Many individuals and companies turn to lend loans and funds to other institutions. The problem is, many times institutions or individuals fail to complete their loan payment. Protect your rights as the lender and avoid bankruptcy with these ready-made templates on Subordination Agreement Templates. Printable, 100% customizable, and highly editable to suit your specific needs, these samples are professionally written by our best writers and reviewed by our best lawyers. These templates will guarantee you the best results. What are you waiting for then? Don't miss this great opportunity, subscribe, and start downloading now!

What is a Subordination Agreement?

A subordination agreement is a legal document that specifies the rank of debt, loan, or lease in an order of importance. This prioritizes collateralize debts is extremely important for collecting payments from debtors and tenants. This agreement is commonly used when multiple mortgages exist in a property.

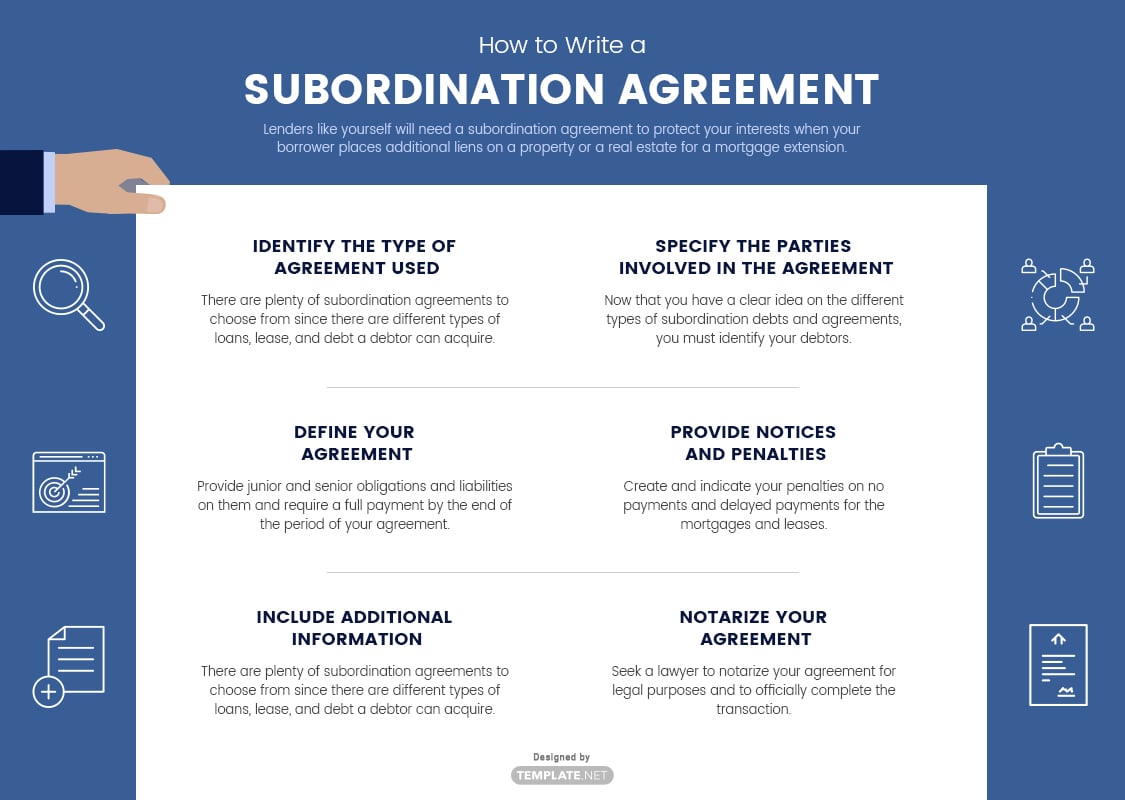

How to Write a Subordination Agreement?

Lenders will need a subordination agreement to protect their interests when the borrower places additional liens on a property or a real estate for a mortgage extension. Compensate yourself once you receive your debtor's loaned amount and create a subordination agreement in a few steps.

1. Identify the Type of Subordination Agreement Used

There are plenty of subordination agreements to choose from since there are different types of loans, lease, and debt a debtor can acquire. A debtor can acquire a collateral subordination debt, structural subordination debt, or a contractual subordination debt. Identifying your debtor's lease will make things easier for you to create a simple agreement.

2. Specify the Parties Involved

Now that you have a clear idea of the different types of subordination debts and agreements, you must identify your debtors. As the owner or the landlord, check their loan history and qualifications to apply a lease on your property. If they fit your qualifications and requirements, you may proceed to provide them the legal contract and have their complete names listed as the parties involved in the transaction.

3. Define Your Agreement

One important thing is to define your agreement and payment schedule to your debtors. Provide junior and senior obligations and liabilities to require full payment by the end of the period of your agreement. Don't forget to state the amount they will be paying you per month. Include collateral and security interest in your agreement, as well as the down payments before they acquire the property. You may insert your waiver and consent with your debtors.

4. Provide Notices and Penalties

In case your debtors failed to complete their payments, always prepare a backup plan. Create and indicate your penalties on no payments and delayed payments for the mortgages and leases. Provide them a noticeabout their actions. If they do not do anything about it, you may increase their interest rate for their payments or you may take back your property and provide them an eviction notice.

5. Include Additional Information

Include additional information to your subordination agreement. This may contain security and assurance that the property on lease or mortgage will be kept in good maintenance during the lease or mortgage period. In addition, you may include a binding effect and miscellaneous to your agreement. This will ensure that this agreement cannot be changed and will be constructed in accordance with the laws.

6. Notarize Your Agreement

Lastly, have your basic agreement signed by you and the other parties involved in the transaction. Consult a lawyer to notarize your agreement for legal purposes and to officially complete the transaction. Remember to give a copy to your debtor and keep a copy for yourself as well.