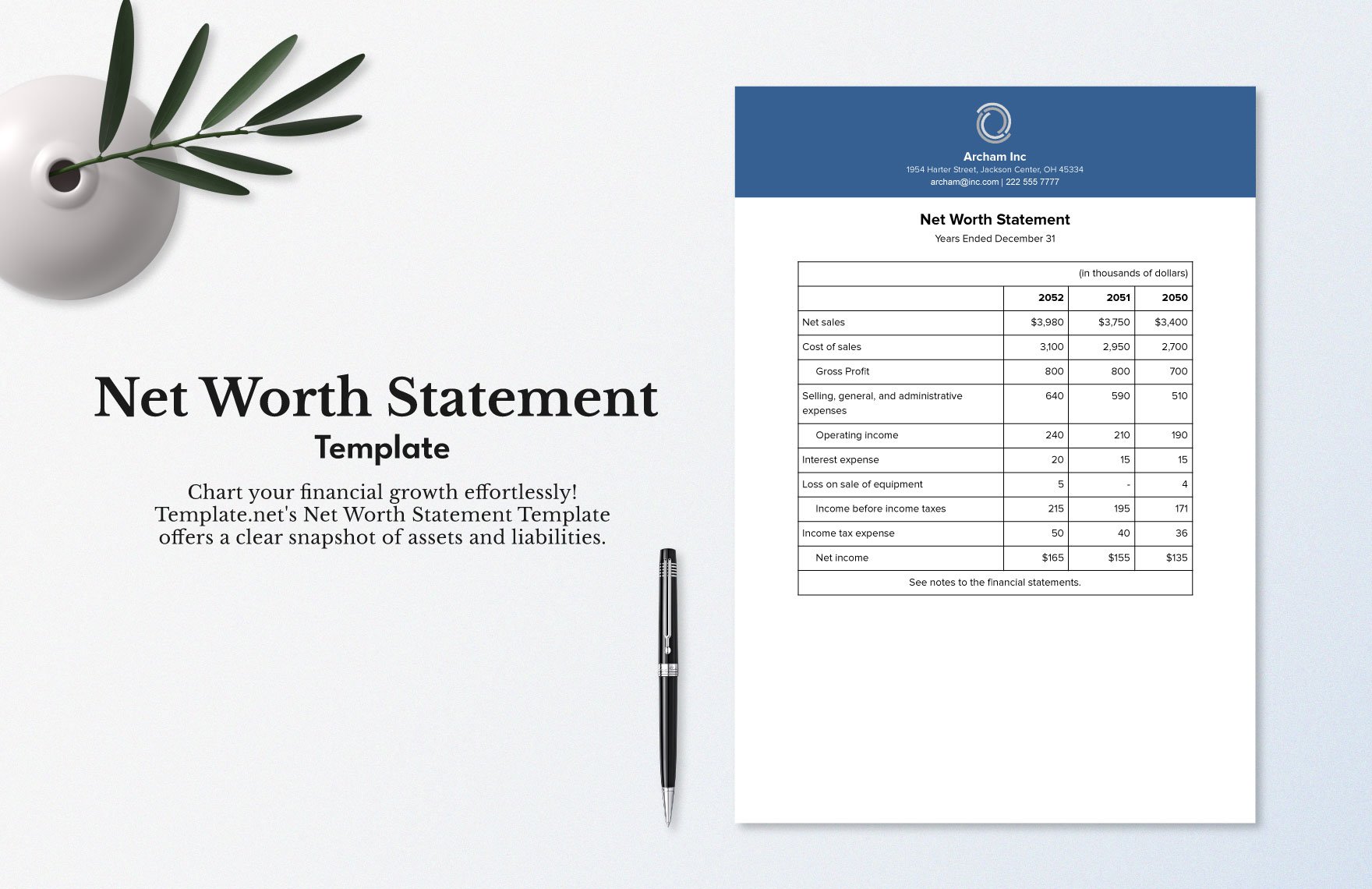

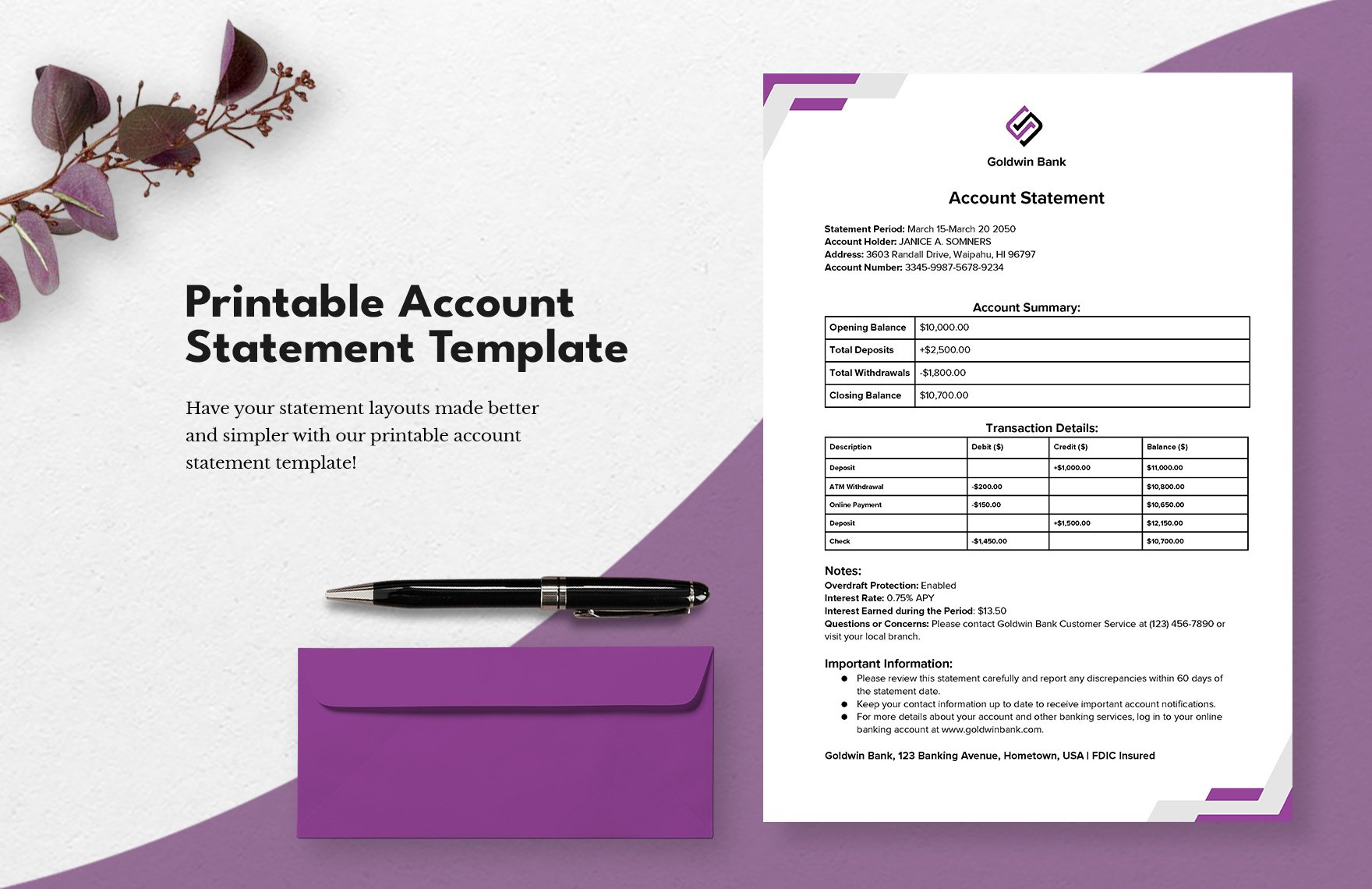

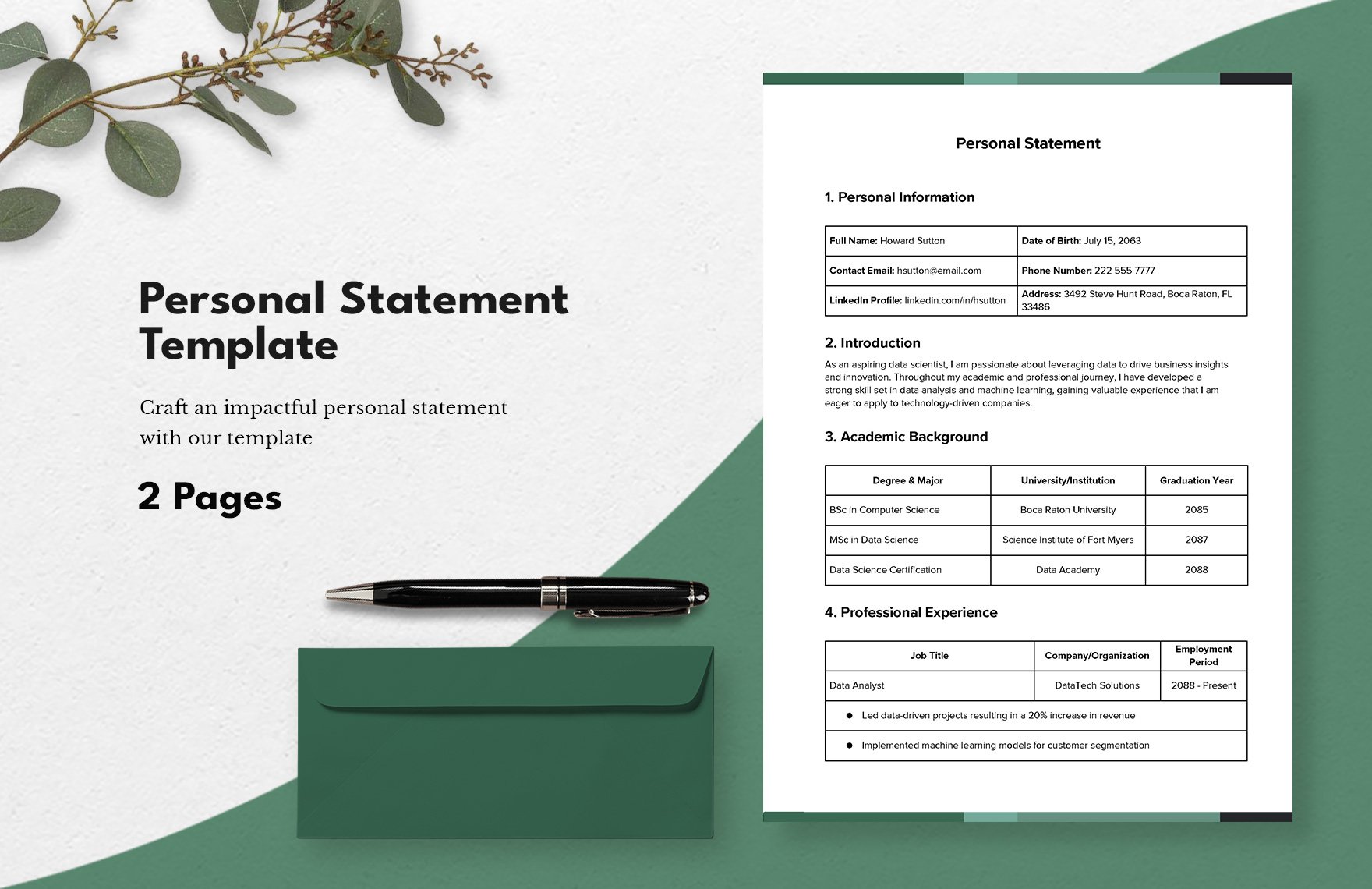

Businesses rely on recorded information about their financial standing so as to gauge their financial position and performance. To help you make an excellent financial statement, we have designed these Financial Statement Templates in Google Docs that are just the thing your company needs to help you create a summary-level report for gaining a deep understanding and control of your company’s finances. Our files are 100% customizable and easily editable in the web-based application Google Docs. Available in US or A4 paper sizes. Make this moment count by getting your hands on our high-quality financial statement templates for use in your business operations.

