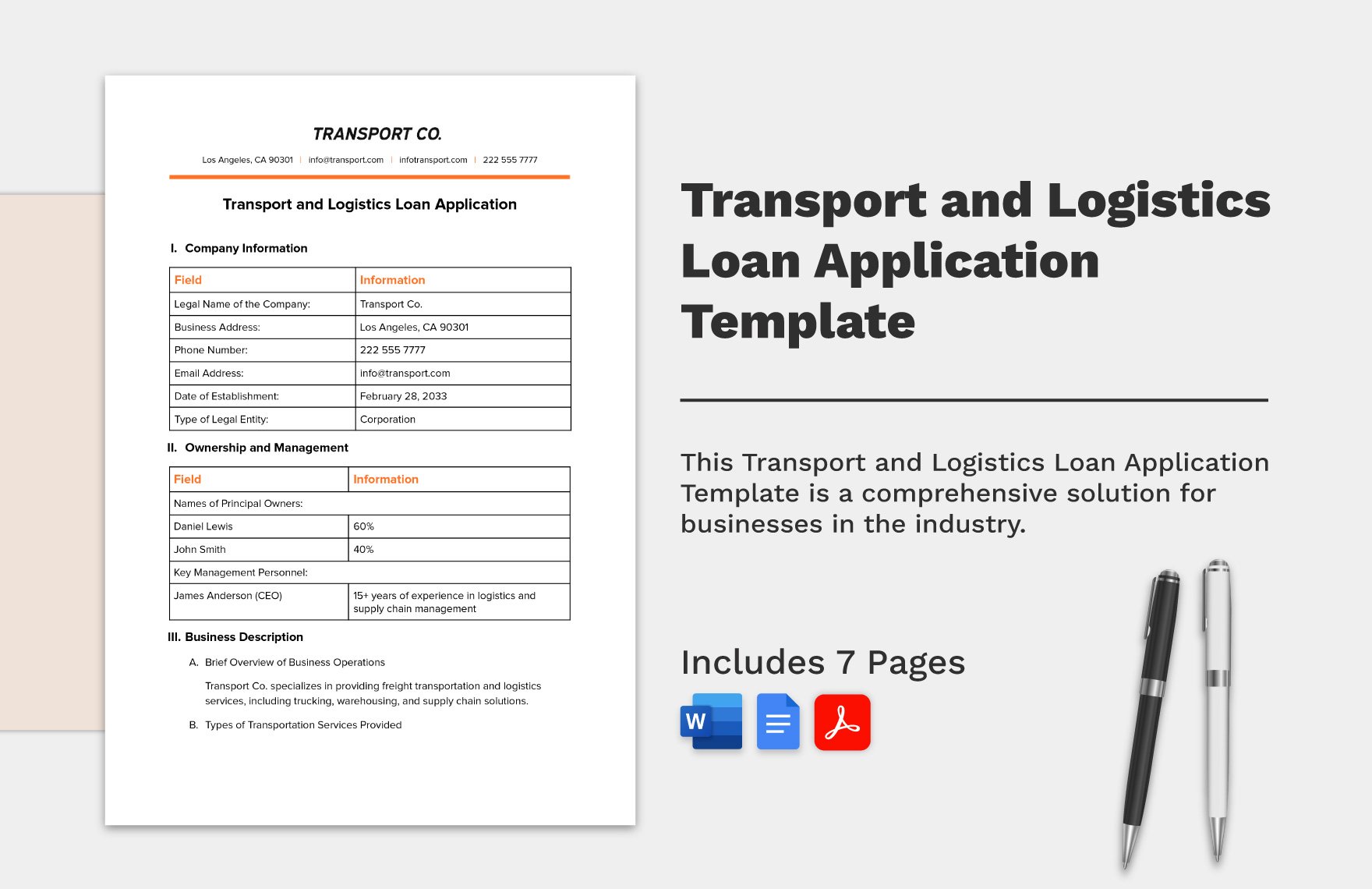

Whether you are extending a personal loan or crafting a loan contract for micro-financing or small business, consider one thing always: decide and write clear loan terms. This refers to the loanable amount, payment schedule, repayment scheme, loan duration, interest amount, collateral, exit plan, collection, and default process. Make sure that all these pieces of information are explicitly stated on your loan agreement.

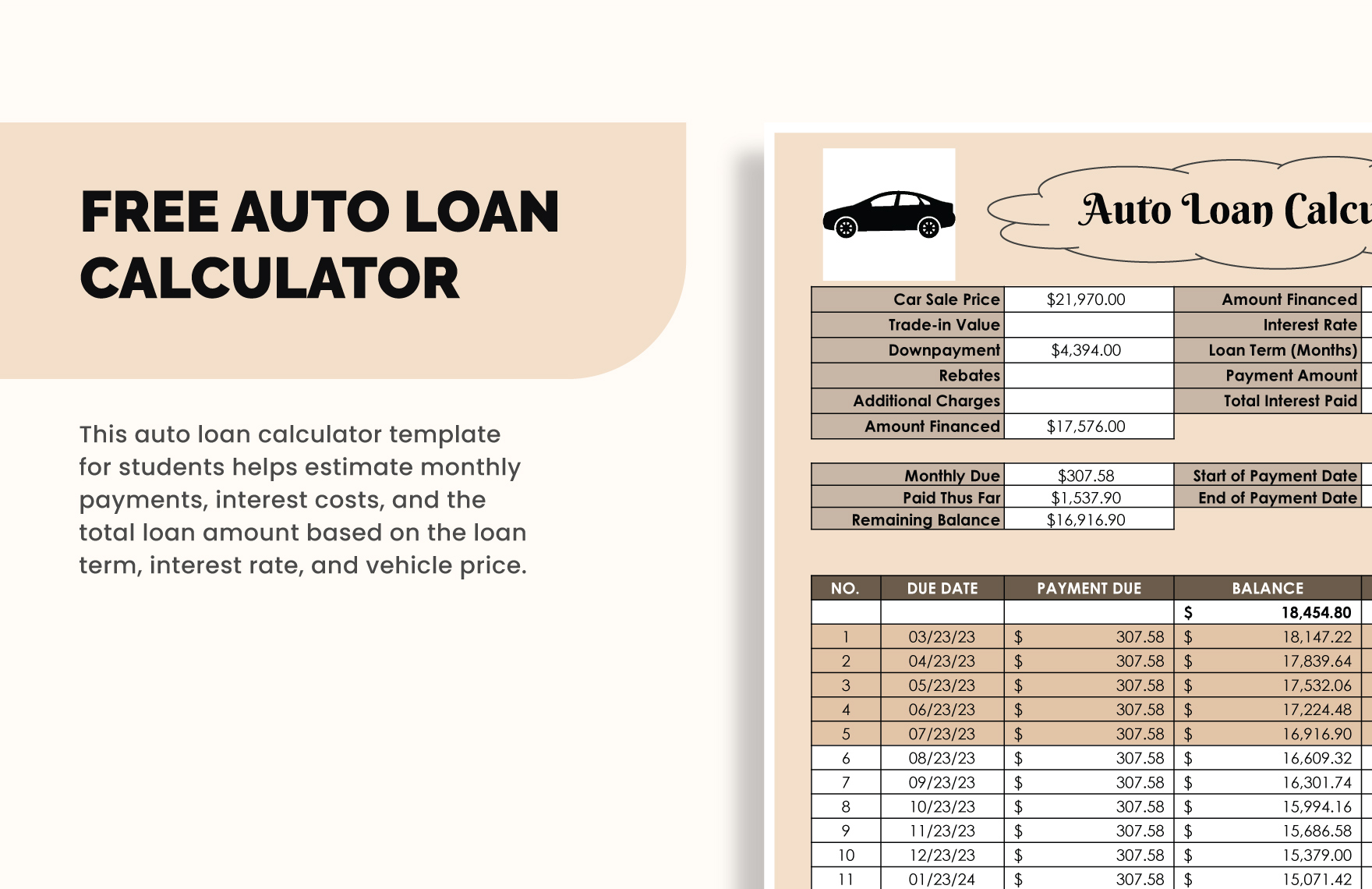

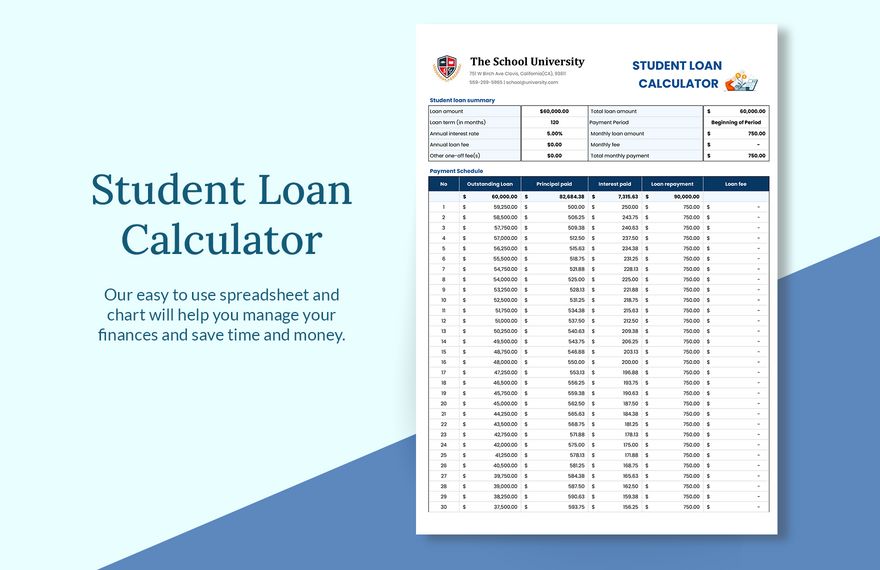

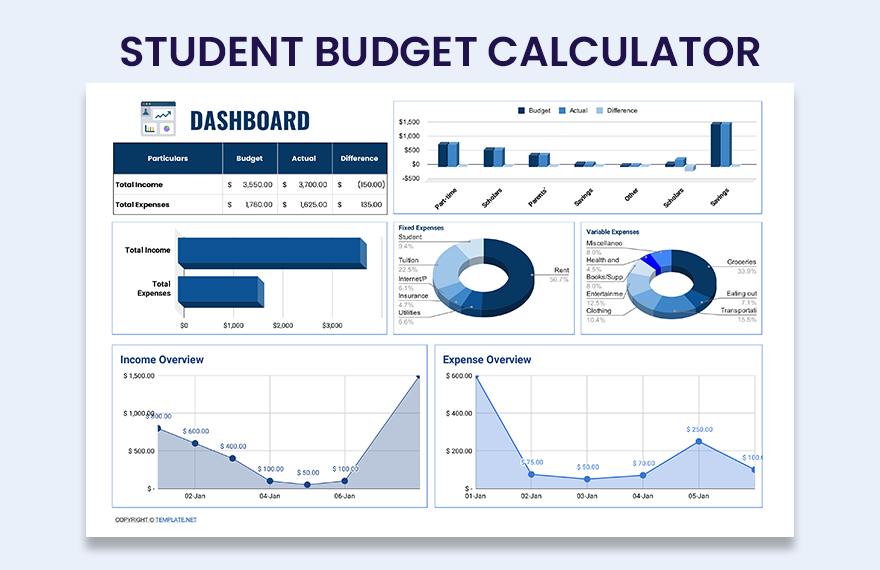

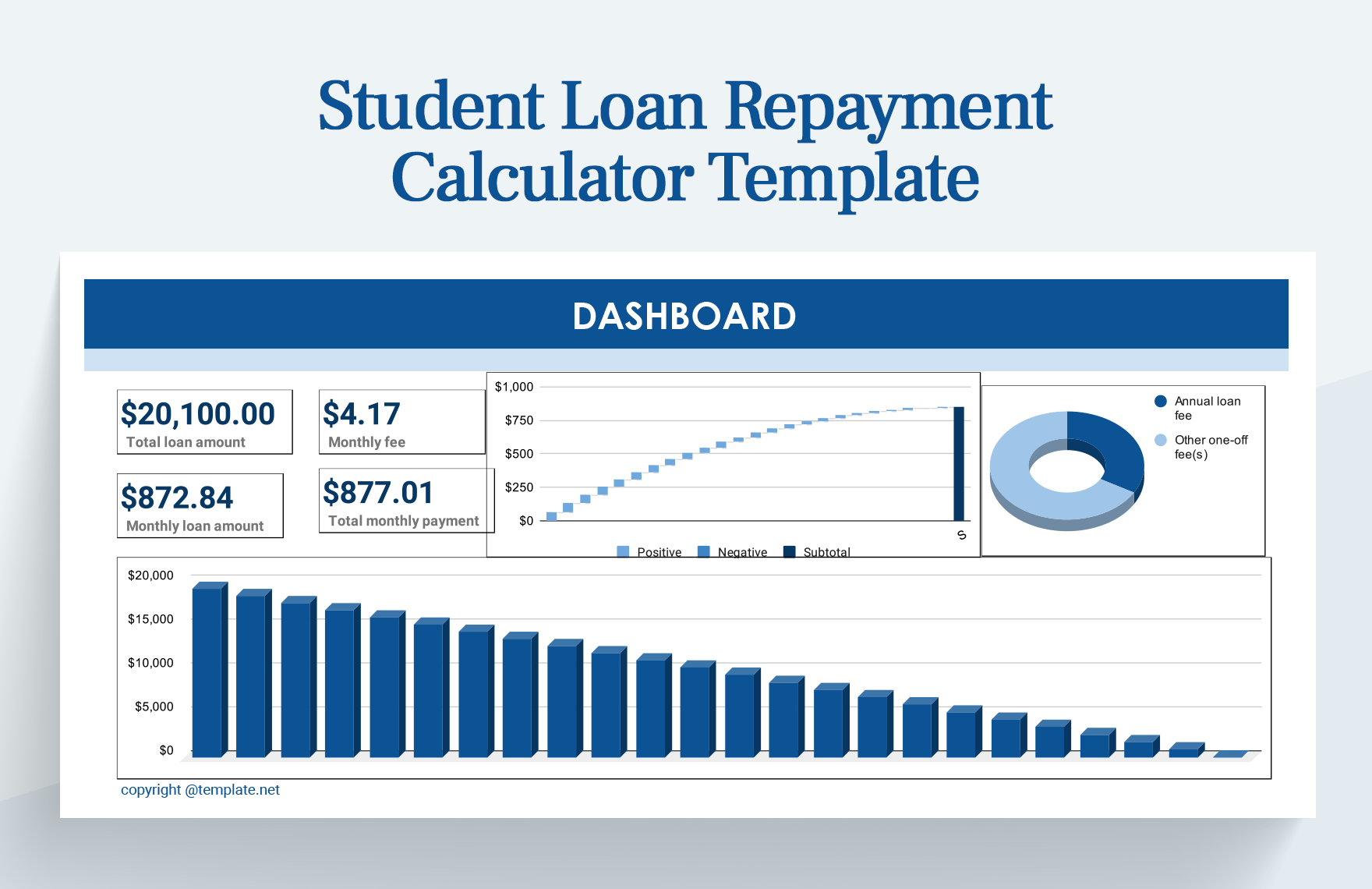

2. Simplify the Payment Schedule

Another way to ensure prompt loan repayment is through the addition of a payment schedule table or chart. With a data visualization tool like this, borrowers and lenders clearly see what amount is owed and when.

Remember, loan agreements do not always have to be filled with legalese. Simplify it with the use of simple charts or tables and you will be getting payback of debt on time.

3. Provide Alternative Payment Options (If Preferred)

A good loan agreement should also incorporate multiple payment options for the borrower. This way, the borrower will have no excuse not to make the payments according to the payment agreement.

4. Add Confidentiality Clause/Privacy Waiver

As a legal contract document, loan agreements may include confidentiality clauses as requested by the lender and/or the borrower. Do note that such clauses are subject to your local or state laws and finance policies. When added to a loan agreement, a loan confidentiality clause may limit the number of individuals allowed to know the entire details of the loan.

On the other hand, some bank loans and microfinance loans may require borrowers to sign a financial privacy waiver. Or add legal confidentiality agreements since these institutions may need to conduct credit checks. This is done to determine the likelihood a borrow is able to pay back his or her loan. As a lender, it is your duty to conduct these background checks and protect your business interests.

5. Notarize the Signed Loan Agreement

Lastly, once both you (the lender) and the borrower has signed the loan agreement, make sure that you have the agreement document notarized by an attorney. This action makes the document an official and legally binding contract that both the lender and the borrower must honor.