How to Make a Finance Statement in Google Docs

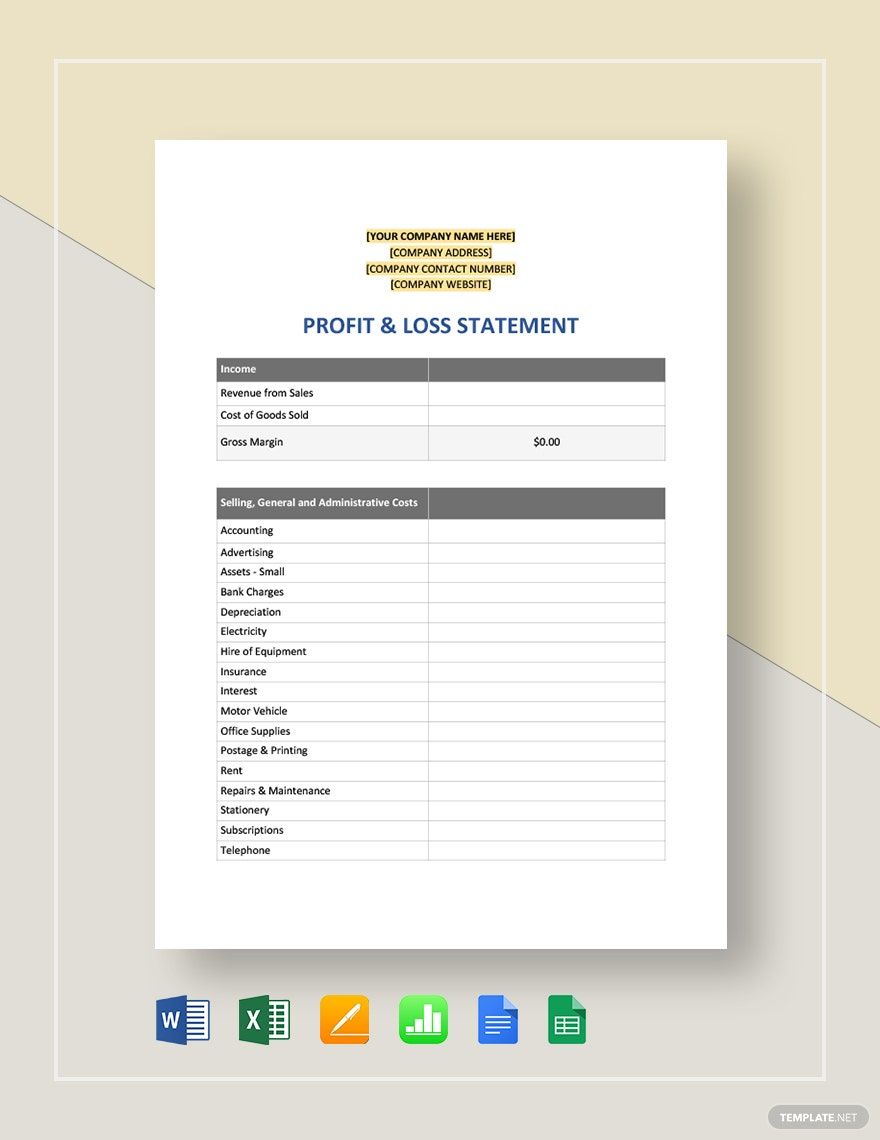

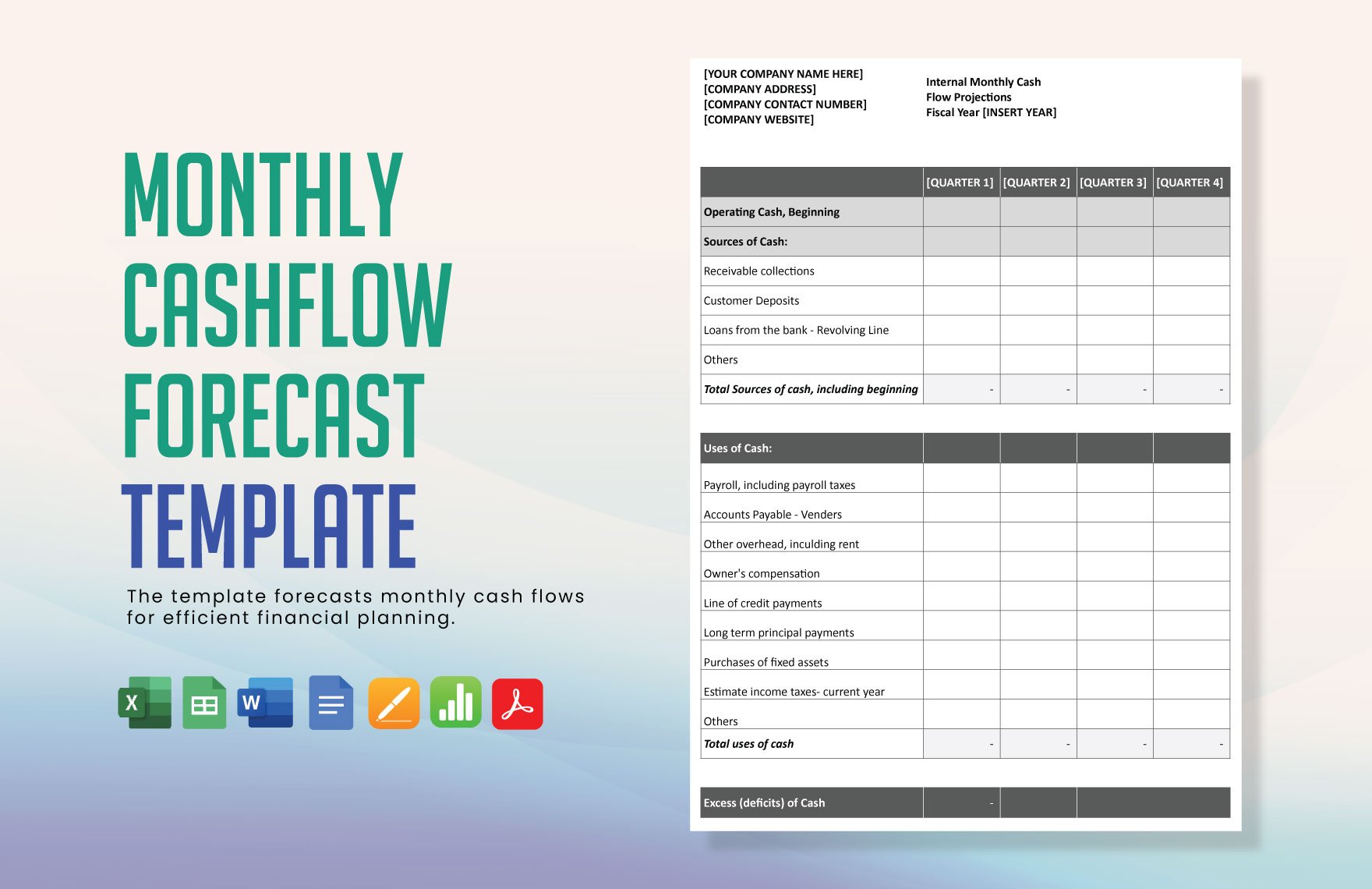

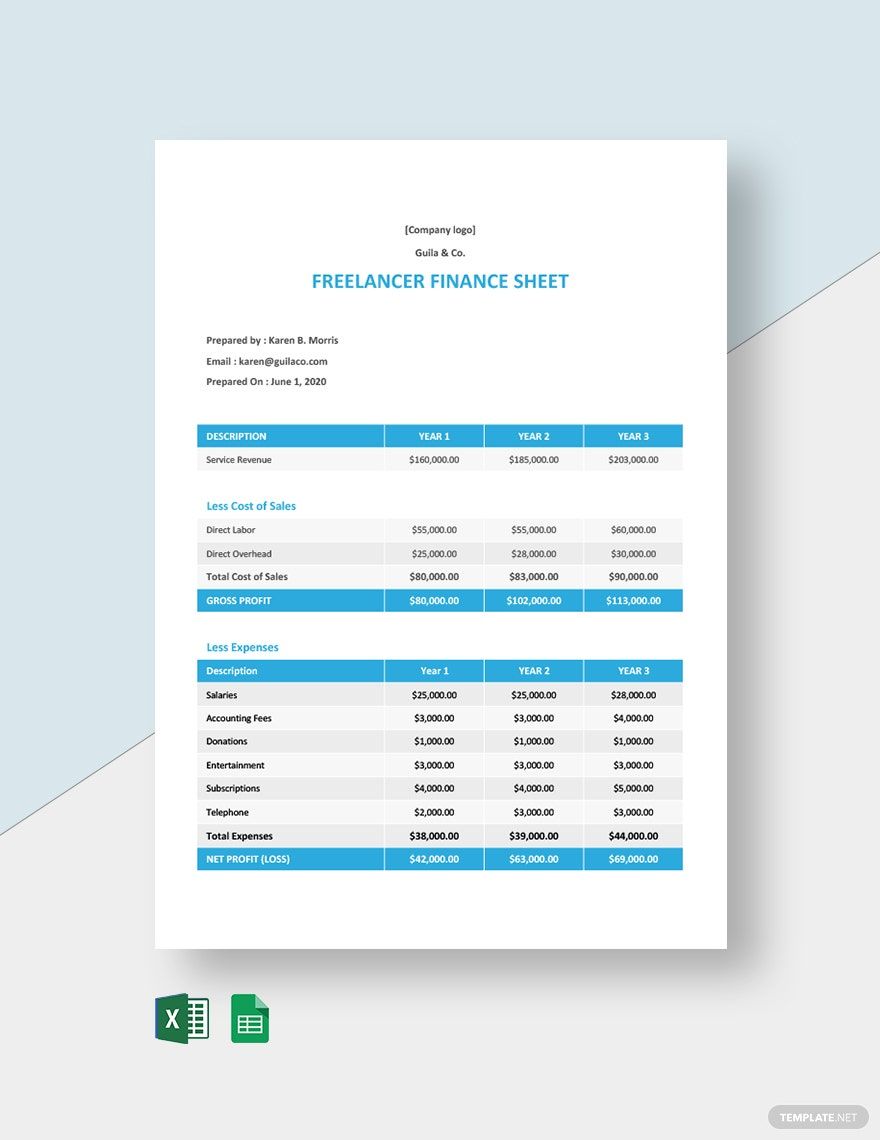

Finance statements are the formal record of the financial activities of a company, business, or person. Main forms of finance statements or pro forma are the balance sheet, the income statement, and the statement of cash flows.

If you want to keep on track with your financial situation, you have to do financial reporting. Crafting a finance statement will surely be a bit challenging. So, we present few guidelines for you to follow.

1. Know the Basics of the Balance Sheet

First off, you have to have a basic knowledge of what and how a balance sheet works. Balance sheet shows the company's balance between assets and liabilities. The basic financial accounting equation (Total Asssets= Liabilities+ Shareholder's Equity) is the main principle basis of the balance sheet. An article states that when you rearrange the equation, you will see that equity is equal to assets minus liabilities. Subtracting assets and liabilities will result in a figure for shareholder's equity. All these are listed and added on the balance sheet and must present this relationship.

2. Define your Assets and Liabilities

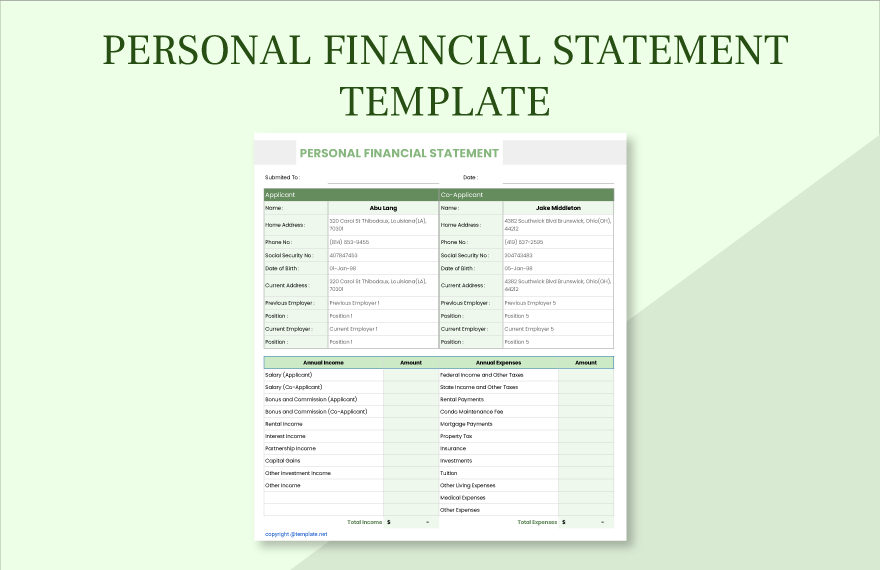

Assets are anything that a company or a person owns. It can be current assets or fixed assets. Current assets include the cash you have on hand and what could be immediately liquidated while fixed assets are tangible. They consist of property, plant, and equipment. There are also intangible assets that may be held on a balance sheet. These include patents, brand recognition, and copyrights, along with other non-physical assets.

Moreover, liabilities are what the company owes or has paid to another company. In a nutshell, it is called debt. These assets have two types called the current and long-term. Current liabilities provide things like what you charge to other businesses for products and supplies on loan and credit card. It also involves revenue and salaries as well as unpaid lease and utilities. Long-term liabilities include long-term debts to be charged, securities to be charged and other liabilities to be paid out over a span of more than one year.

3. Note All the Information

In organizing your balance sheet for your finance statement, you need to be detailed in presenting each information. For instance, label and state each asset along with its price or amount. Classify if it is current or fixed assets. Then add to come up with a total.

4. Expand on the Capital of the Shareholder

In this section, you need to incorporate items that represent the shareholder's interests in the company. For instance, common shares, preferred shares, remaining assets, and retained earnings are all common equity types of shareholders. After you have enumerated all these categories, then add everything to arrive a total shareholder's equity. Then, make a comparison between your assets and liabilities total from your previous calculations. If the results don't match, maybe you have made some errors along the way. Go back and review.

According to studies, most of the balance sheets are structured in an organized format. The assets are totaled on the left and liabilities and shareholder's equity are totaled on the right. This format provides a succinct summation of the basic financial accounting equation.

5. Use Google Docs

Google Docs is a convenient web-based application that allows you to create, edit, store files, and spreadsheets instantly. Files can be obtained from any computer with a complete-featured browser and with an internet connection.

An article states, Google Docs users are able to access, generate, print, and maintain records and spreadsheets in different fonts and file formats, connecting writing with equations, charts, tables, and pictures.